What Is The Top Tax Bracket?

The supreme court ruled that the combined Federal and State income taxes cannot exceed 100% (because at one time, they actually did exceed 100% on the top tax brackets). What is the top tax bracket? Depends on when and where. Some countries actually take all of the money, and distribute only what they think you need. (Basis of absolute socialism and communism). Some places have no taxes that are bracketed, but have other forms of taxes. So, really can’t answer your question with specificity.

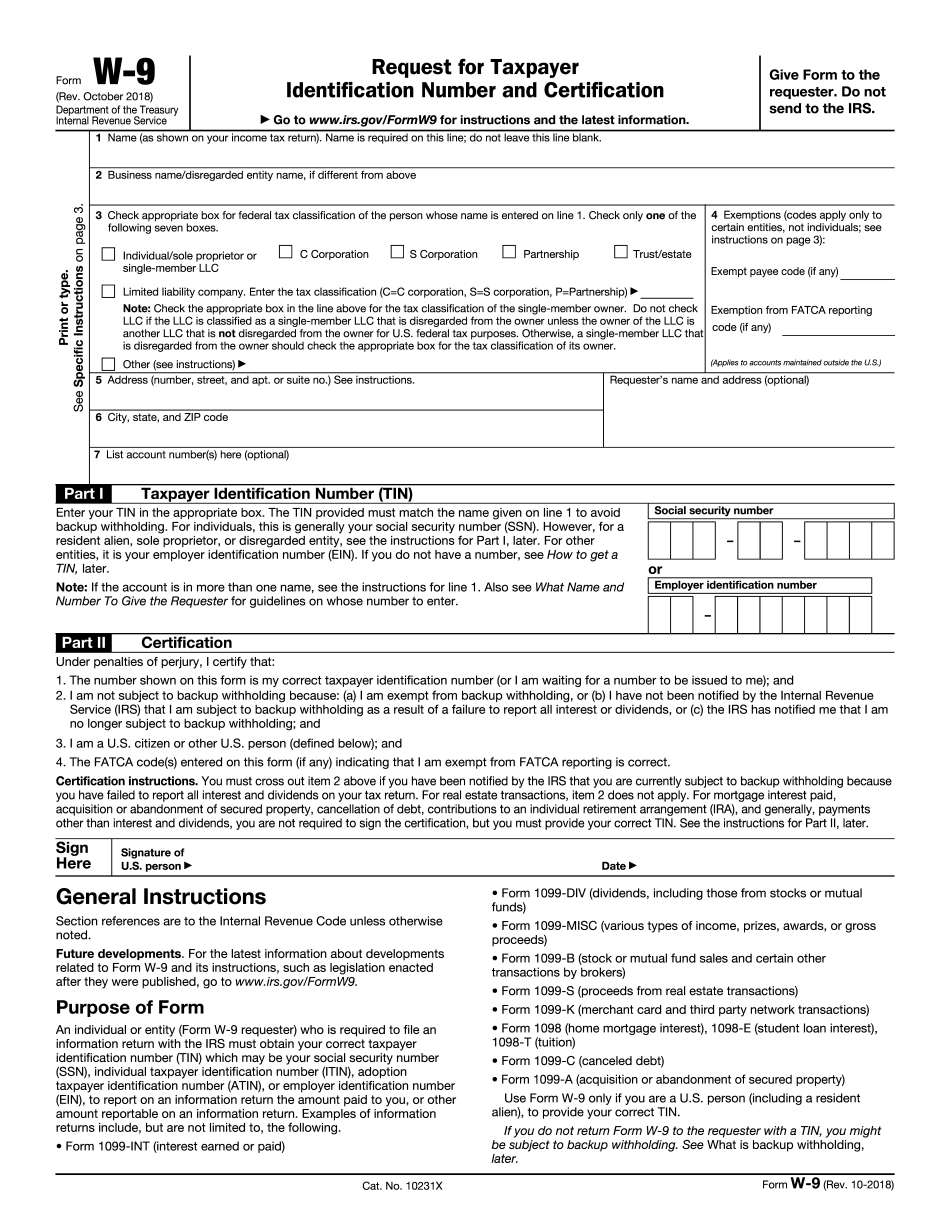

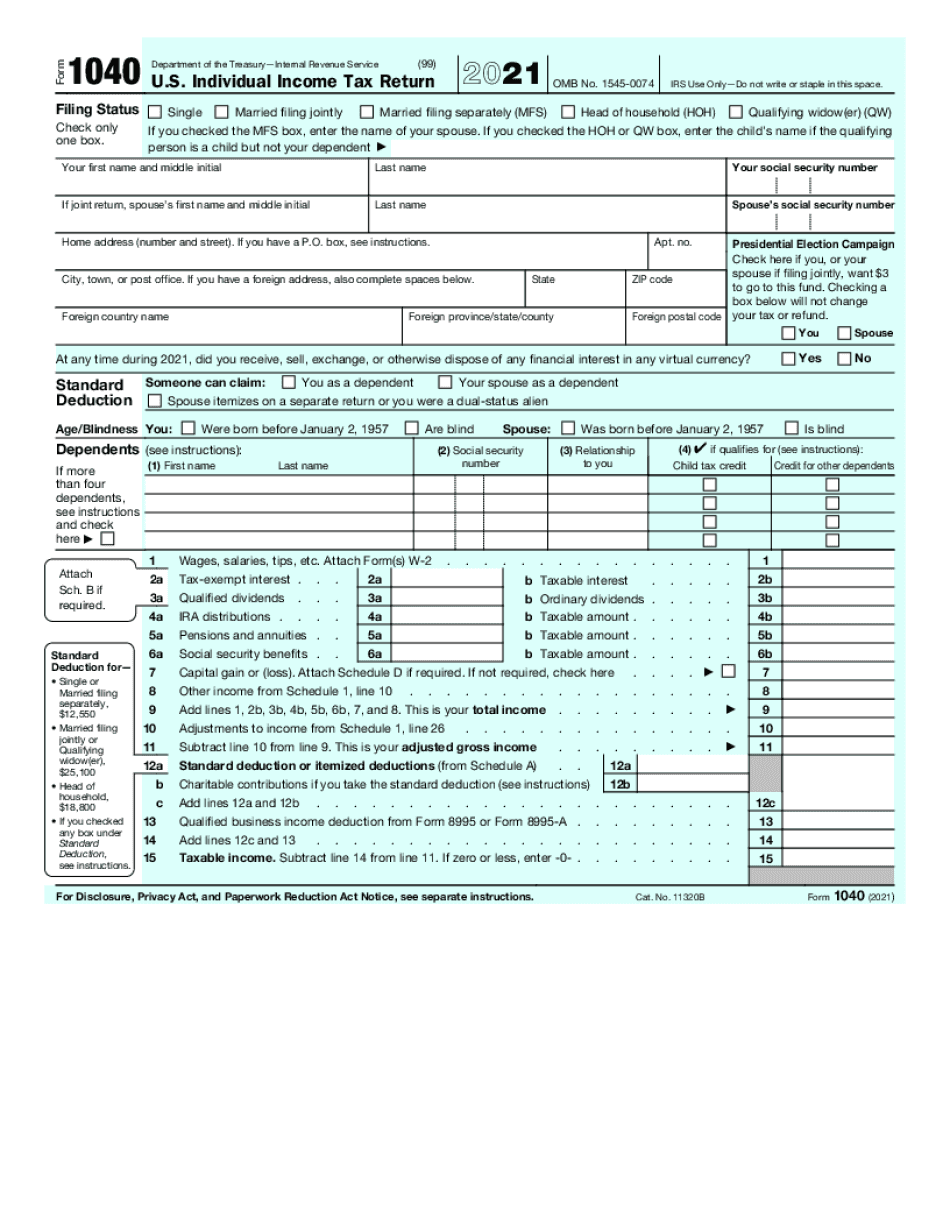

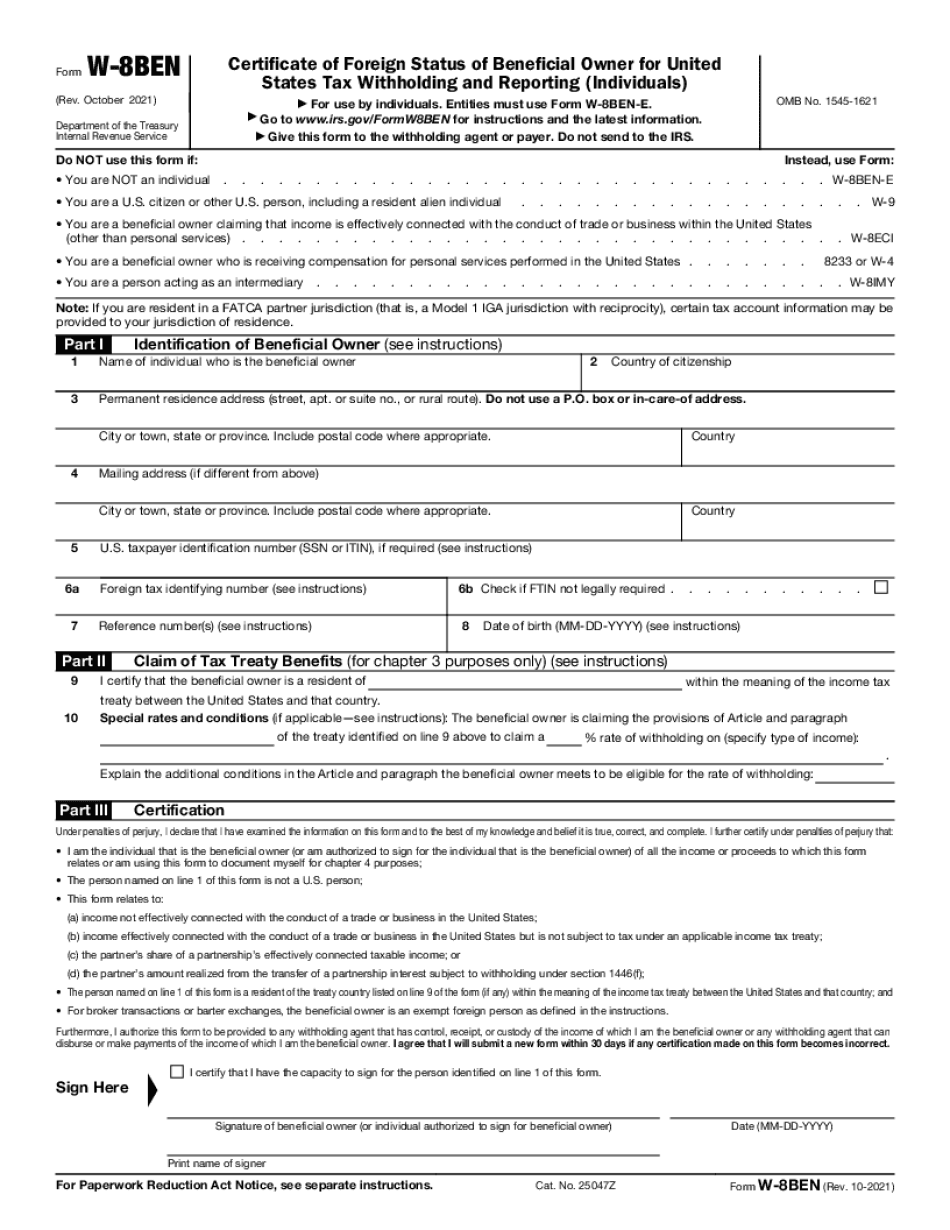

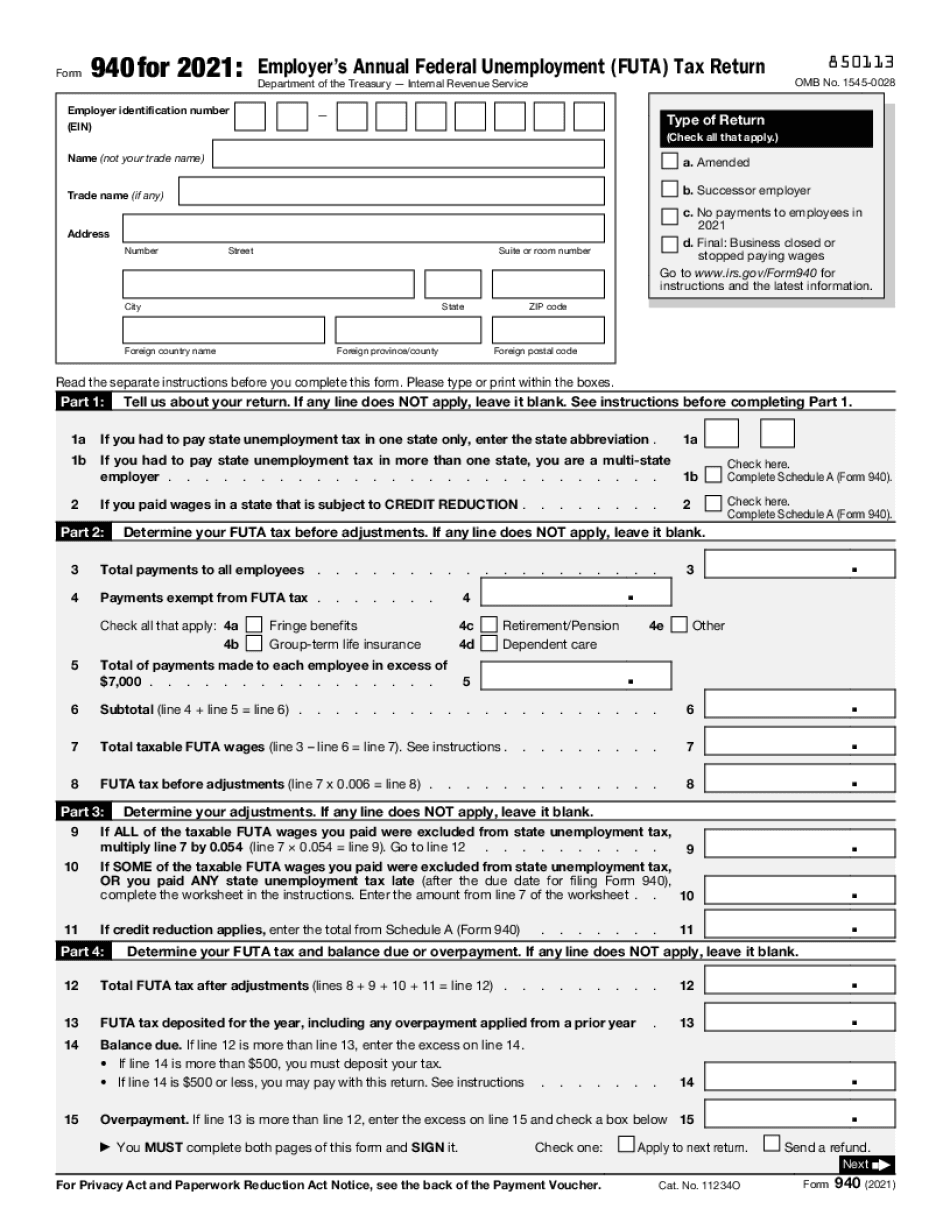

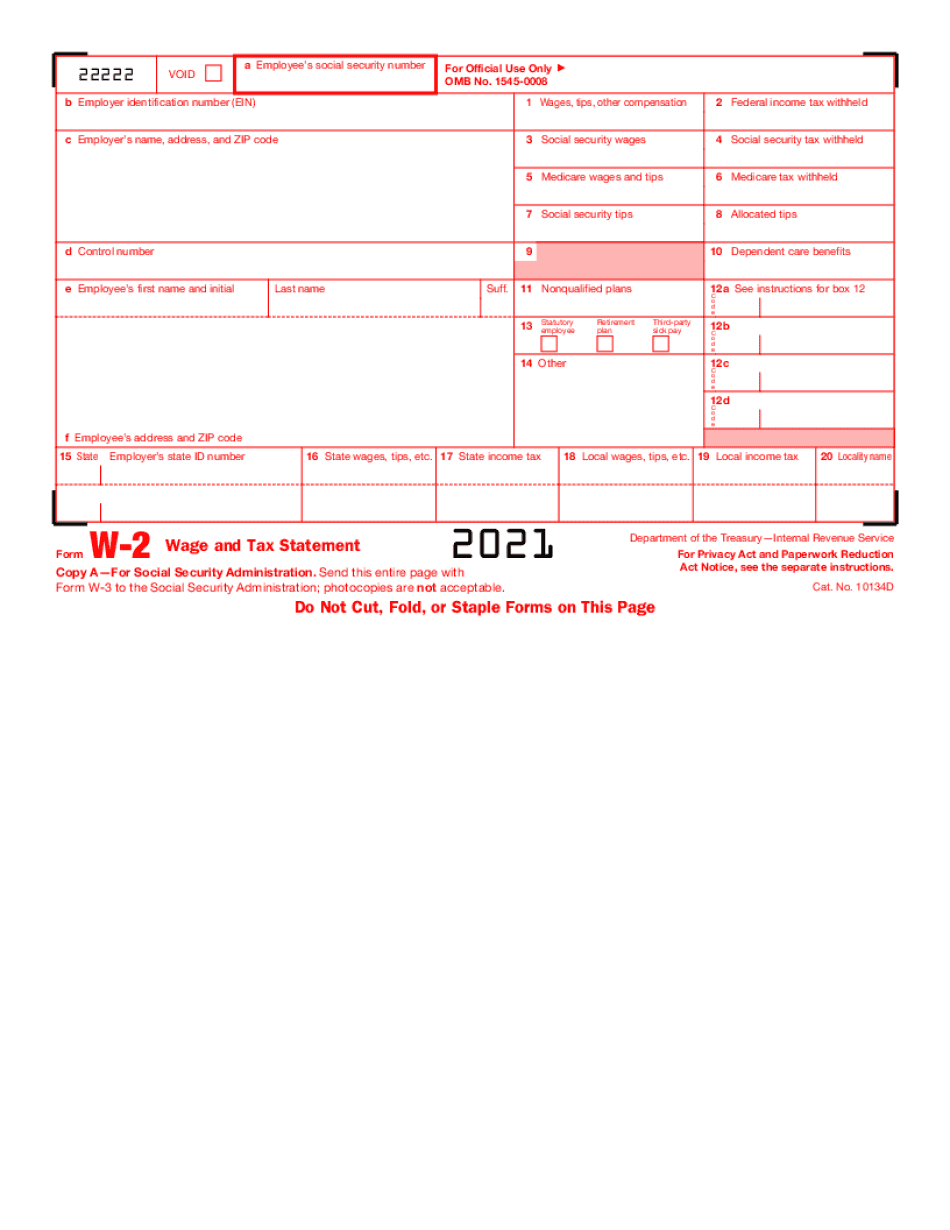

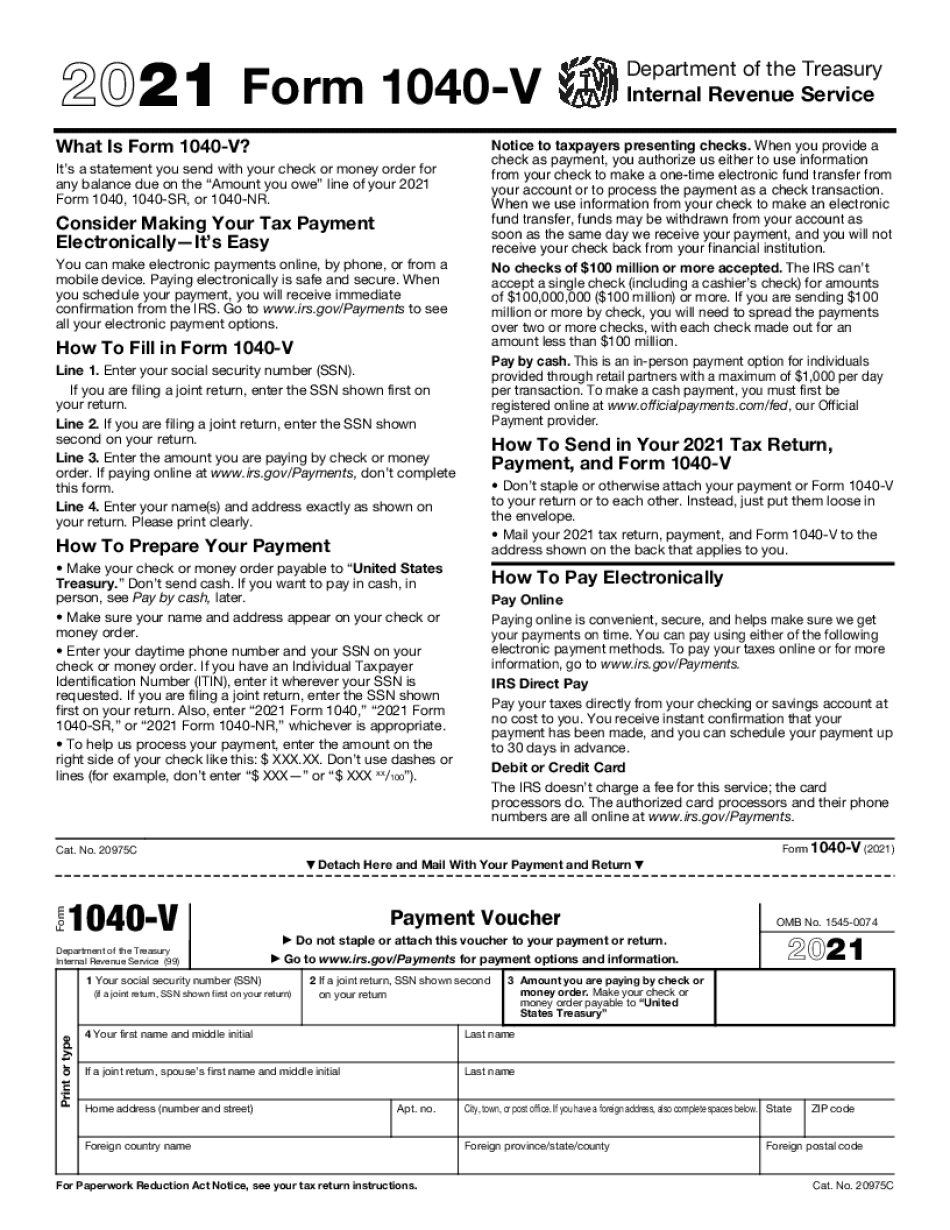

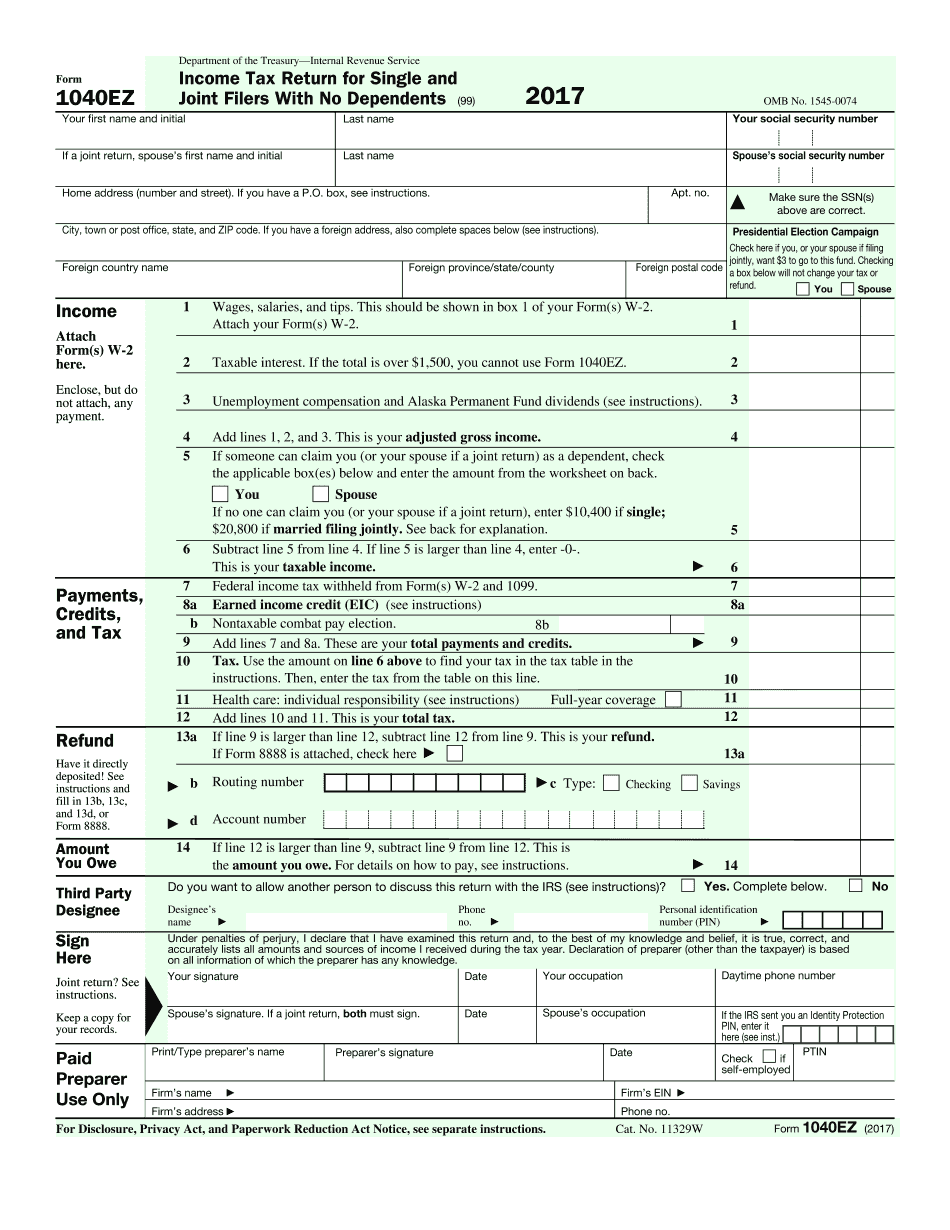

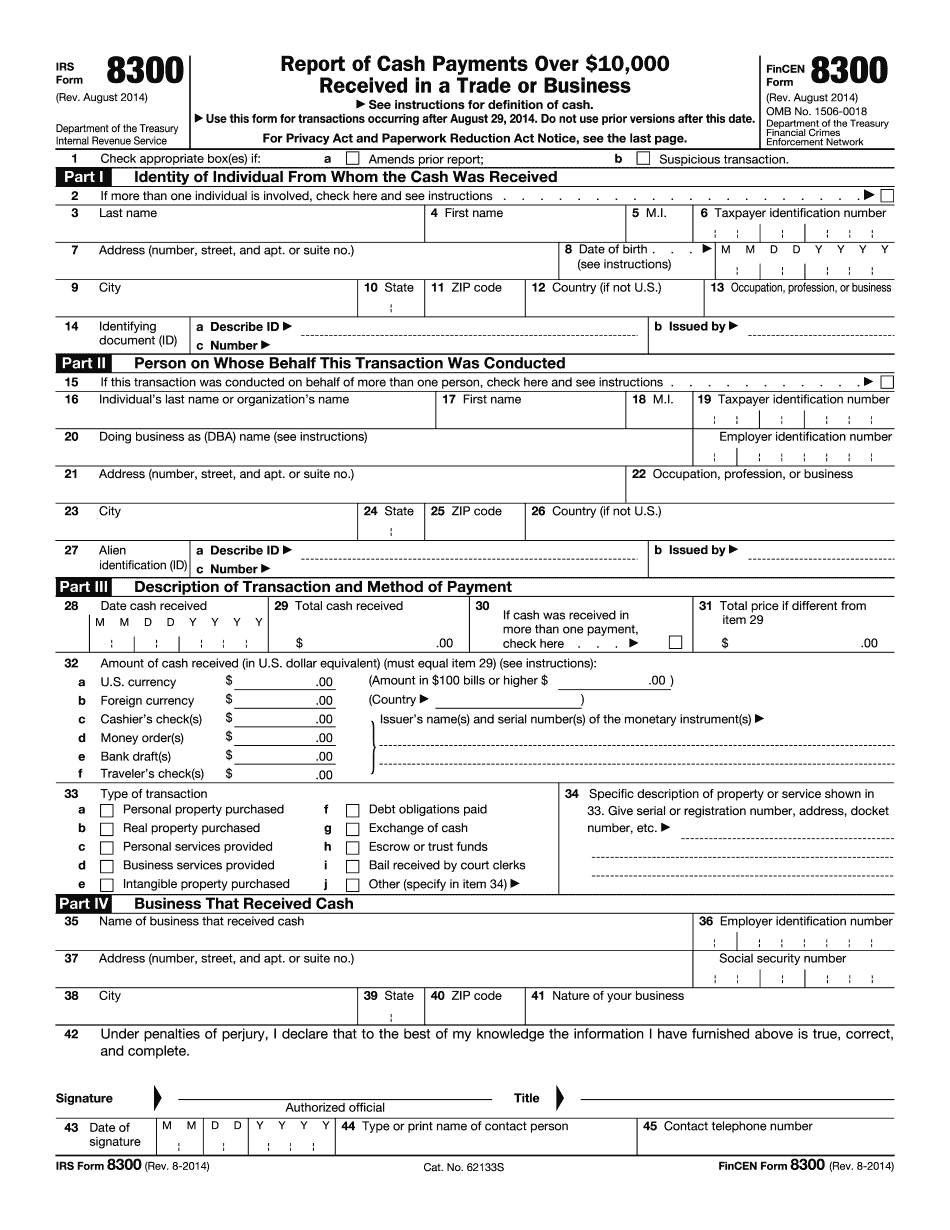

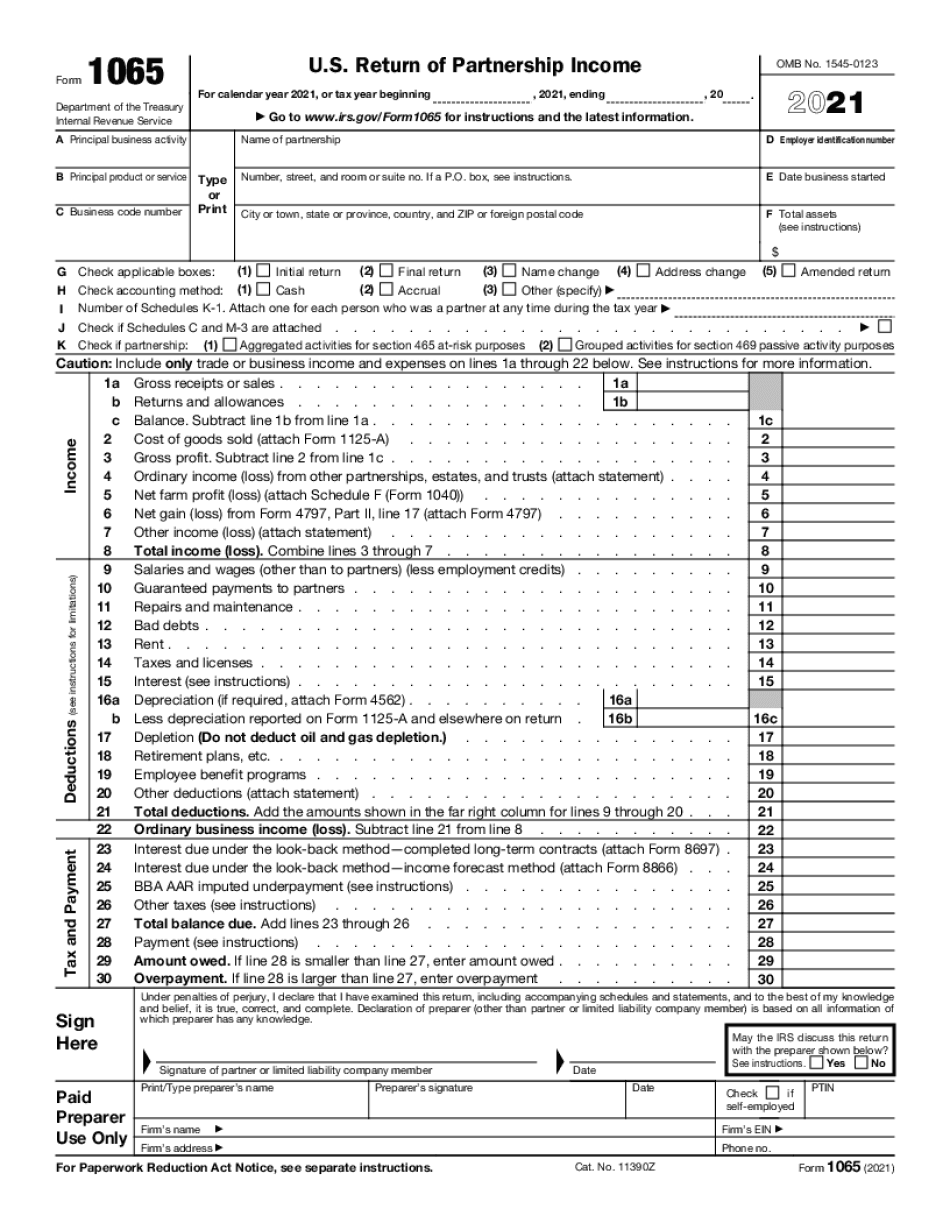

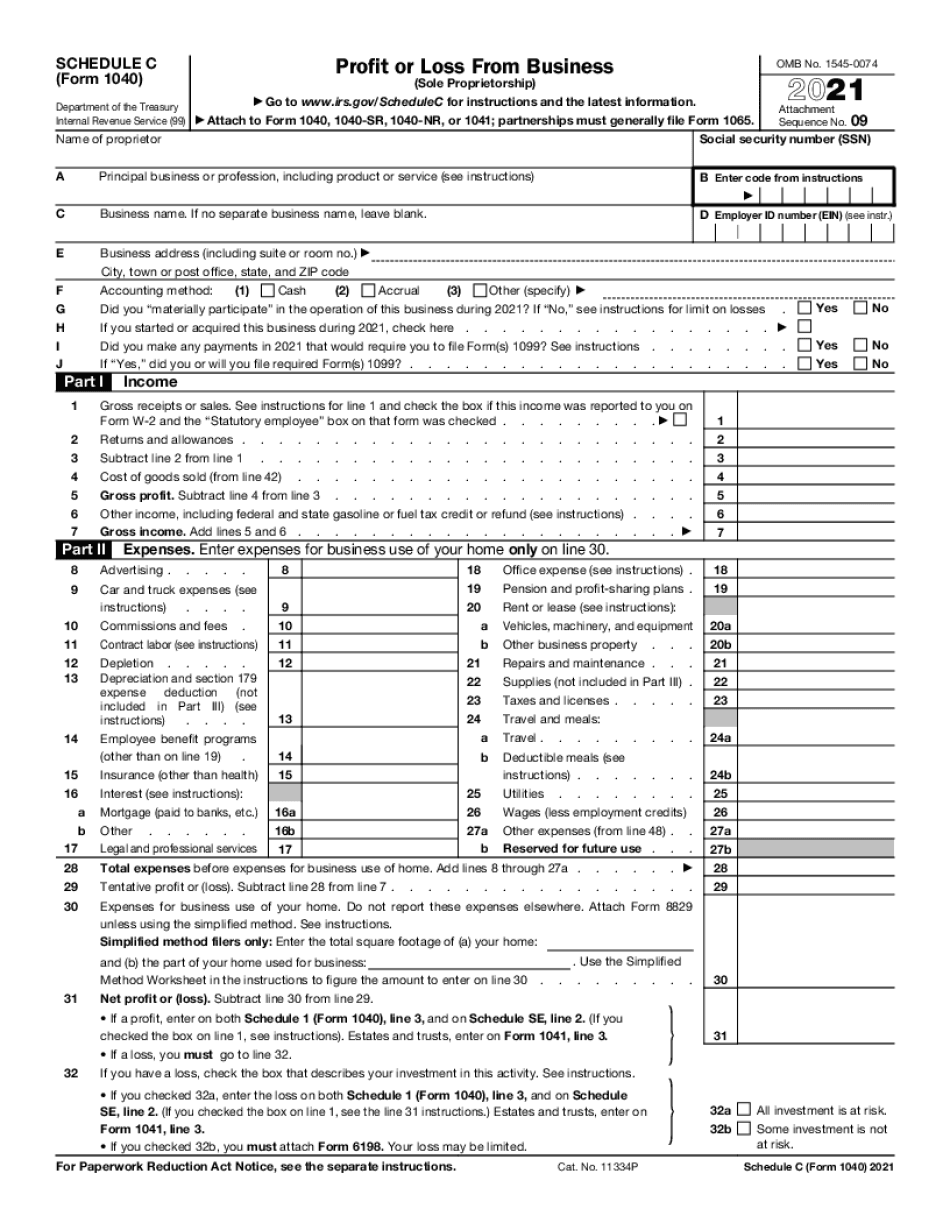

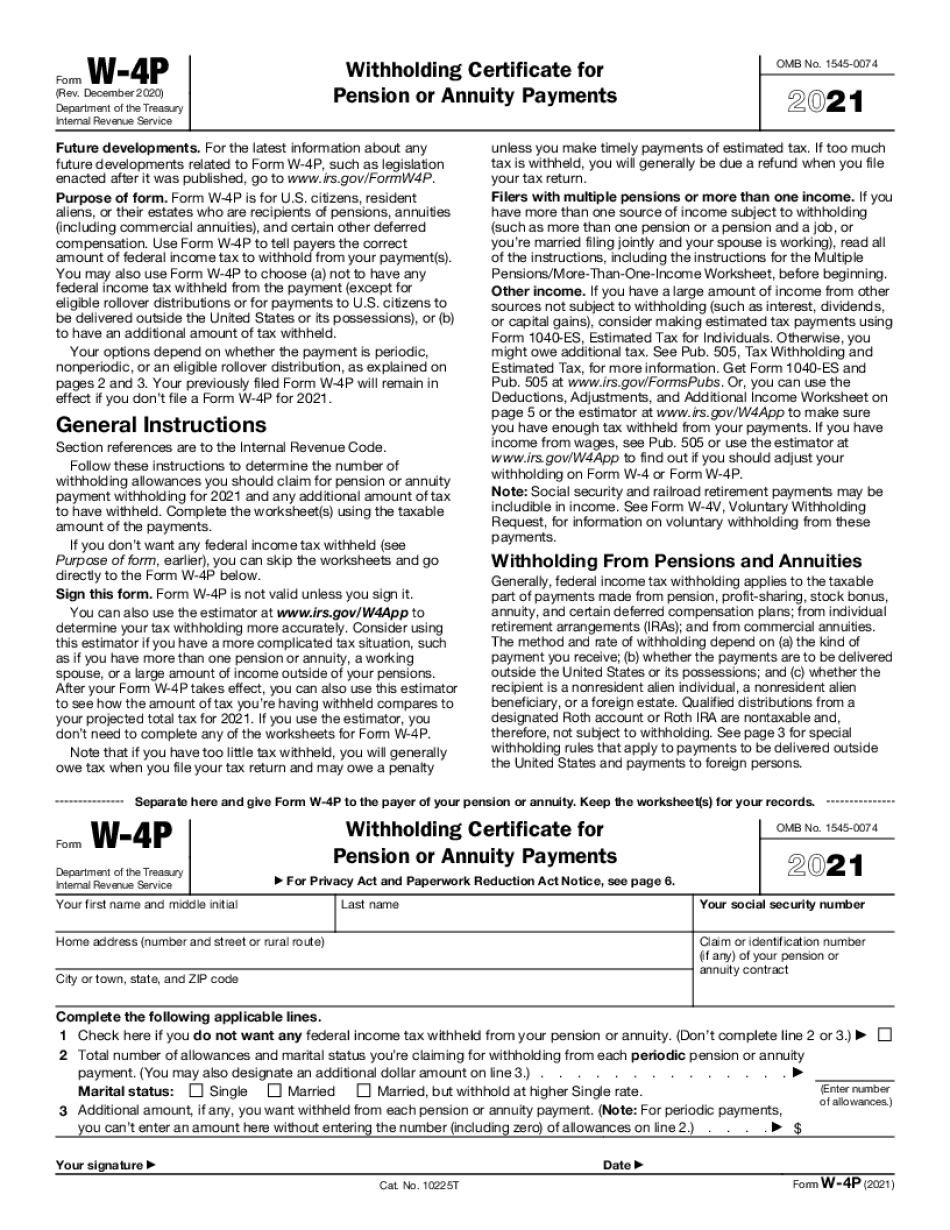

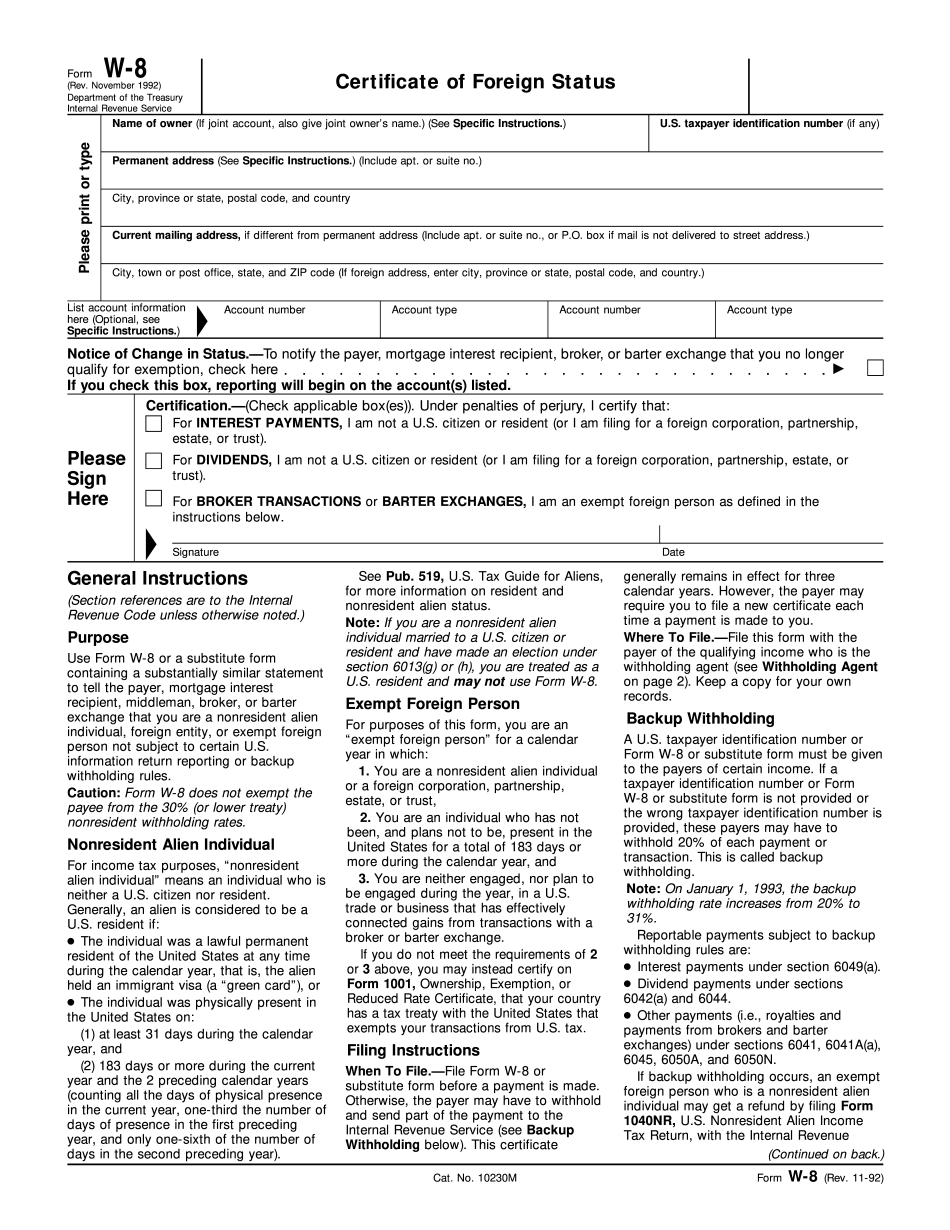

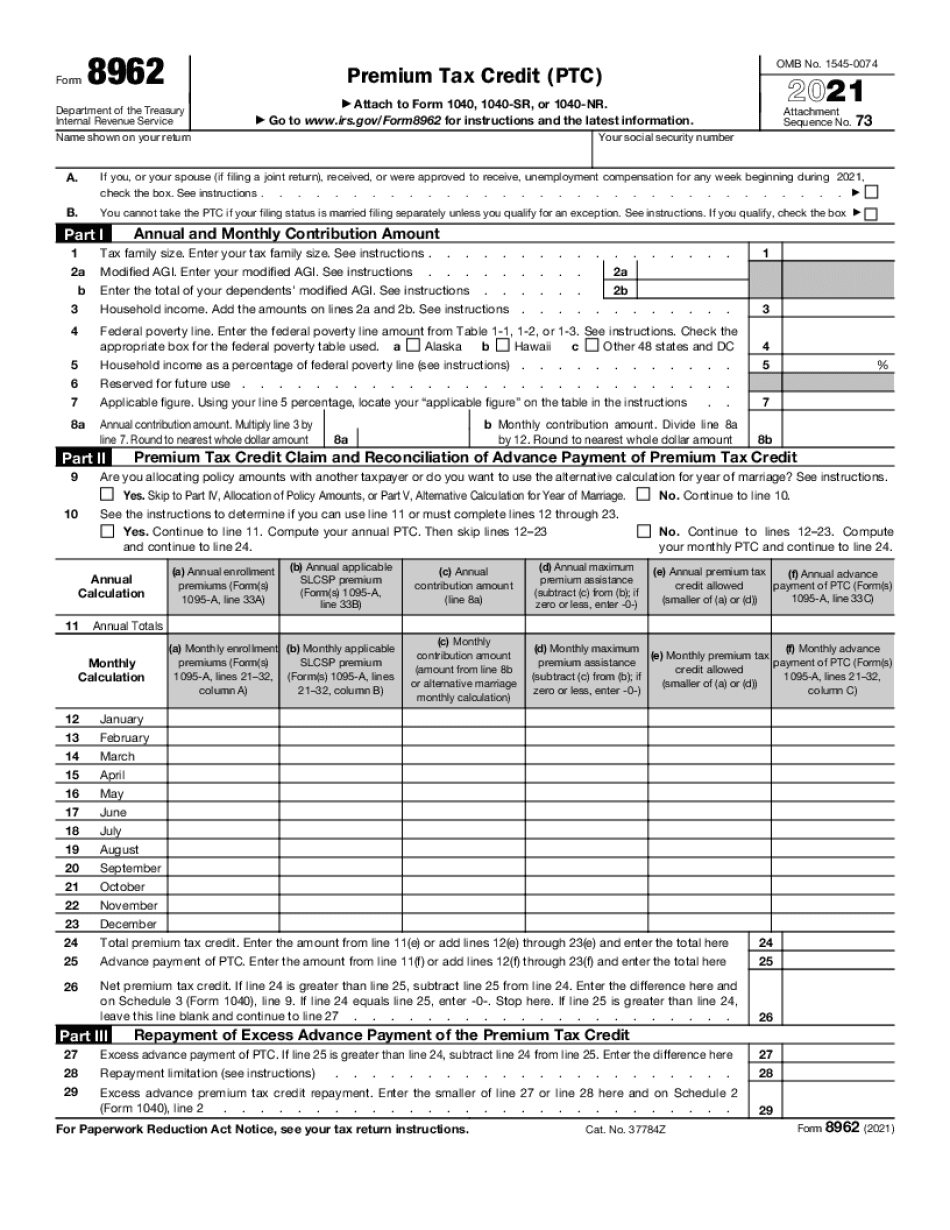

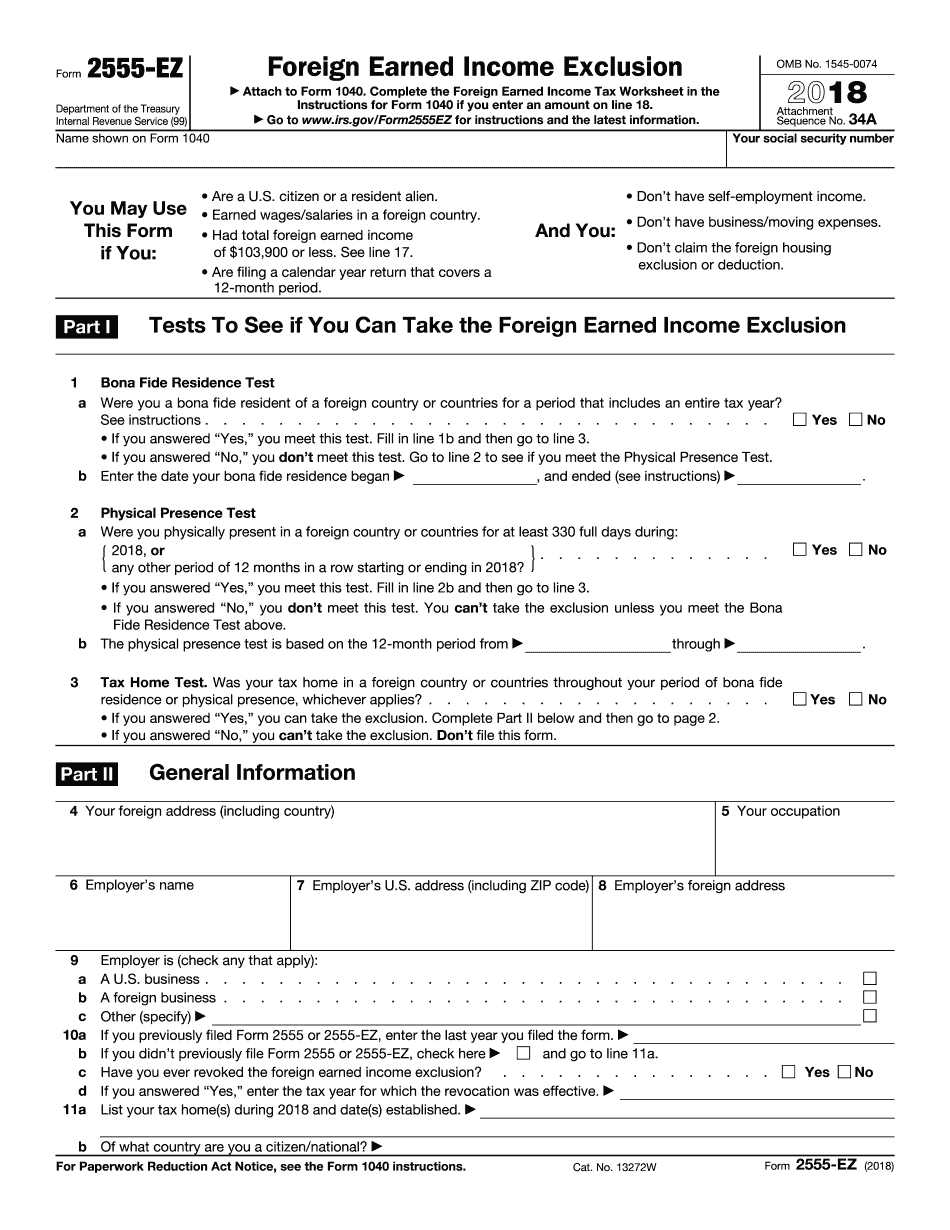

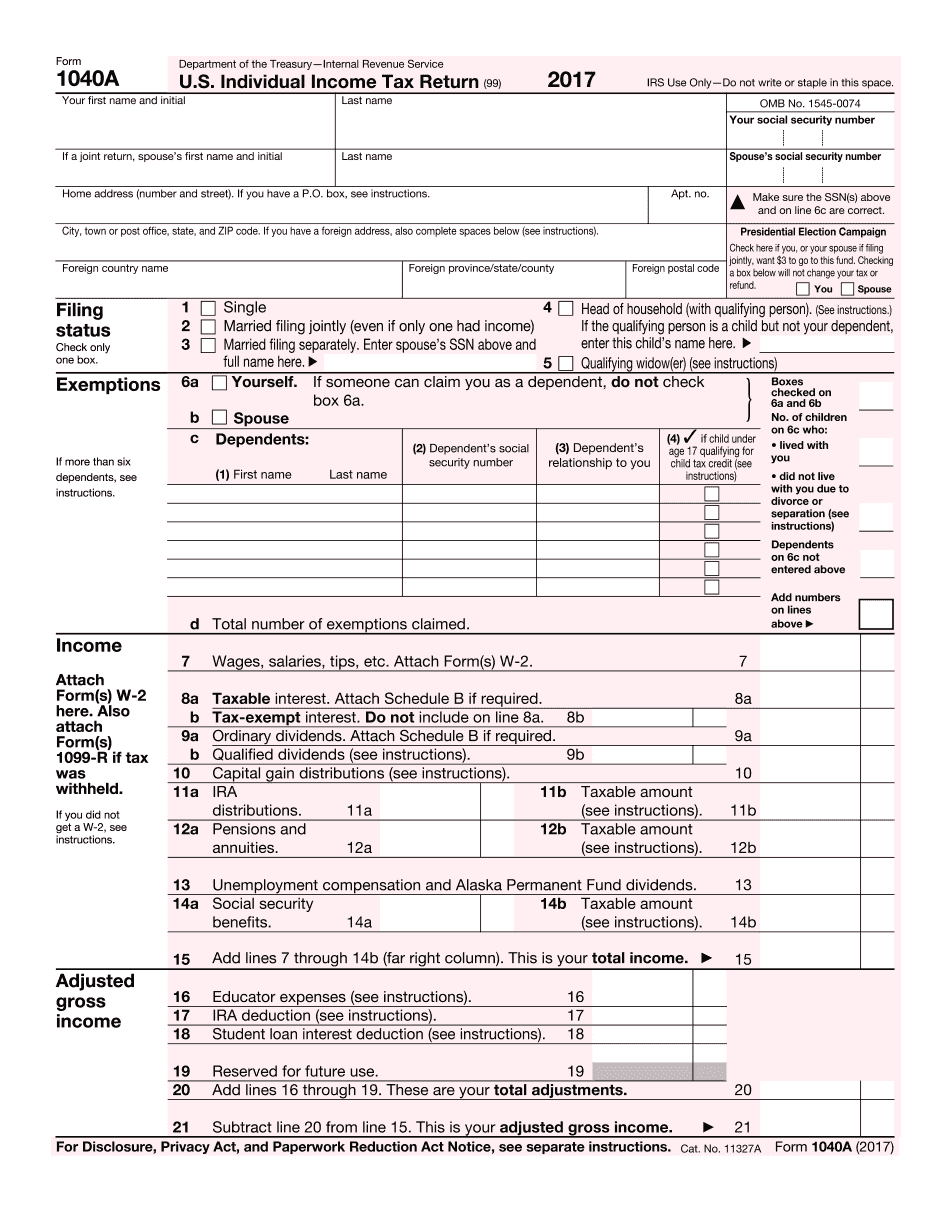

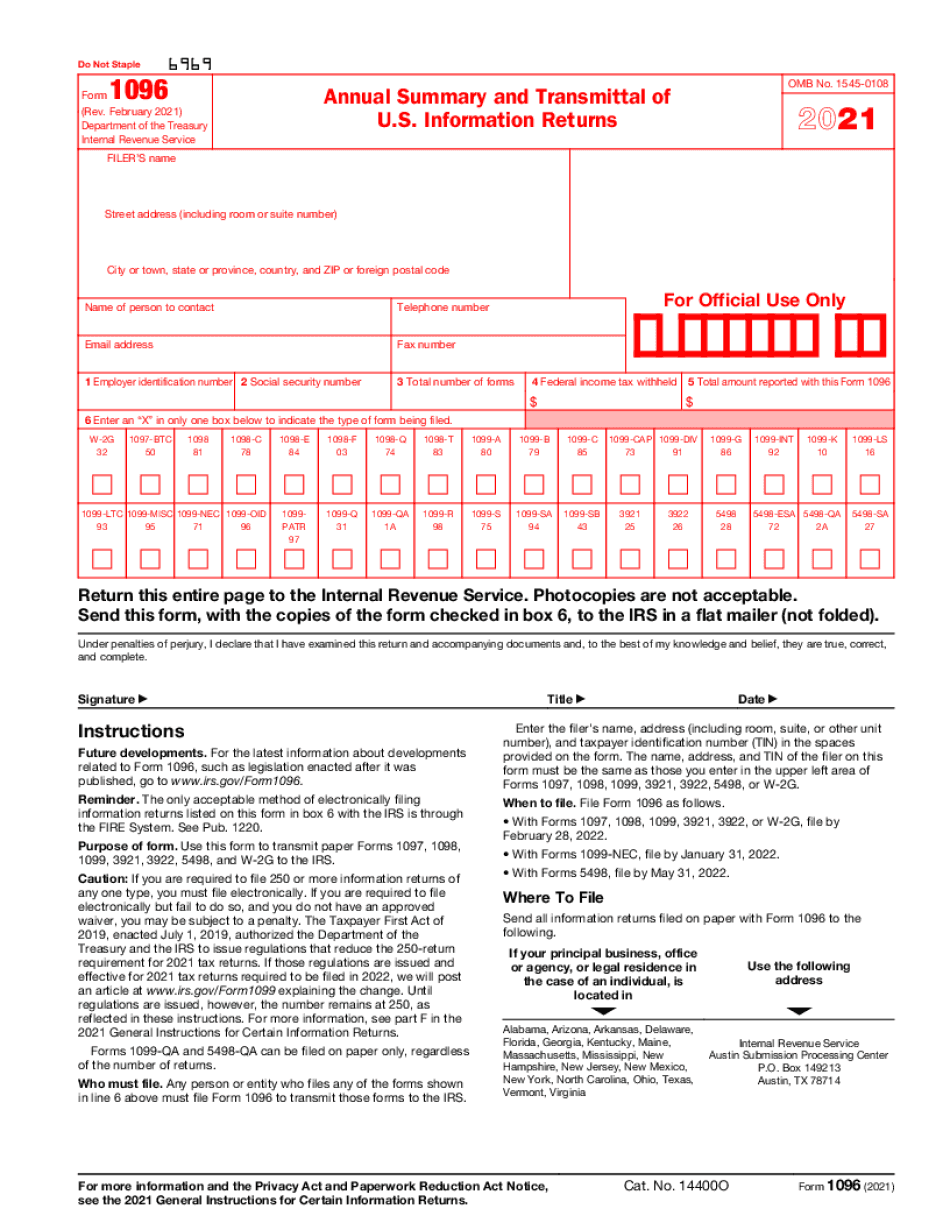

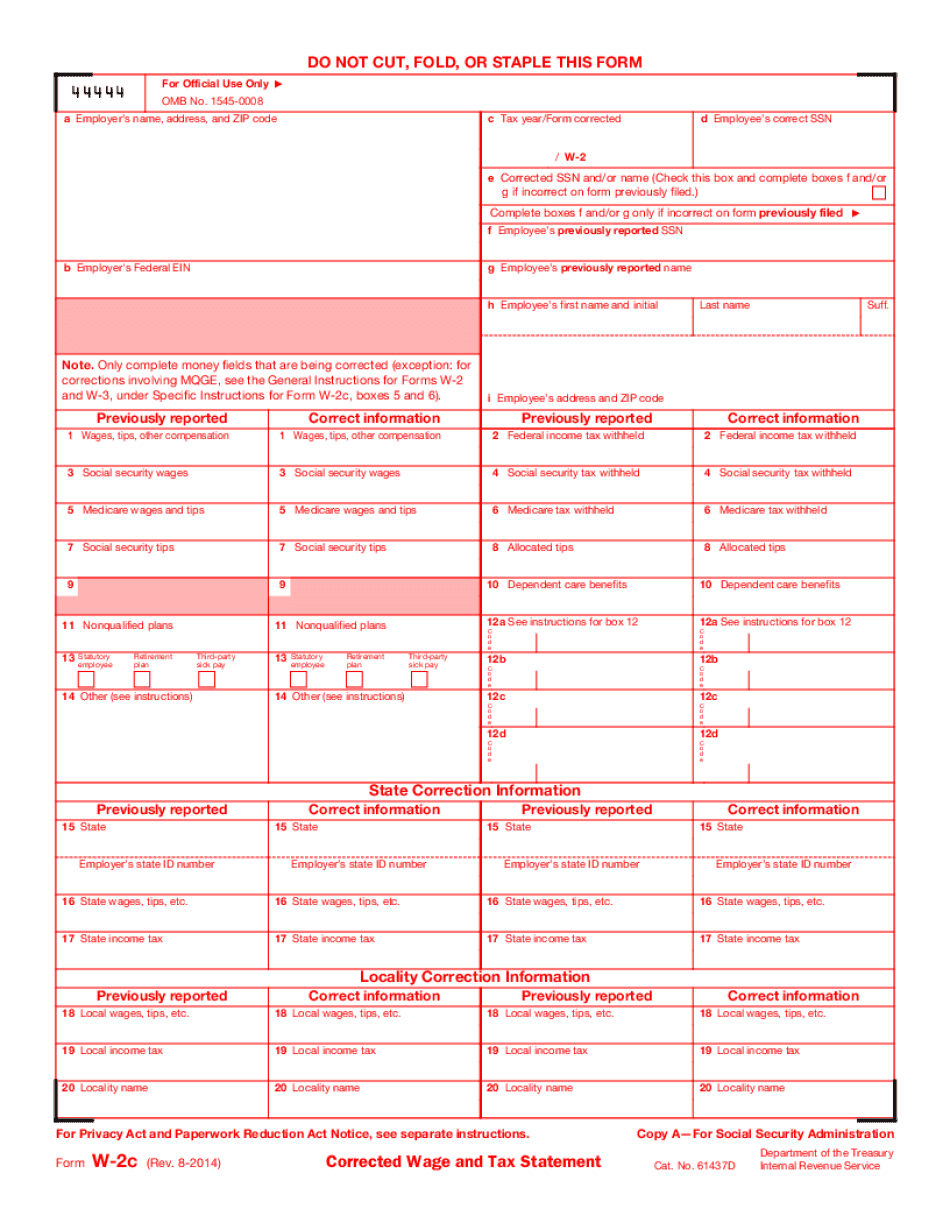

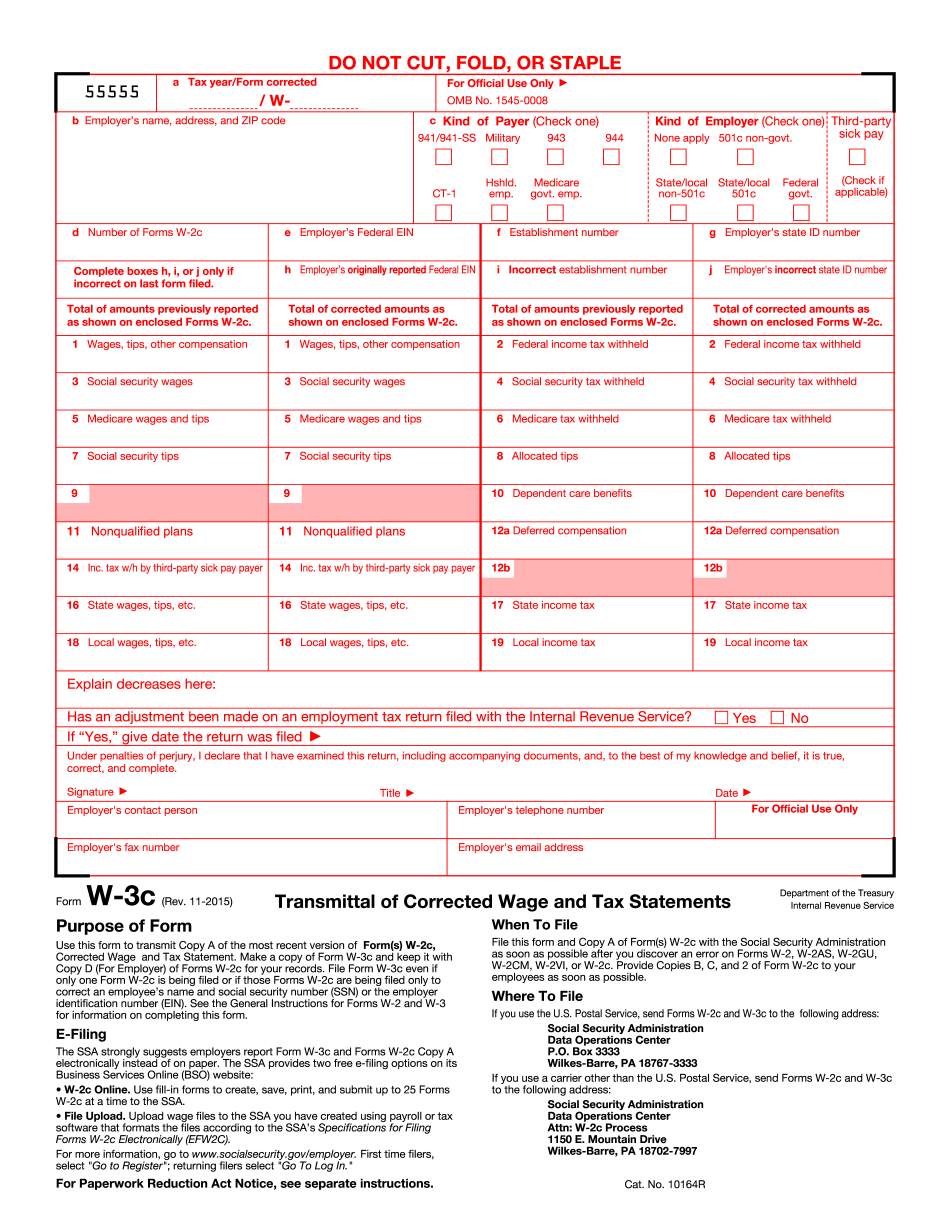

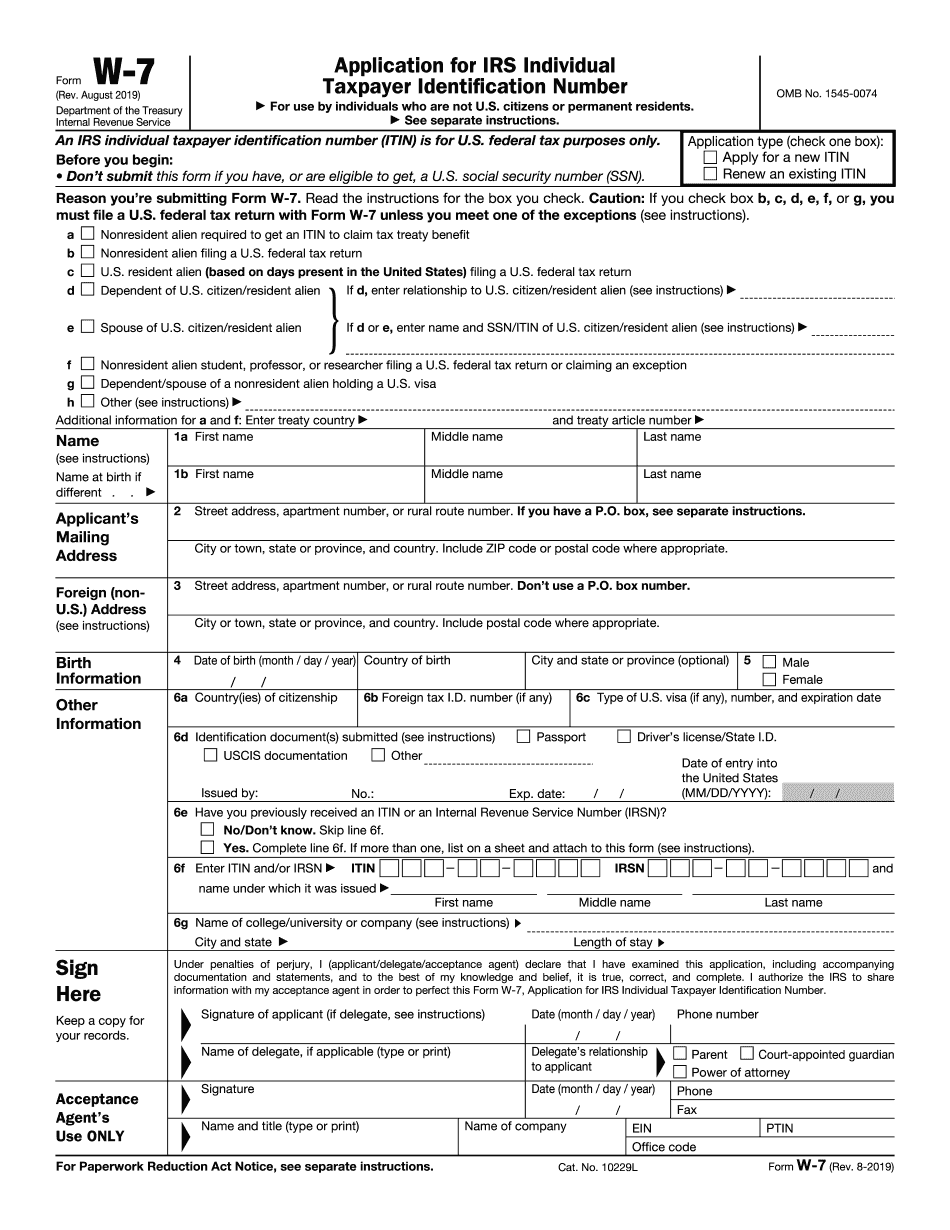

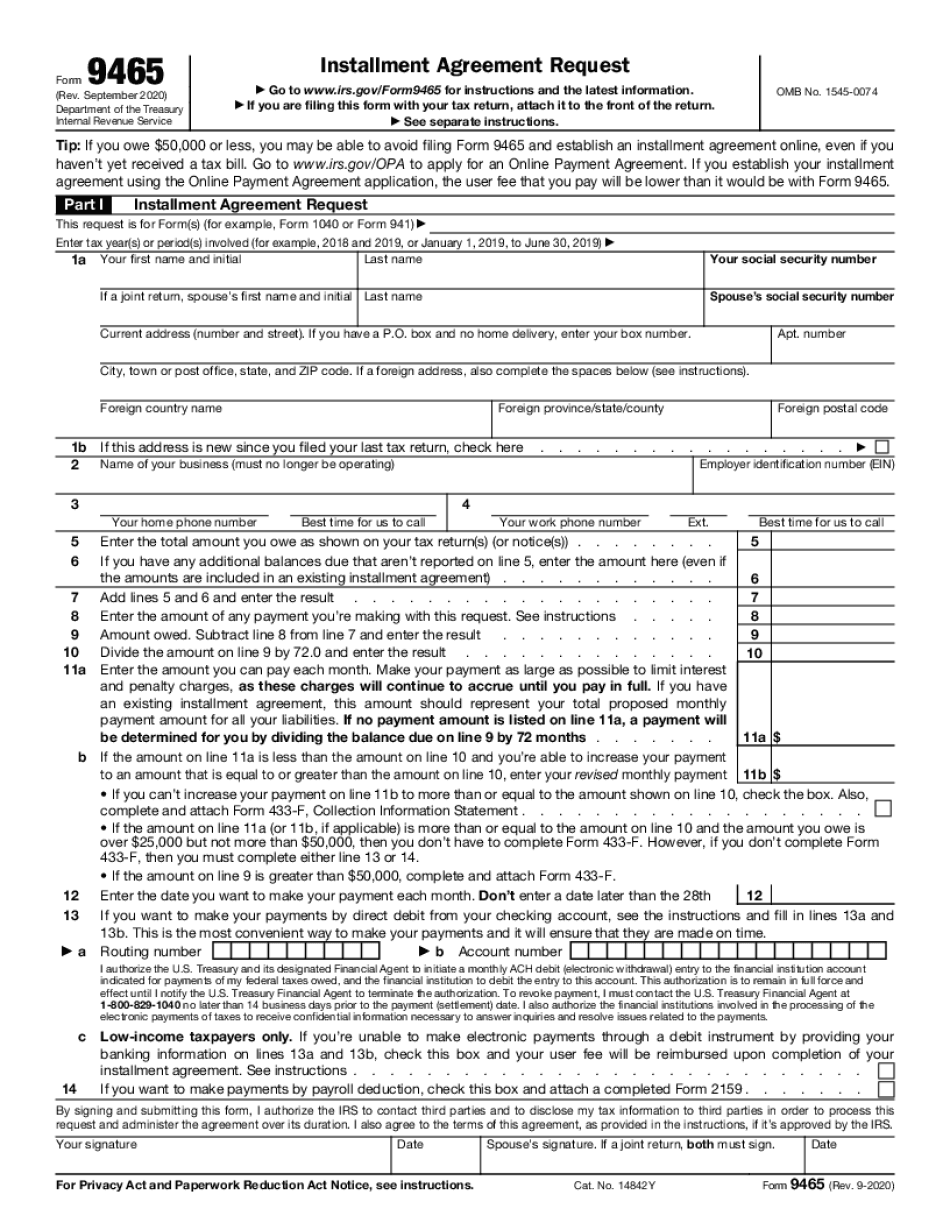

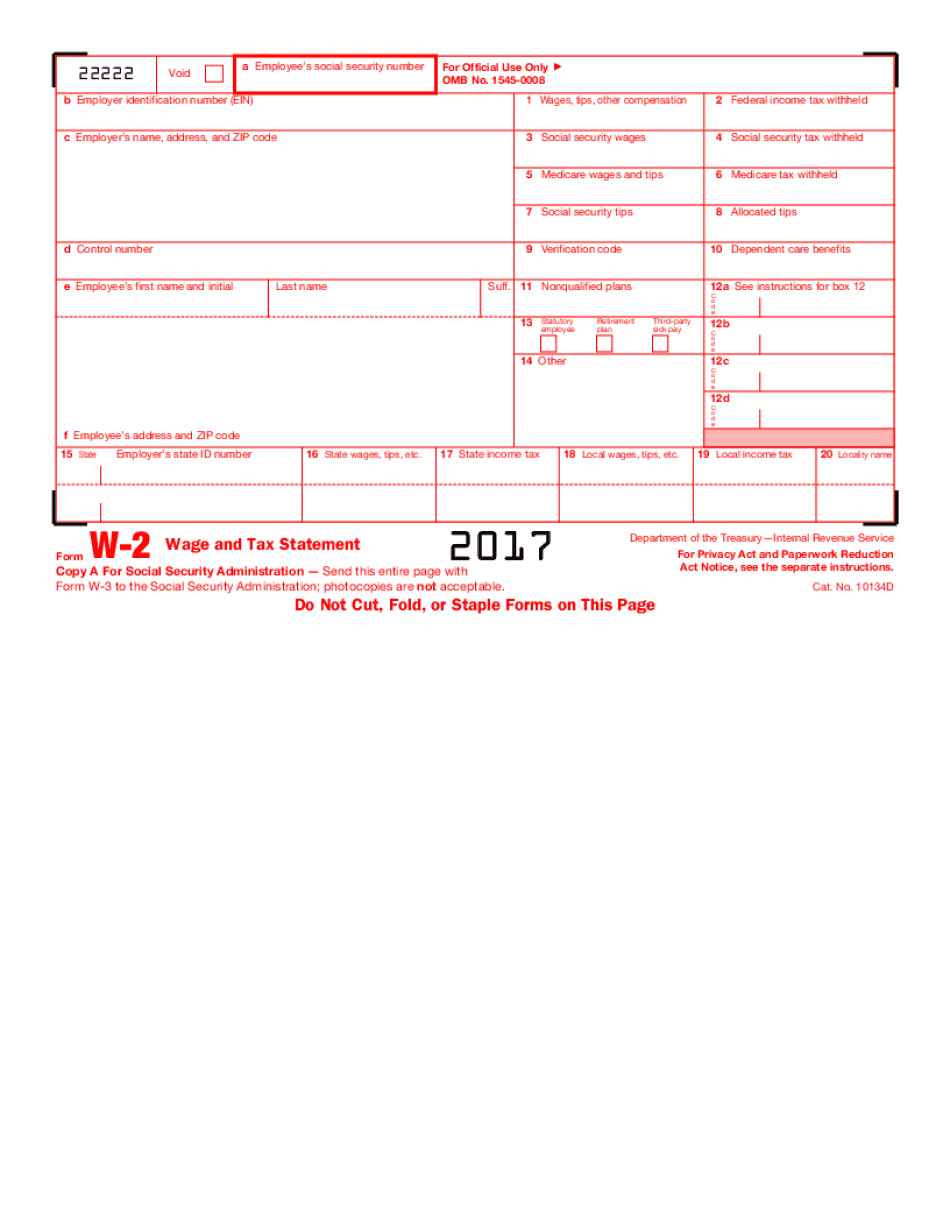

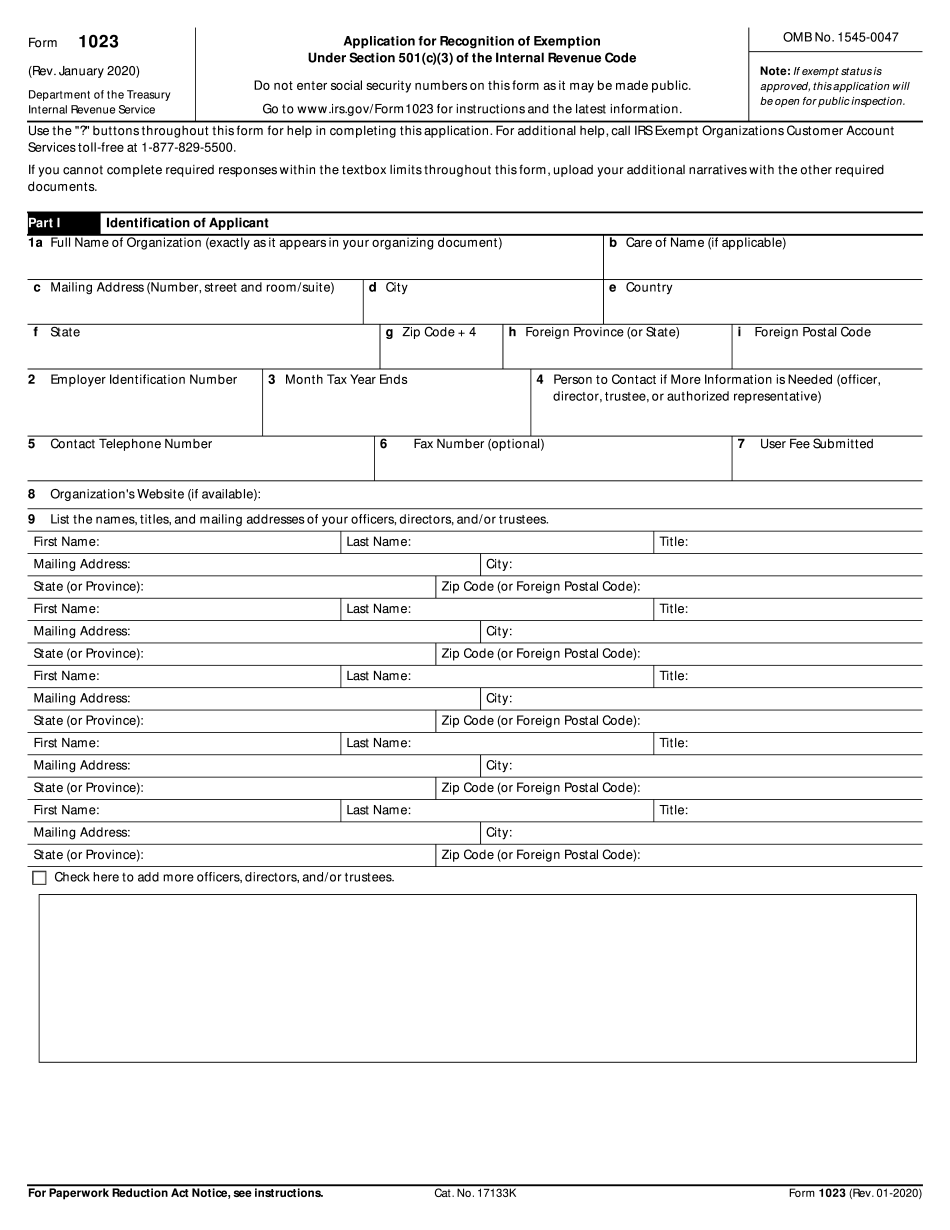

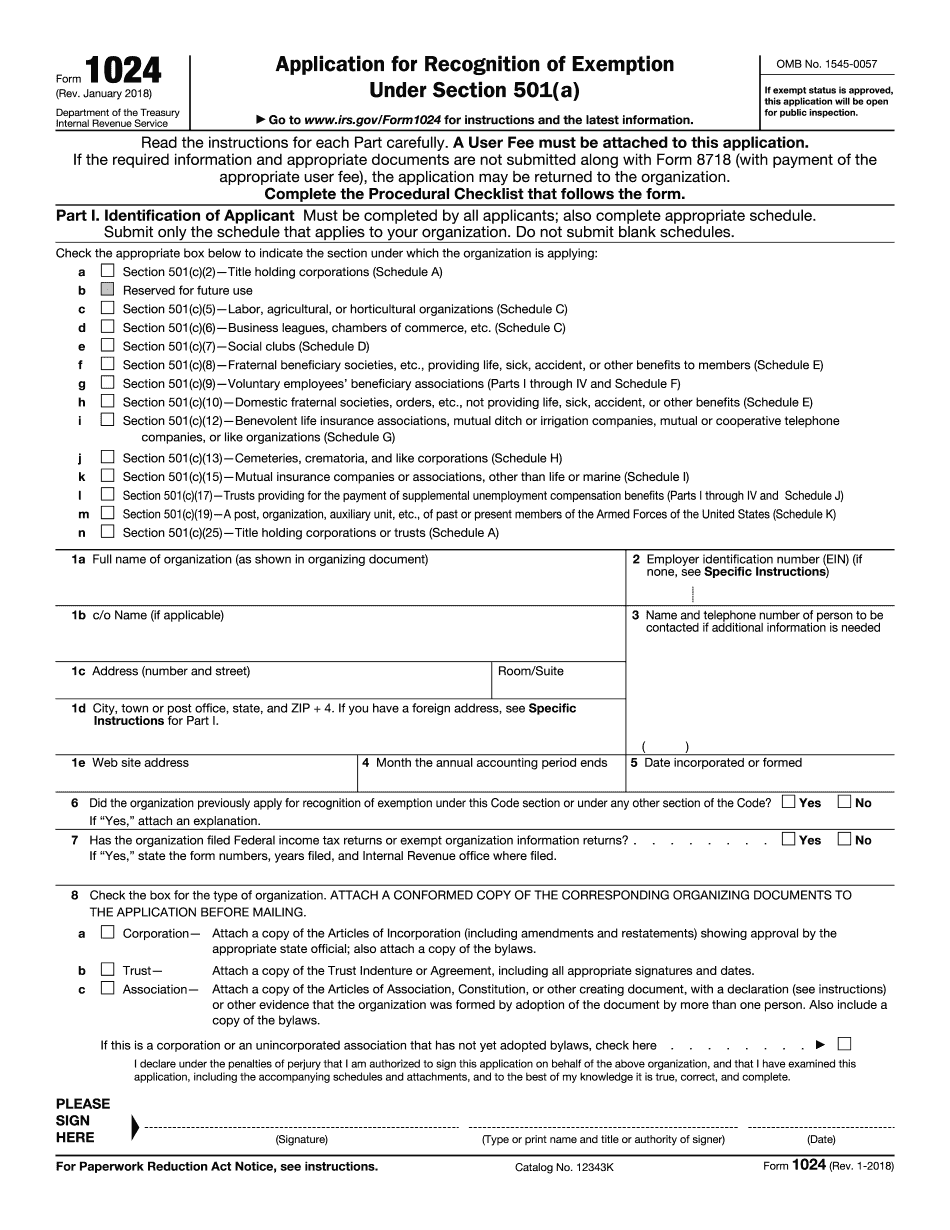

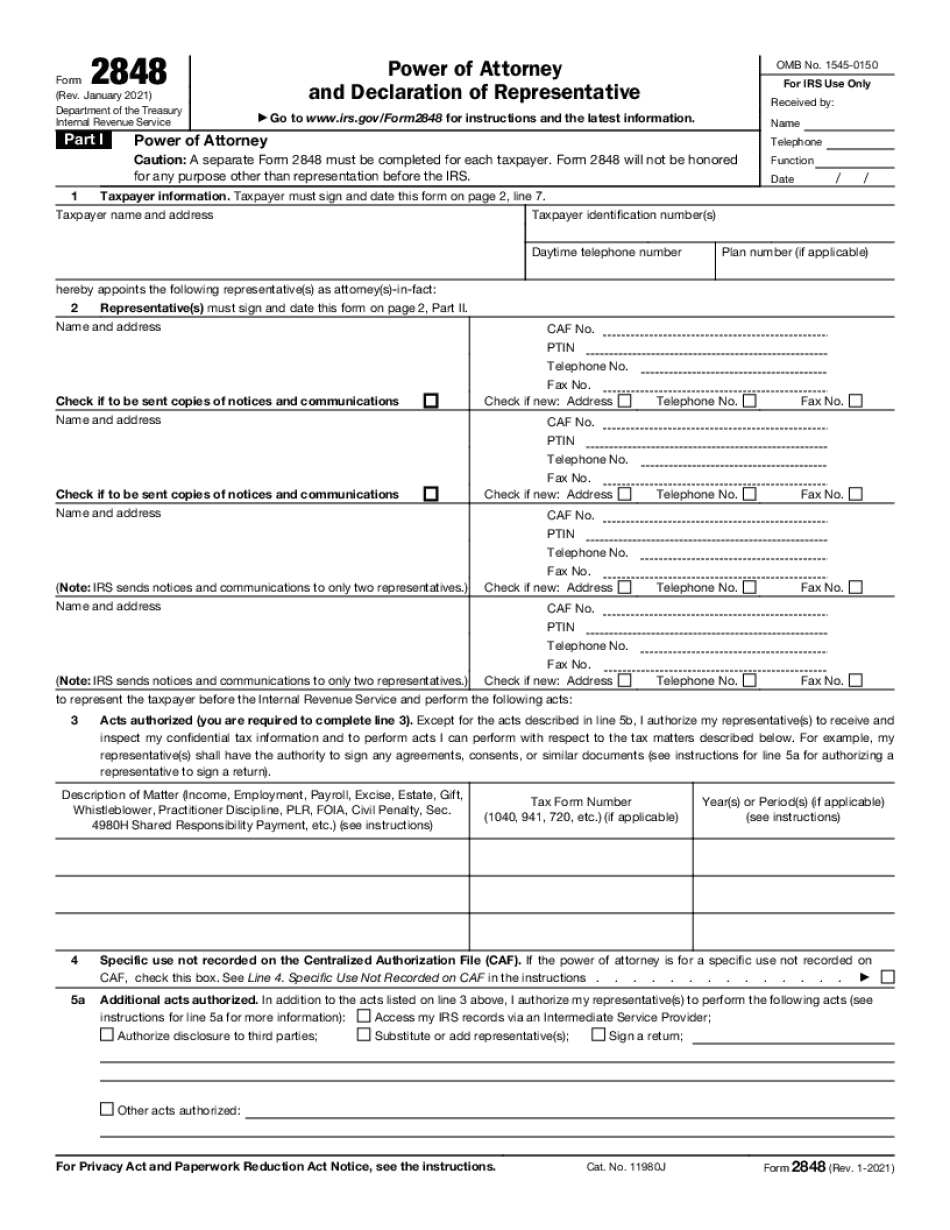

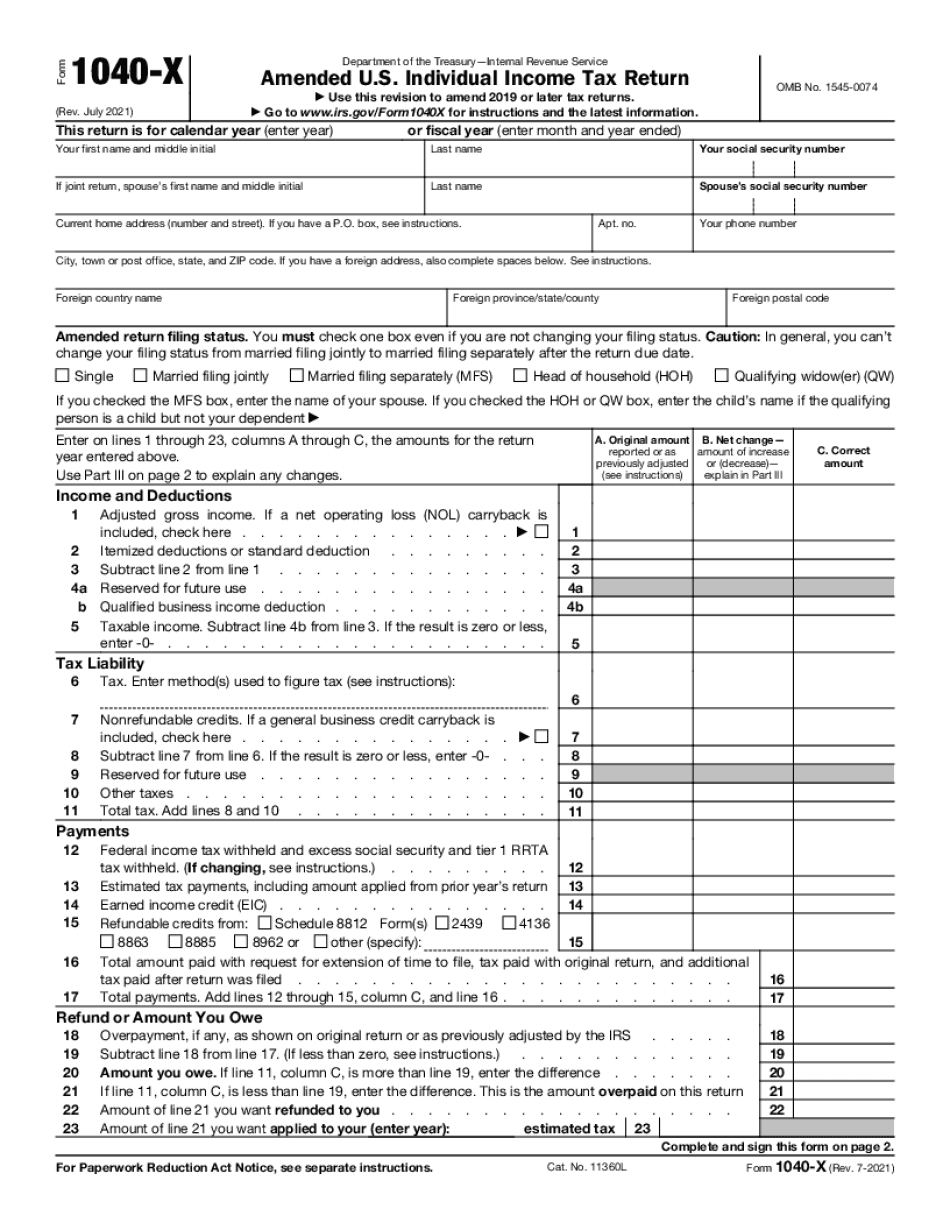

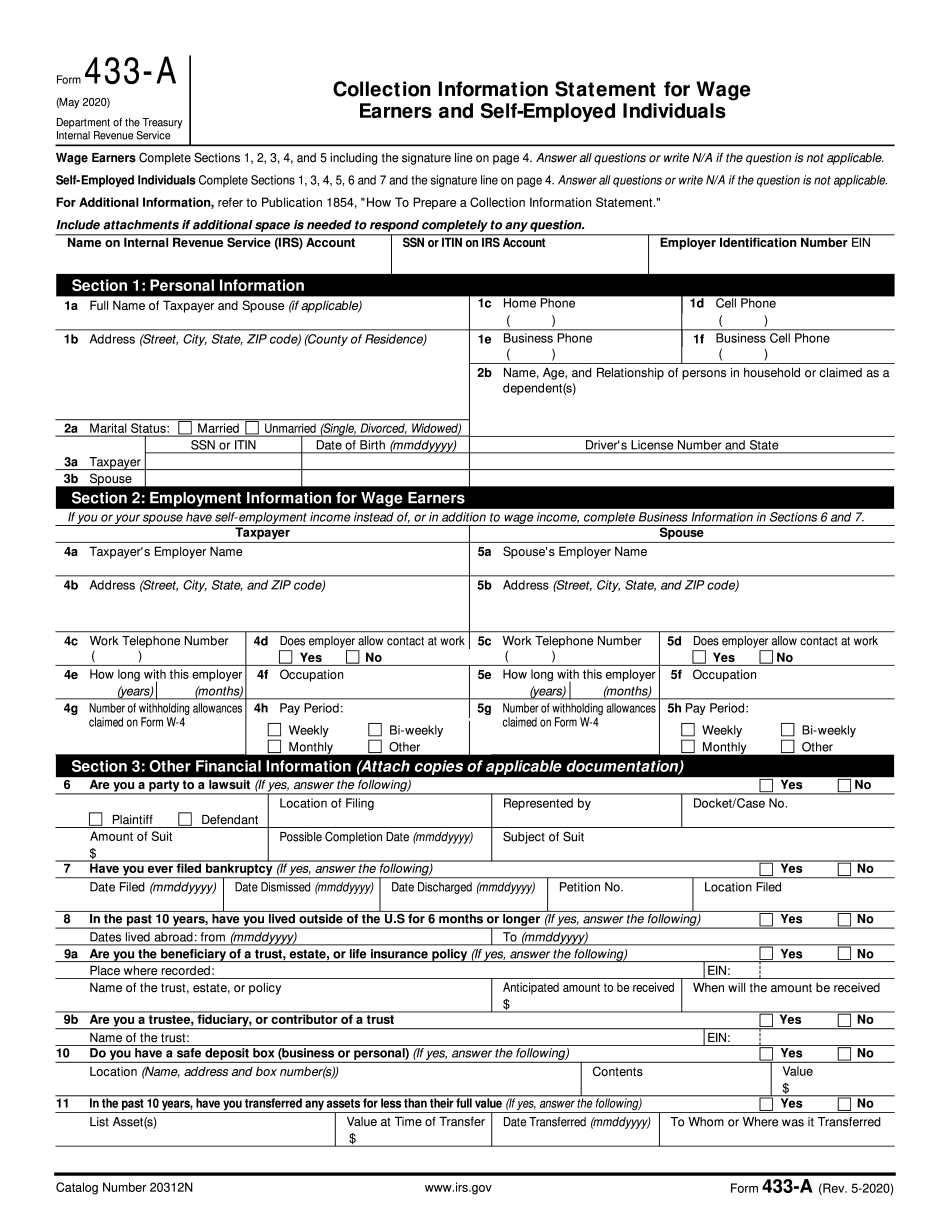

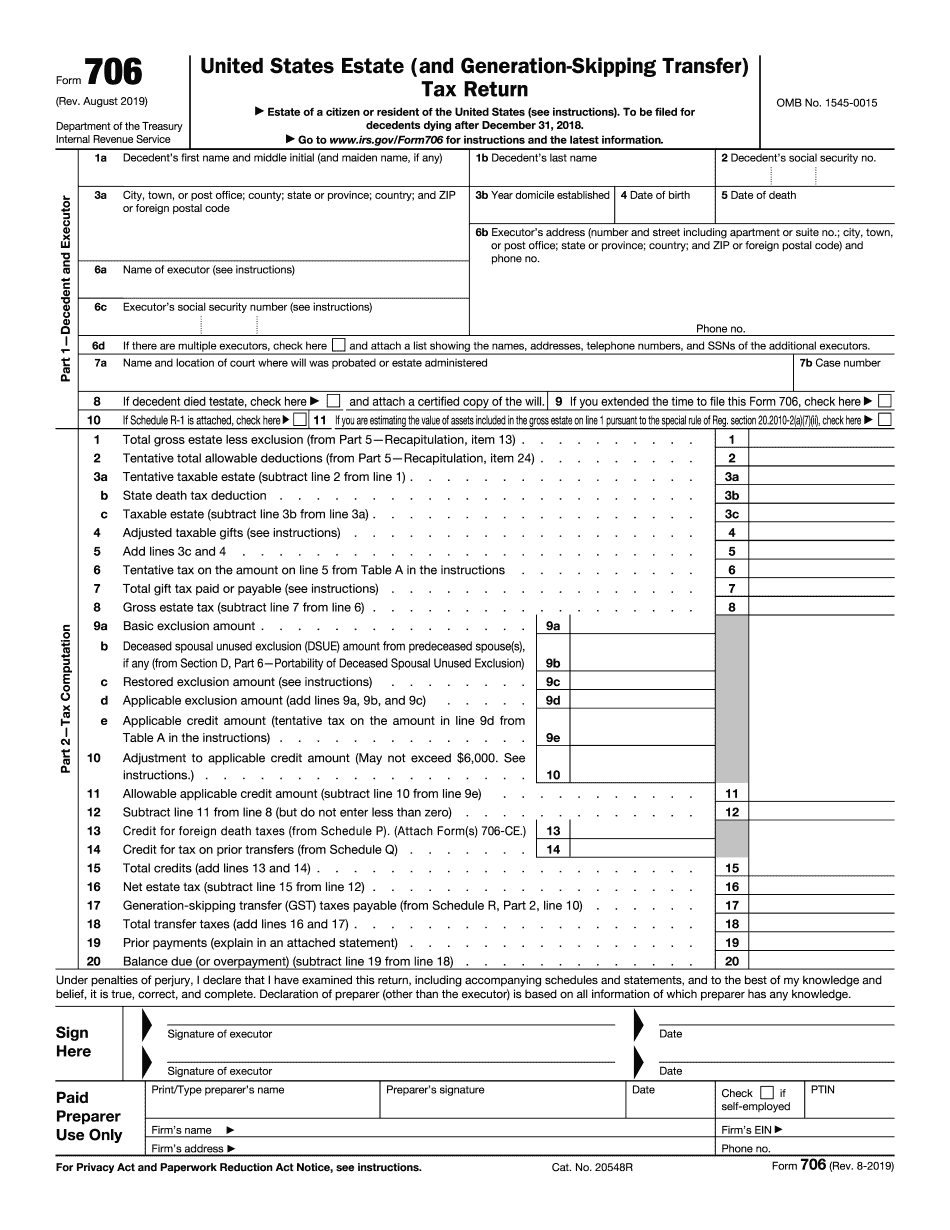

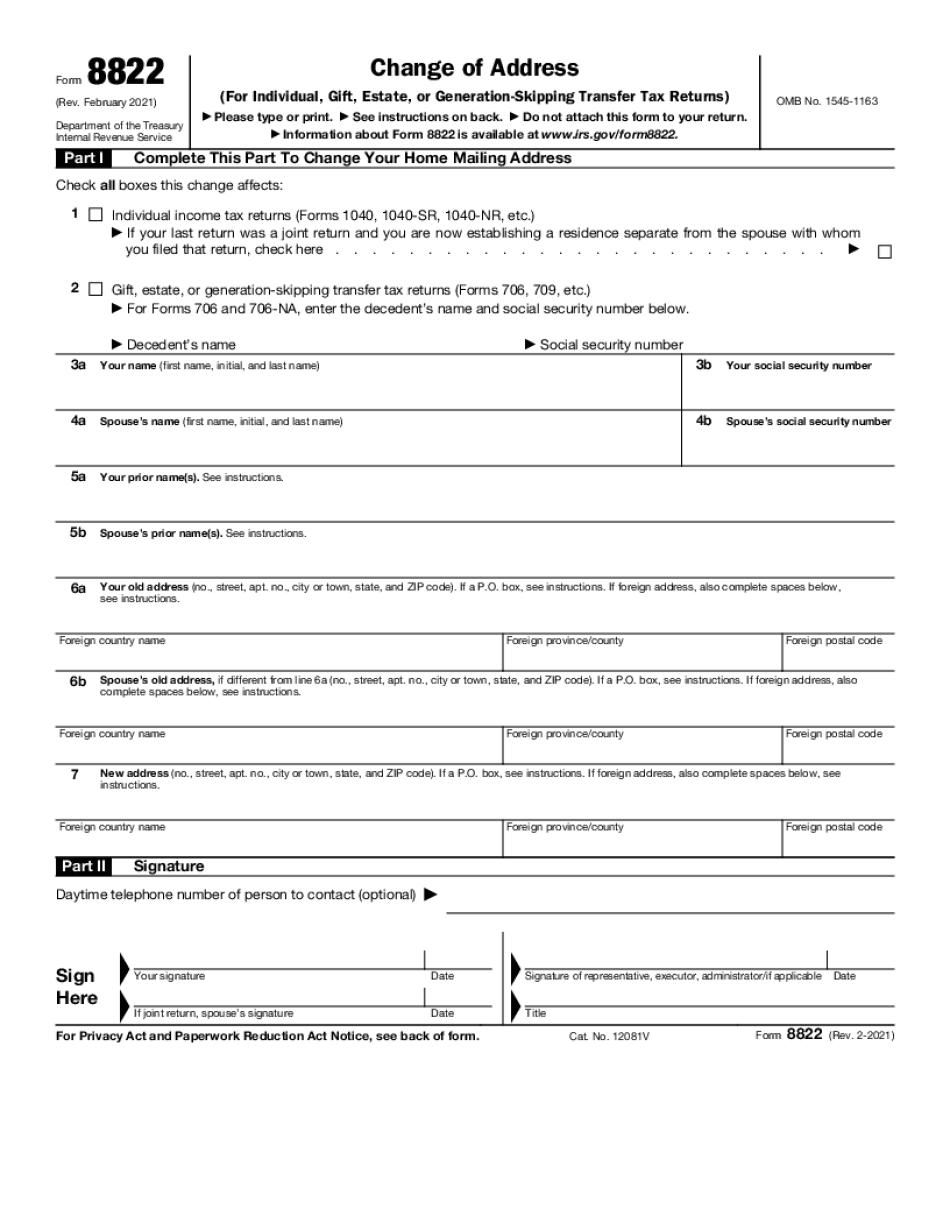

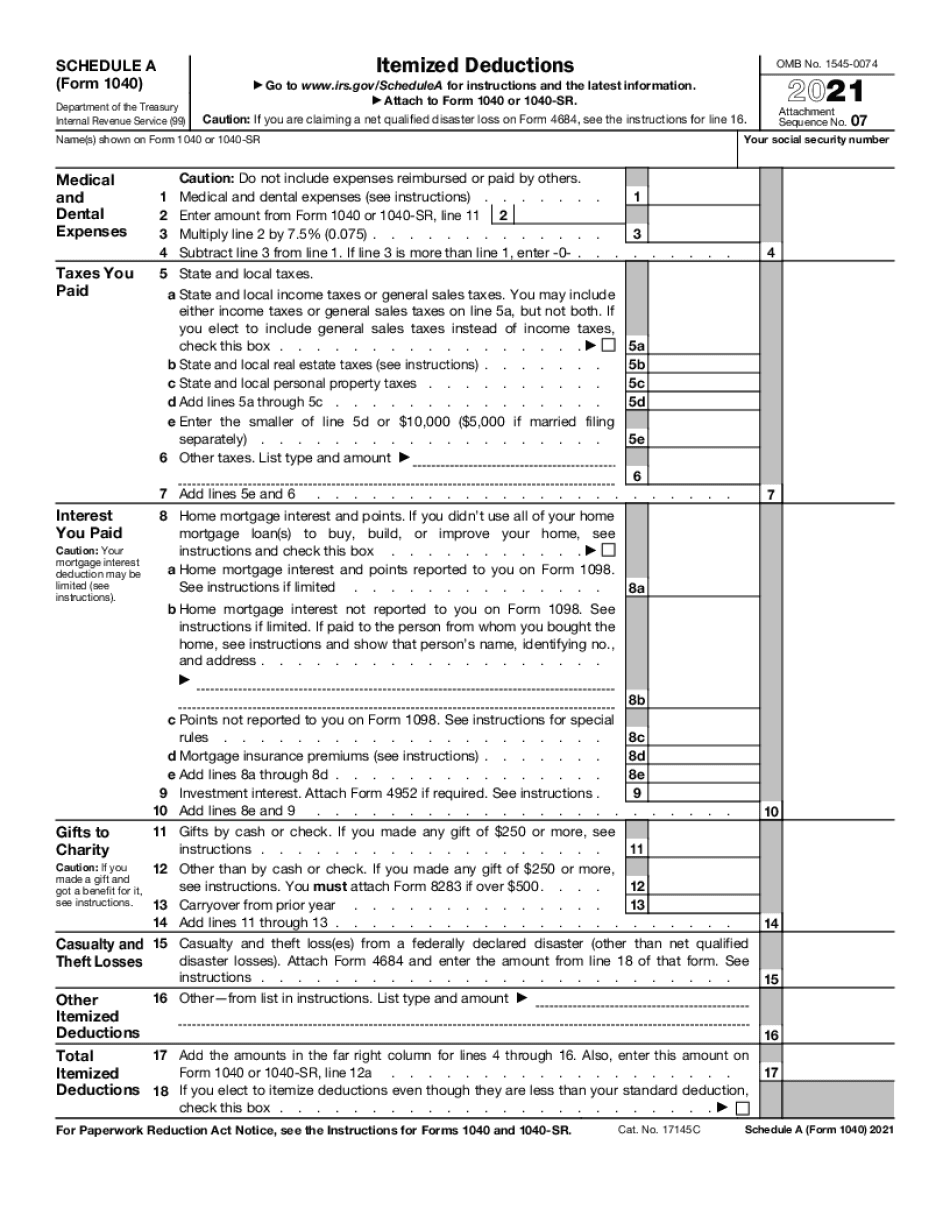

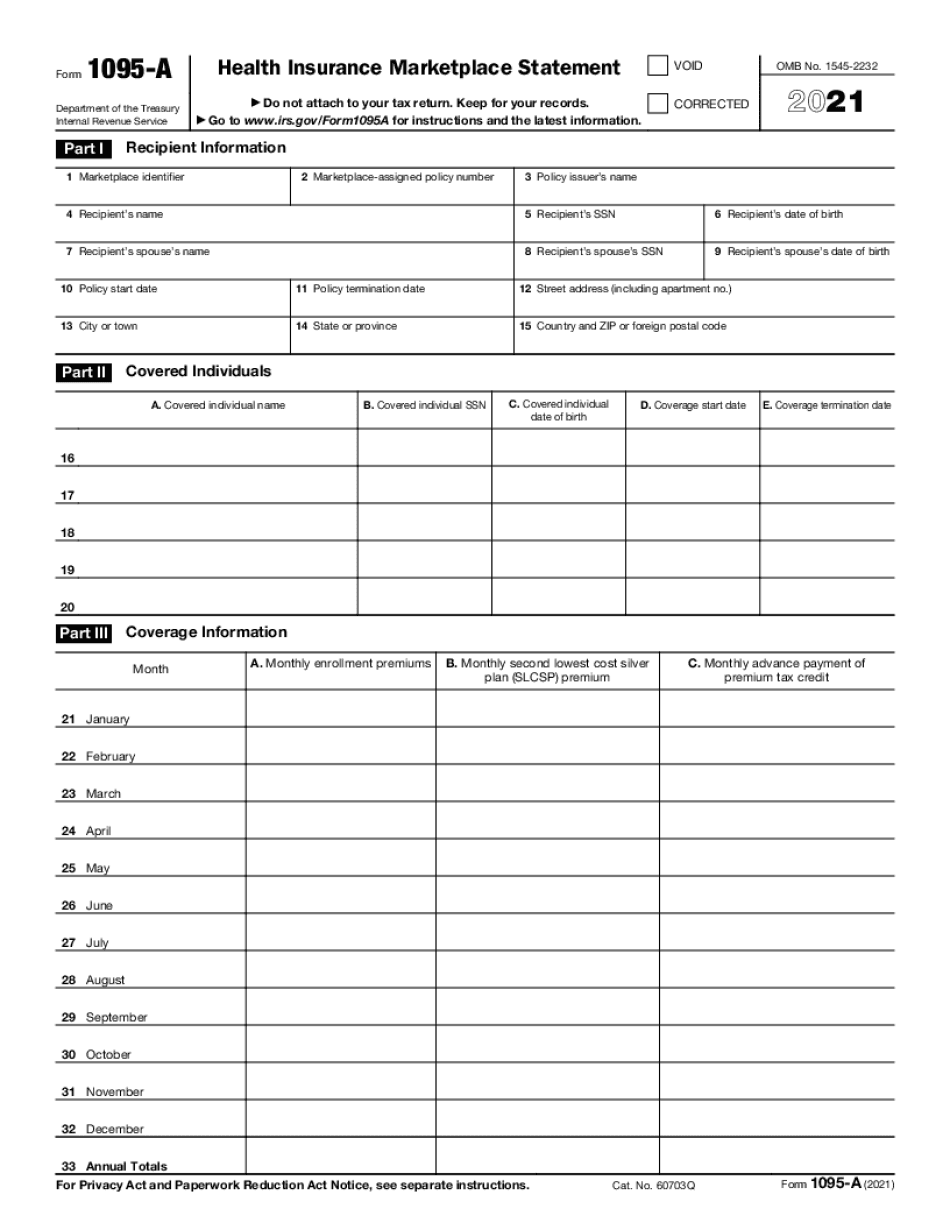

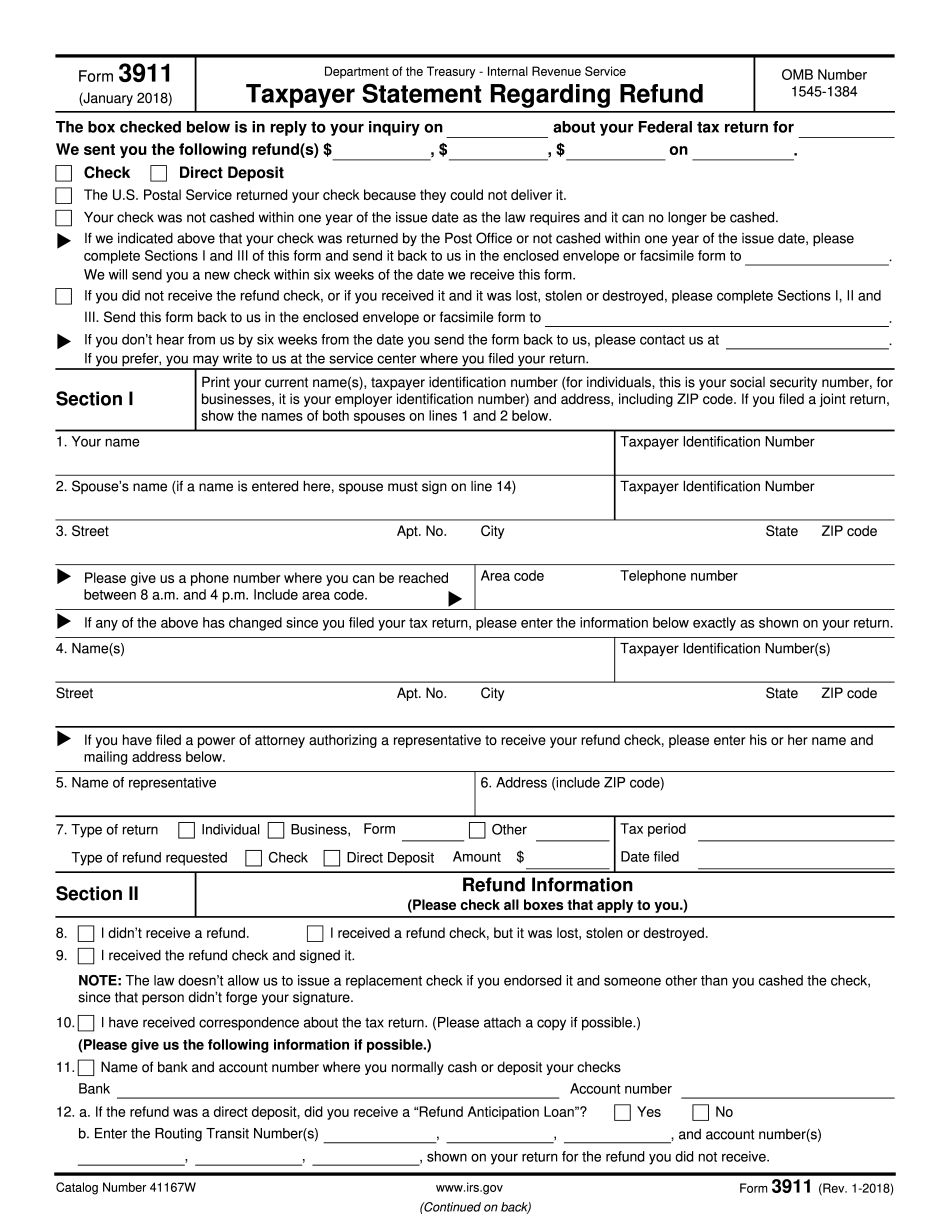

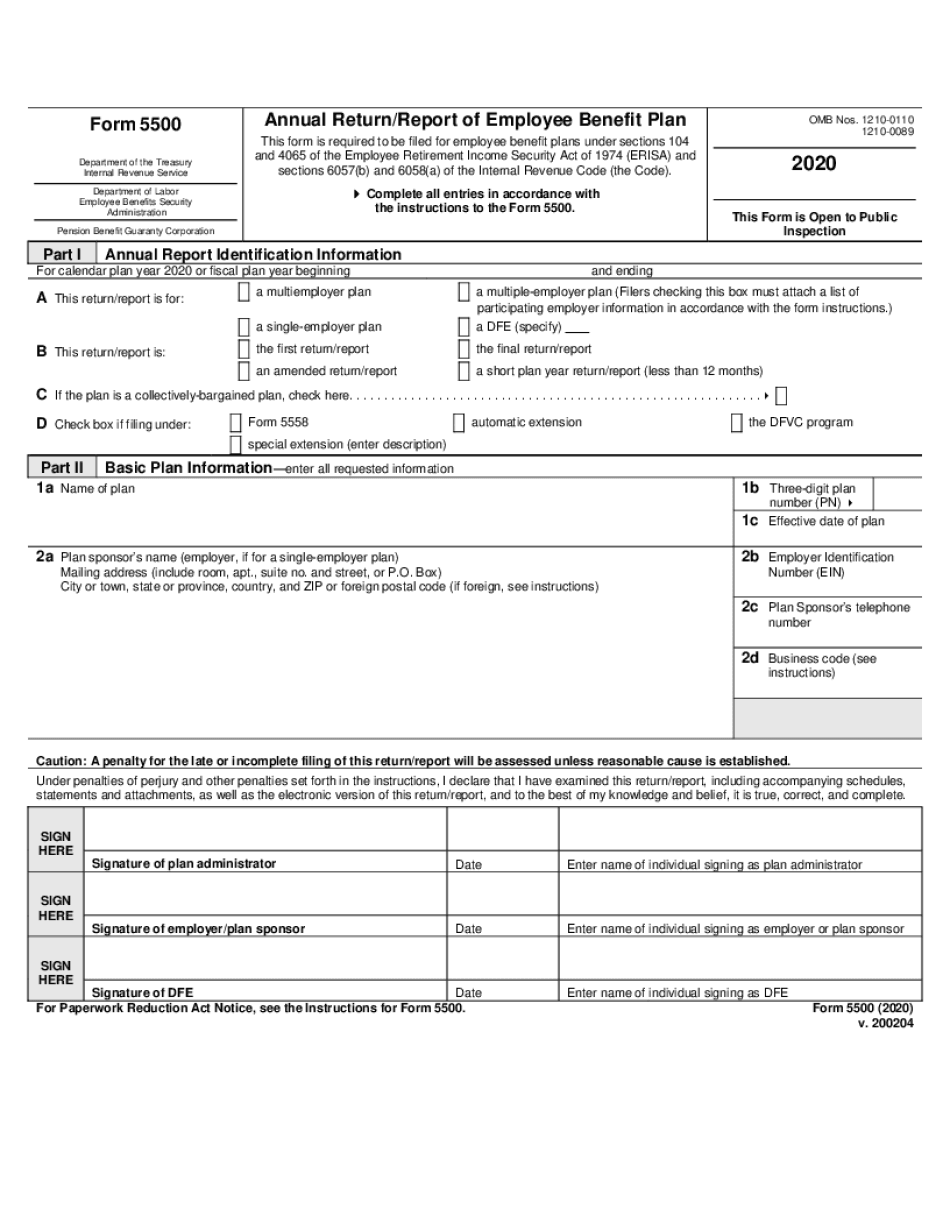

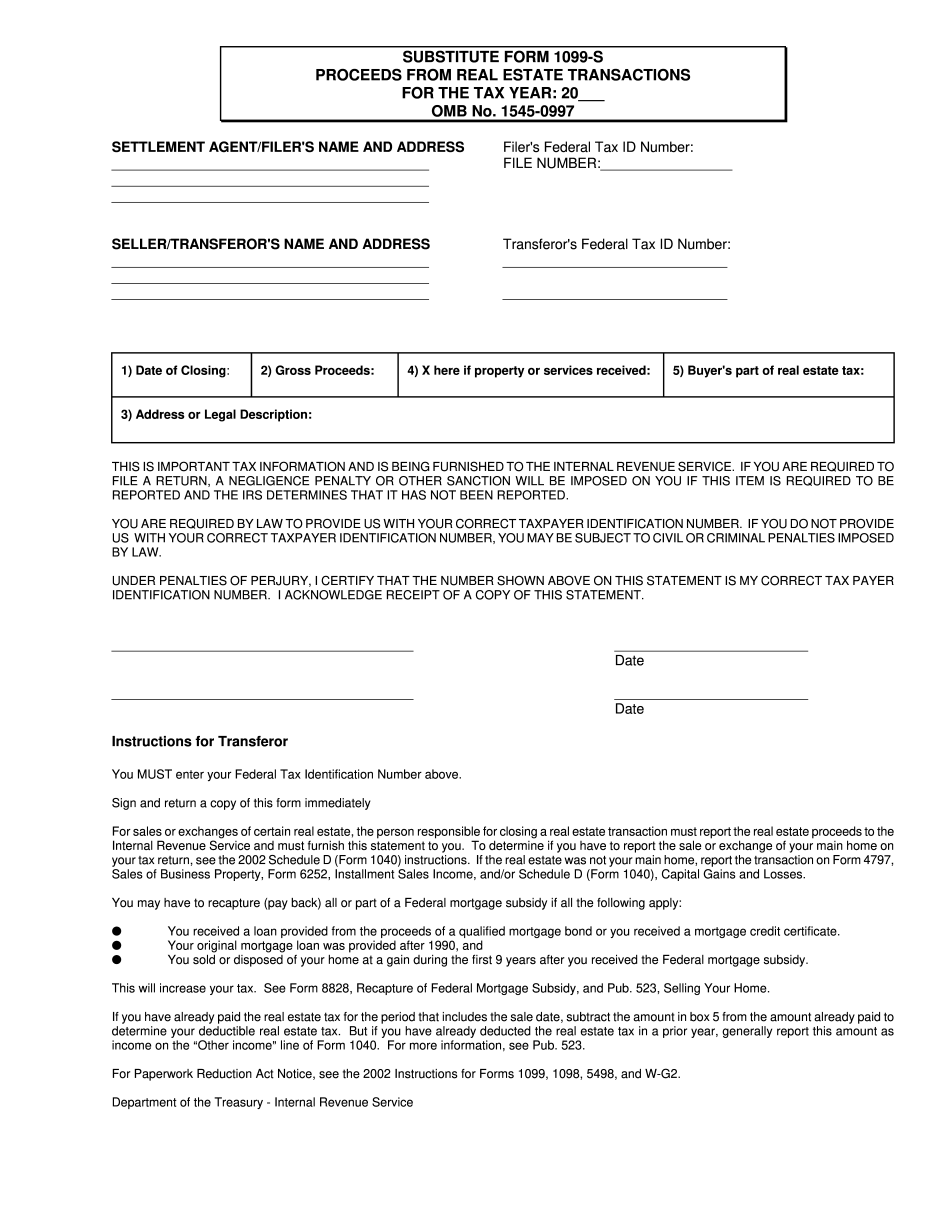

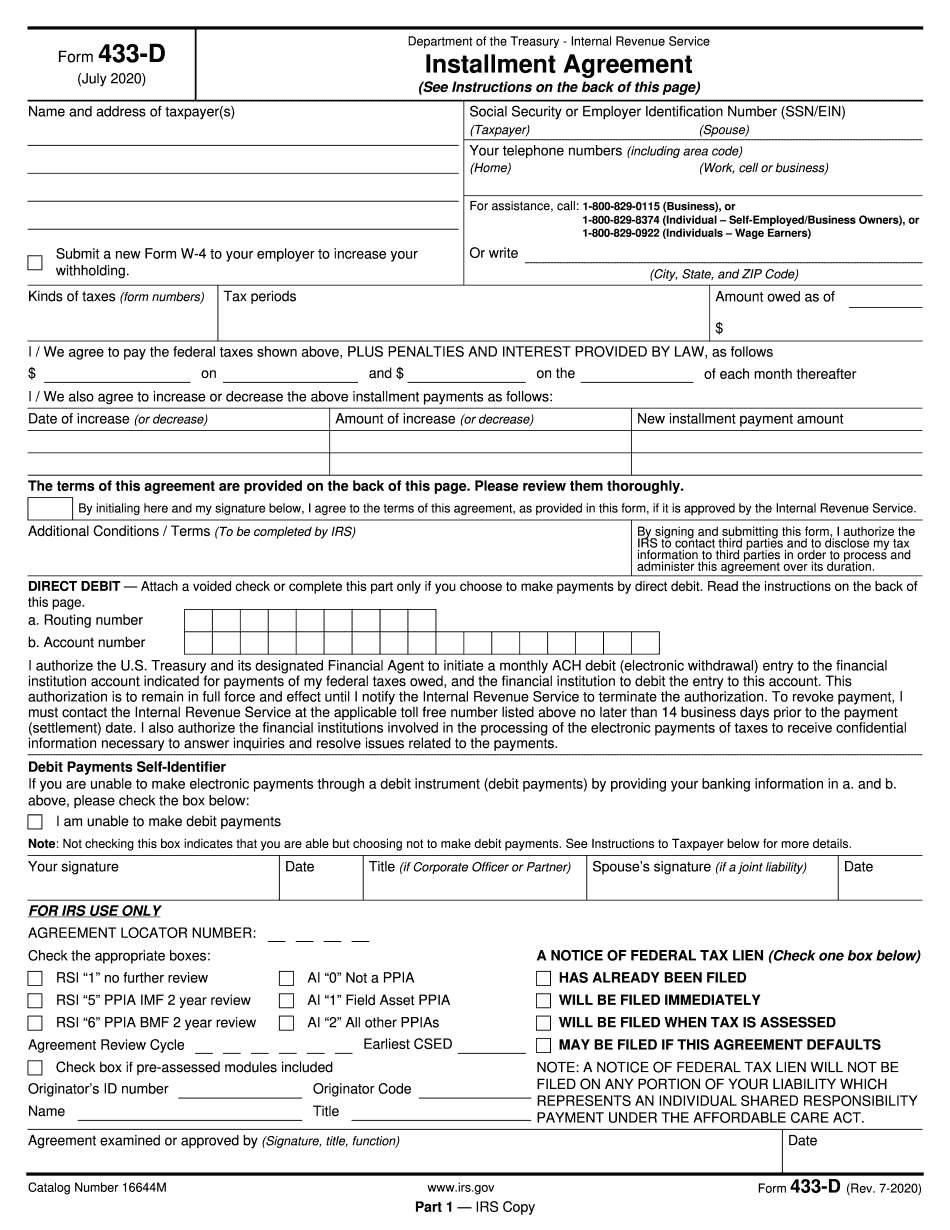

Most wanted tax and legal web forms

Choosen an appropriate tax year, your filing status, and annual taxable income to know your estimated tax rate and fill out the required form right now.

What are new tax brackets?

Submitting taxes annually is definitely a tricky thing for most people as a consequence of US taxation. How can I compute the amount I owe? What are new tax brackets? Nevertheless, these inquiries aren't that difficult. Let's cope with them together!

The American income tax method is modern: it increases as individual's earnings increase. Therefore, people with a lesser earnings level pay out much less - only ten percent for income less than $9,875 (2020). Nevertheless, taxes can get to 37Per cent for anyone as their revenue are beyond $518,401. All probable incomes are split into seven specific divisions known as income tax brackets that determine tax rates for various amounts of taxable income (dividends, capital gains, and so on.).

How are tax brackets calculated

When you are aware much more about calculating expenses, you can start preparing templates for submitting. You can sit, search, and fill in them by hand or you can stick to the step-by-step guide under to file earnings documents less difficult:

- Compute your taxable income.

- Open the home page of Taxbracketscalculator.

- Select your Filing Status in the box at the top of the screen.

- Get real rates for each part of your income.

- Compute the quantity you should pay out.

- Place this data in to a needed template.

- Submit it towards the IRS.

Don't spend your time on routine paperwork. Check our platform out now!