Do Single Moms Get Put On Lower Tax Brackets?

The IRS does not discriminate on the basis of sex. Head of Household is a filing status for single or unmarried taxpayers (male or female) who keep up a home for a Qualifying Person who is related to you, if they lived with you for more than half the year and you can claim them as a dependent.. Any of the following relations may count as a Qualifying Person: your child, stepchild, grandchild or other descendant of one of your children (or stepchildren or foster children), son-in-law, daughter-in-law, brother, sister, half brother, half sister, stepbrother, stepsister, brother-in-law, sister-in-law, parent, stepfather, stepmother, father-in-law, mother-in-law, grandparent, great-grandparent, and, if related by blood, aunt, uncle, niece, or nephew. If the qualifying person is the taxpayer's father or mother, the taxpayer may file as Head of Household even if the father or mother does not live with the taxpayer. However, the taxpayer must be able to claim the exemption for the father or mother. Also, the taxpayer must pay more than half the cost of keeping up a home that was the main home for the entire year for the father or mother. The taxpayer is considered keeping up the father or mother's main home by paying more than half the cost of keeping the parent in a rest home for the elderly. Taxpayers who qualify get a higher standard deduction and wider tax brackets compared to the single filing status. Also, Heads of Household have a higher threshold income than Single filers before they owe income tax. To be considered Head of Household means: You file a separate return (not joint) You paid more than half of the cost of keeping up your home for the tax year You spouse did not live in the home during the last 6 months of the tax year Your home was the main home for the qualifying person for at least 6 months of the tax year You must be able to claim the person as a dependent

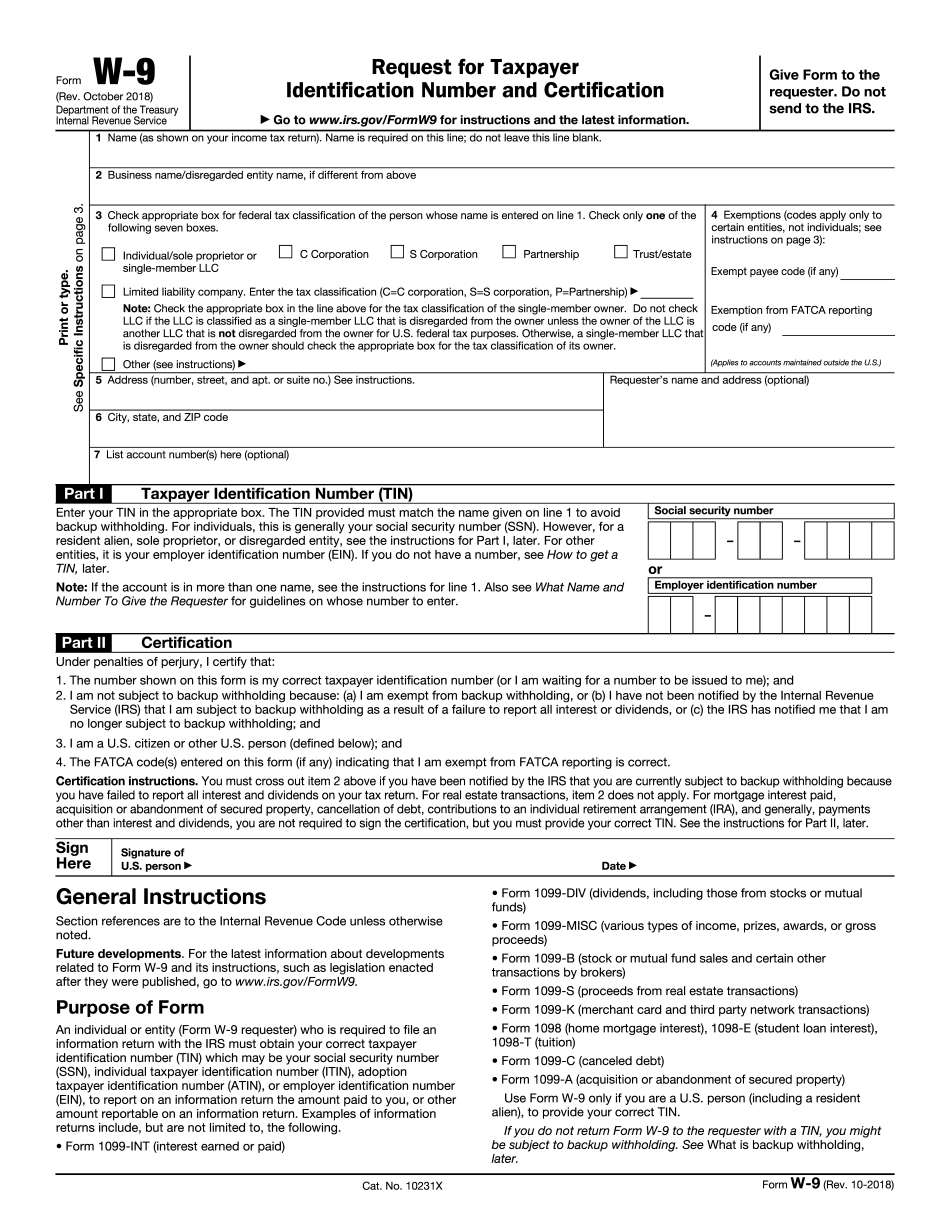

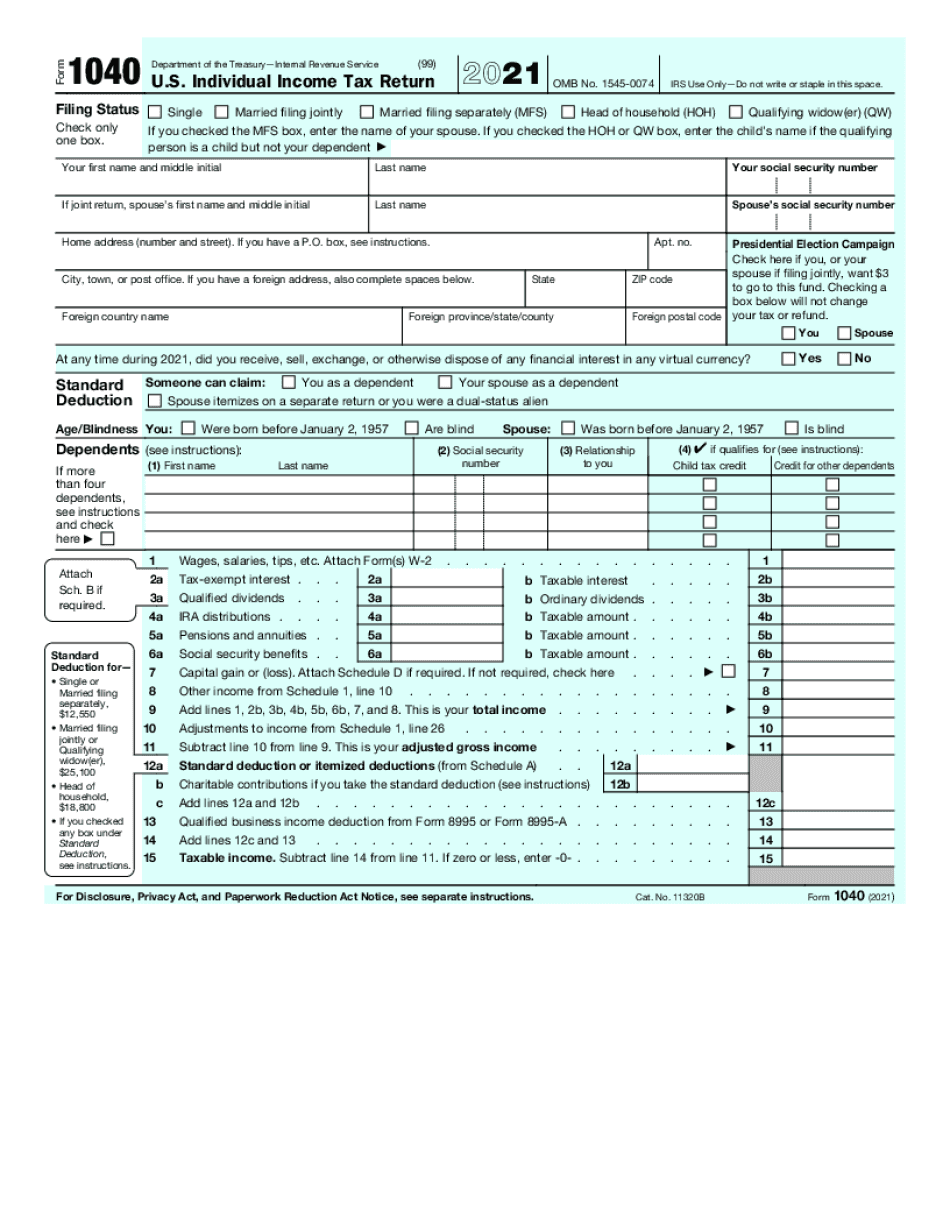

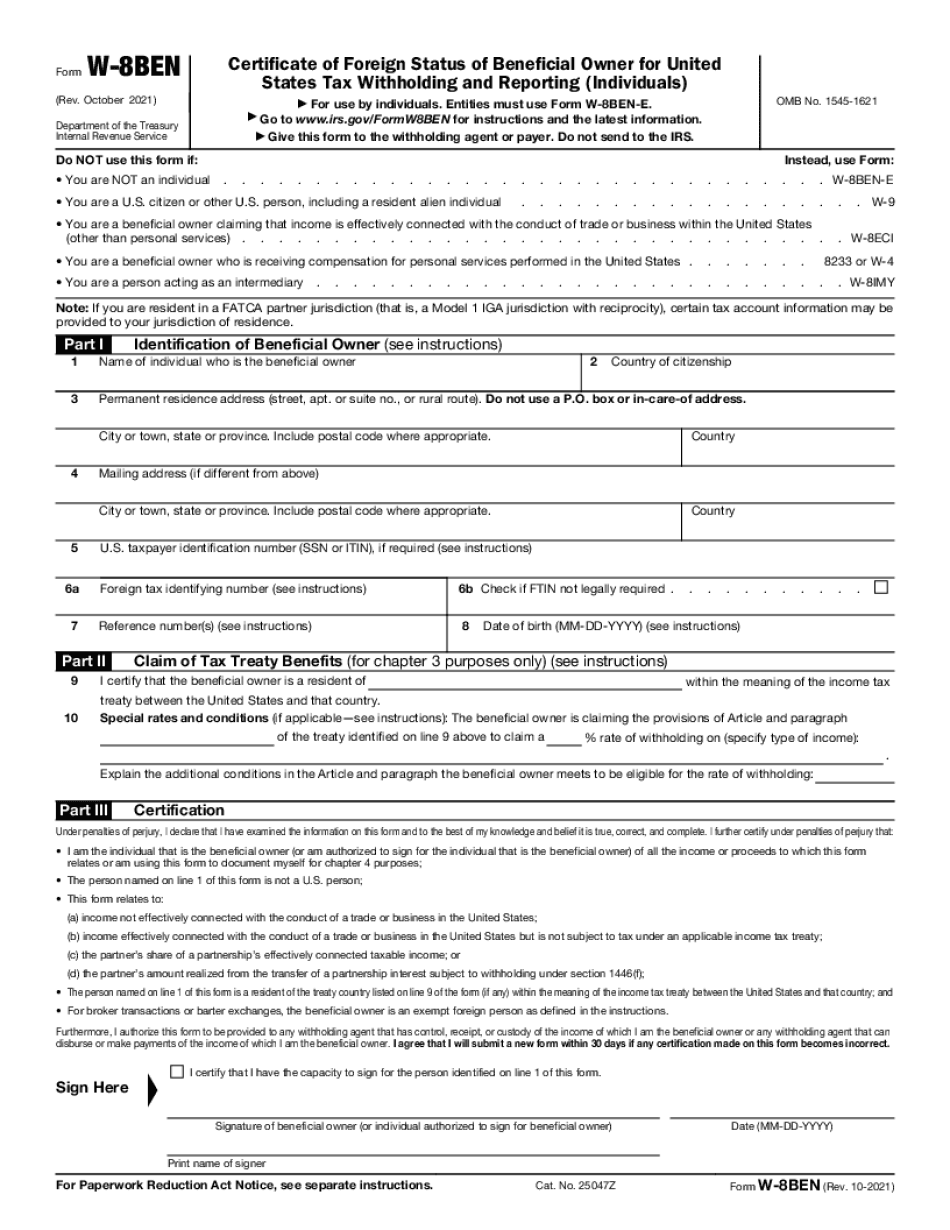

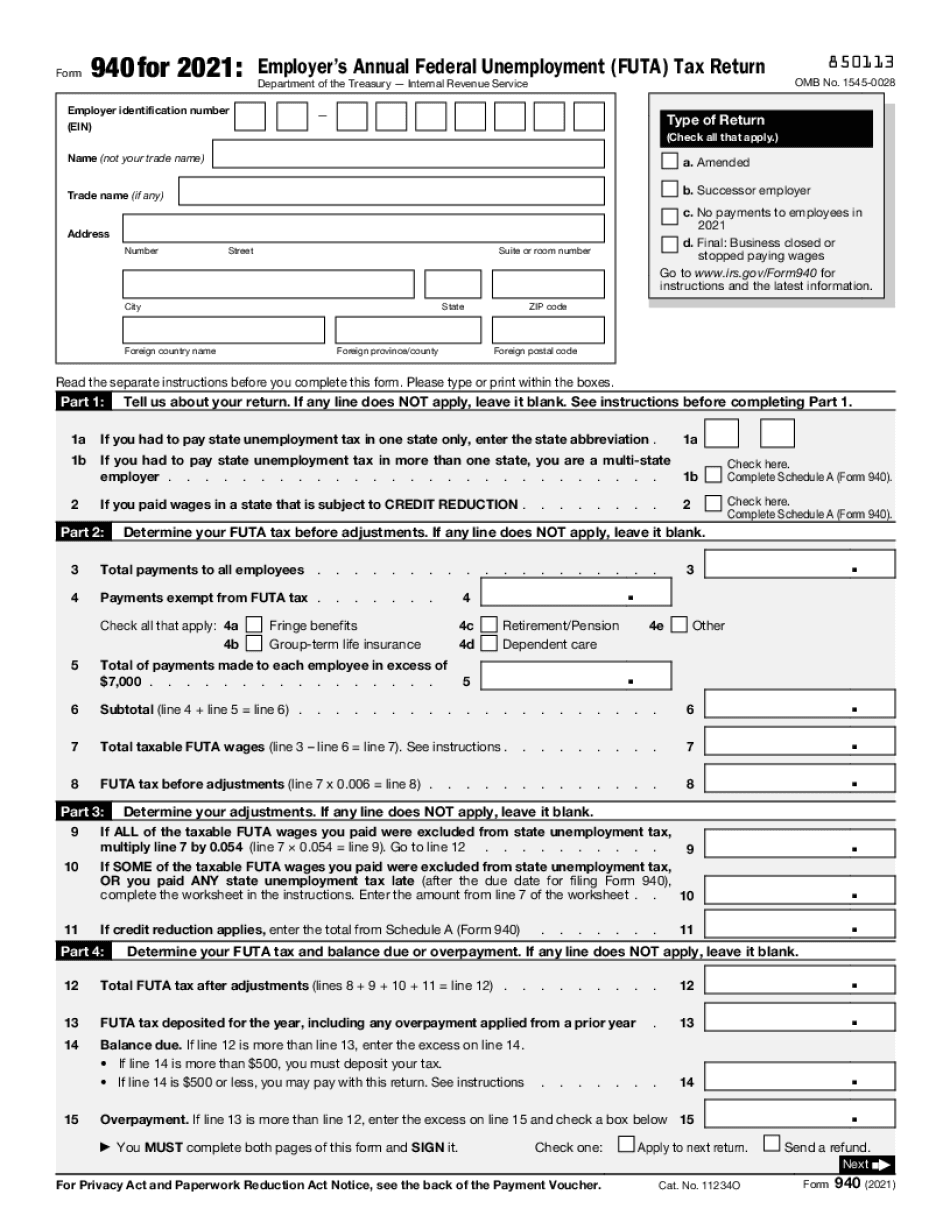

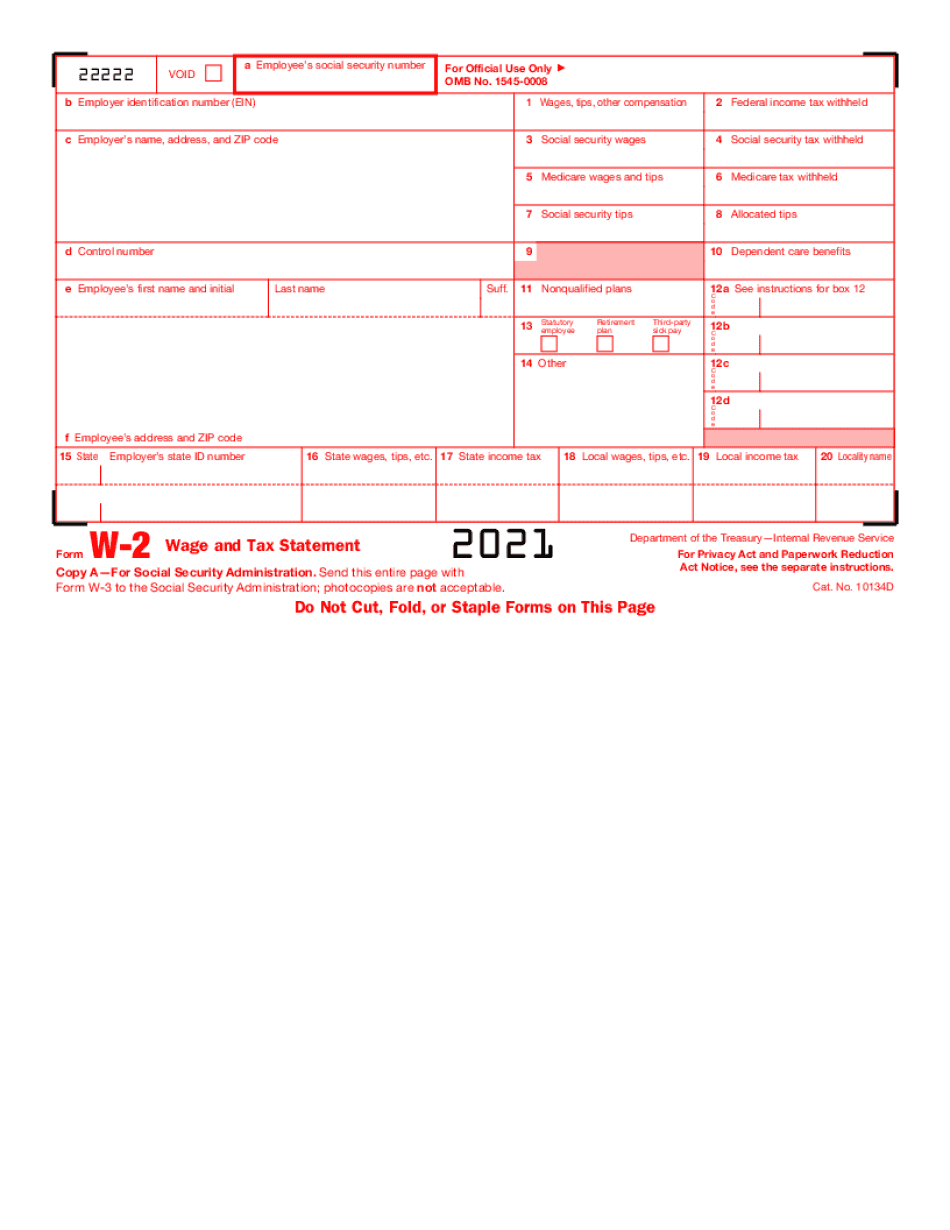

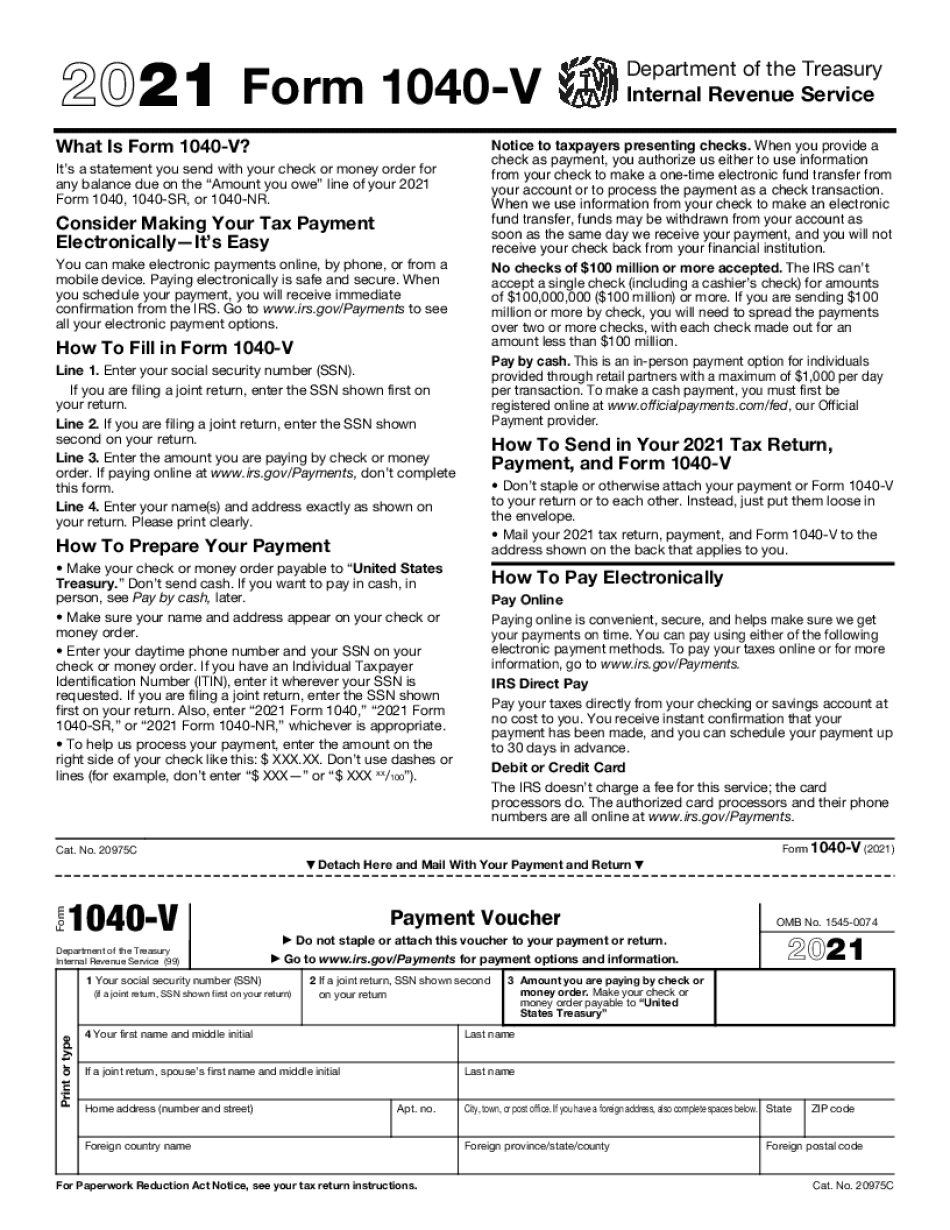

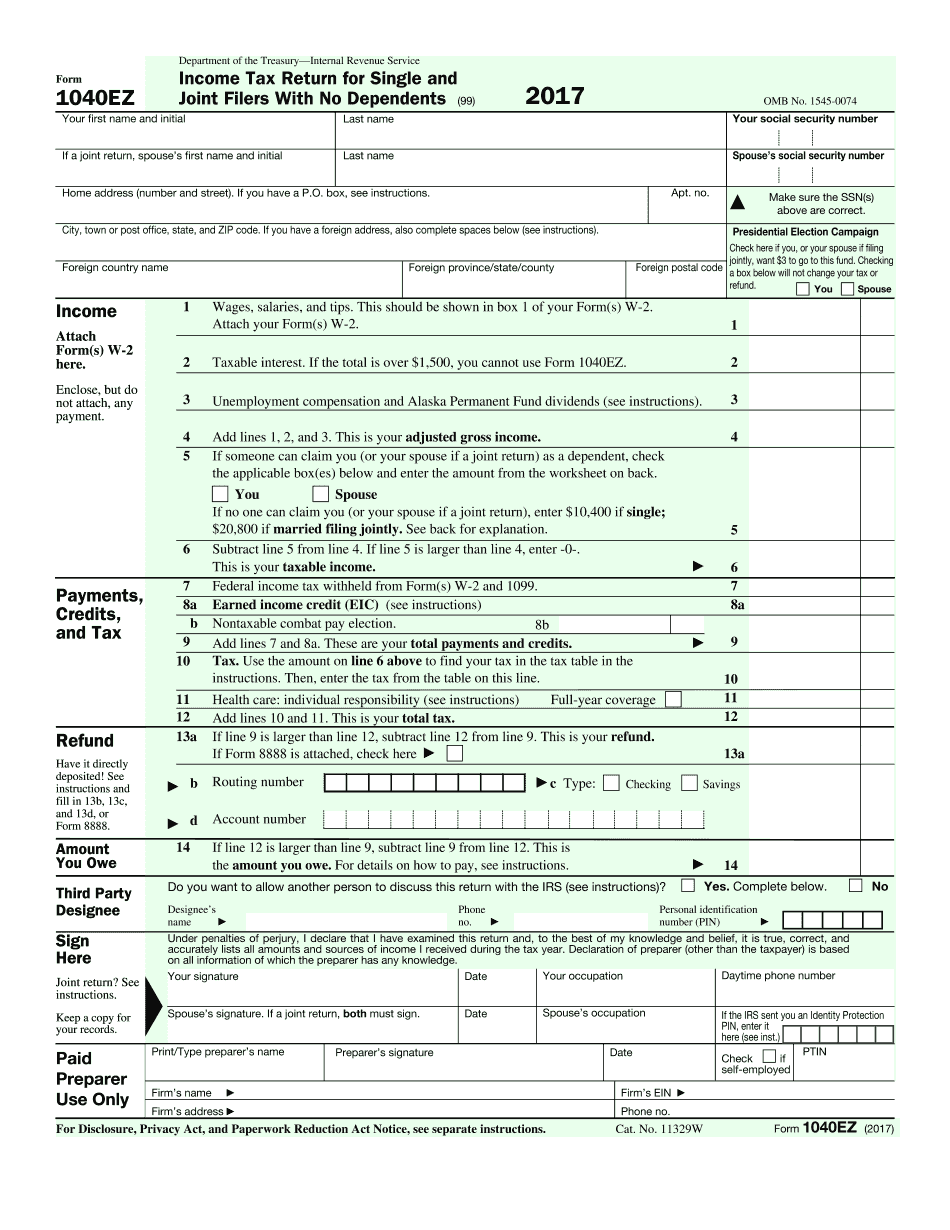

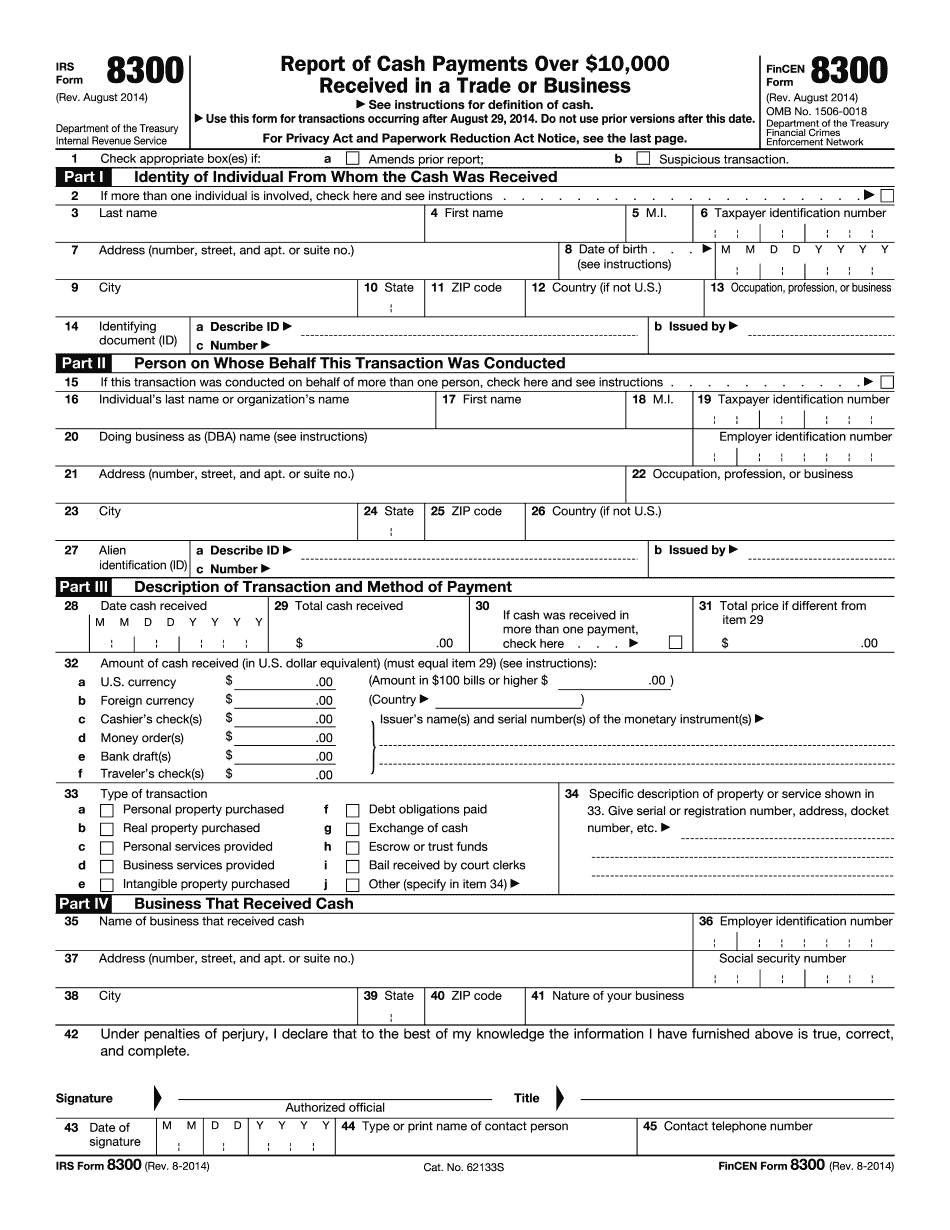

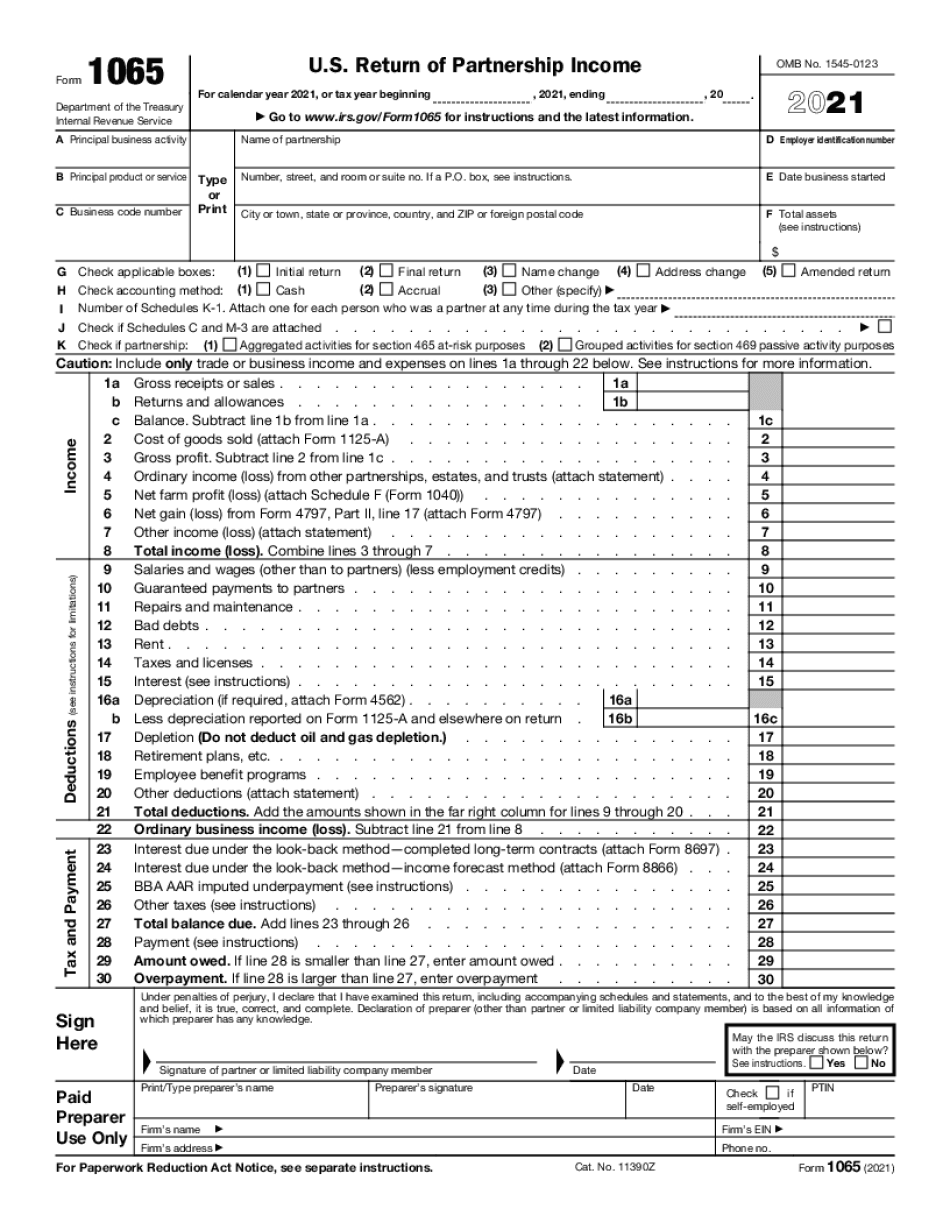

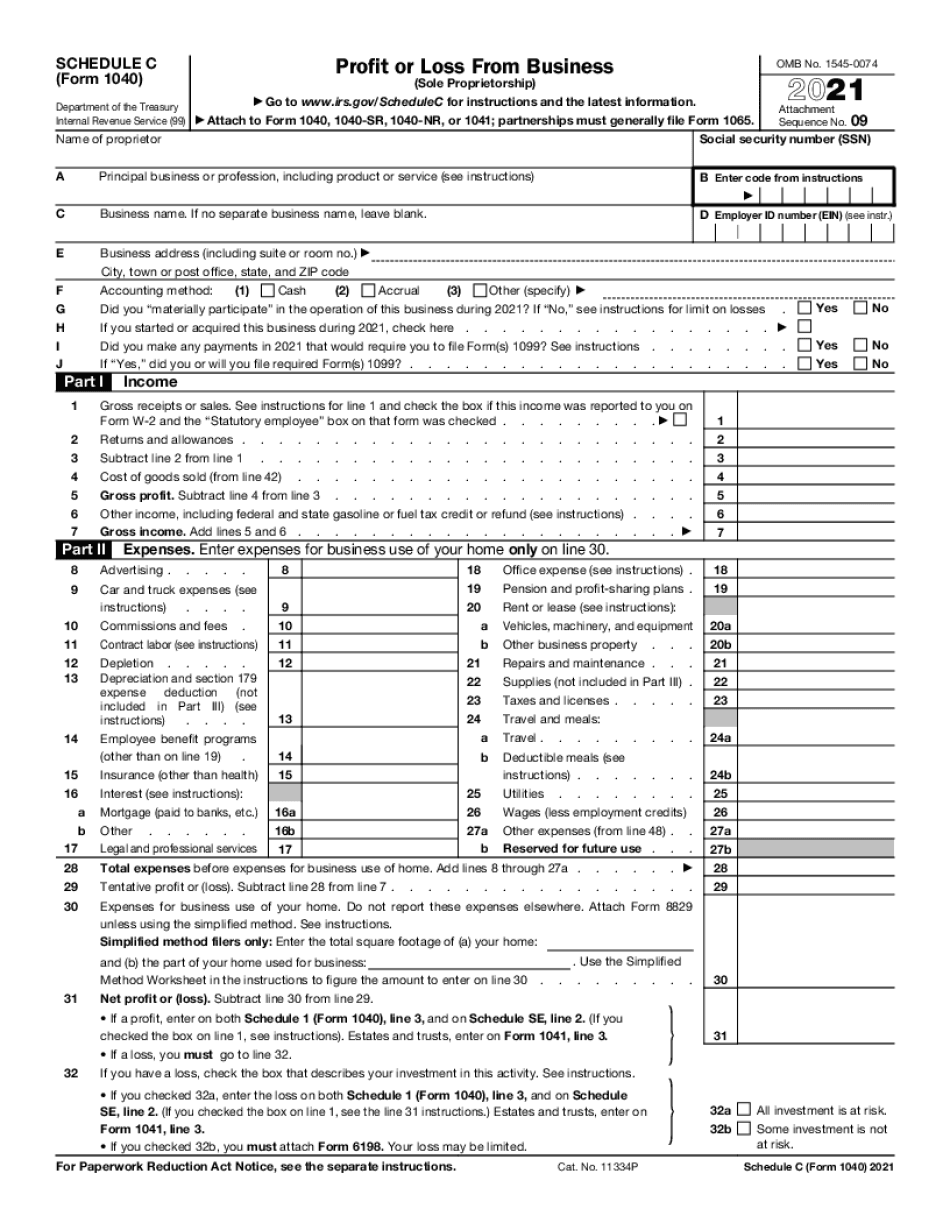

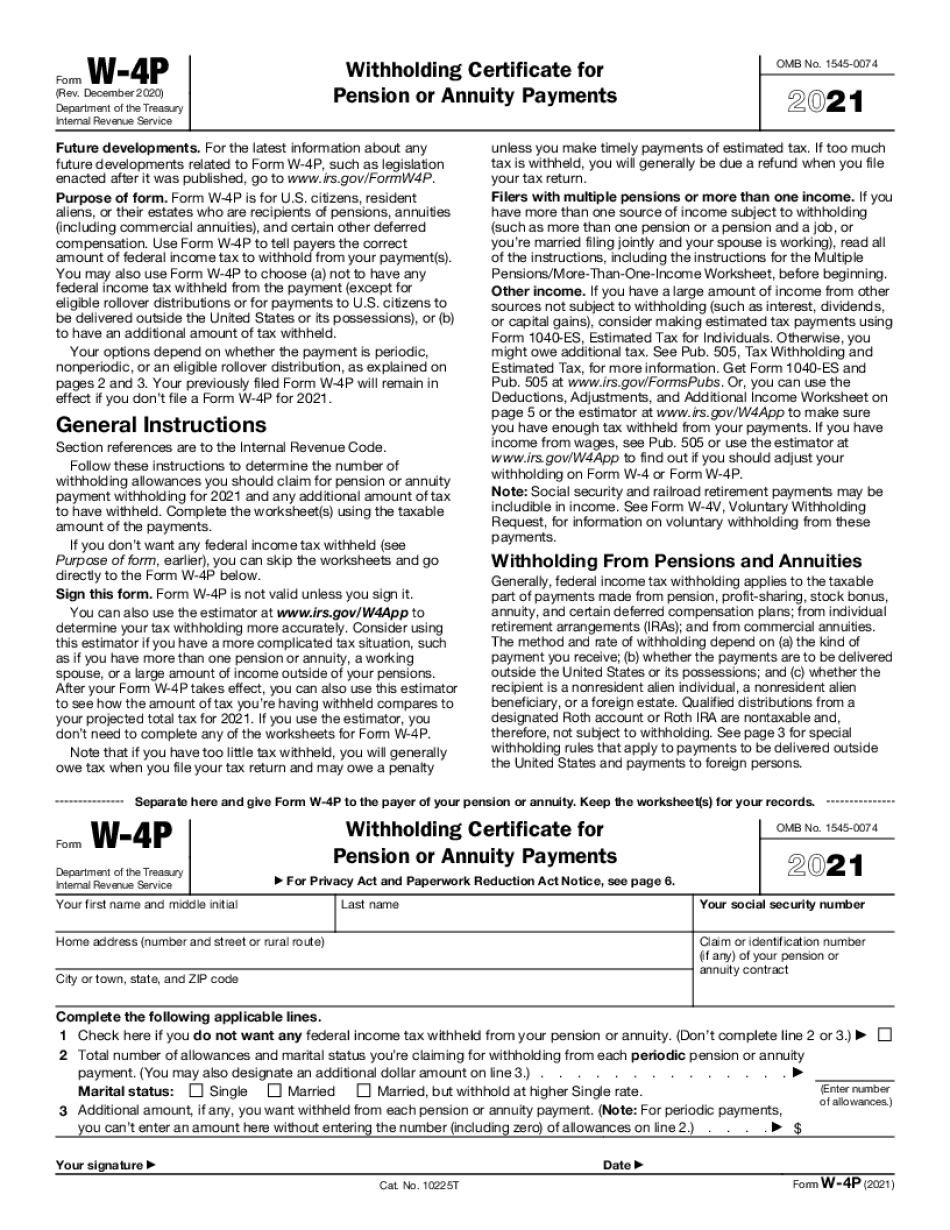

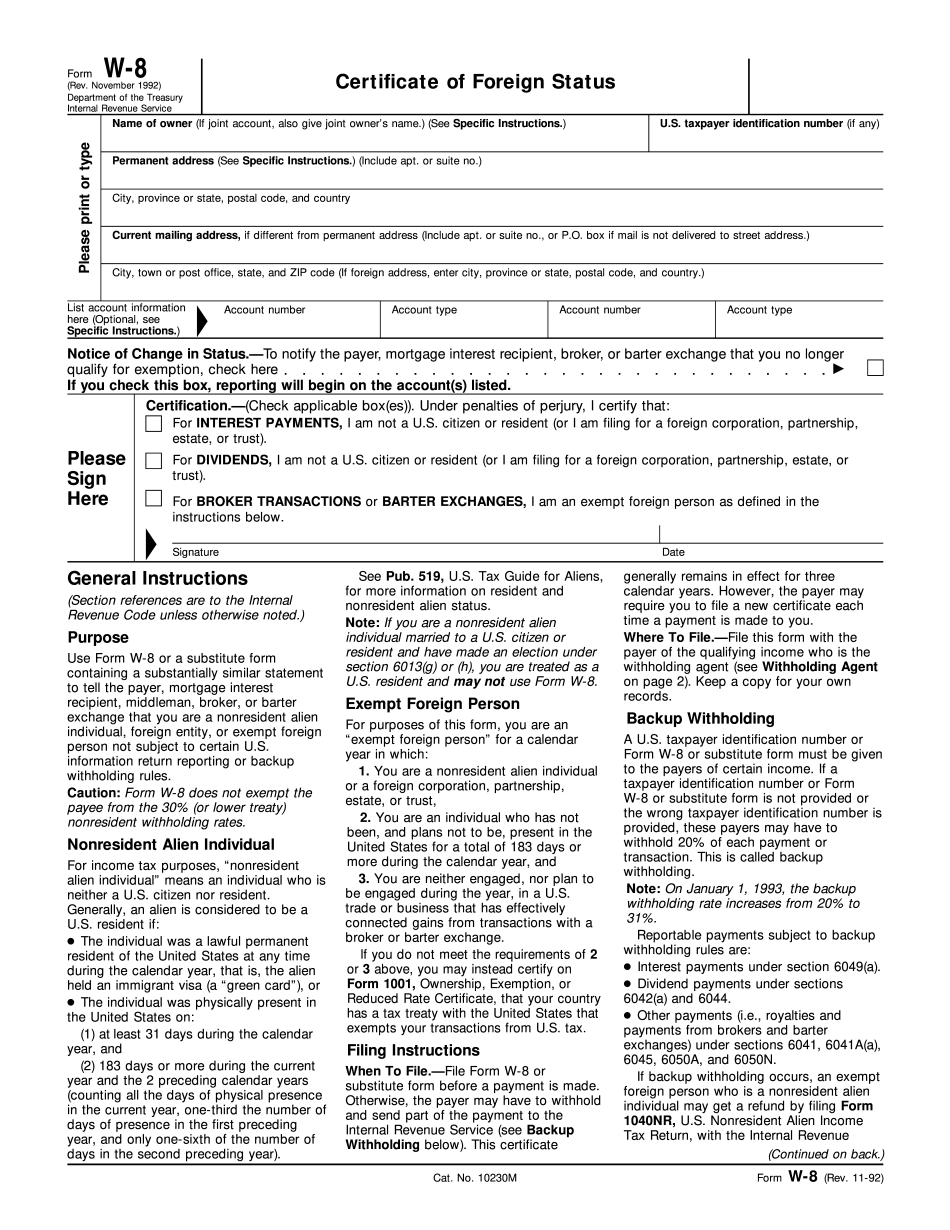

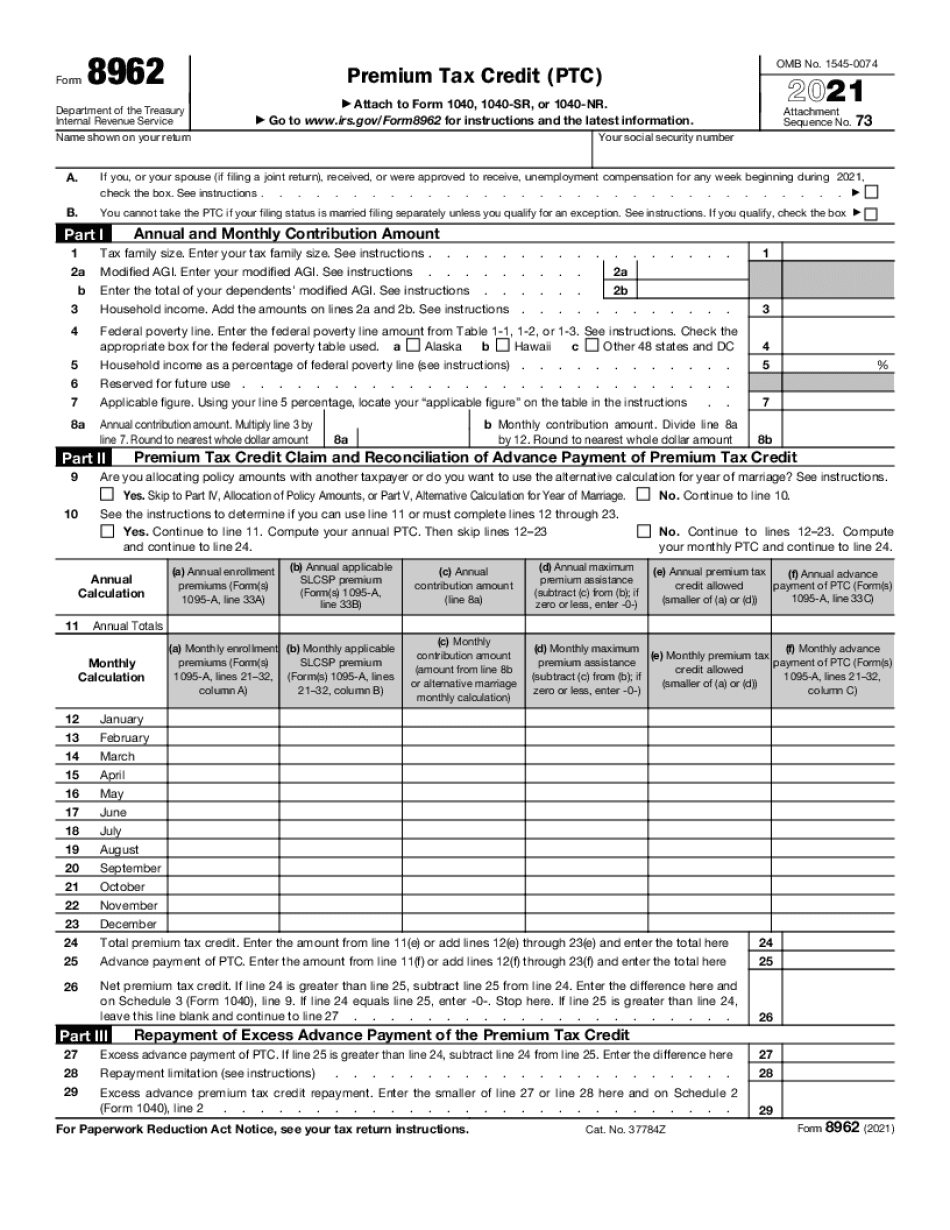

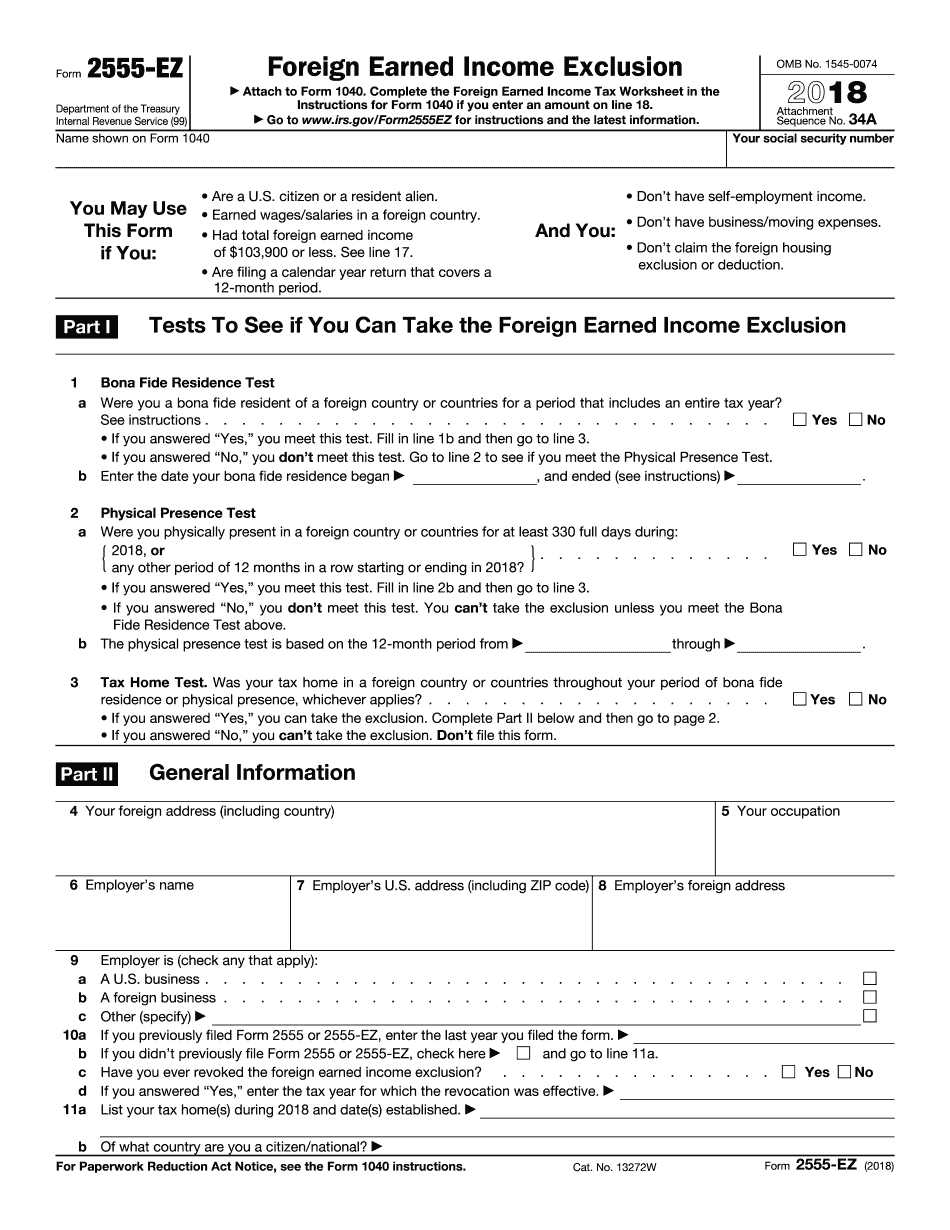

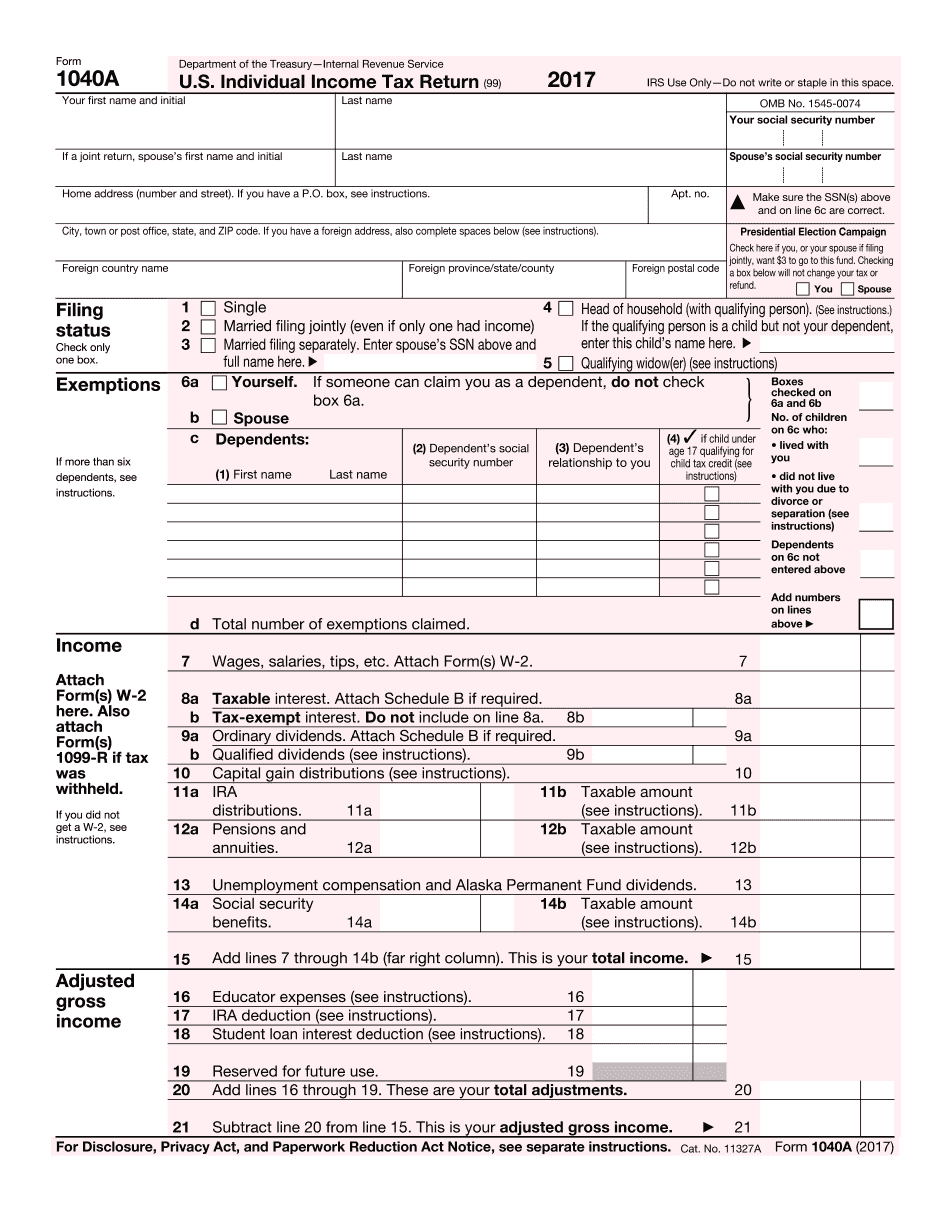

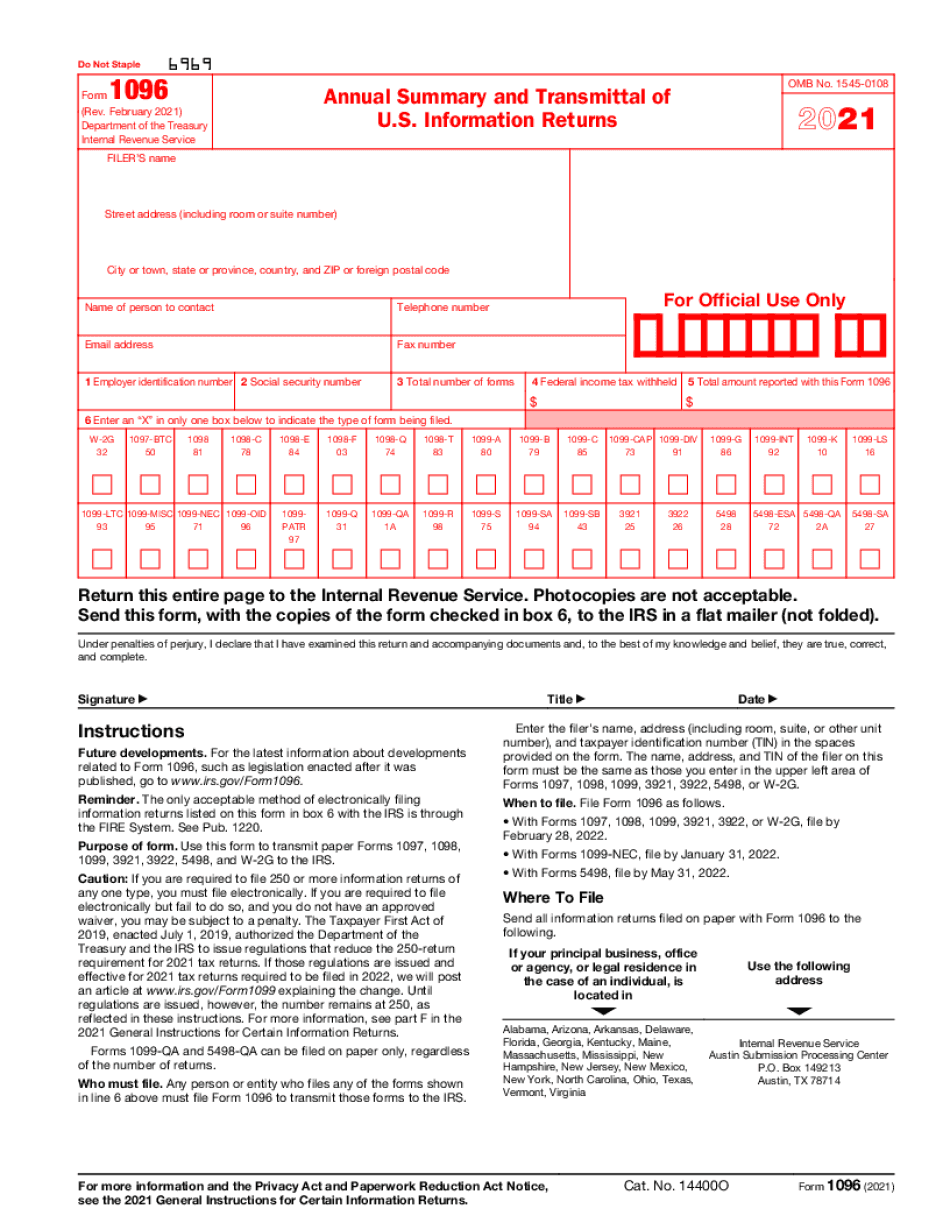

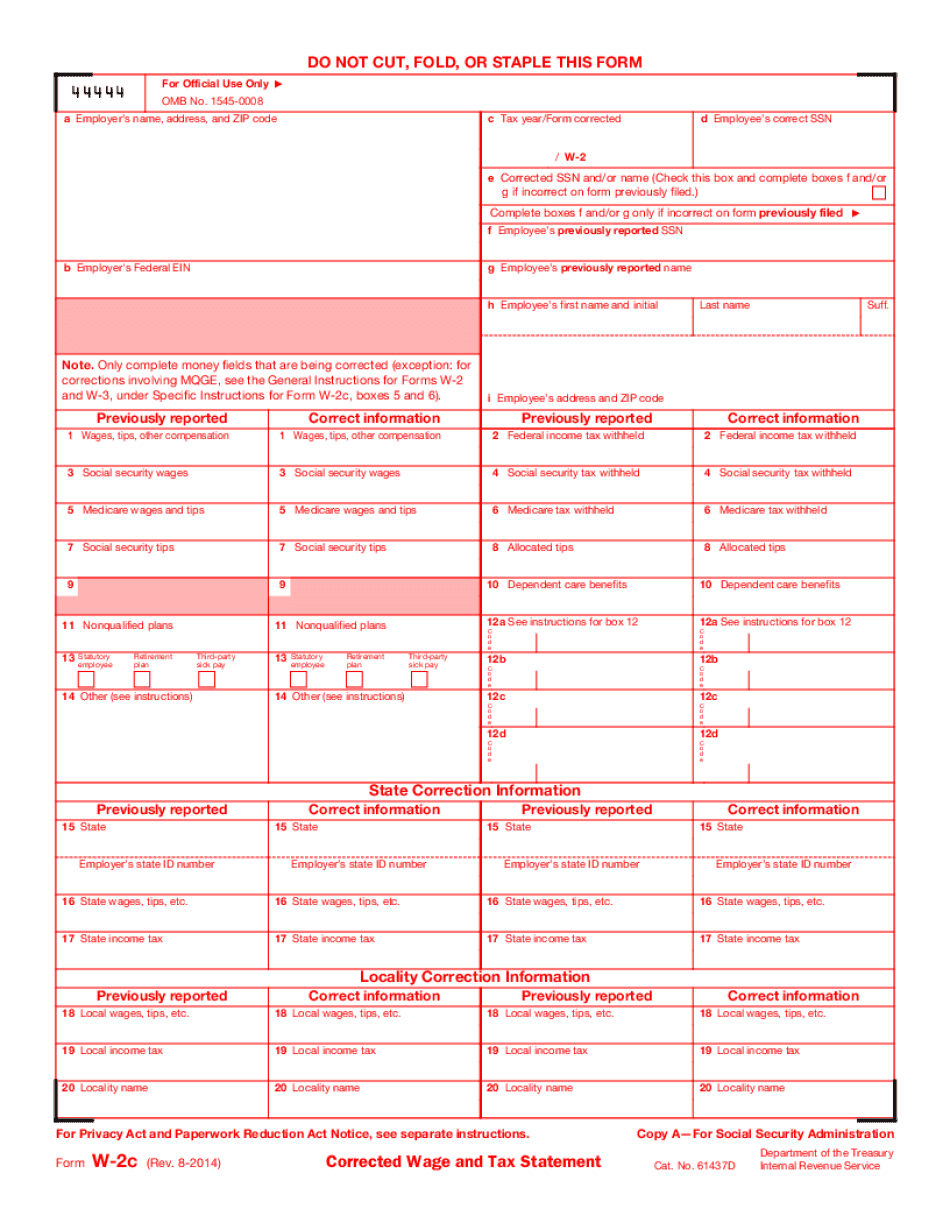

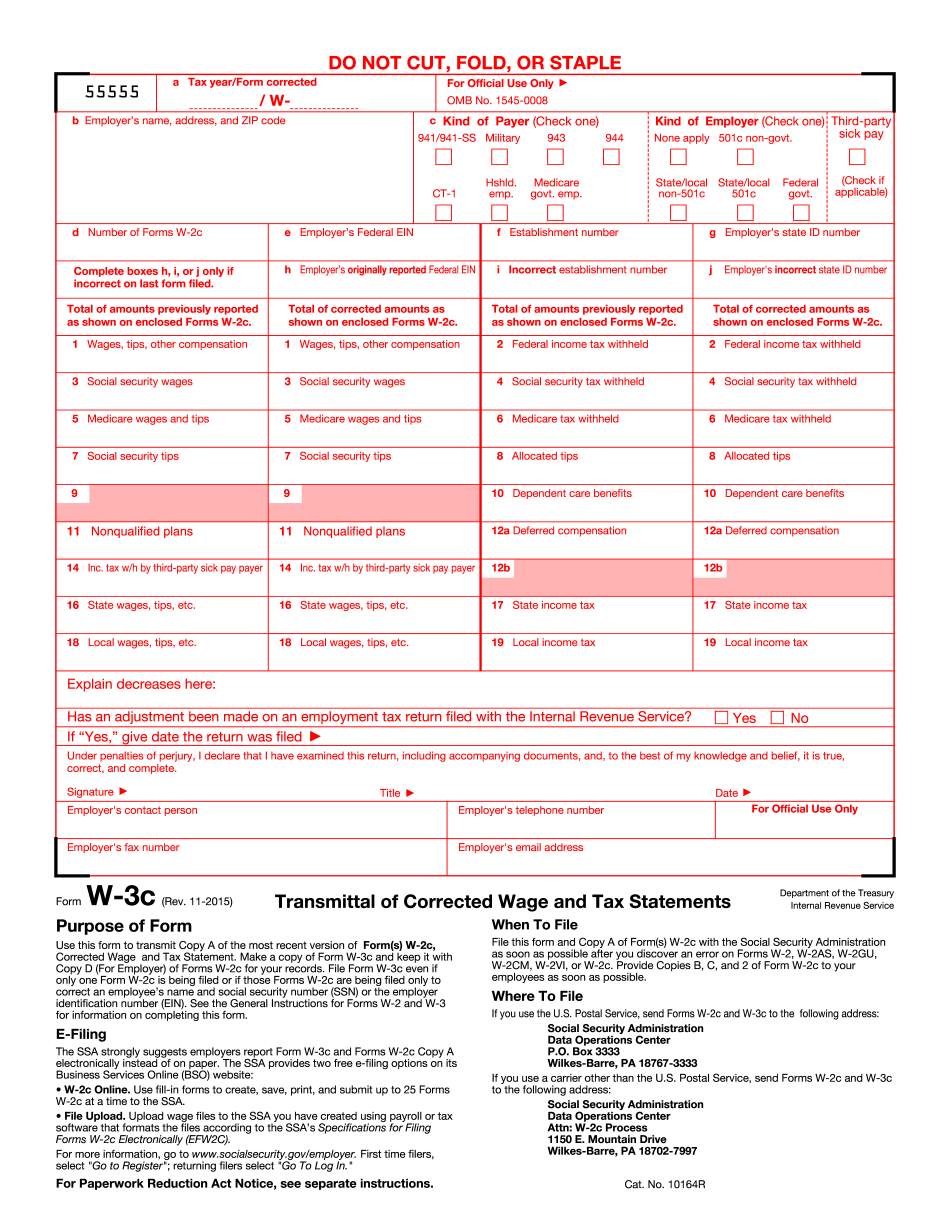

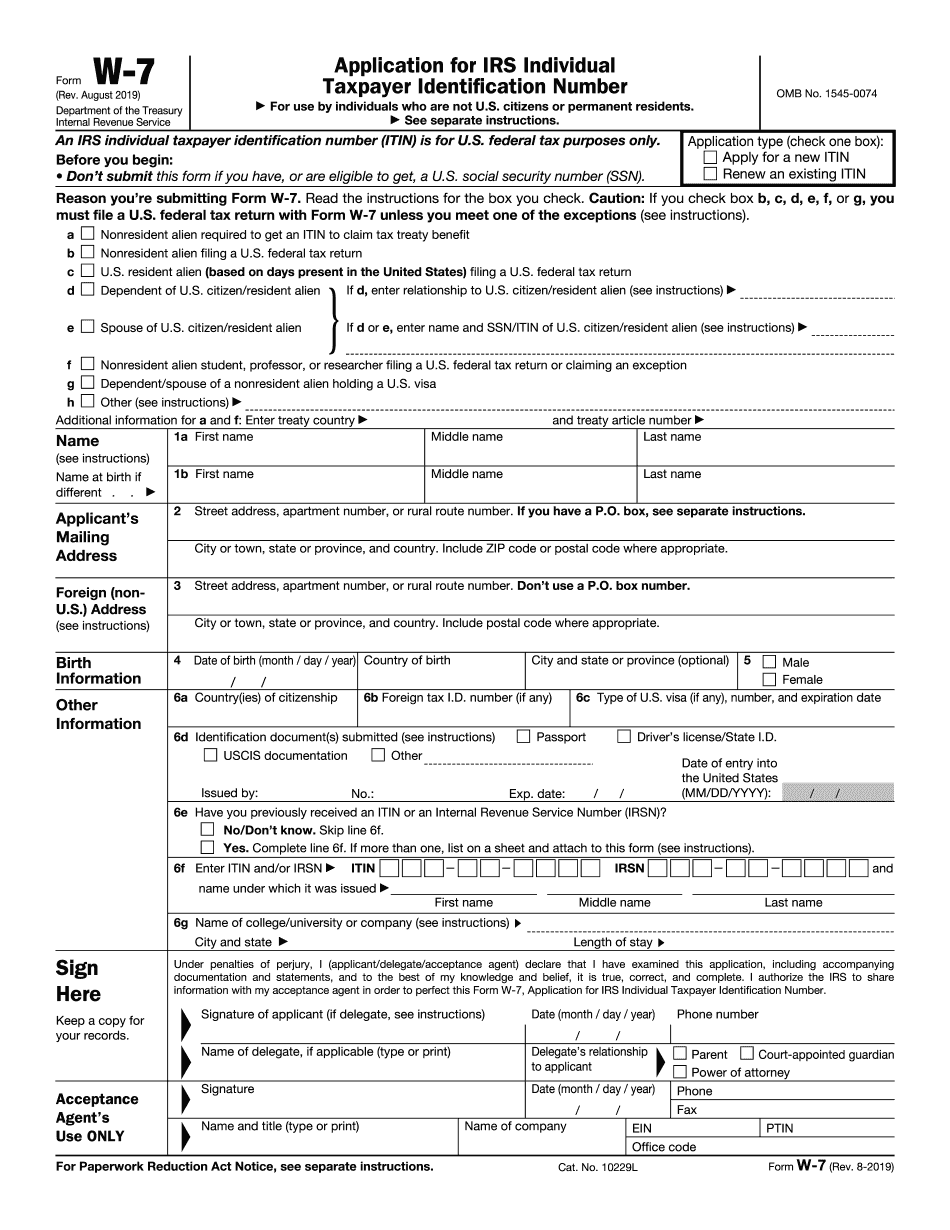

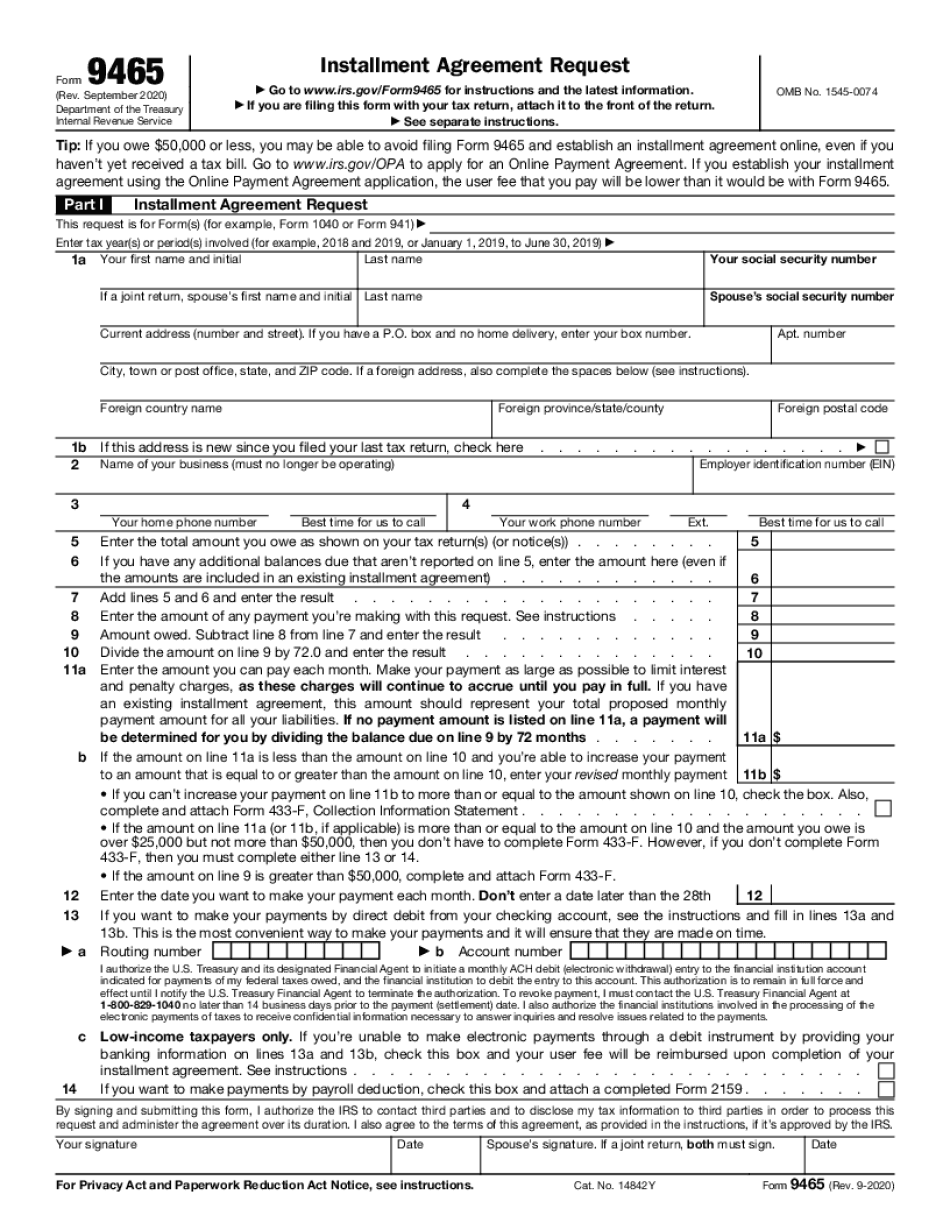

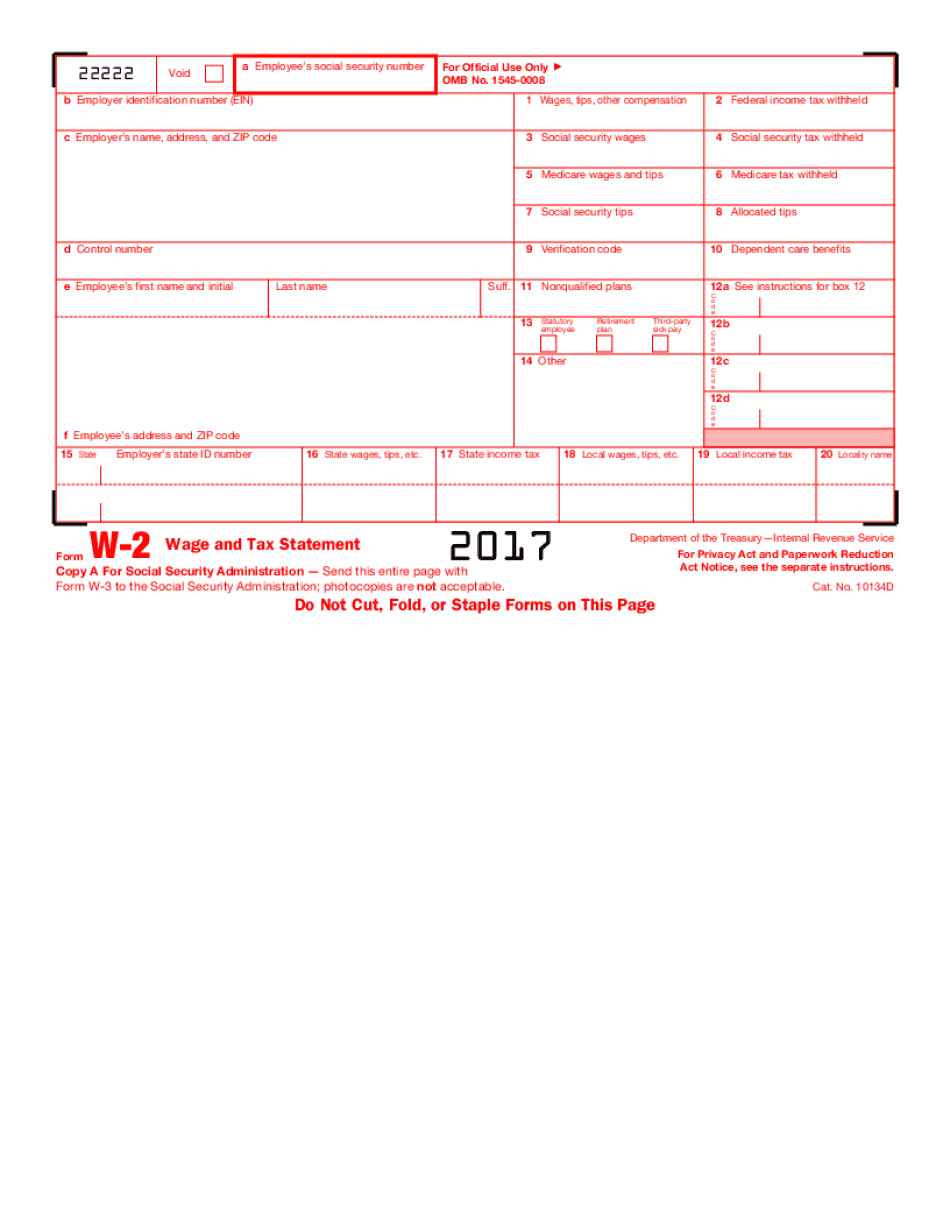

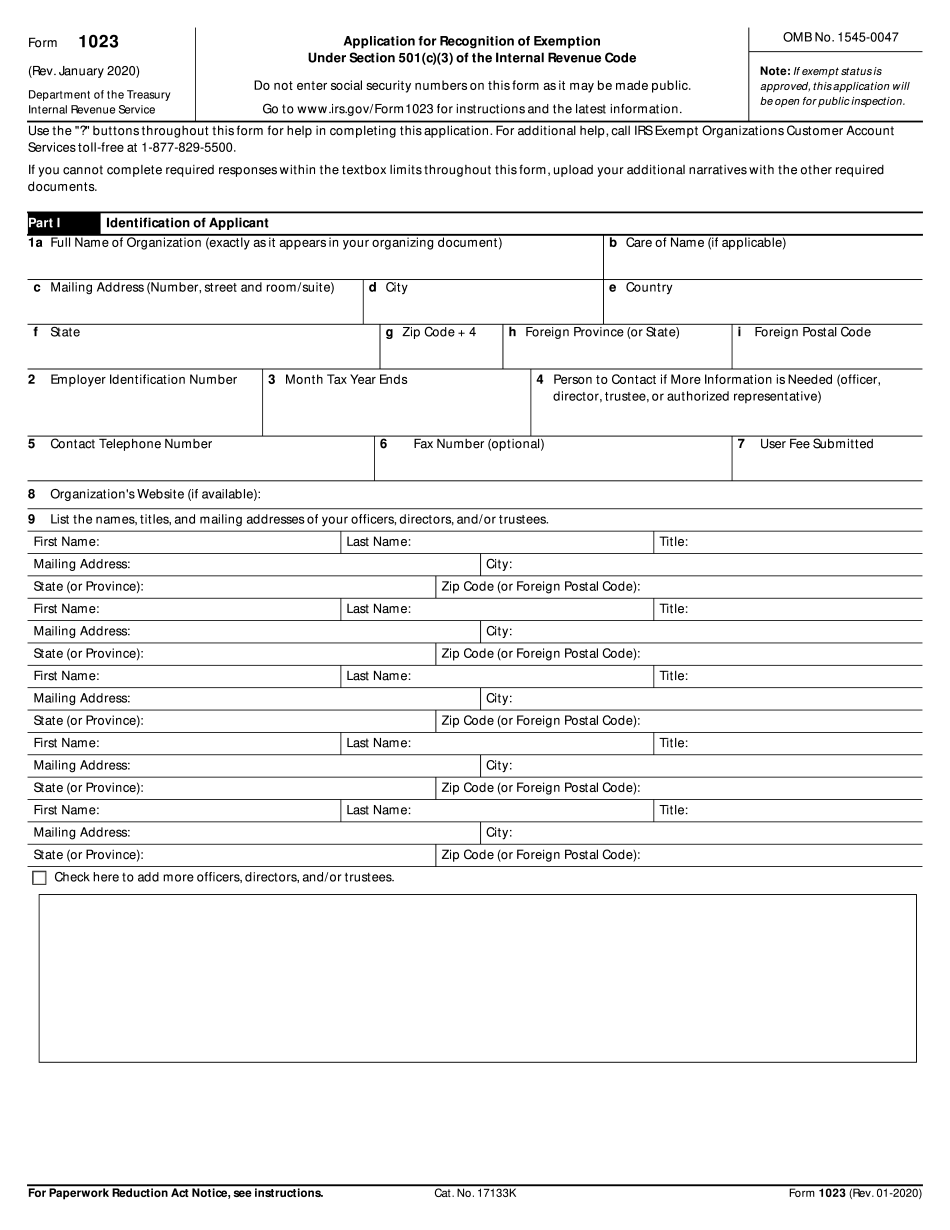

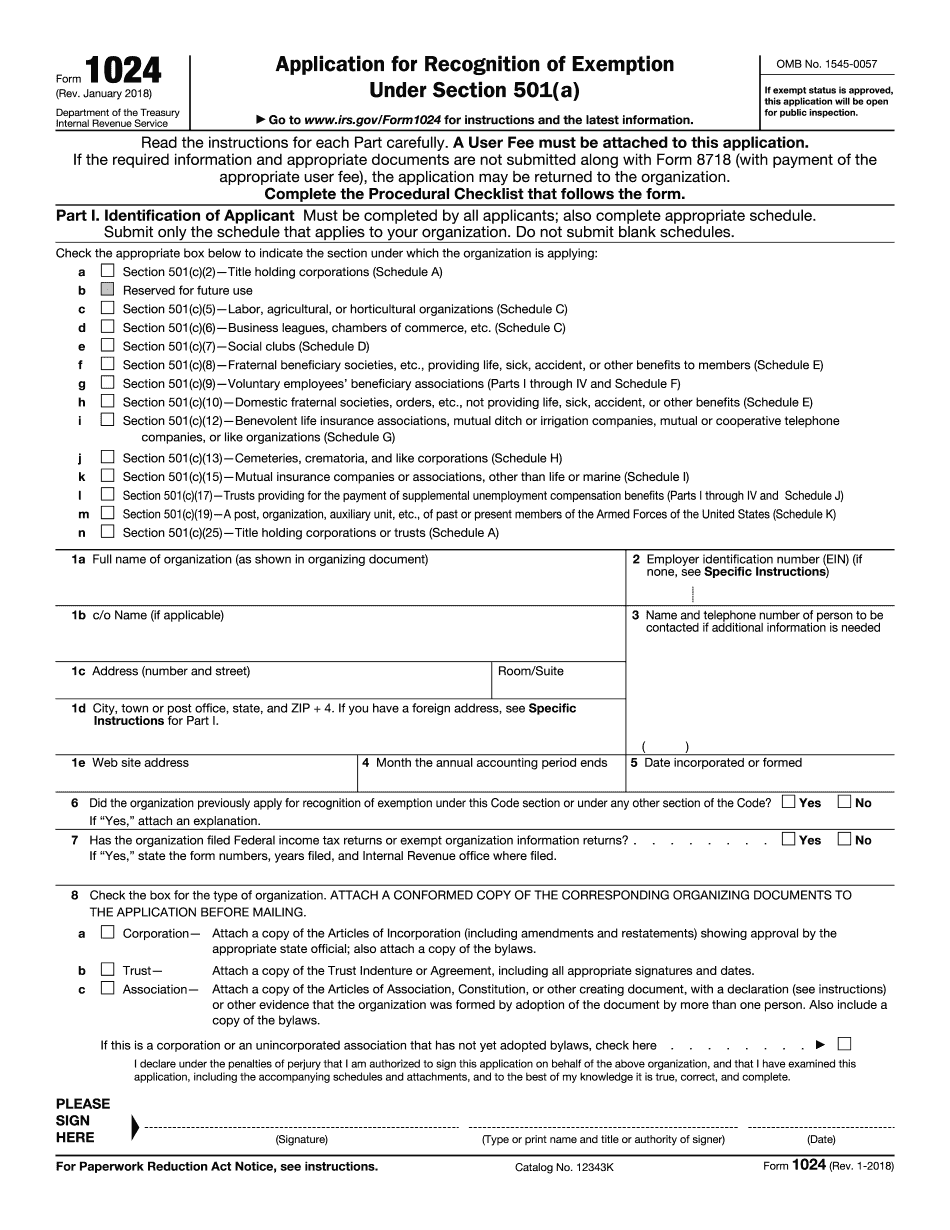

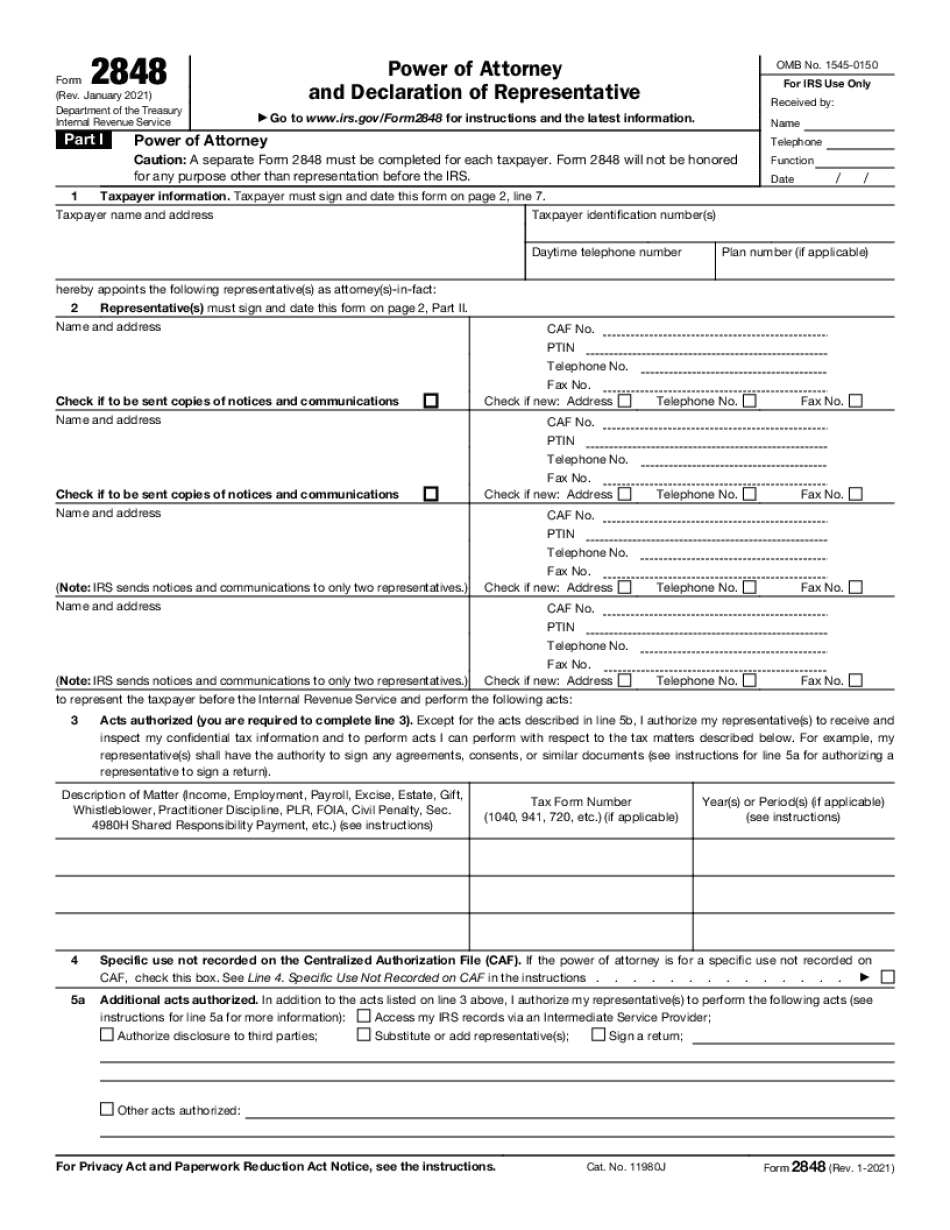

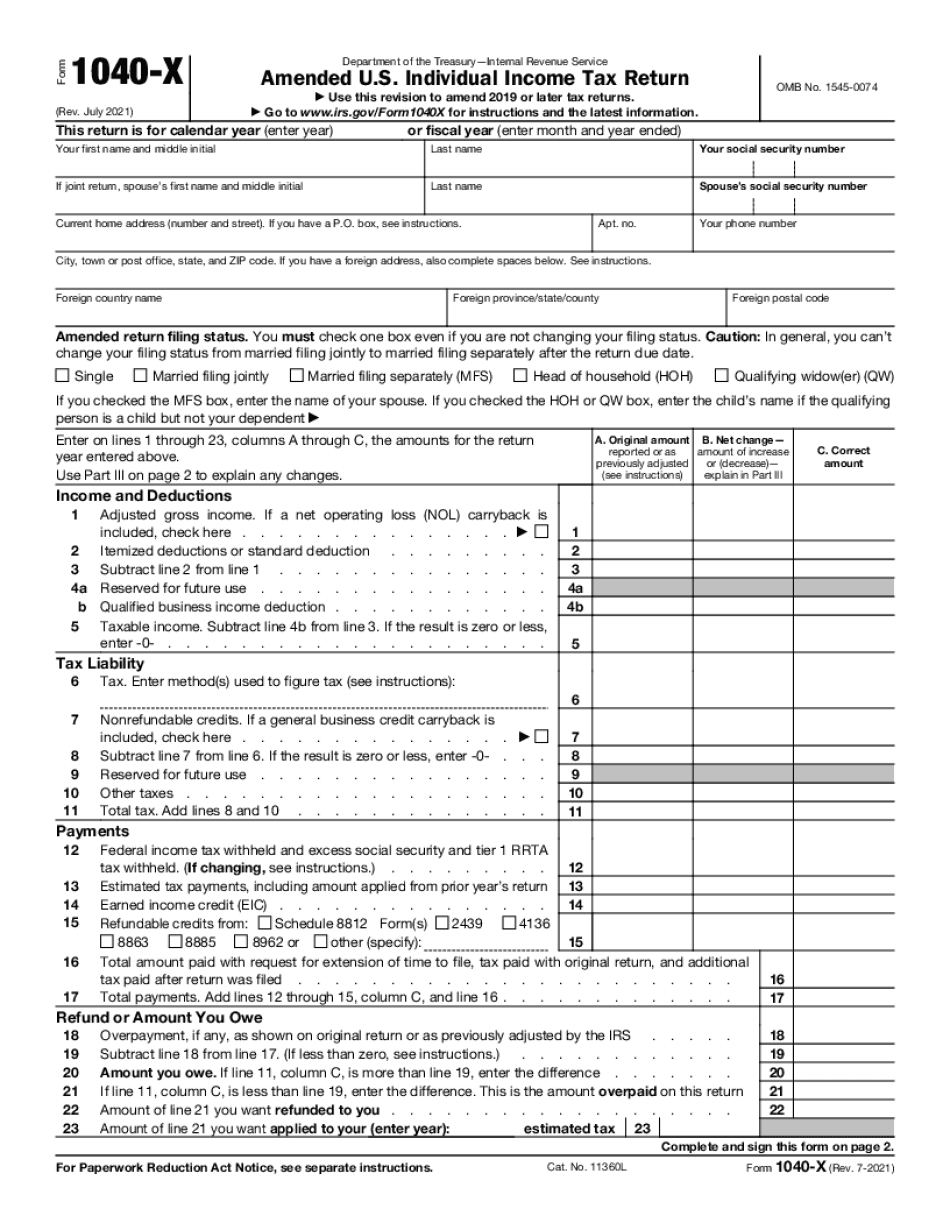

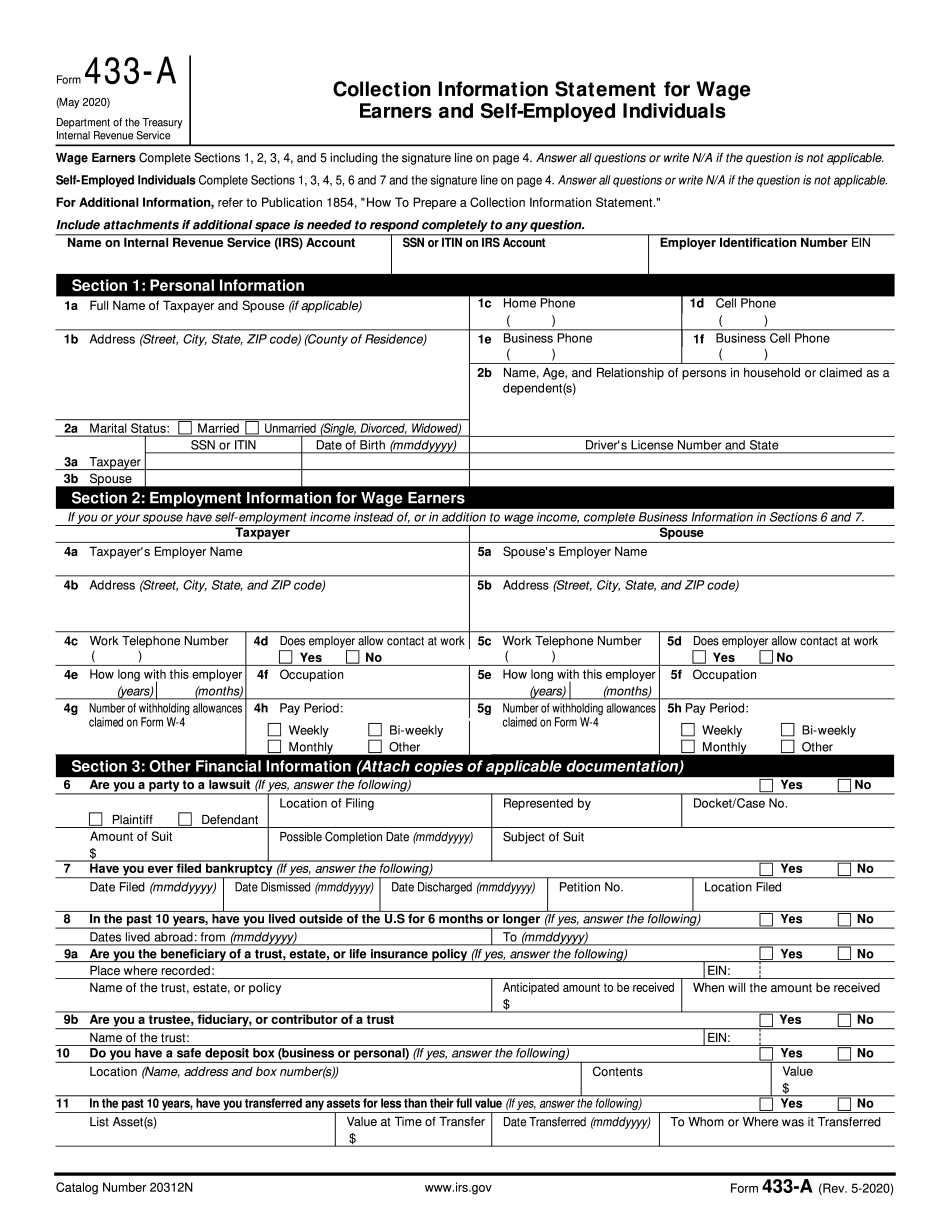

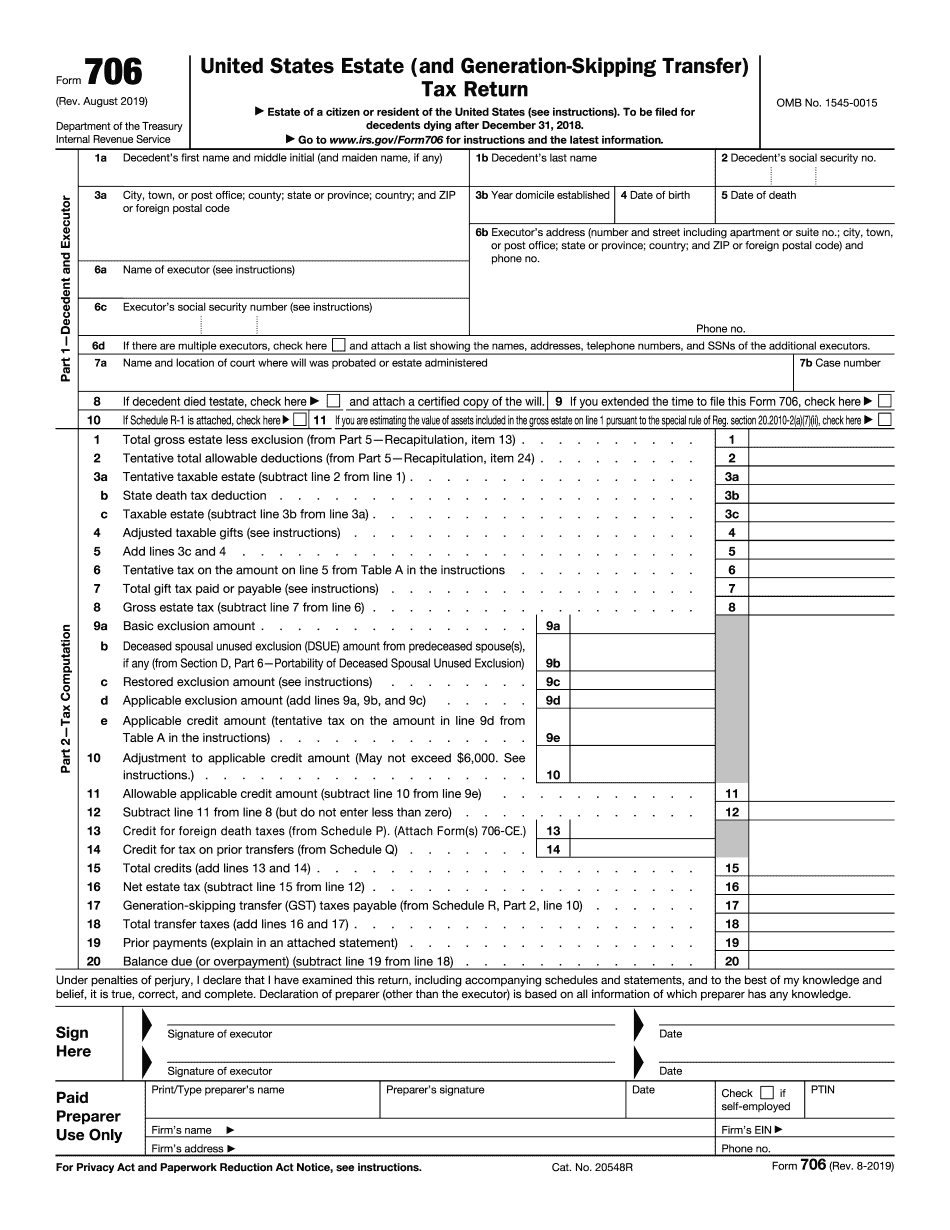

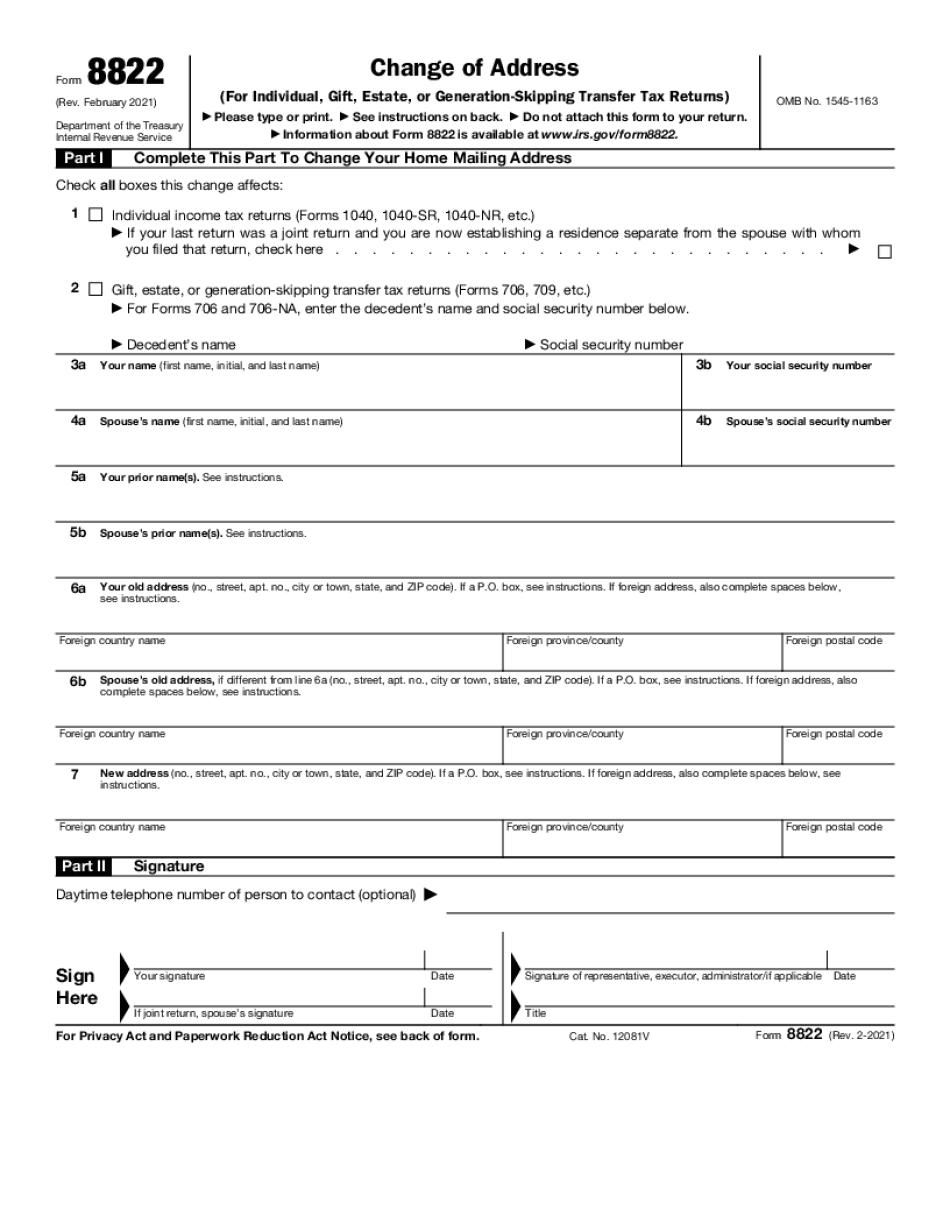

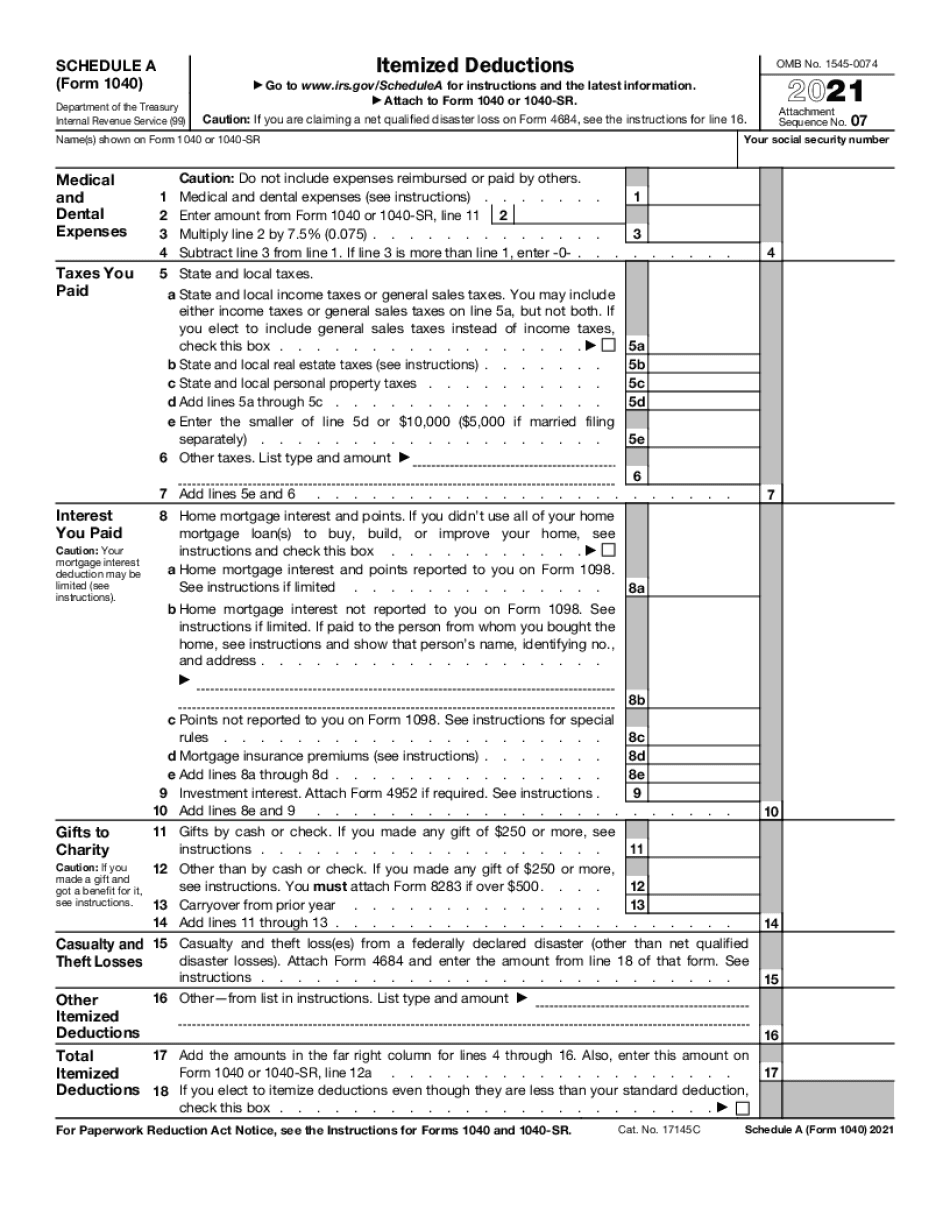

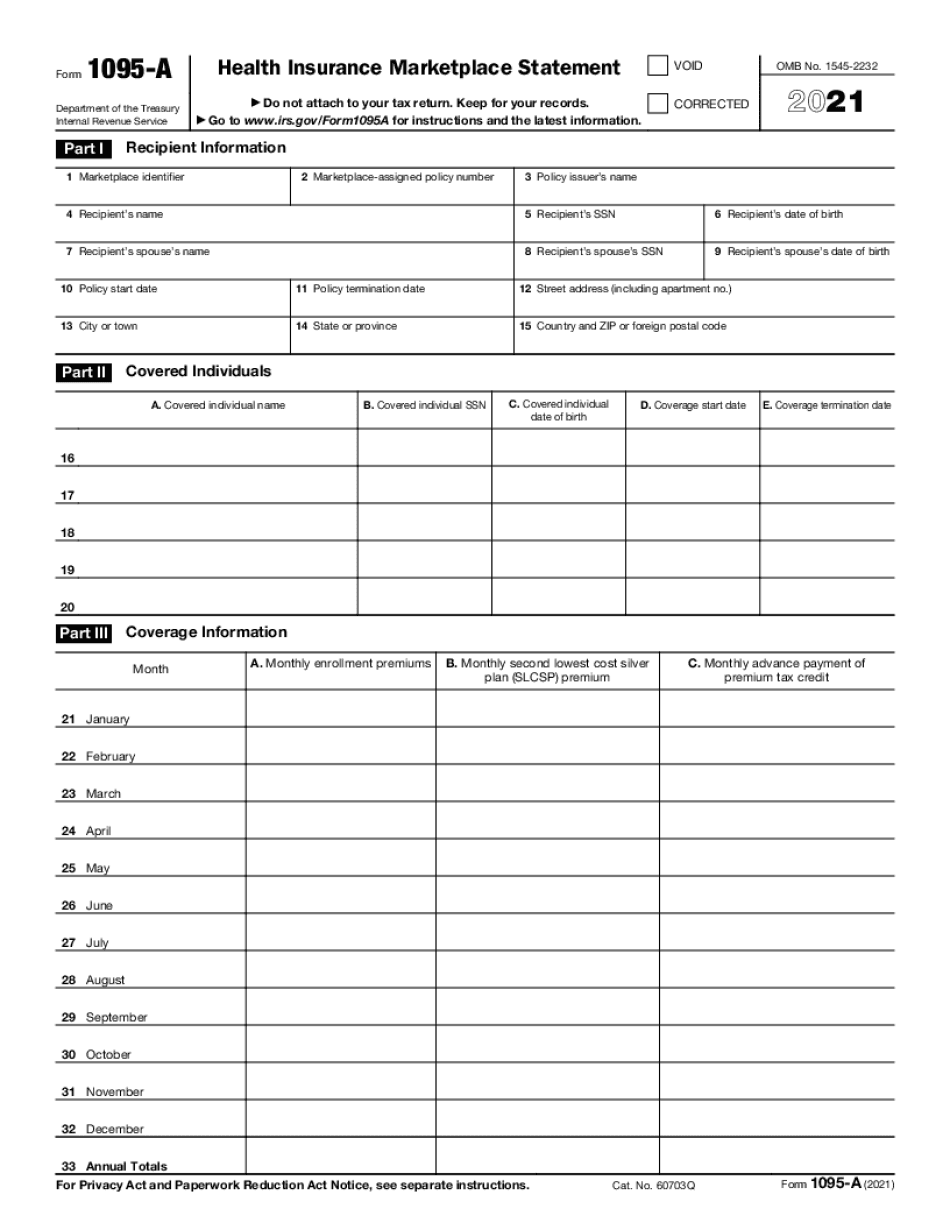

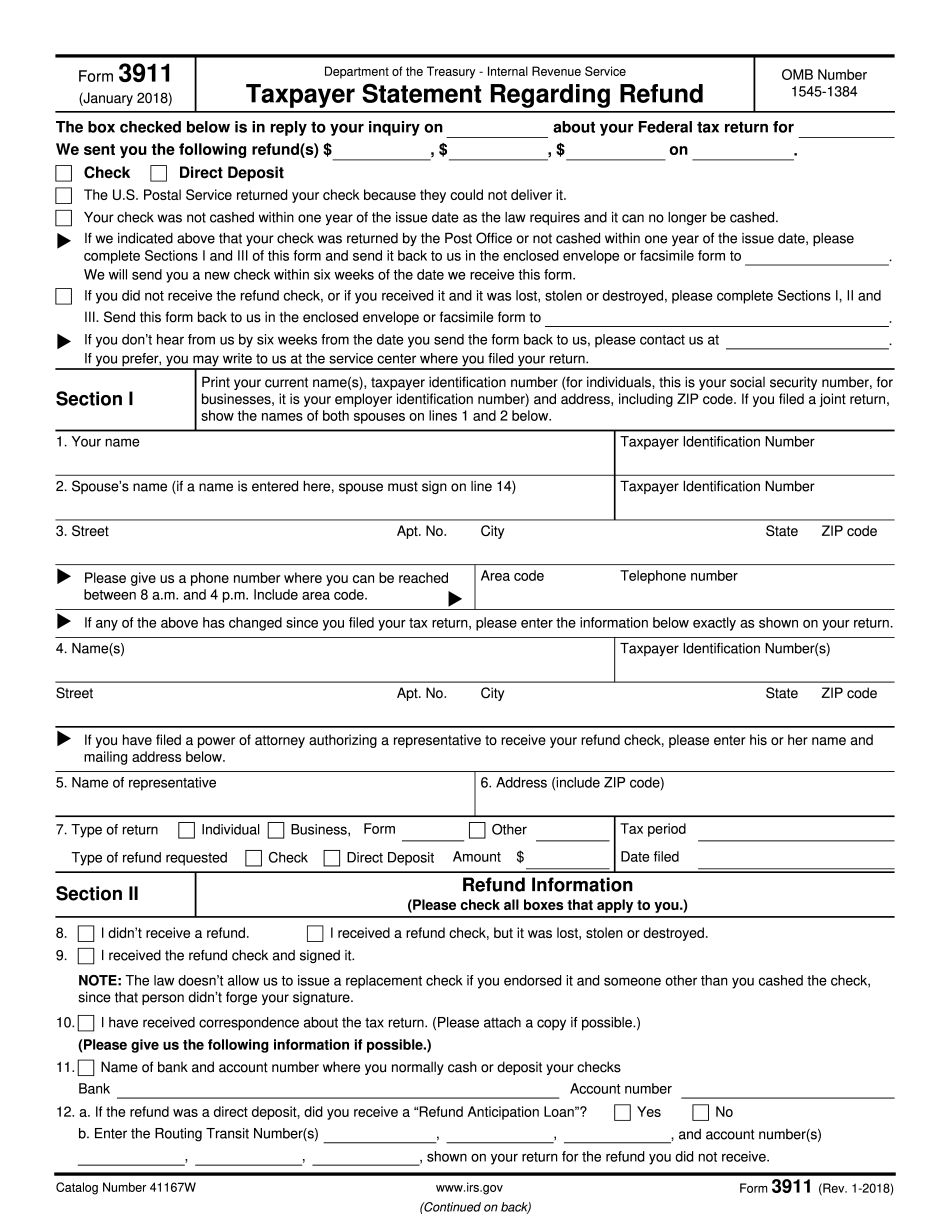

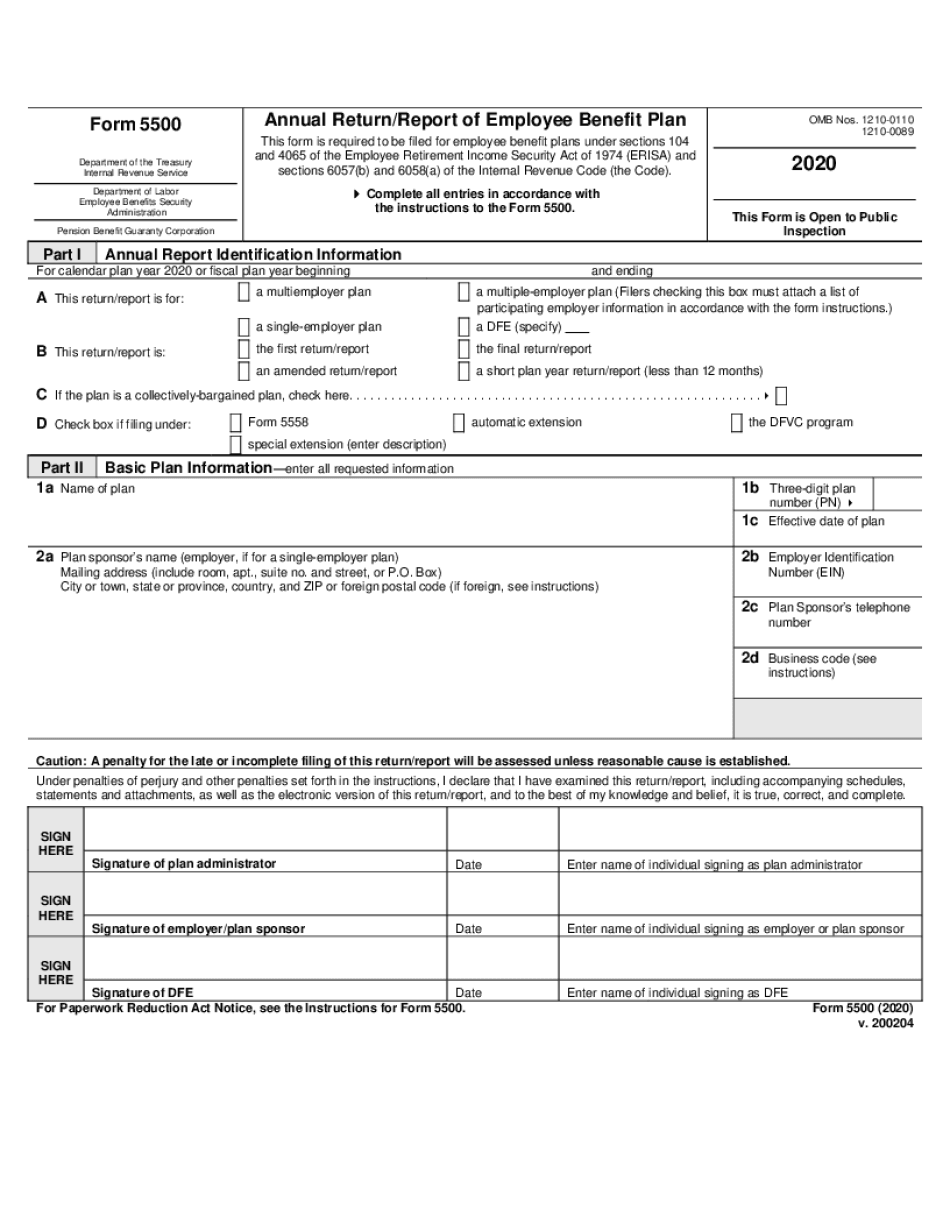

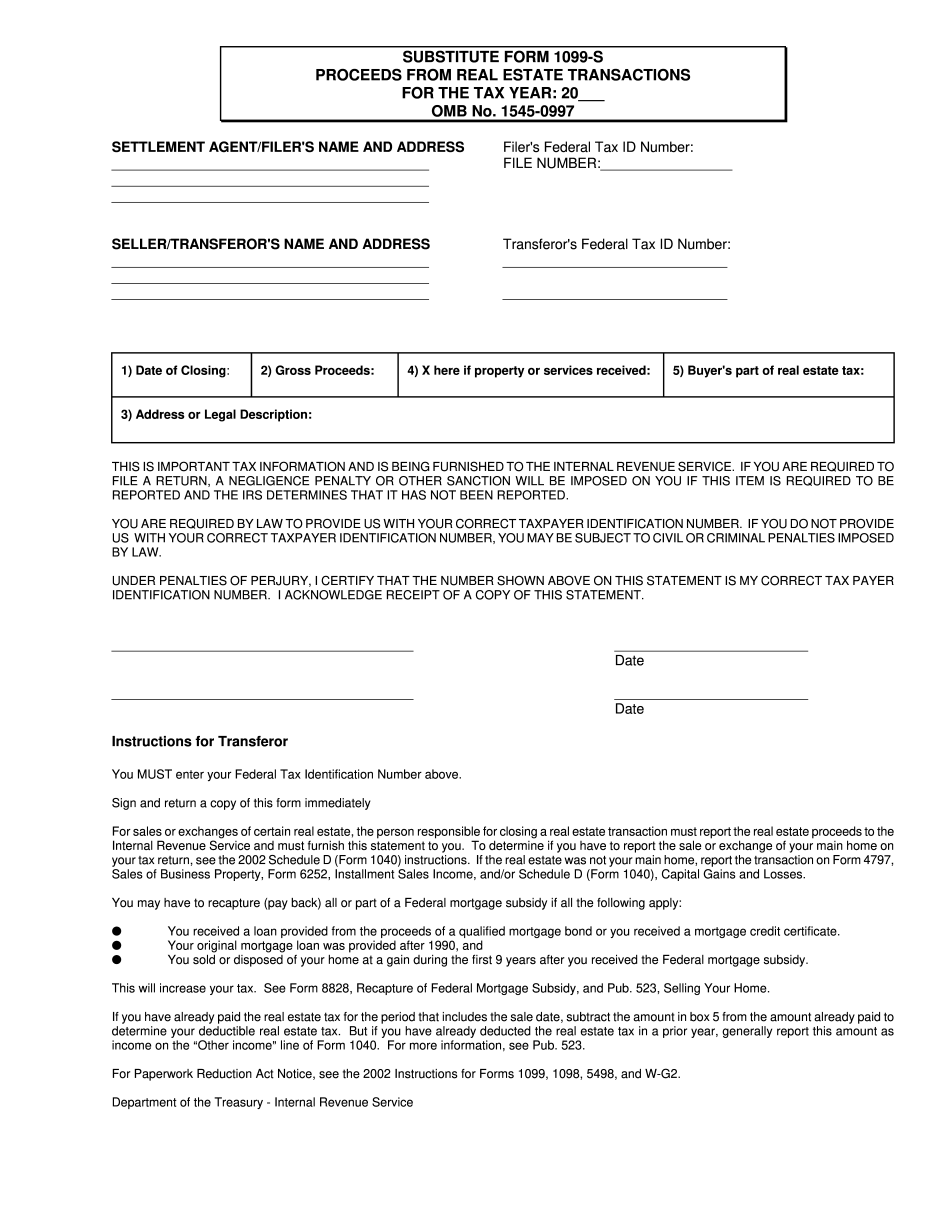

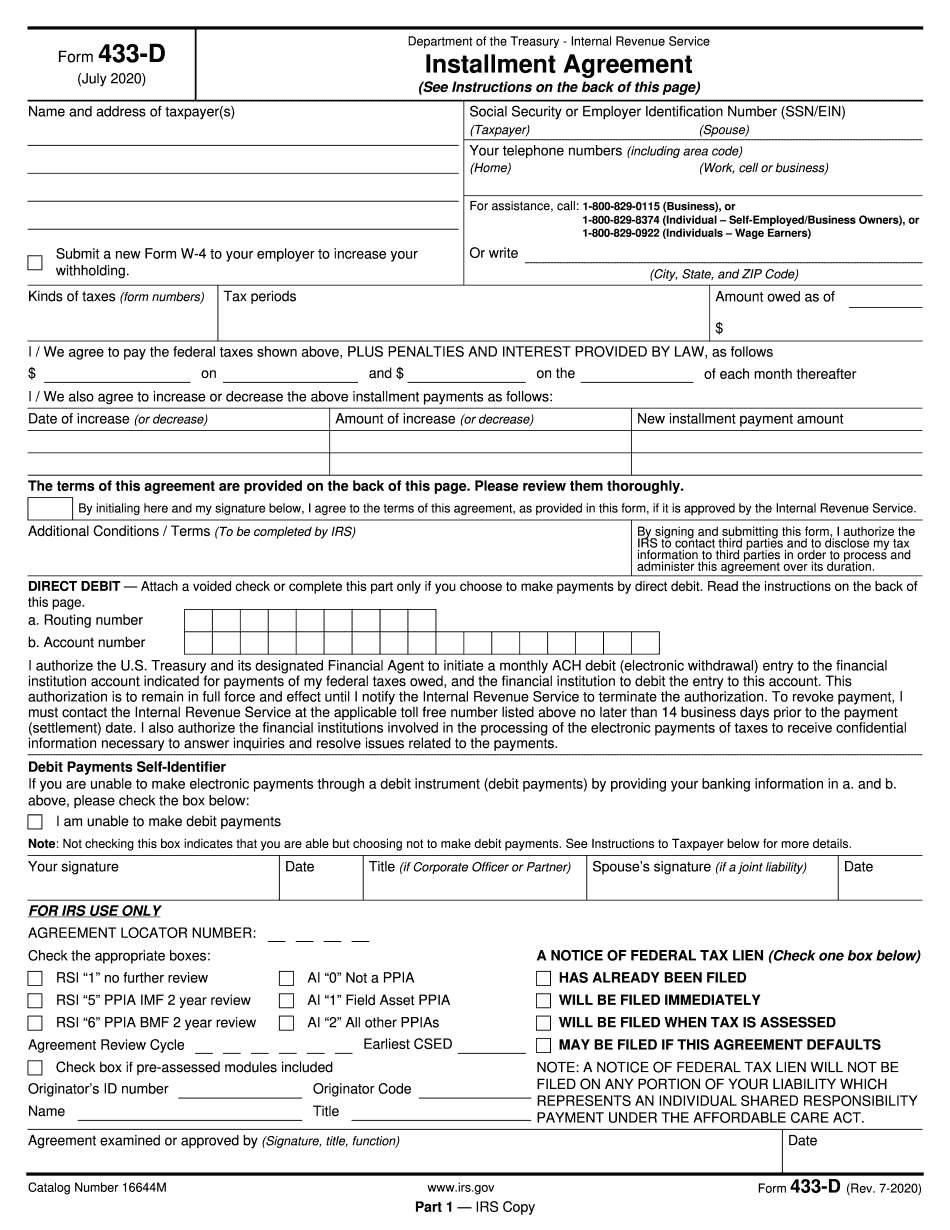

Most wanted tax and legal web forms

Choosen an appropriate tax year, your filing status, and annual taxable income to know your estimated tax rate and fill out the required form right now.

What are the new tax brackets?

Usually, paying income taxes isn't the most simple process. First, you have to calculate the amount of your taxable earnings for the entire 12 months. Then, you'll be able to get the sum you owe to pay. When you look for rates, you obtain some divisions named US federal tax brackets. What are the new tax brackets?

At the beginning, you reveal to which group you belong:

- single filer;

- married filing jointly (MFJ);

- married filing separately (MFS);

- Head of a household.

Every group has its own 7 income tax rate divisions. For 2020, reviews start from ten percent for your lowest profits and grow as income increase. You will find actual rates on the IRS website, but everything they have is information and facts that doesn't make simpler the submitting process. Nevertheless, you have an alternative - our valuable platform in which it's difficult to get puzzled.

How do tax brackets work

Allow us to collectively learn how to simplify the submitting procedure. Follow the instructions below:

- Gather required details. Be sure you have all your taxable earnings (like salaries, dividends and commissions and many others.) summed.

- Open up our website inside your preferred internet browser.

- Select your status (one of four classes mentioned previously). By default, it displays amounts for single filers.

- Select the second dropdown menu to find out relevant brackets. Separate your annual income into portion in accordance with the demonstrated list.

- Determine the due sum for every portion.

- Calculate the resulting amounts.

- Double-check estimations and insert them in a necessary template.

To save more time, go paperless and make forms online - you can use required fillable templates under the calculator.