Does Putting Money Into A 401k Potentially Lower Your Tax Bracket And Increase Your Tax Refund?

Yes and no. 401k contributions do lower your taxable income and will therefore lower your total federal taxes. But tax brackets do not work the way you are suggesting with the second part of your question. The top of my income is in the 28% tax bracket, but the rest of it is in the 10%, 15% and 25% brackets. Just because my income is high enough that some of it is taxed at 28% does not mean all of my income is taxed at 28%. So there is no such thing as using deductions (like 401k contributions) to lower the tax on the rest of my taxable income.

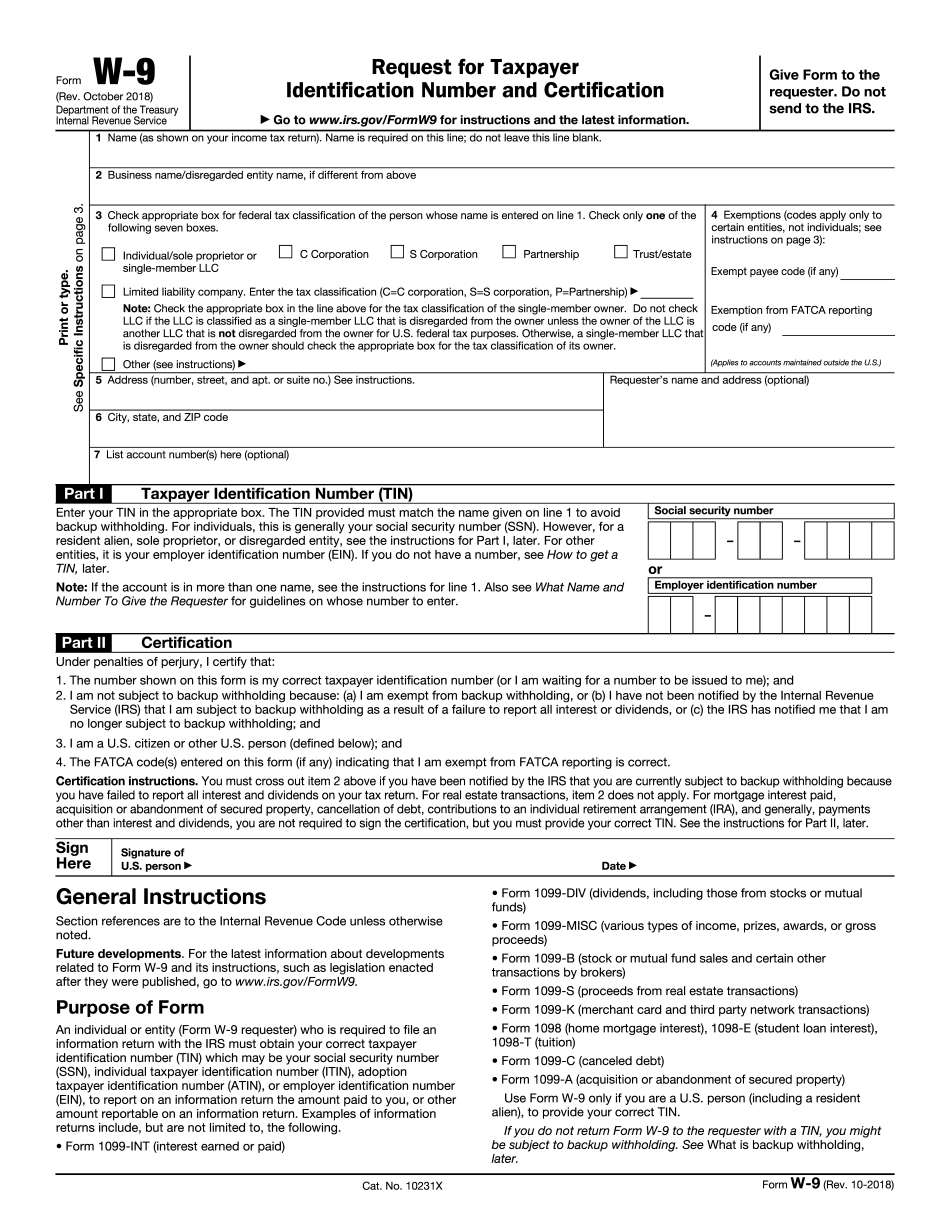

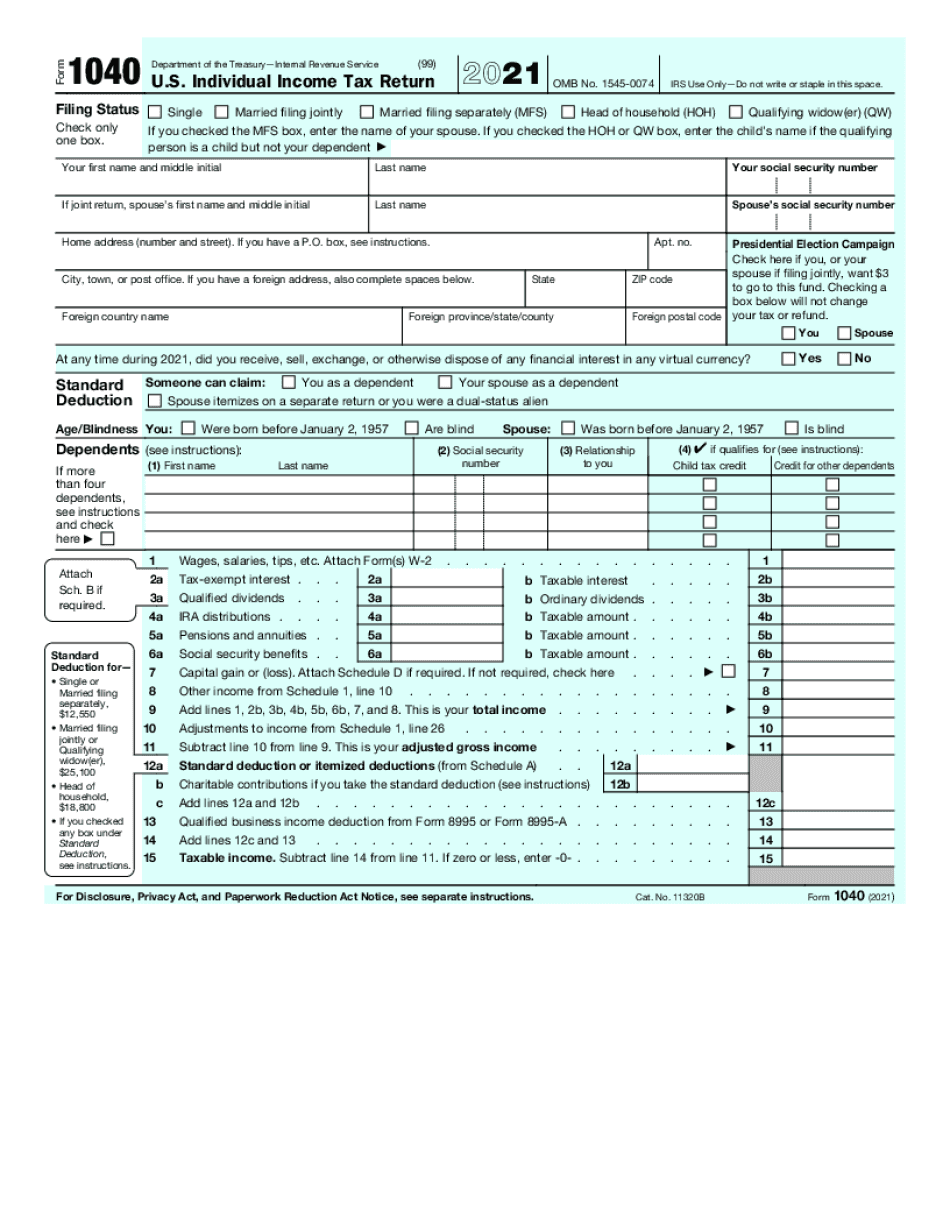

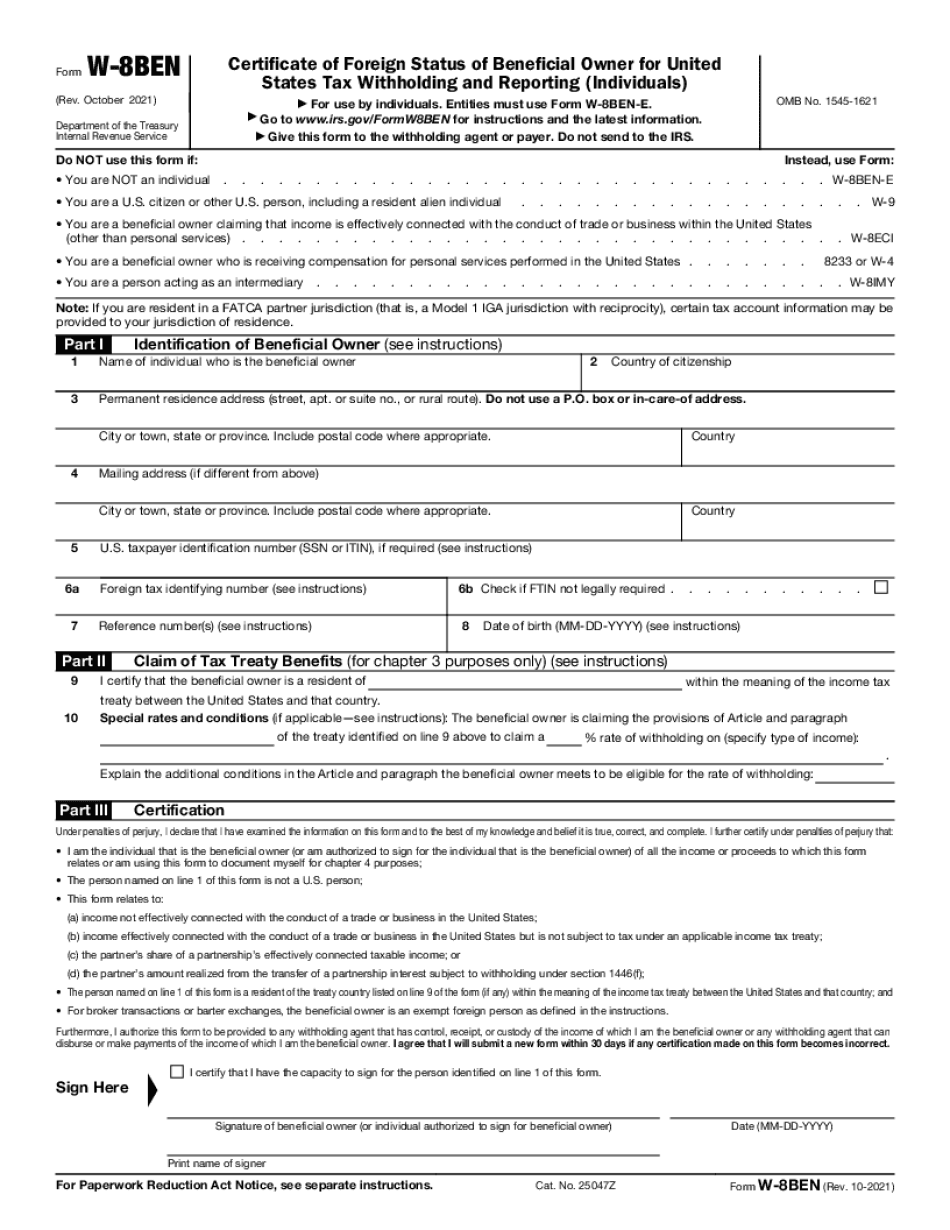

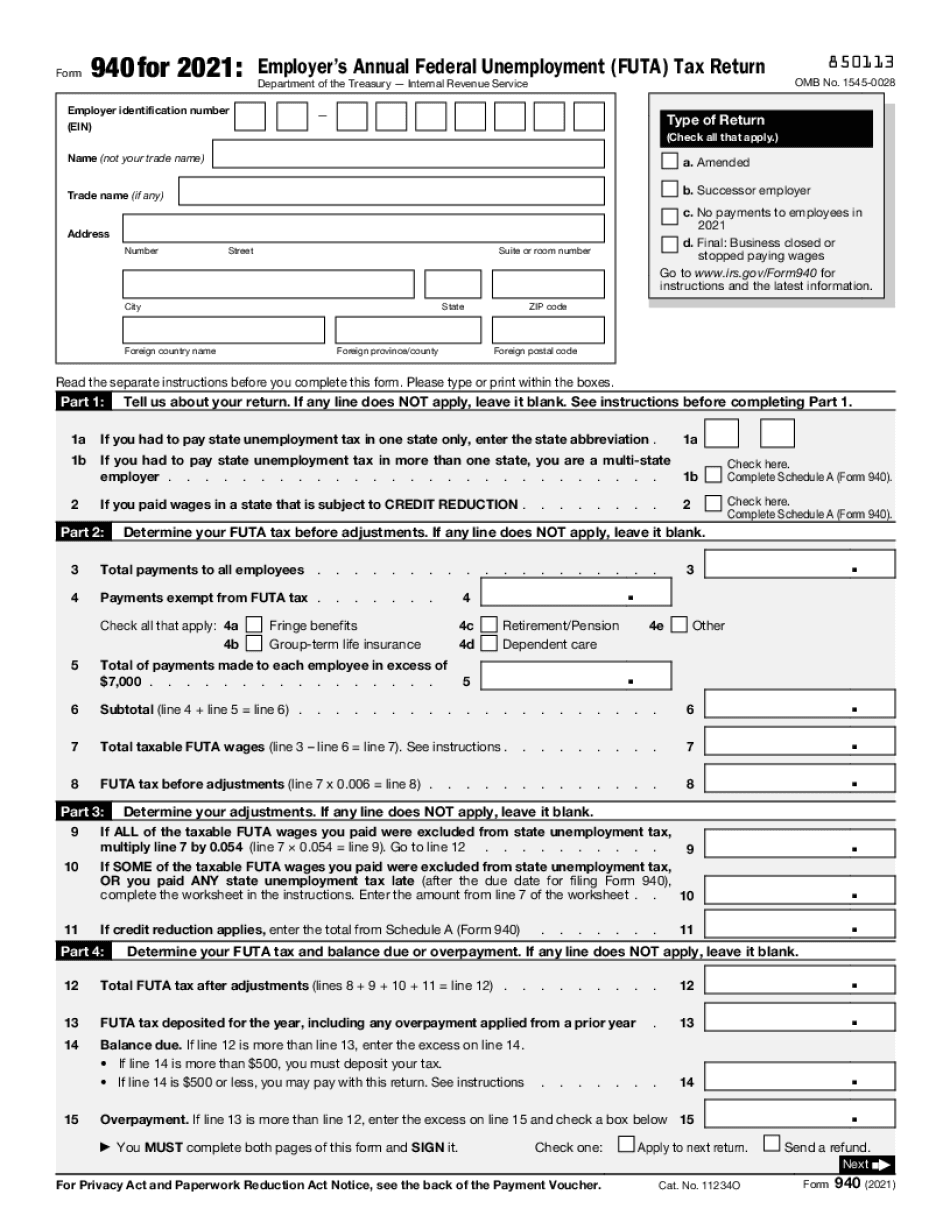

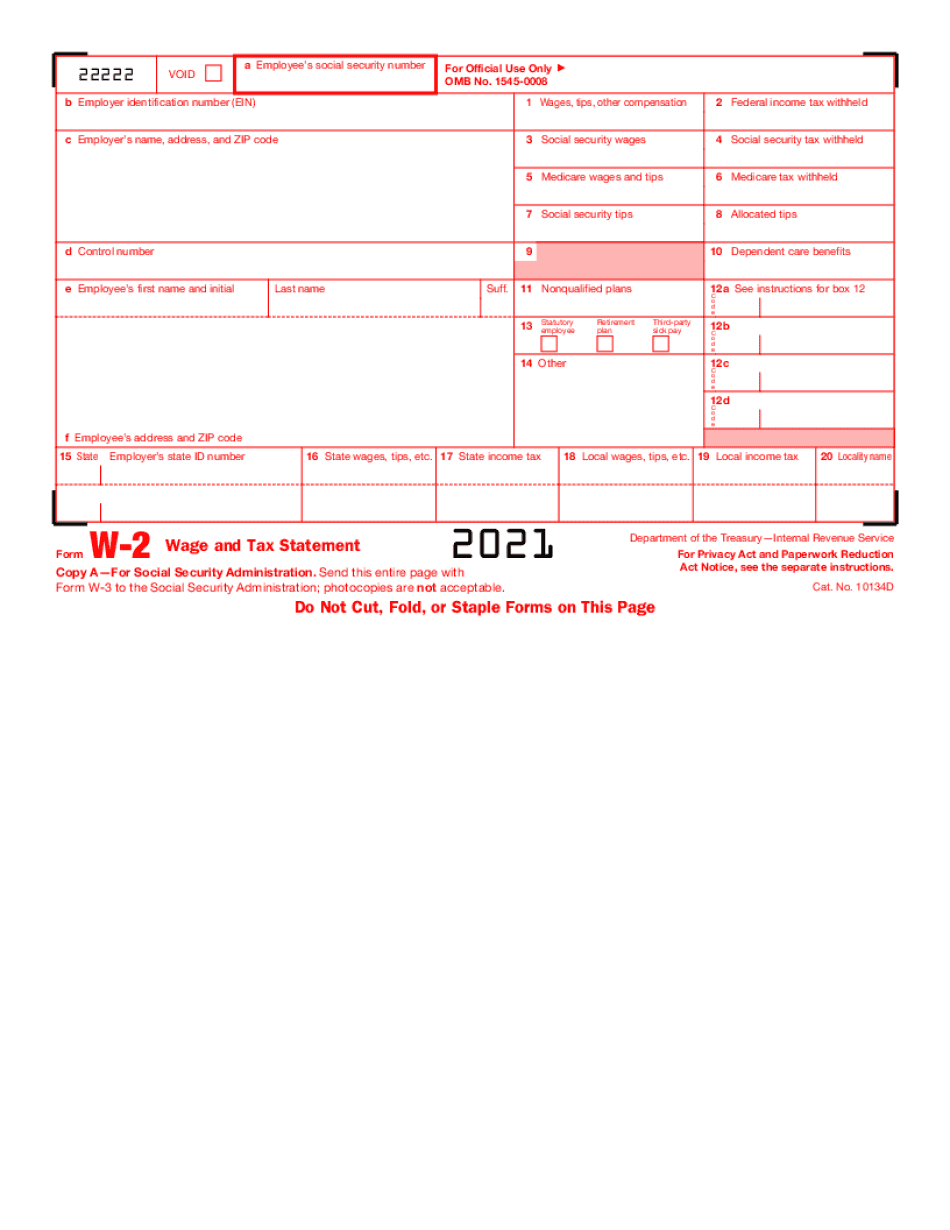

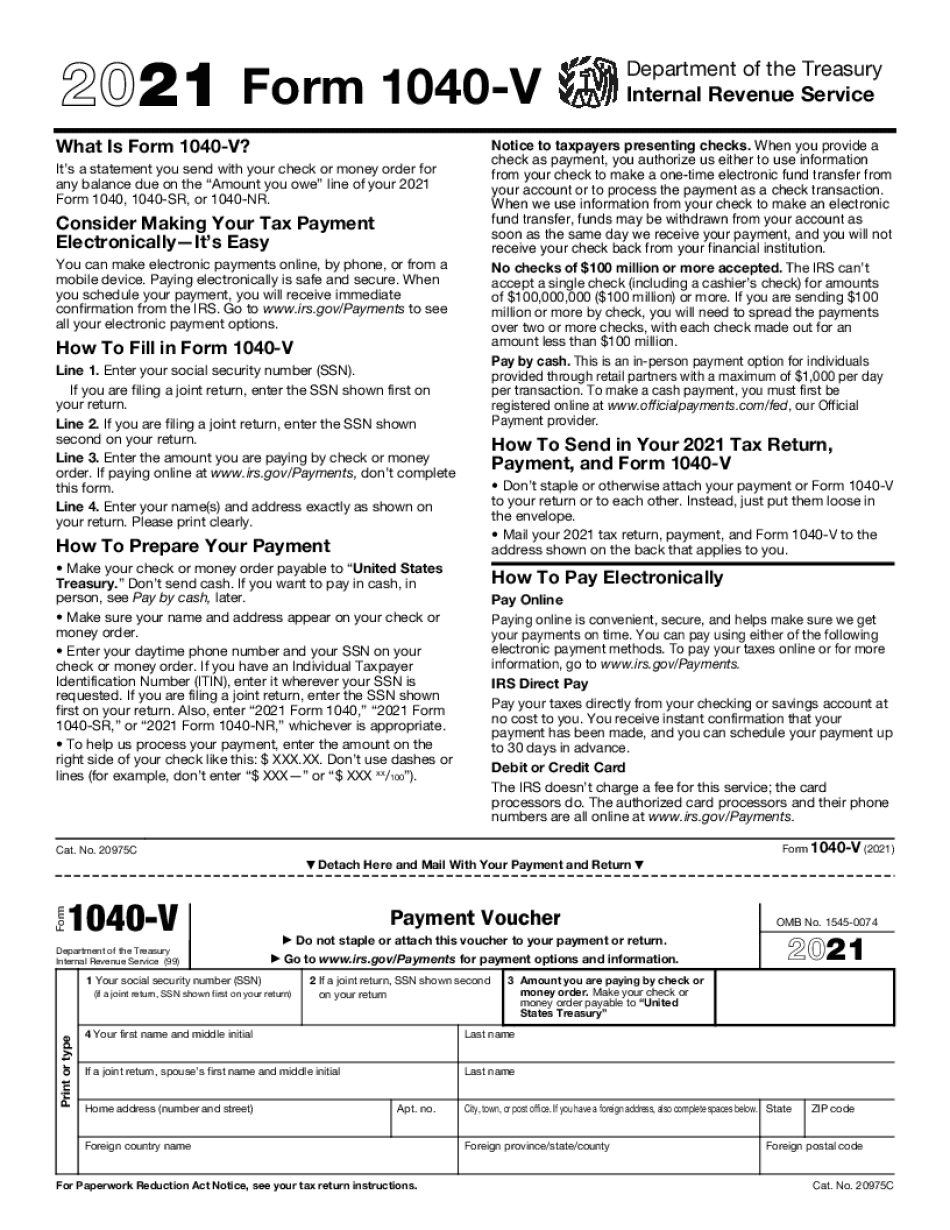

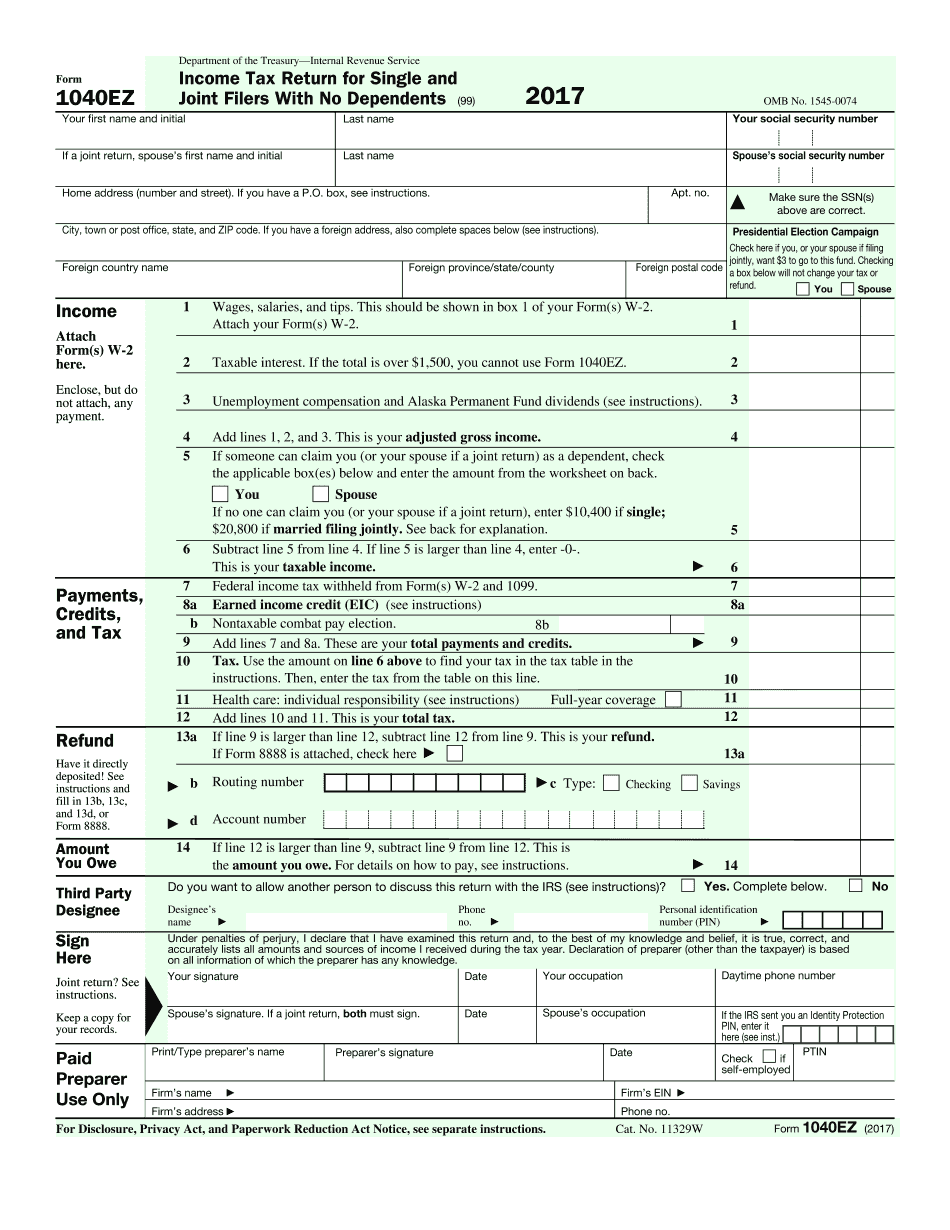

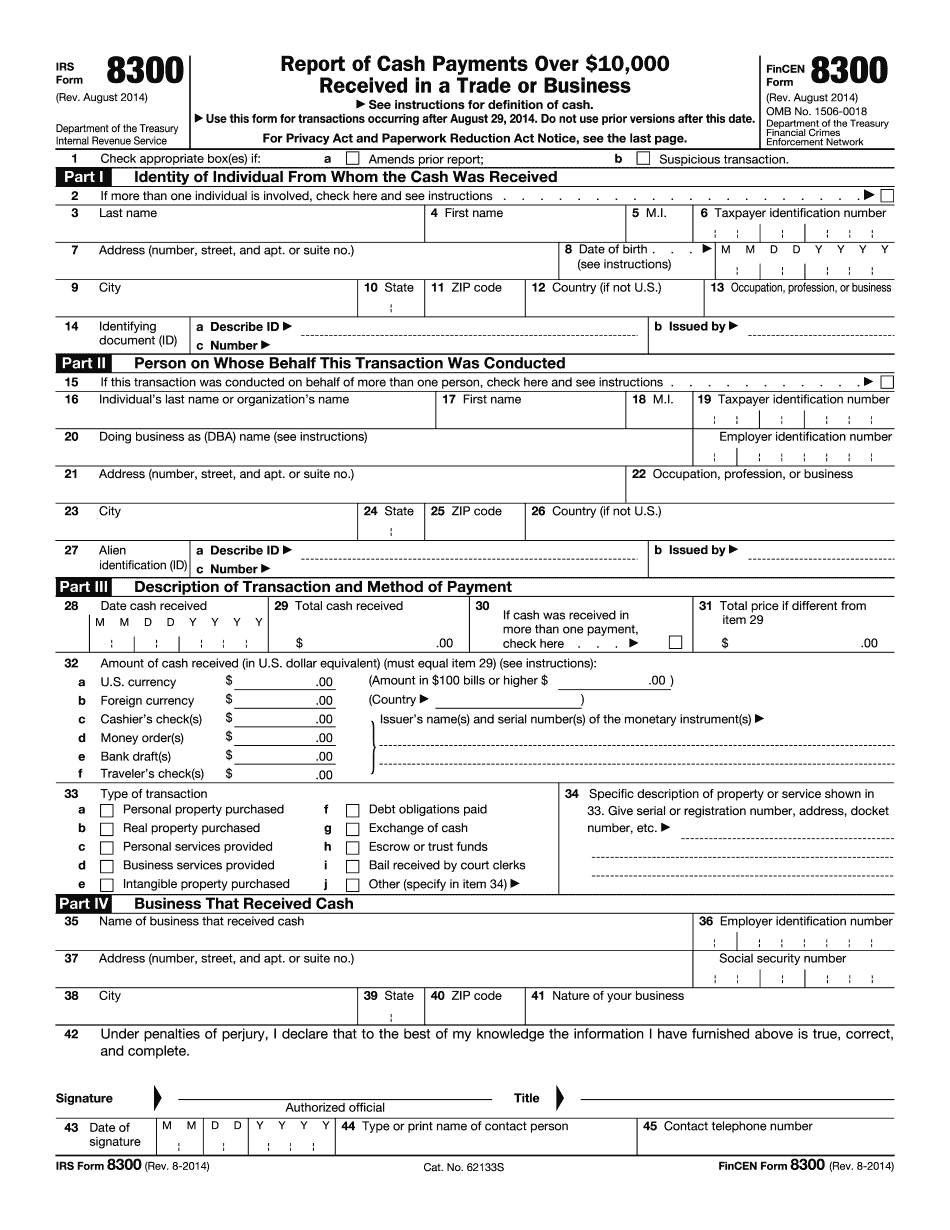

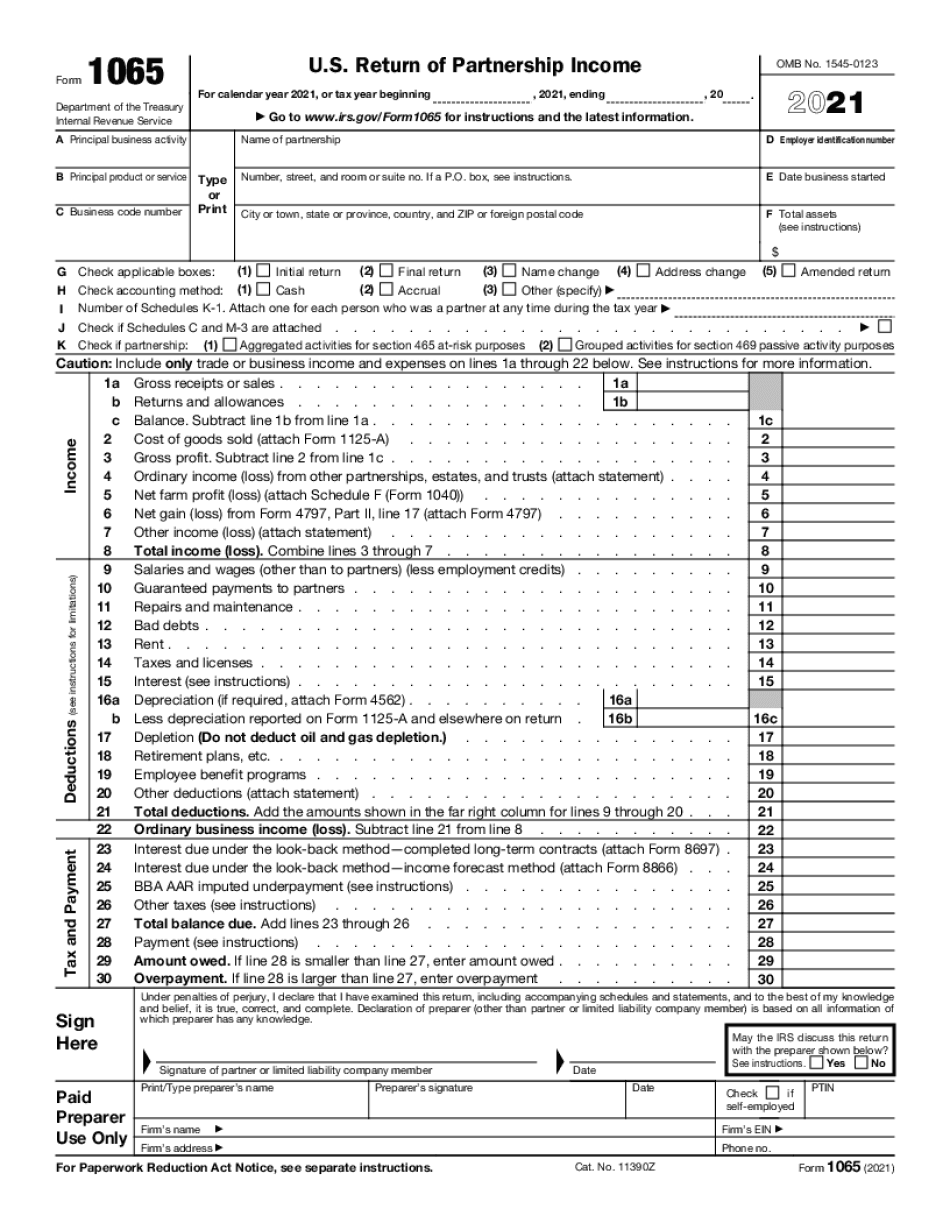

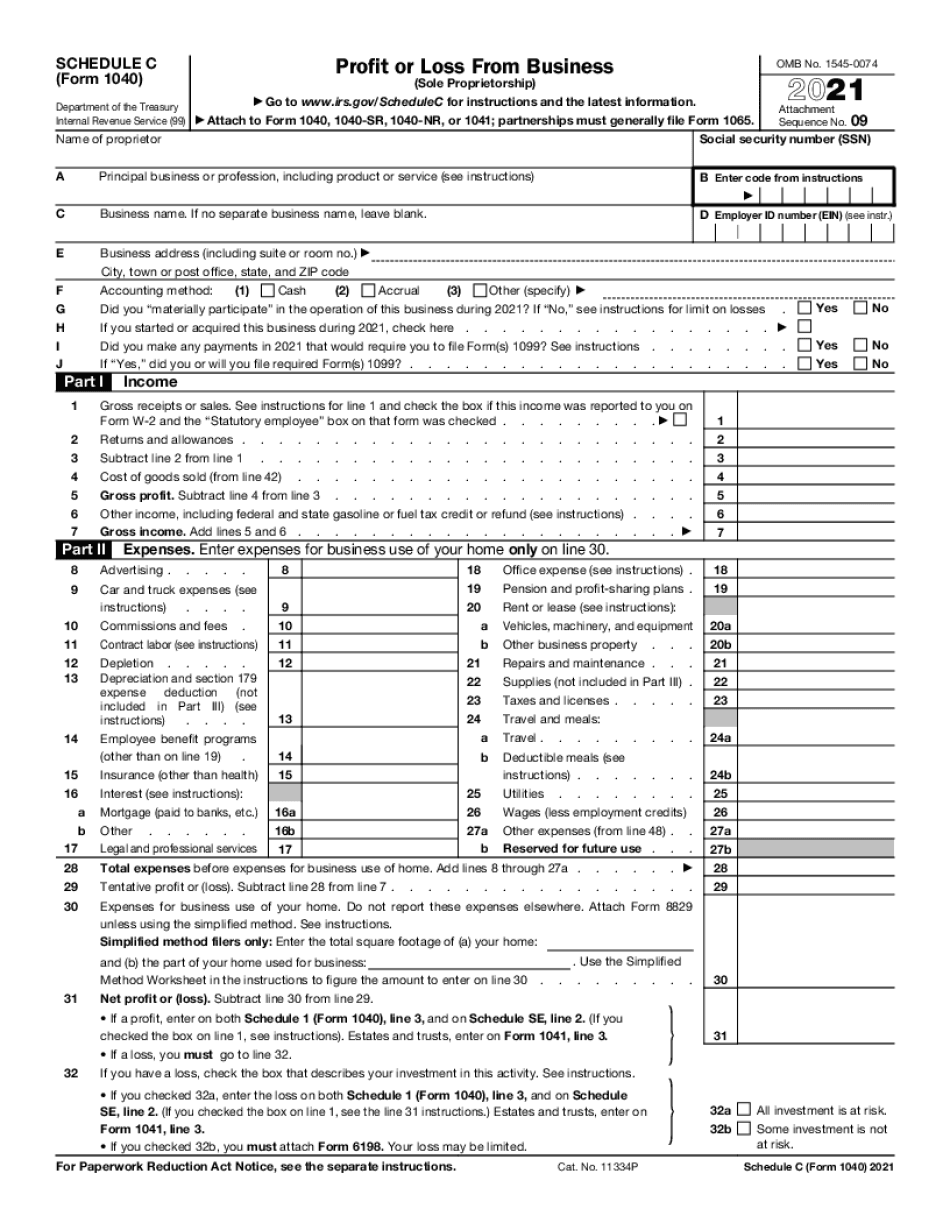

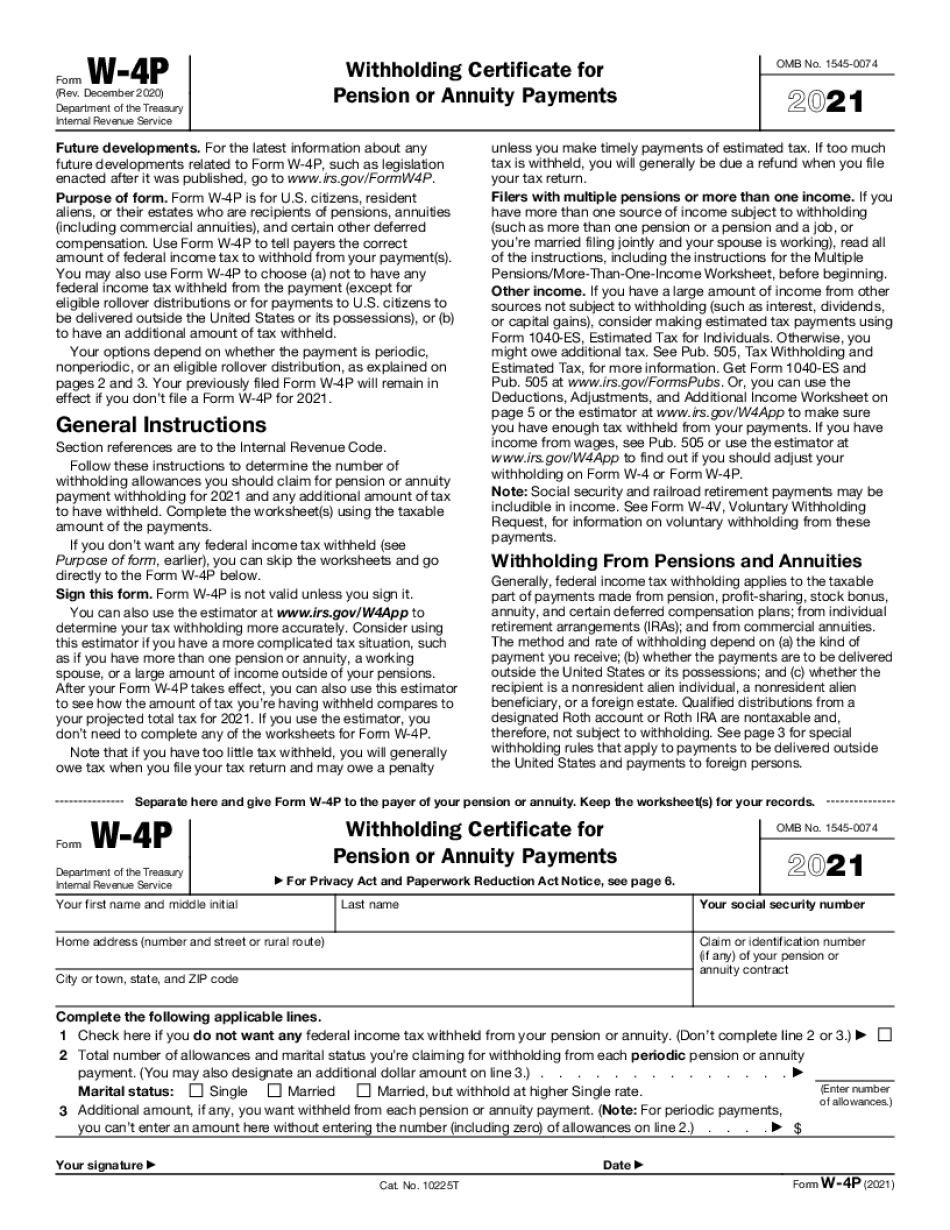

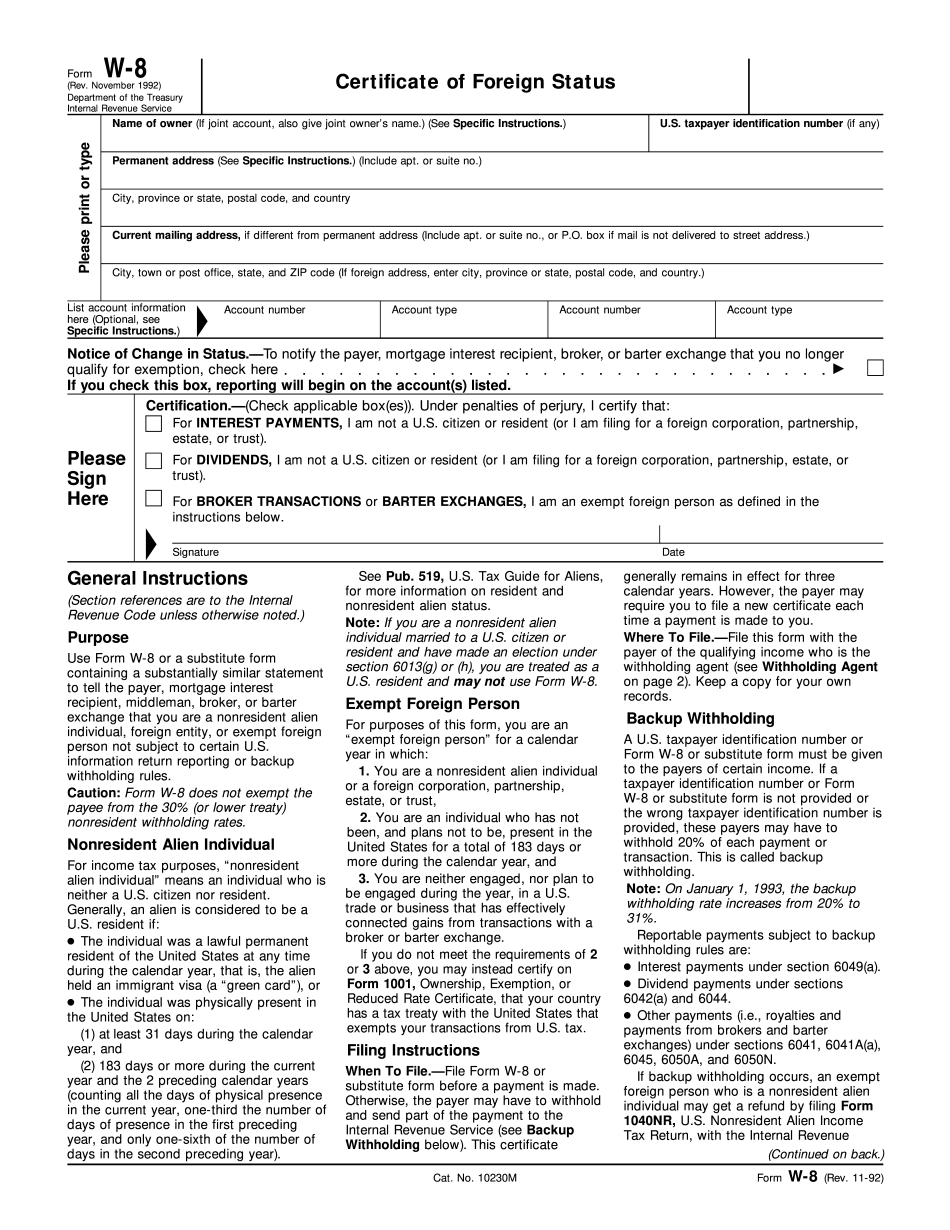

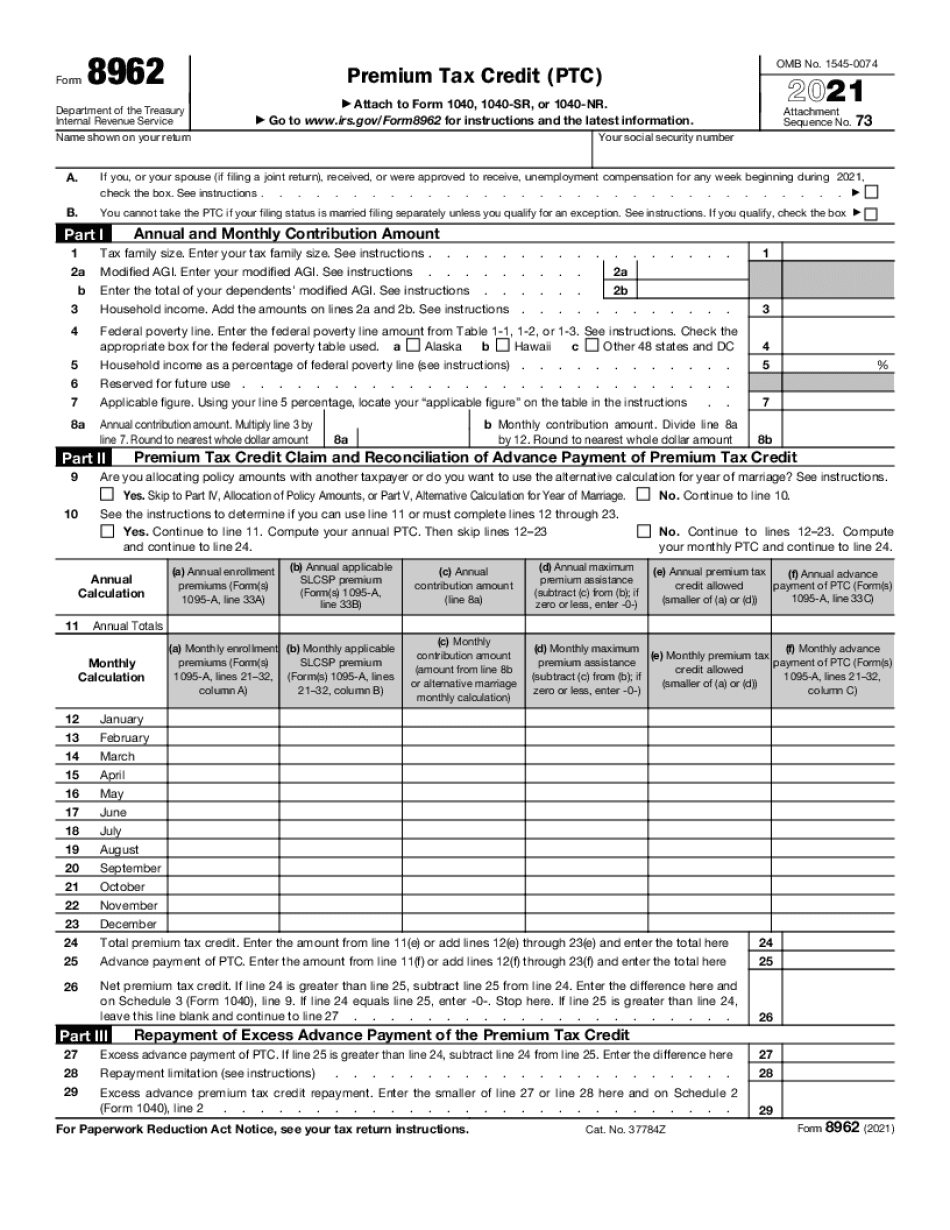

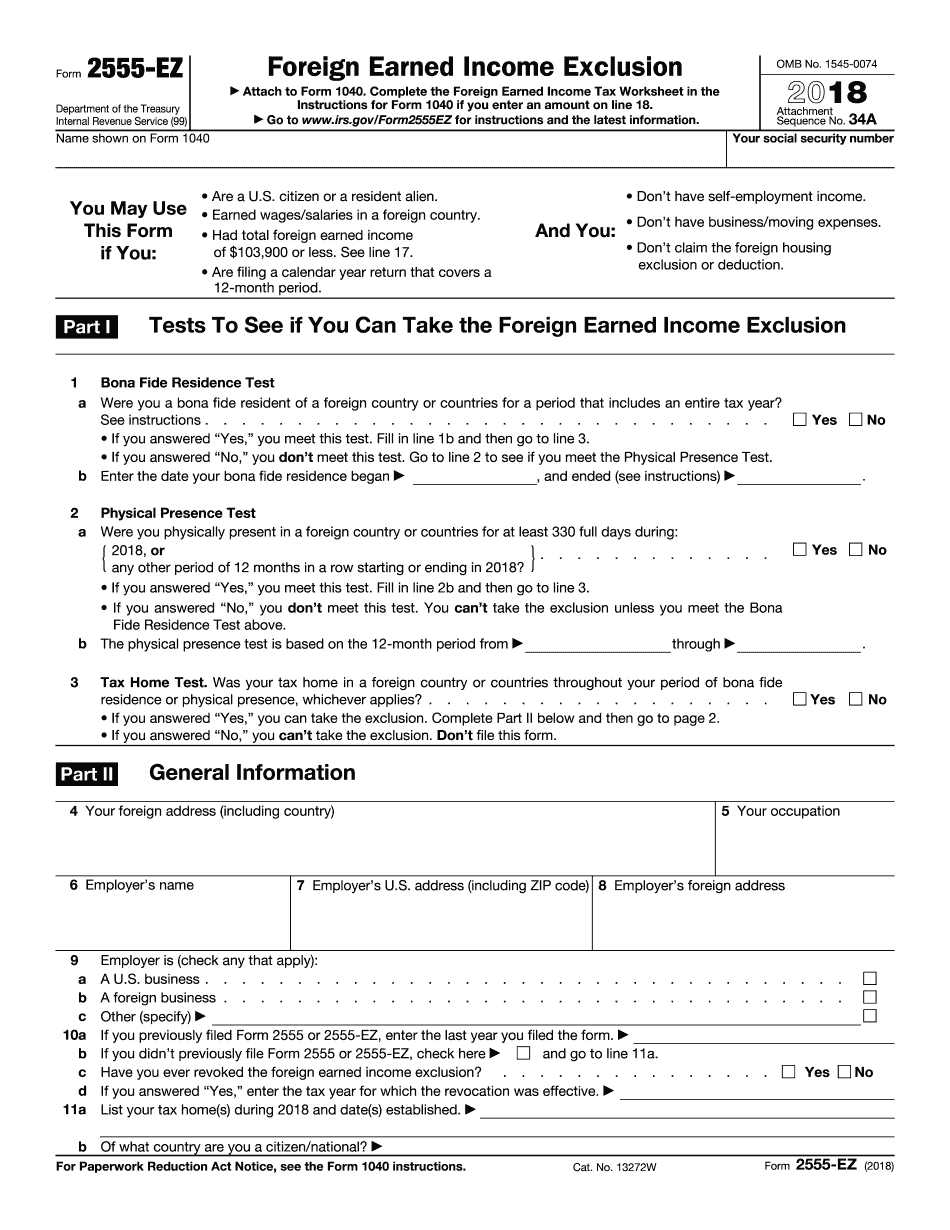

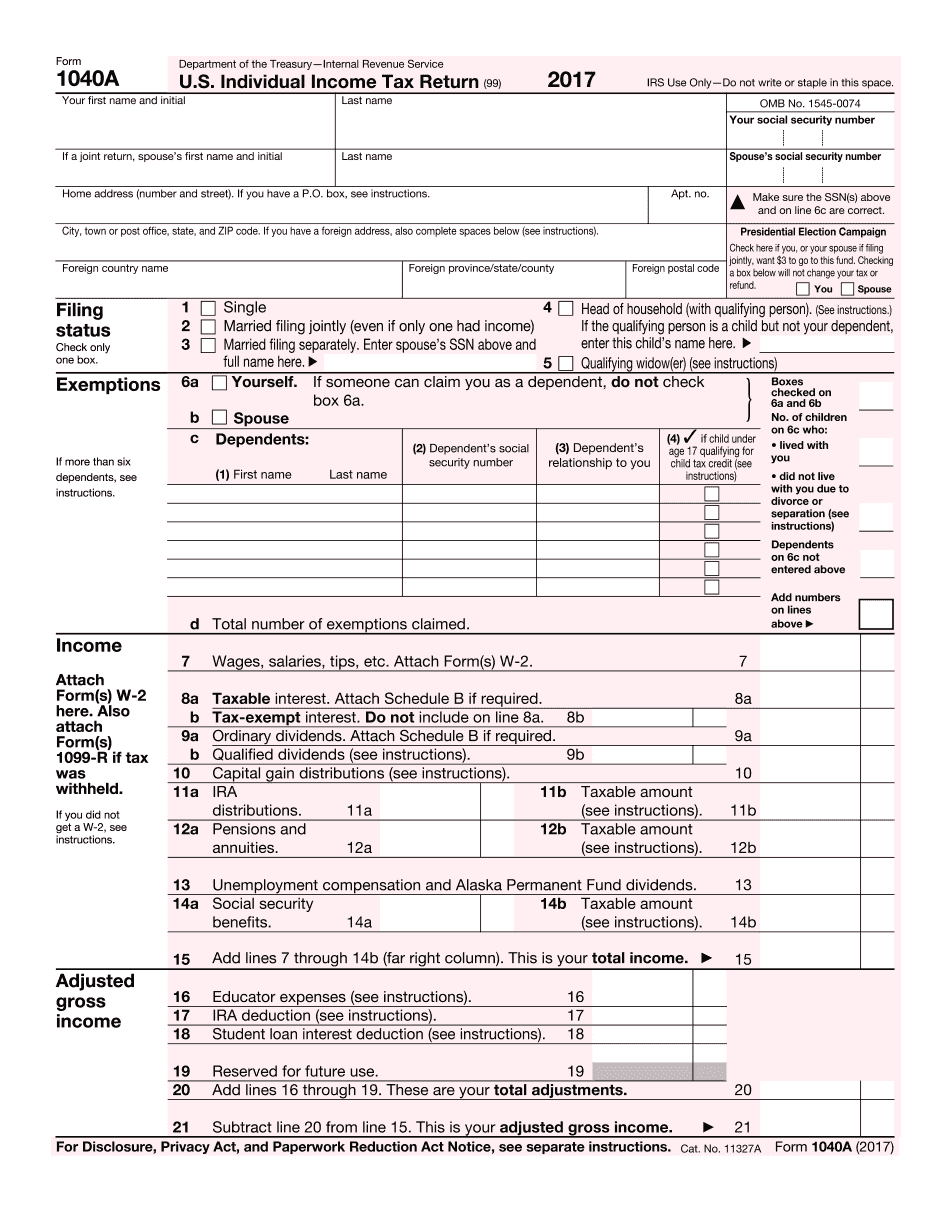

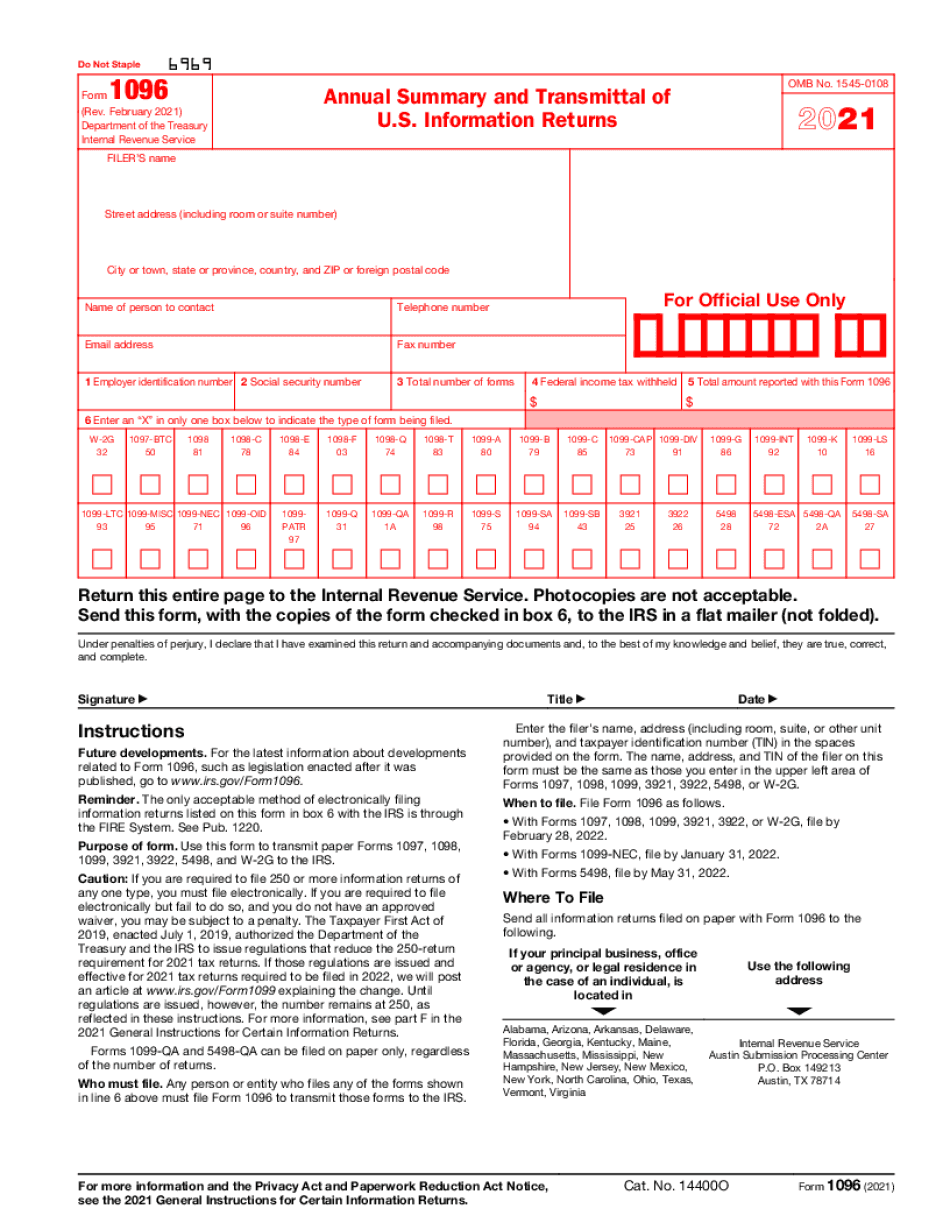

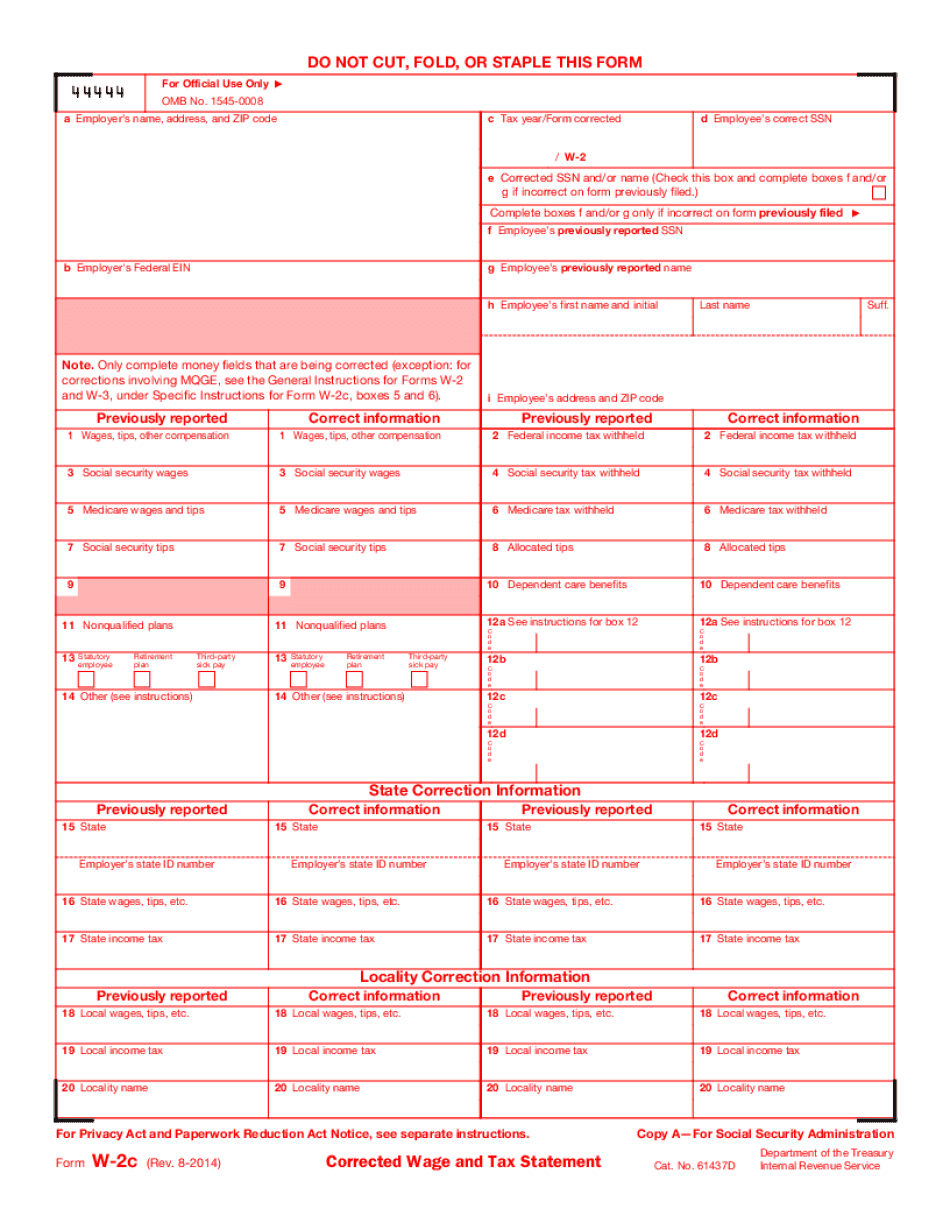

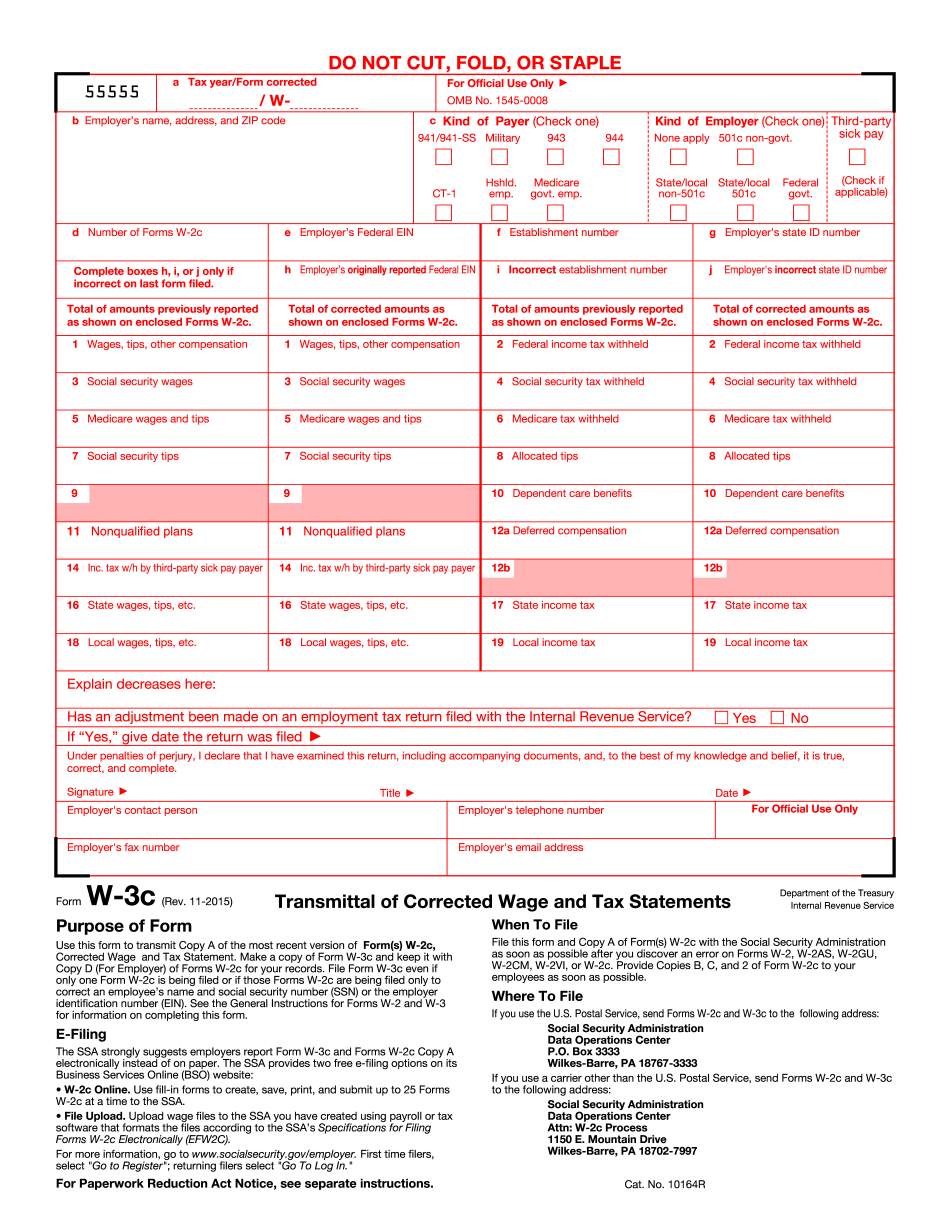

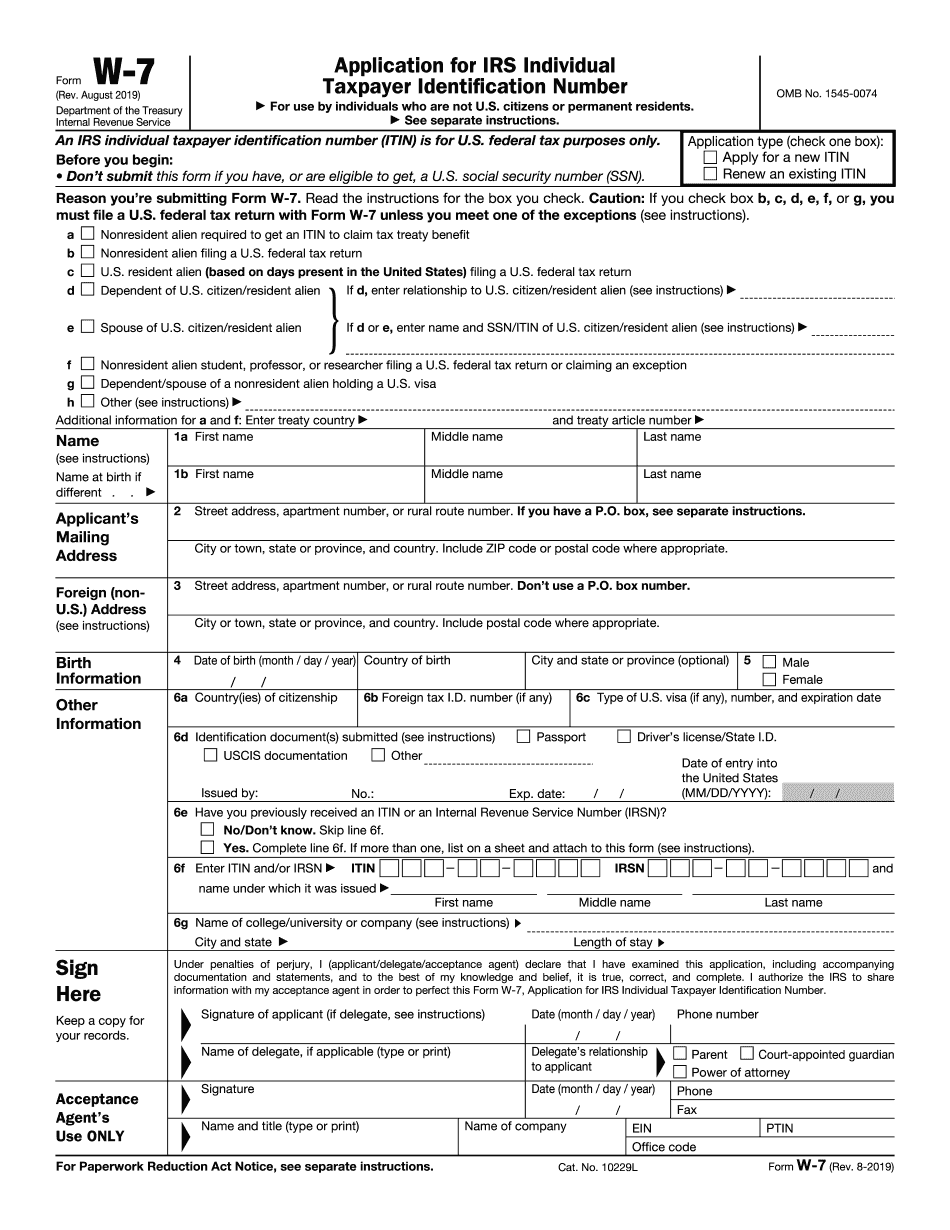

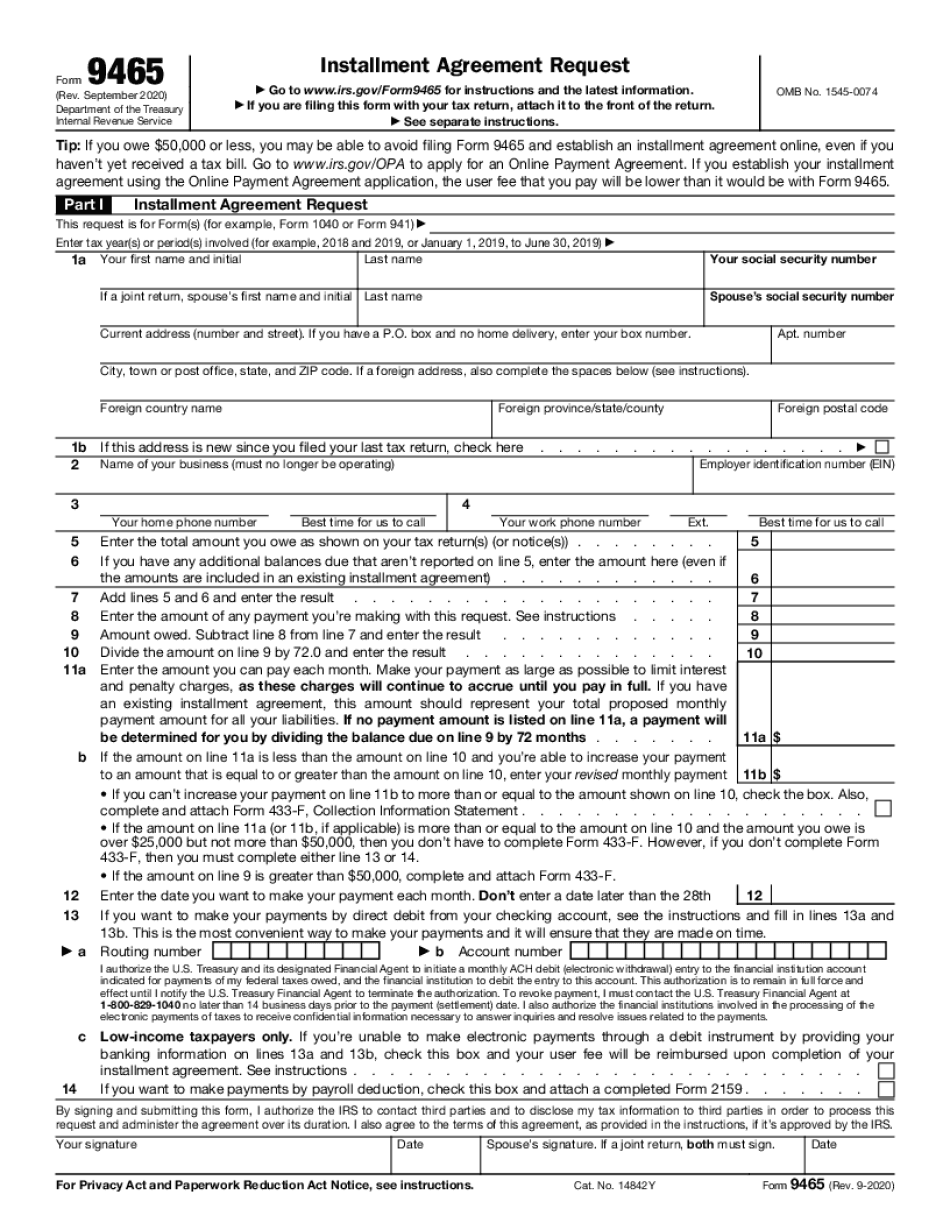

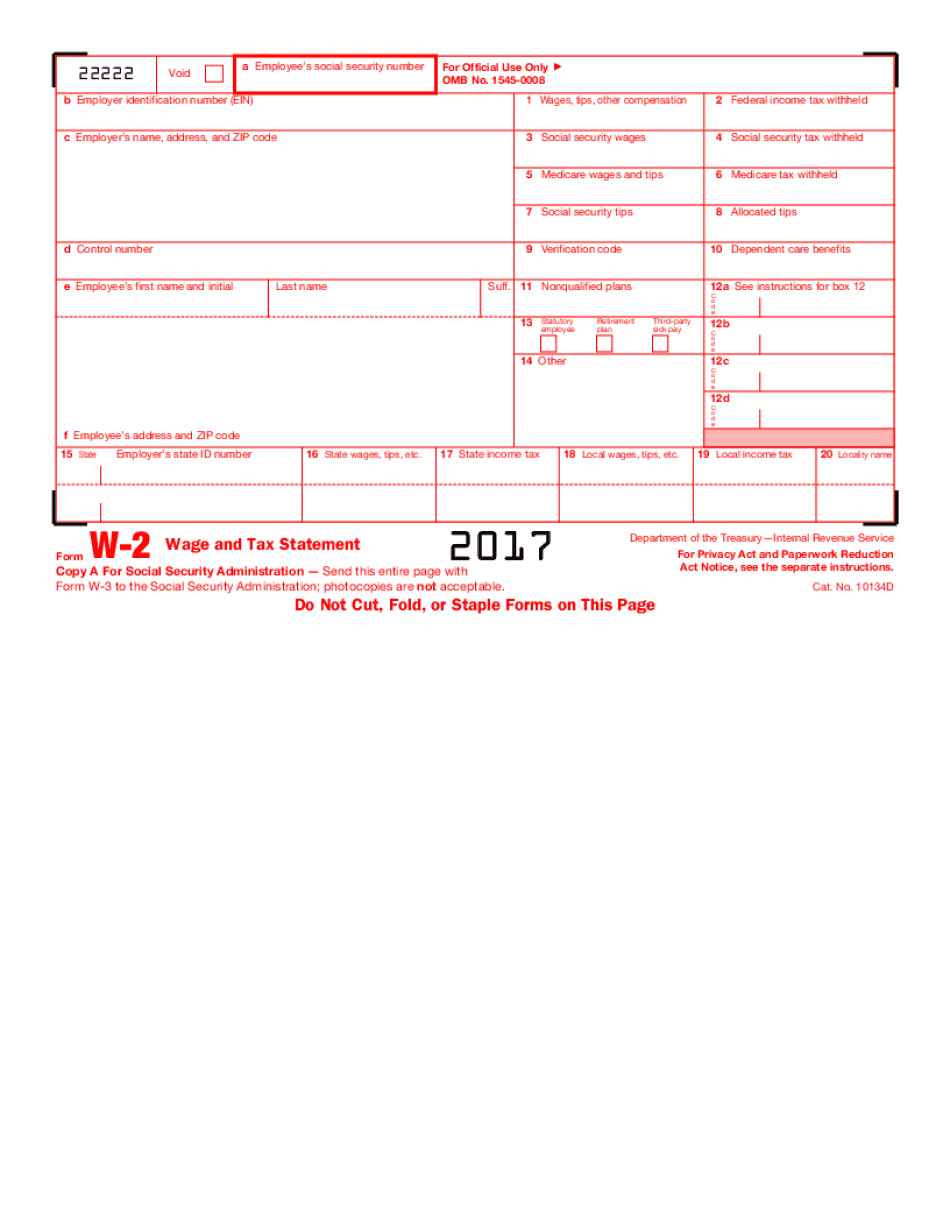

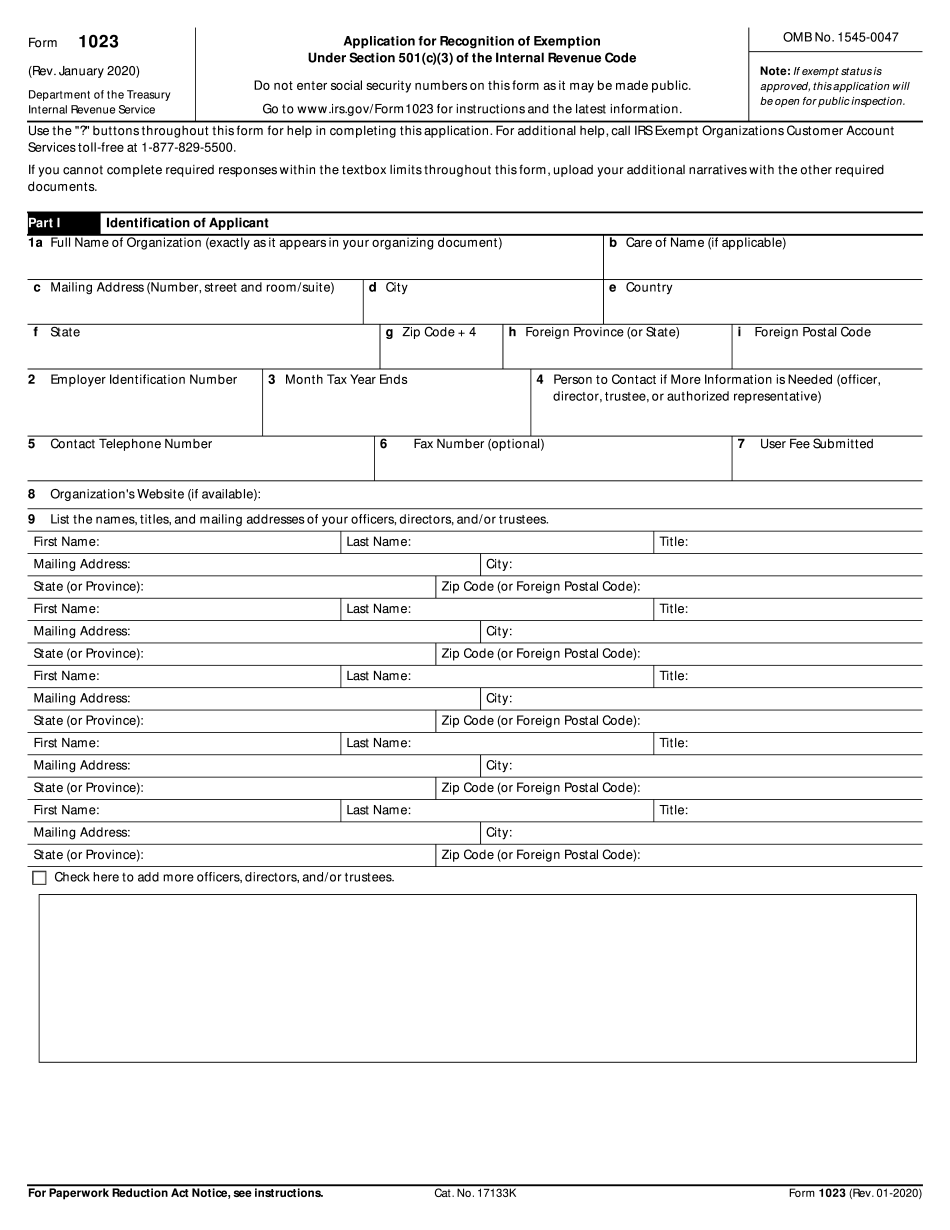

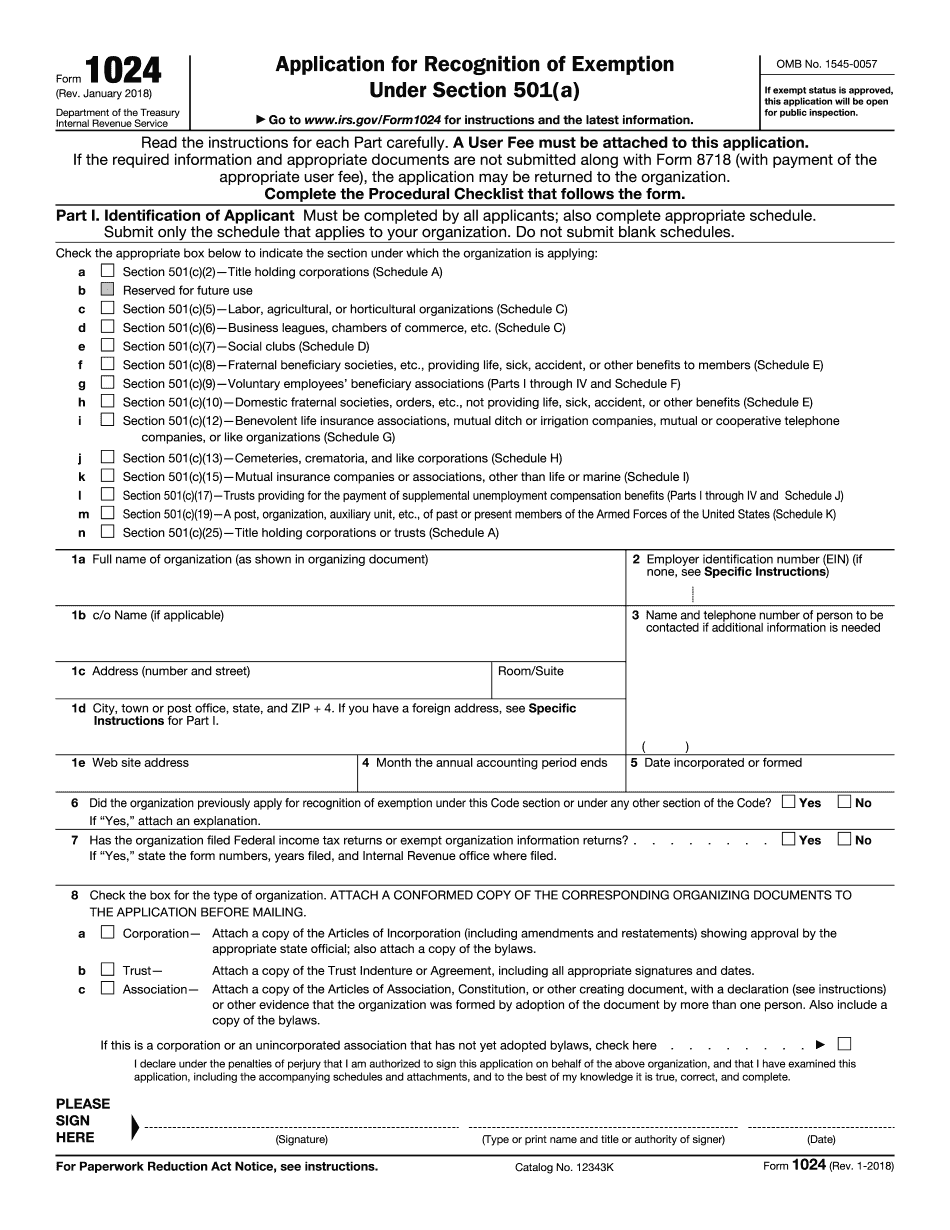

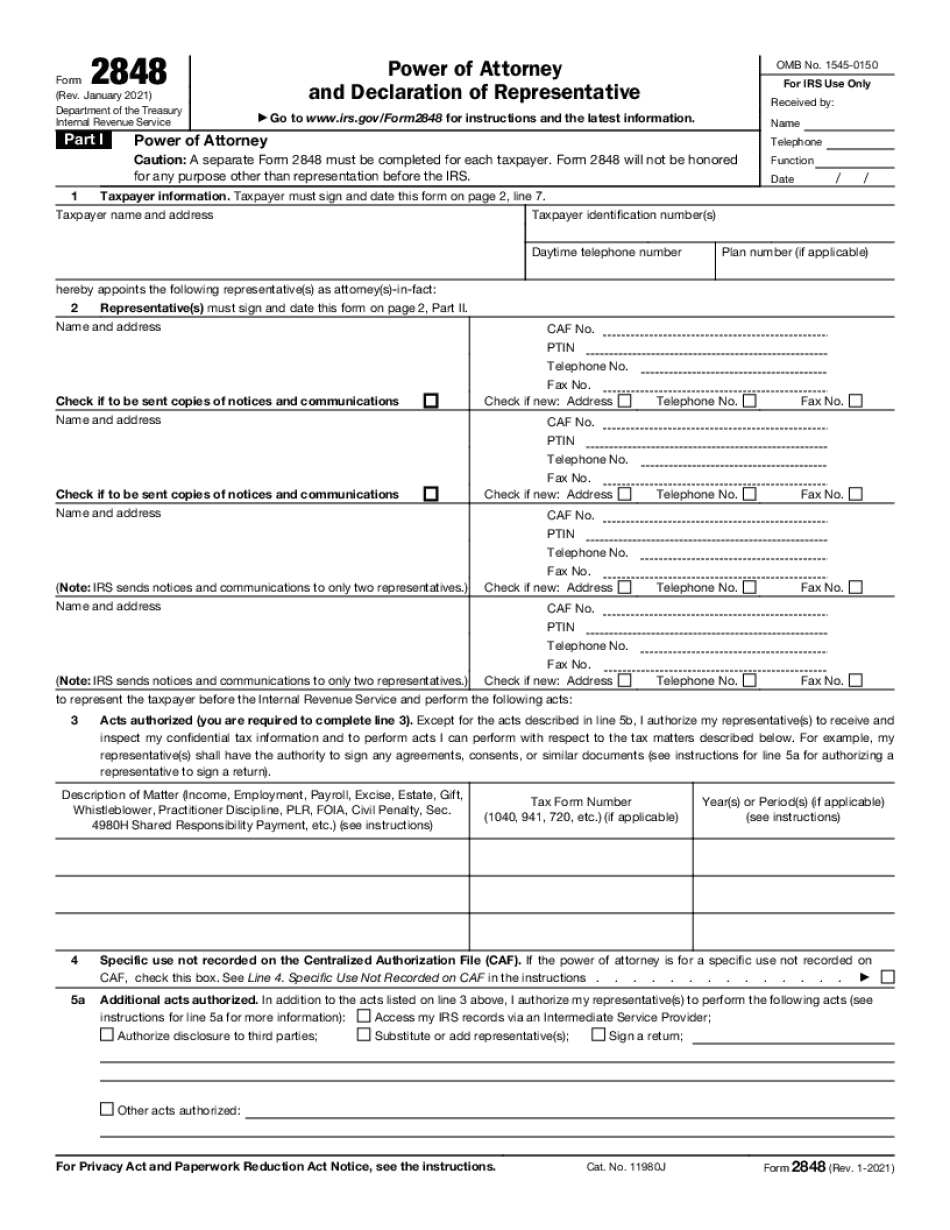

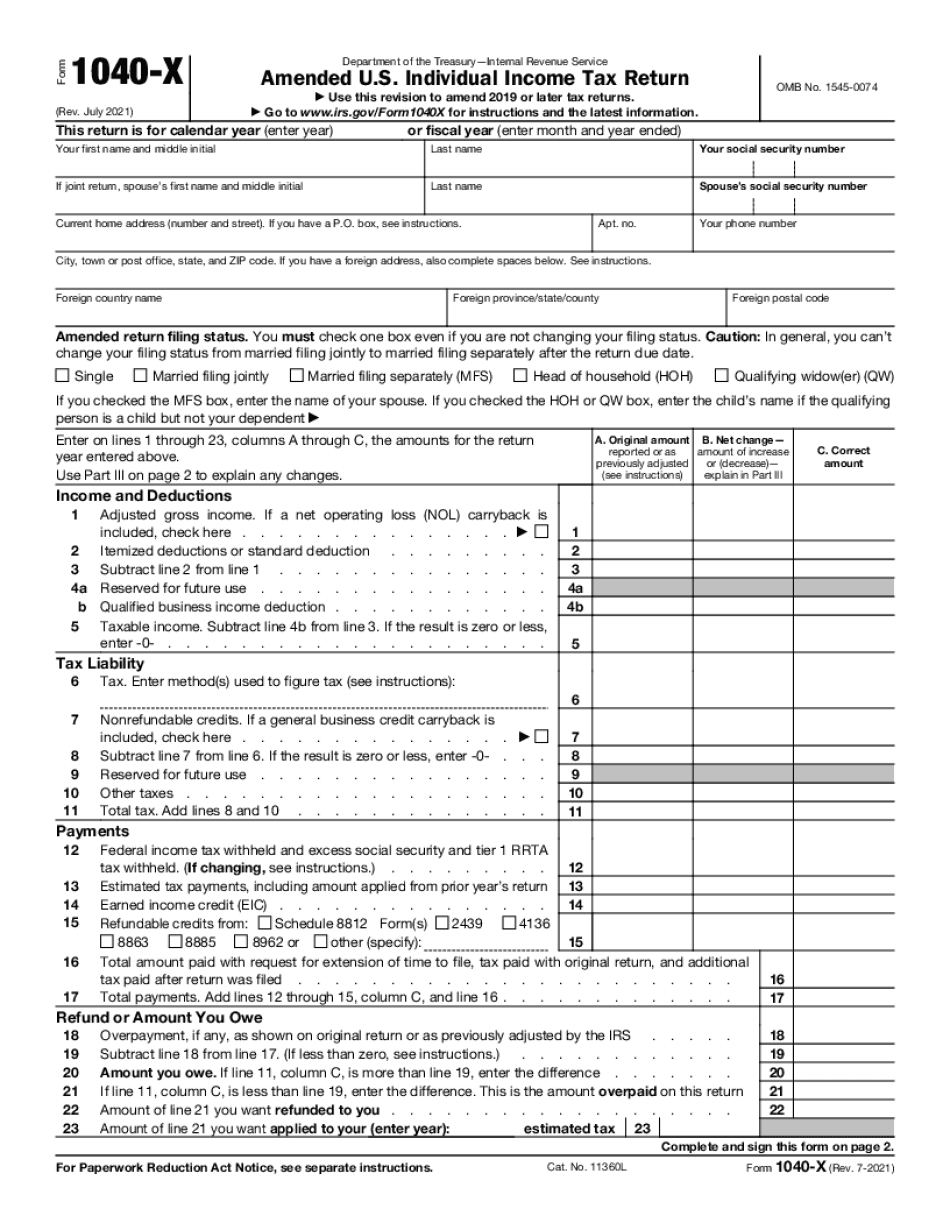

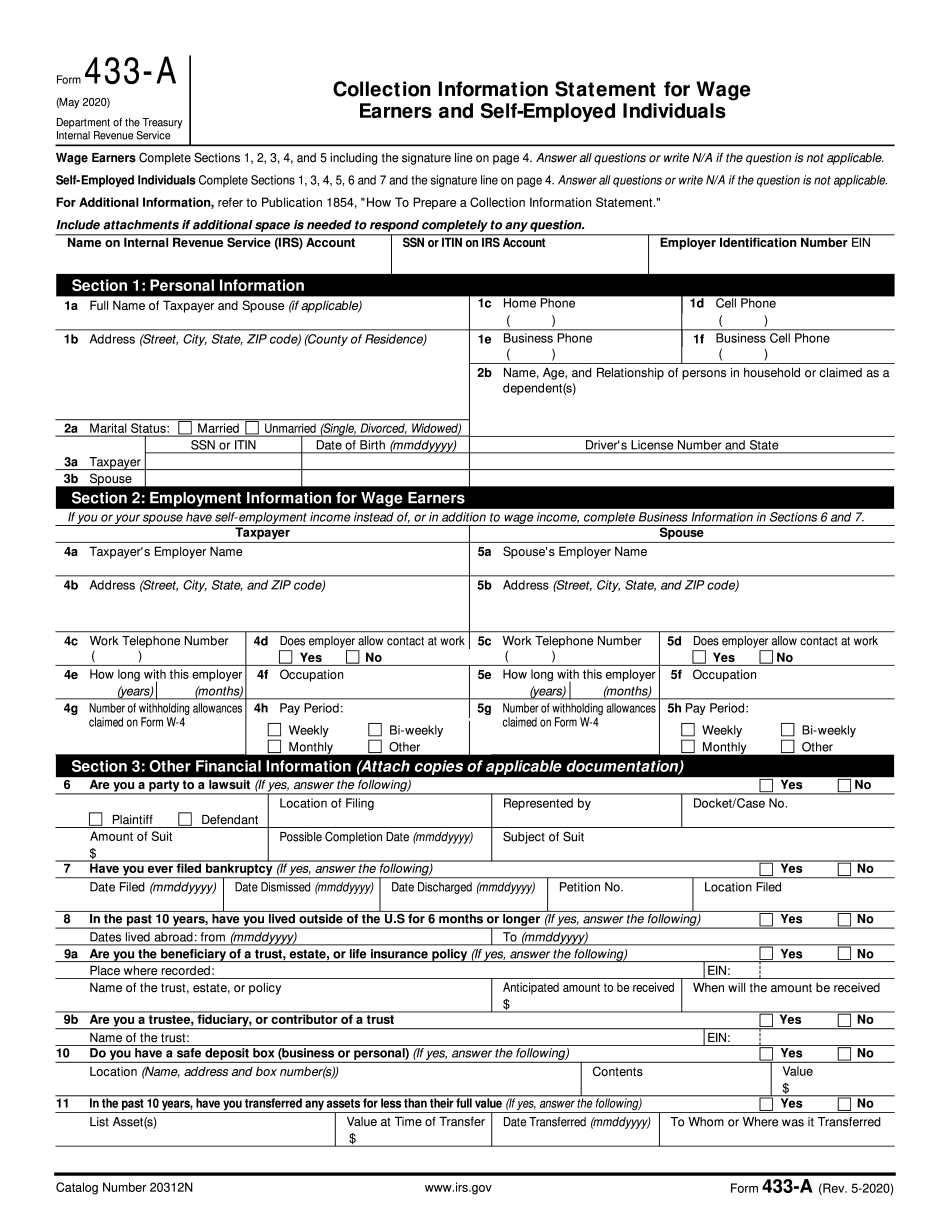

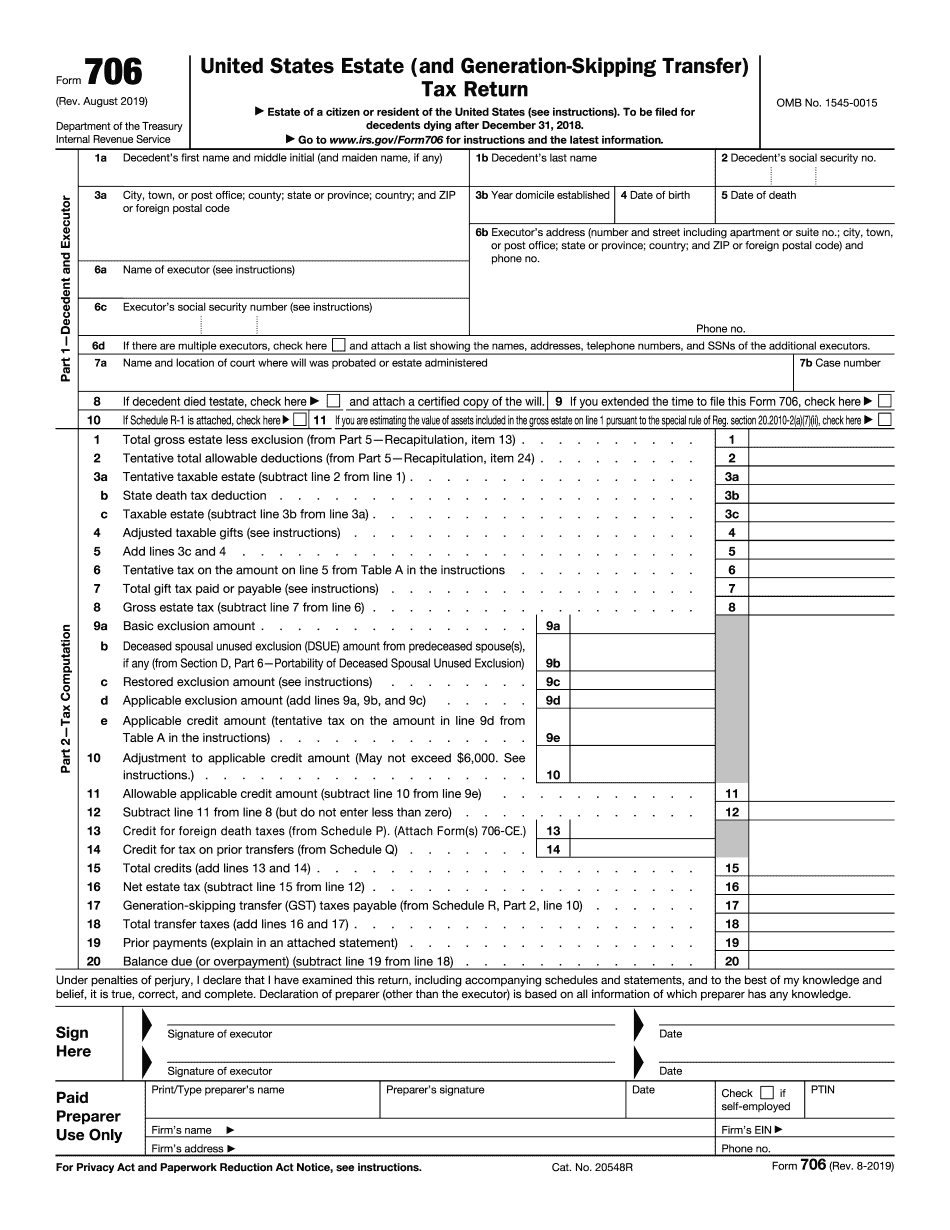

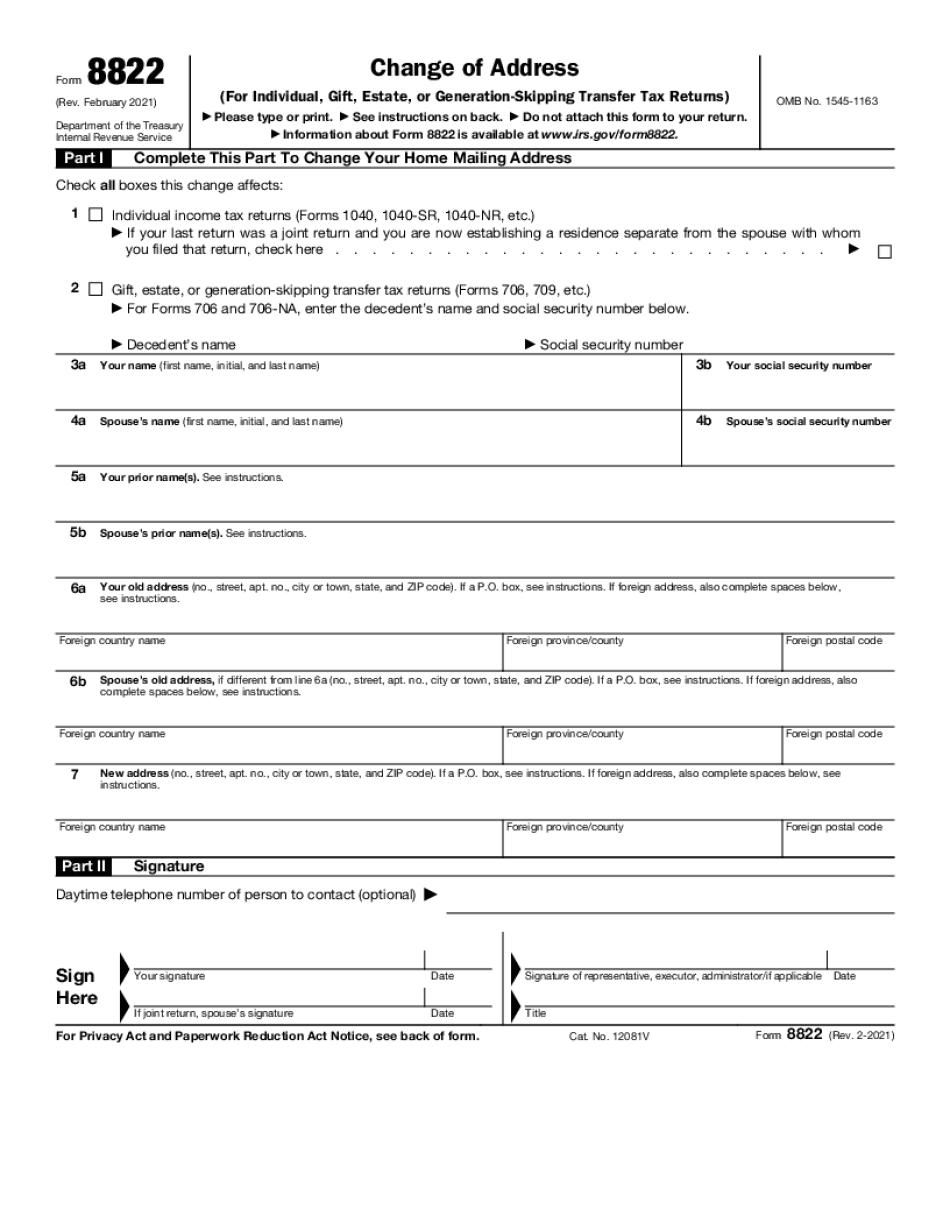

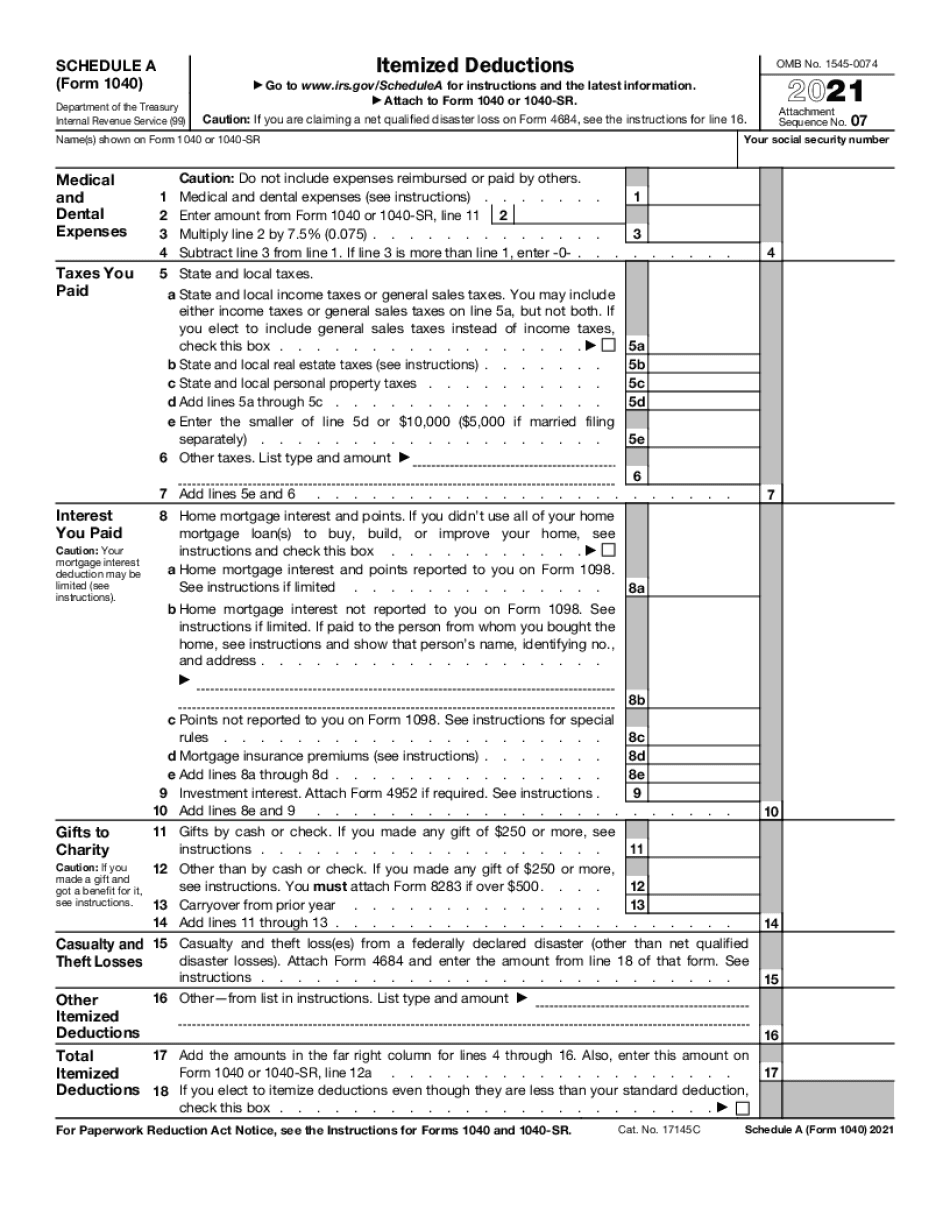

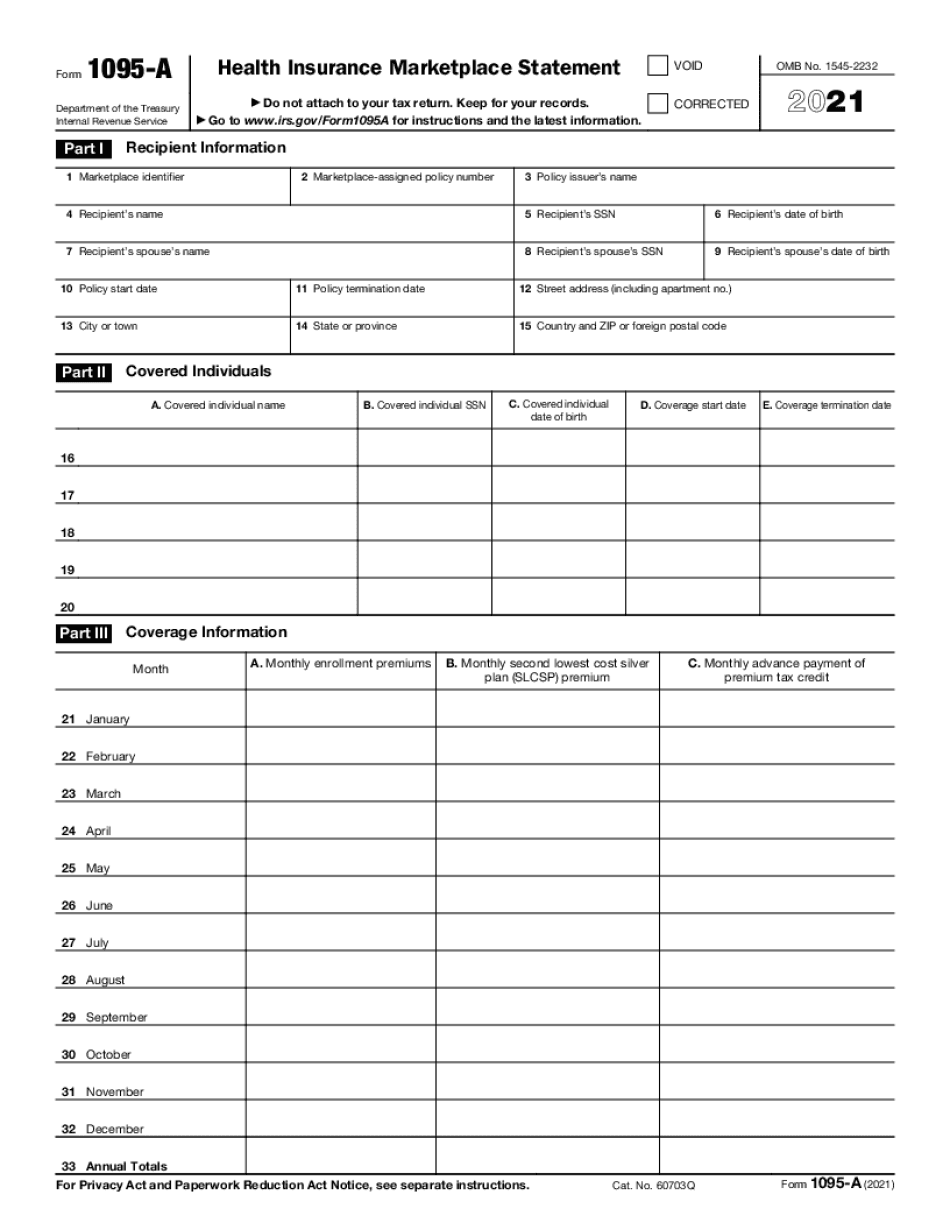

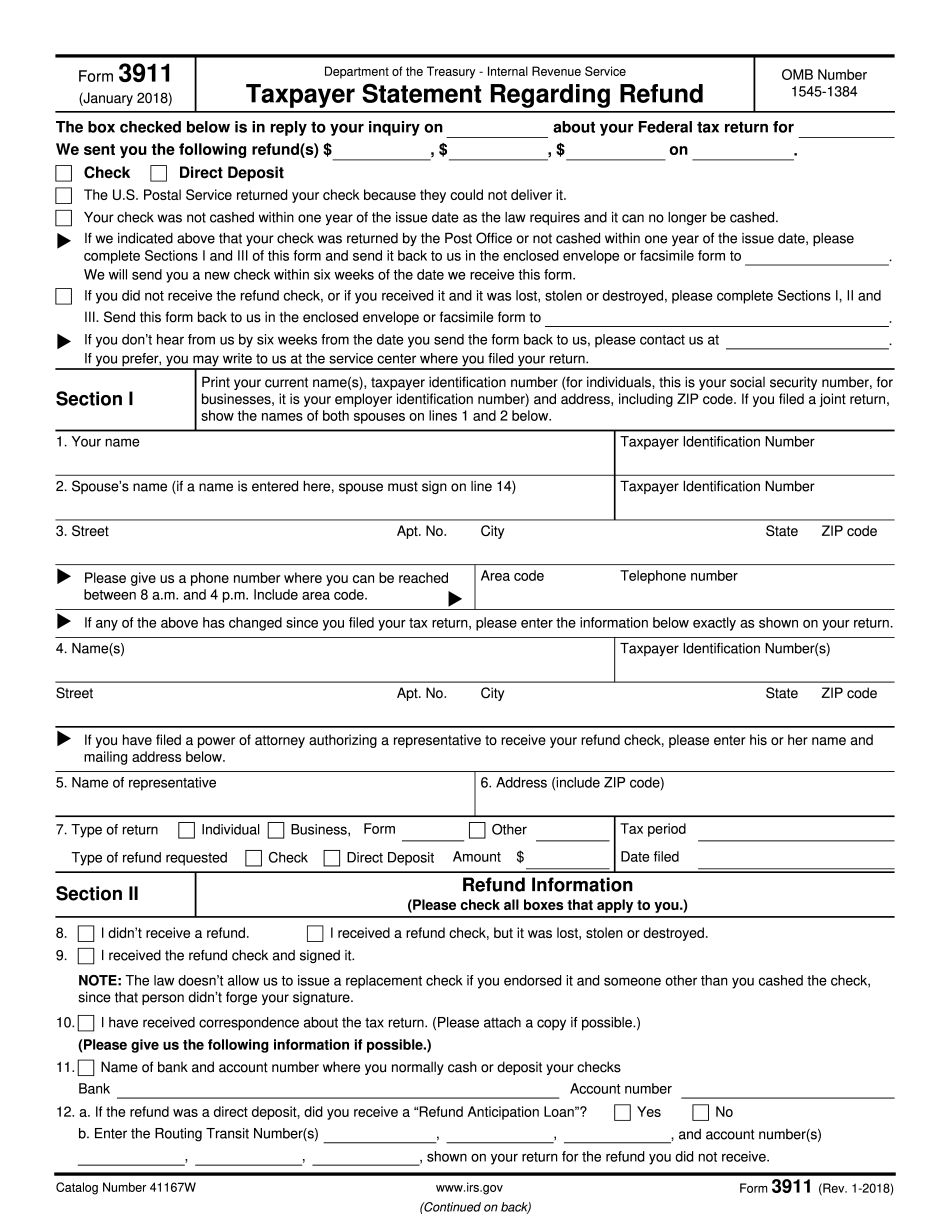

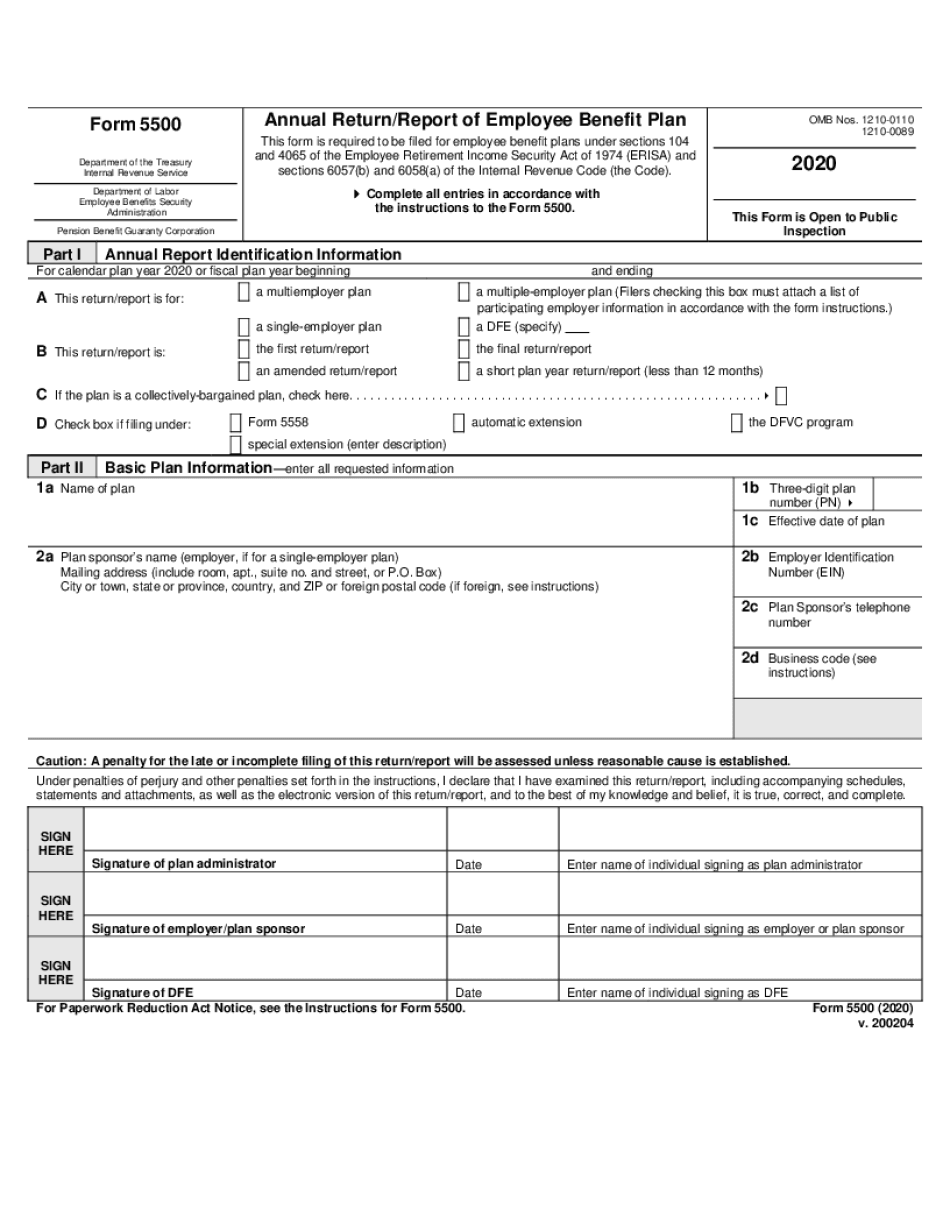

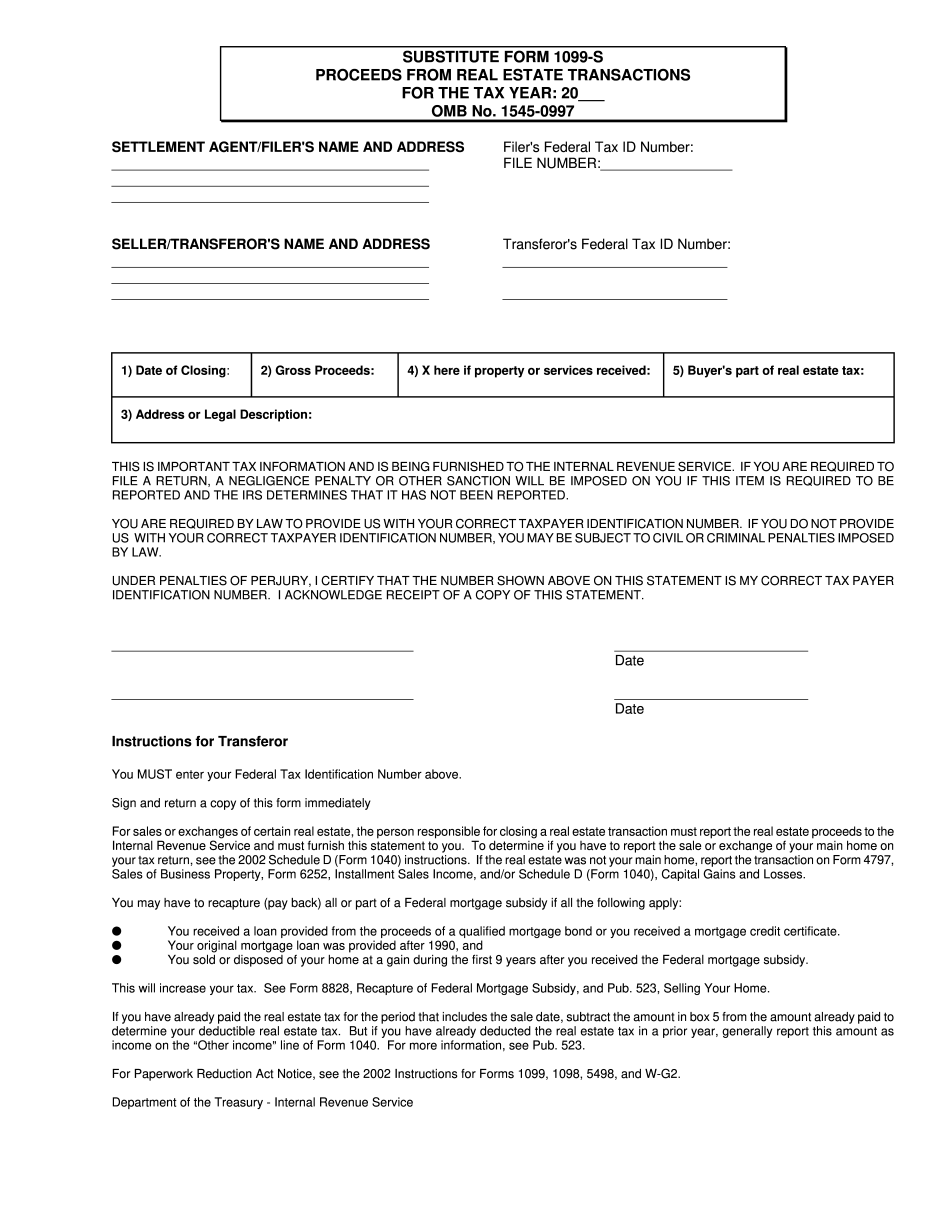

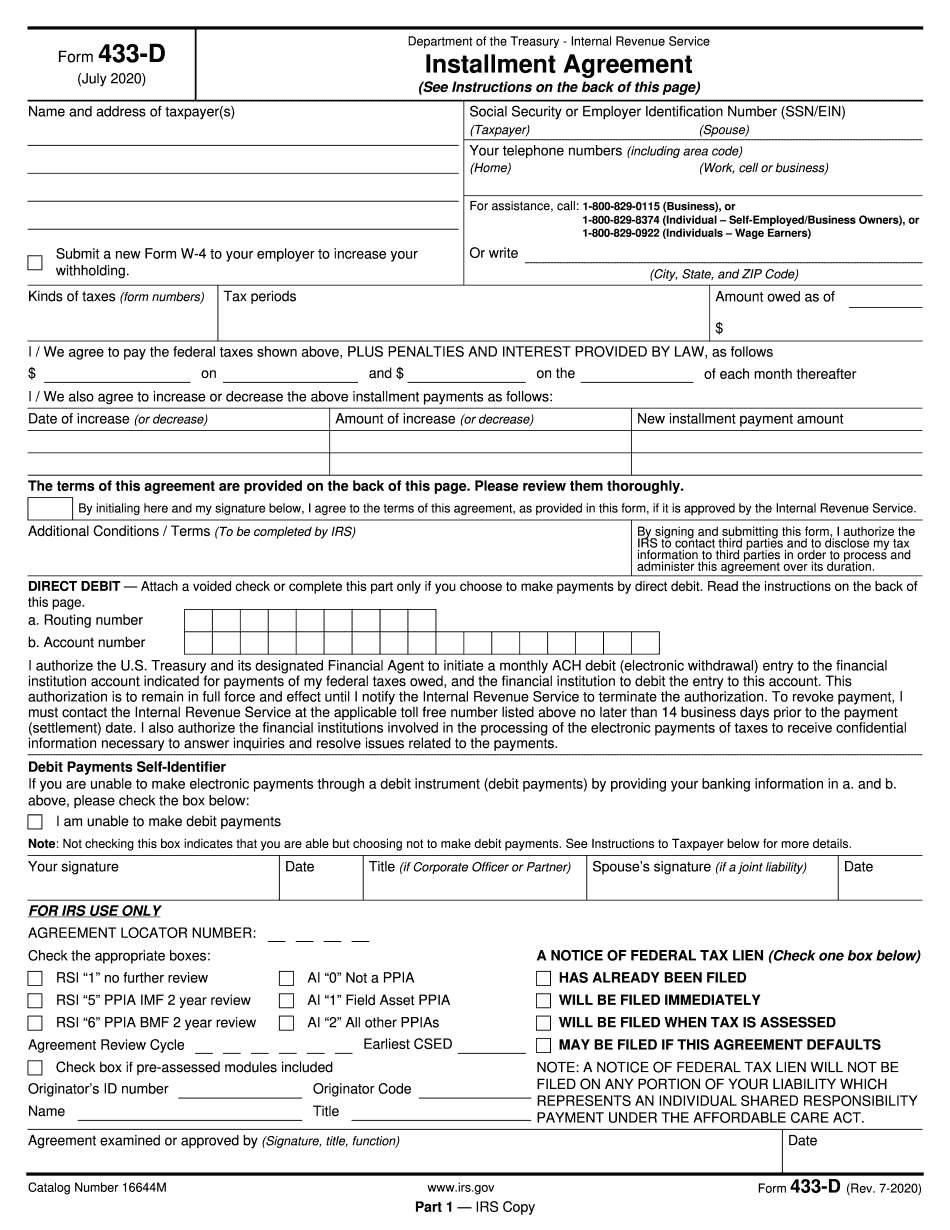

Most wanted tax and legal web forms

Choosen an appropriate tax year, your filing status, and annual taxable income to know your estimated tax rate and fill out the required form right now.

What are the federal income tax brackets?

Submitting taxes is definitely accompanied by a number of pressure. What are the federal income tax brackets? Exactly where should I get real details? How do I calculate the whole quantity? We'll respond to all of these queries in the following paragraphs to make the process a lot less nerve-racking.

As you might know, American taxation is modern. It means that various amounts of profits demand diverse income tax rates. Additionally, these charges also differ from the filer's current status: one, married filing jointly/separately, or head of household. Let's get into detail about this question.

How do tax brackets work

Submitting income tax reports seems very challenging, but it will be easier after looking at this information. Adhere to the step-by-step guidelines to accelerate this process:

- Obtain a total amount of your taxable revenues. An extensive list of this sort of types of payments you can get on the Internal Revenue Service site.

- Open our rate calculator. It will be at the top of our home page.

- Choose your status. Click the first dropdown menu and select one variant that suits you.

- Divide your revenue into parts according to the United States tax brackets inside the second dropdown menu.

- Make use of the demonstrated prices to compute owed taxes for each element of revenue.

- Sum all received amounts.

With our service, submitting earnings reports becomes more practical. Try it now!