Do Income Tax Brackets Act As A Deterrent To Professional Ambition?

Not if you take the time to understand how progressive tax rates work. Say you have exactly $8,700 of taxable income (the top of the 2012 bottom tax bracket).You owe $870 of tax or 10% of taxable income. So basically you keep 90% of your taxable income and pay the government 10%. Remember also, this calculation is based on taxable income, so your gross income, before exemptions and deductions is some number larger than $8,700. In a real simple example where you are single and only have your personal exemption and take the standard deduction, that means you have $18,450 of gross income and pay 4.72% effective tax on your gross income, so you keep about 95% of every dollar you earn. Now, if you make one more dollar of taxable income, you jump to the 15% tax bracket. That means you now pay the original $870 plus 15% of the incremental dollar or another 15 cents. Since you can round down when you calculate your taxes, you actually have to get to $4 incremental income before you owe another dollar of tax in this tax bracket. So now you have gross pay of $18,454 and pay tax of $871. You are still keeping 95% of your gross pay and you have to go out 4 digits past the decimal before your effective tax rate changes. Since bumping up to the next tax bracket by one dollar has effectively no impact on the net amount of pay you get to keep, let's get crazy and assume your income doubles. You now make $36,900 and have taxable income of $27,150 and your tax is $3,638. Wow huge jump in your income tax liability, it more than tripled, but as a percentage of your gross pay it is still only 9.9%. Even though your effective tax rate almost doubled you still keep 90.1% of your gross pay. To look at it another way you paid an additional $2,768 in tax in order to make an additional $18,450 in gross pay. The math works the same way no matter how much money you make. Even when you get to the very top tax bracket and start to loose the benefit of certain credits or are subject to alternative minimum tax, there is not a situation where the effective tax on another dollar is greater than 100% so it is always to your net benefit to make one more dollar of income even if it means you pay more tax.

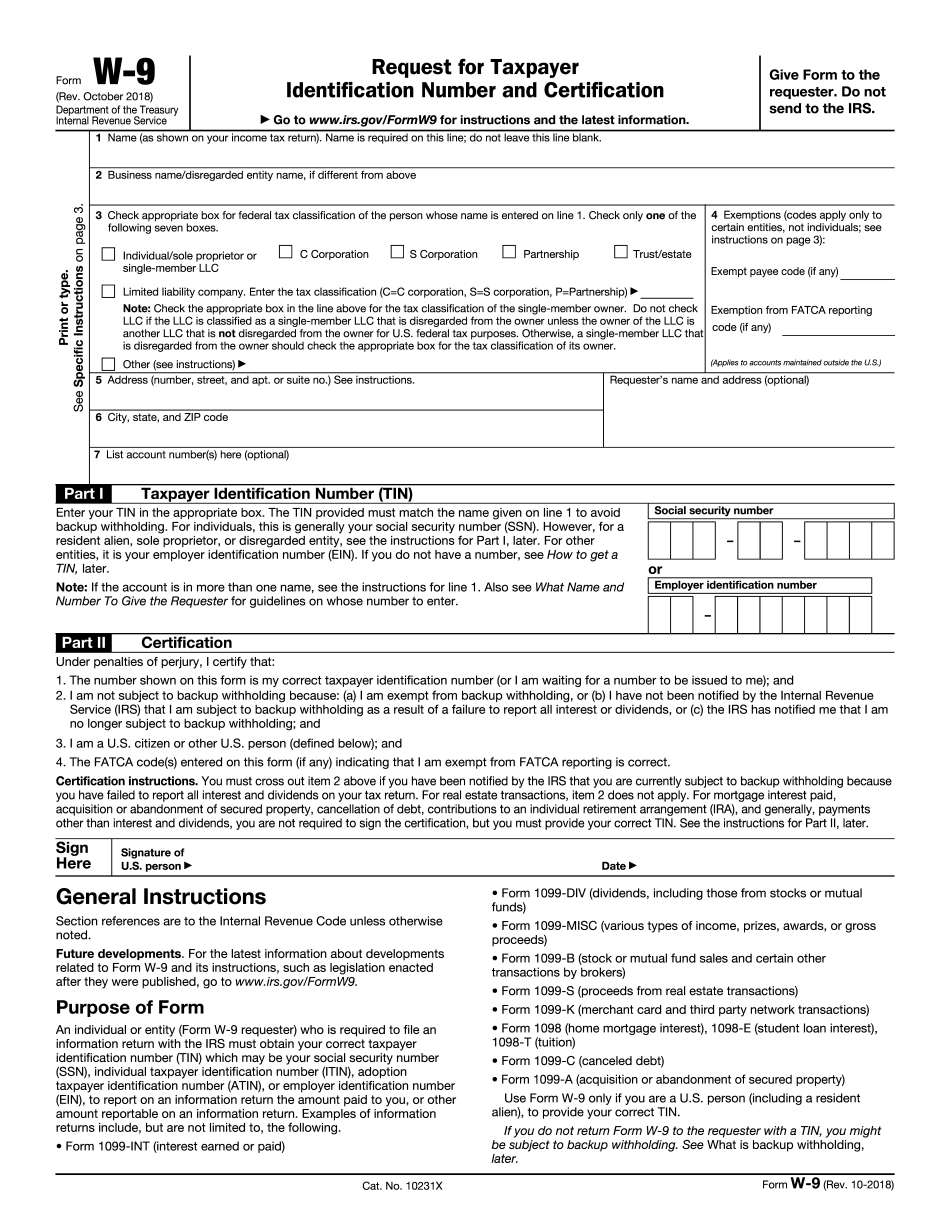

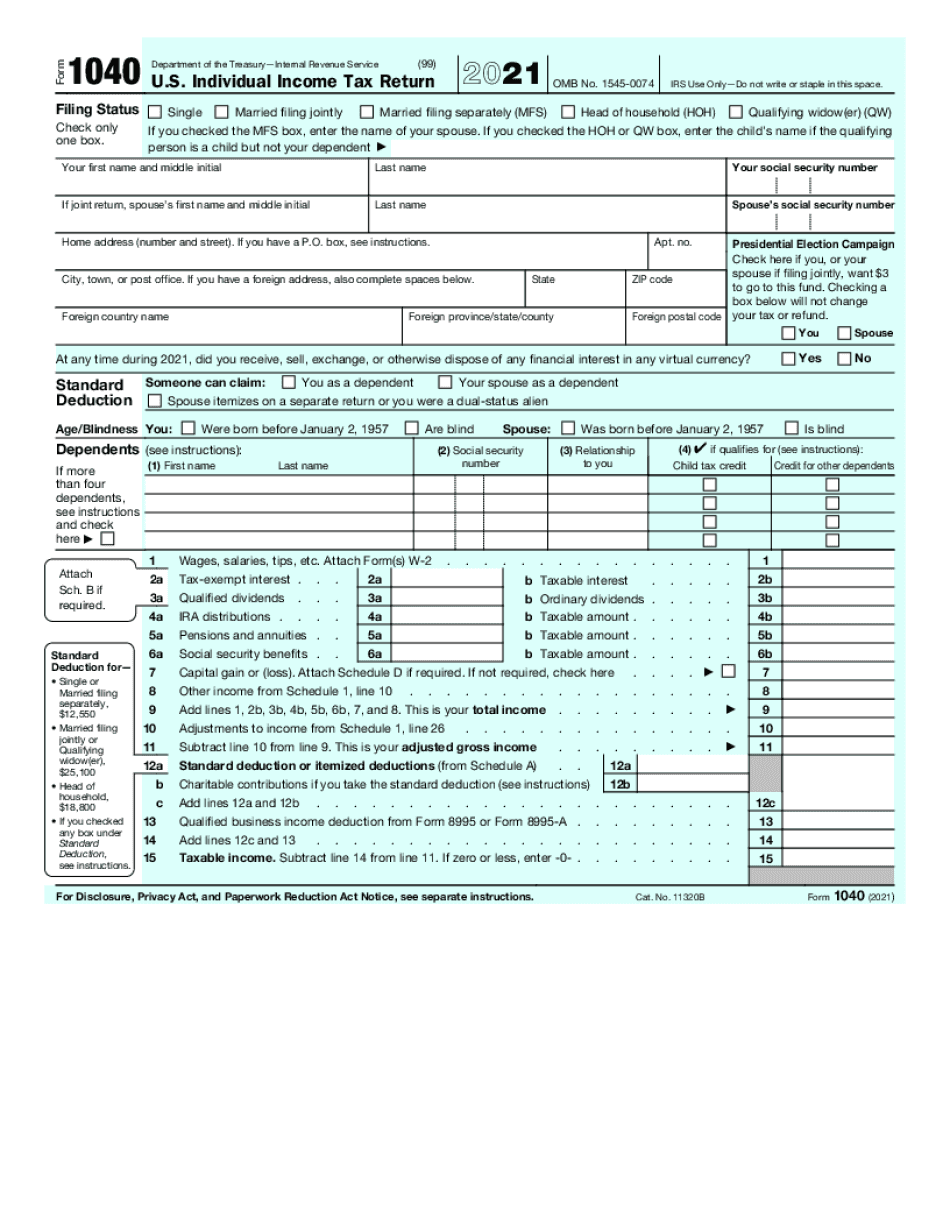

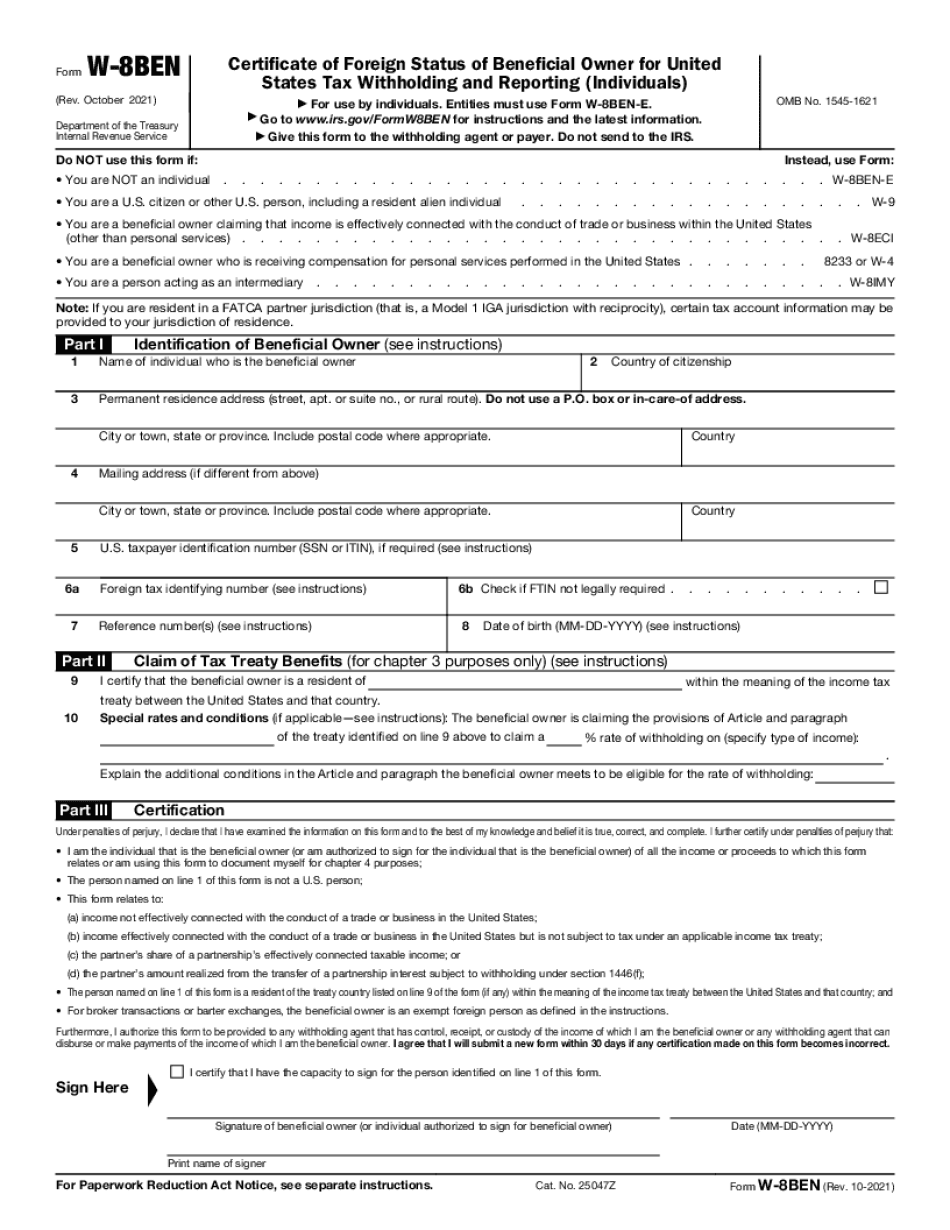

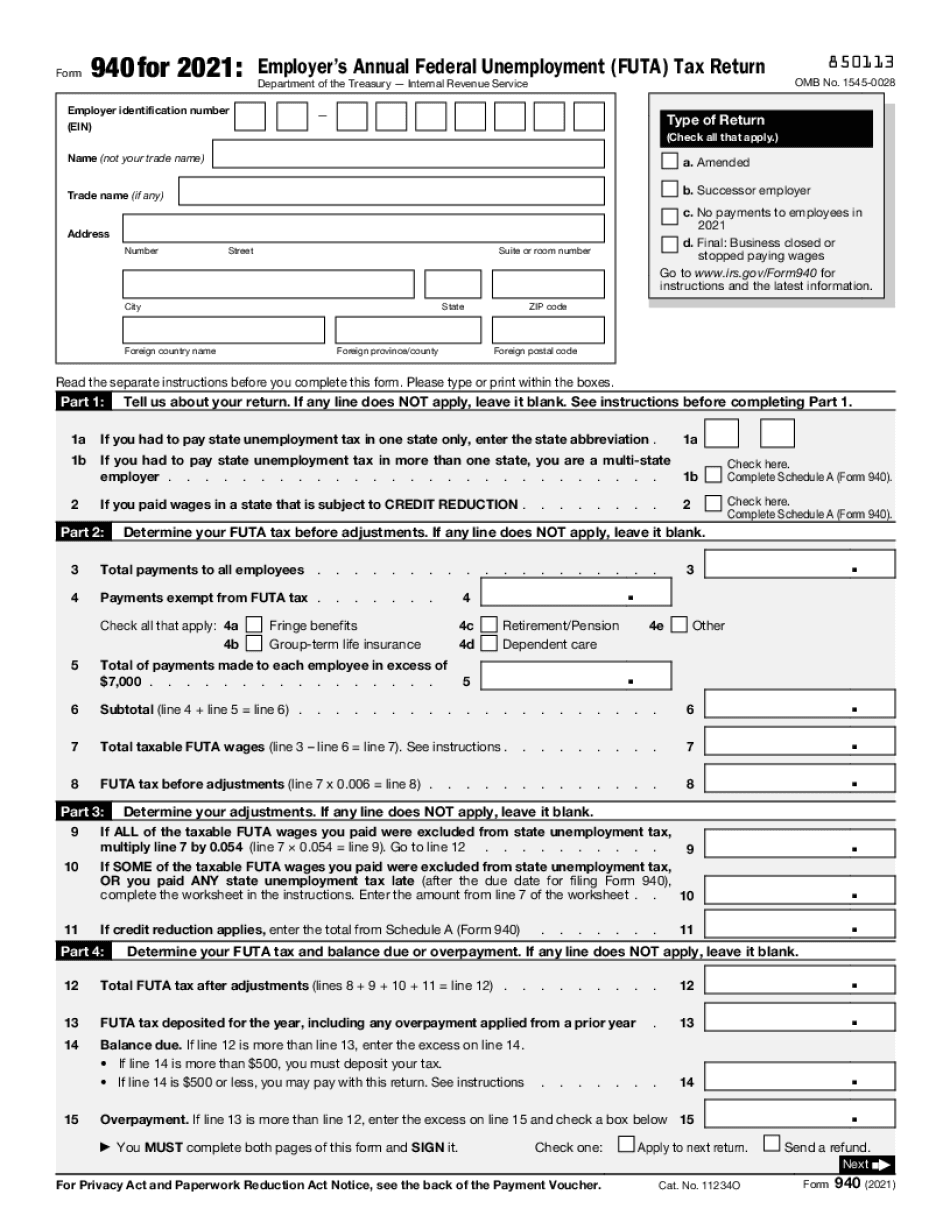

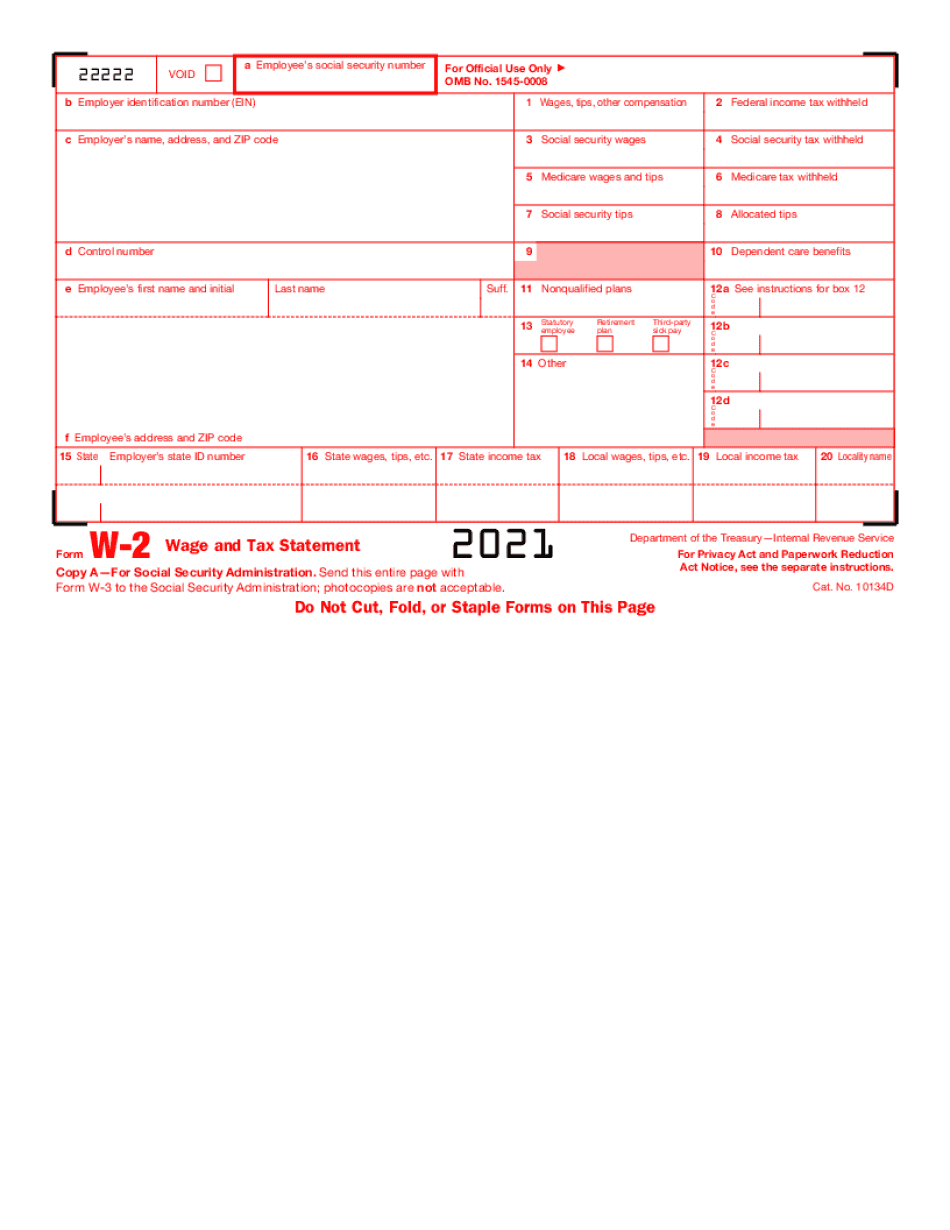

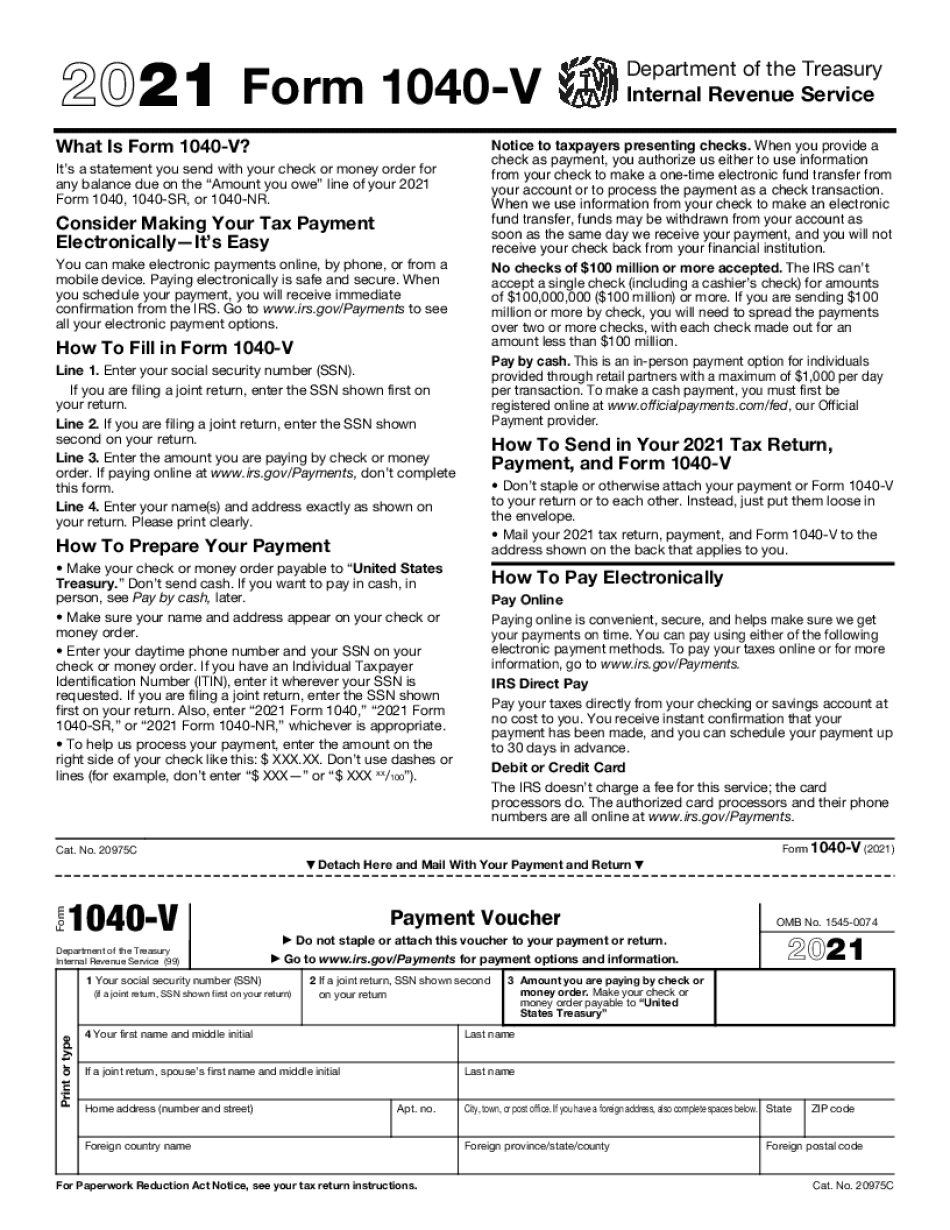

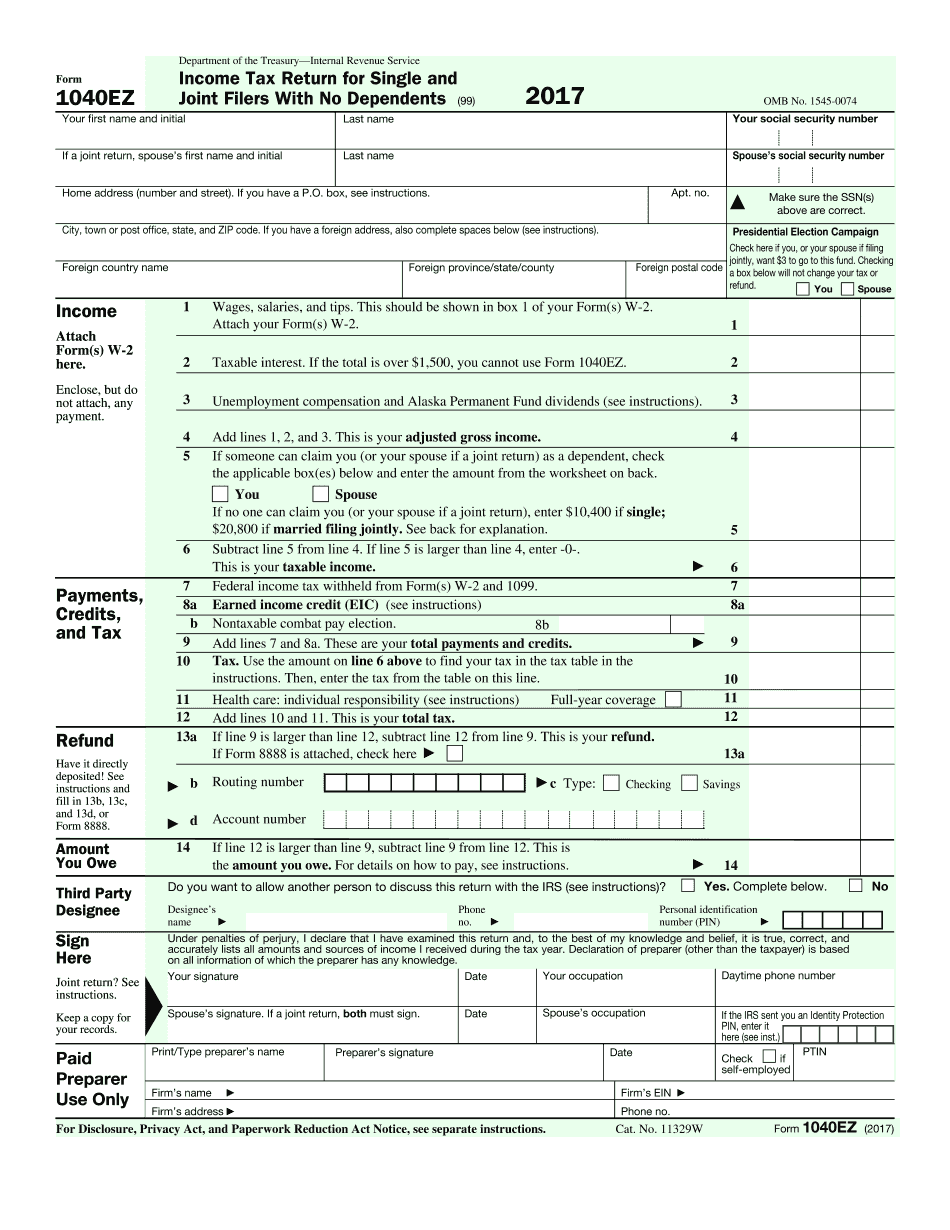

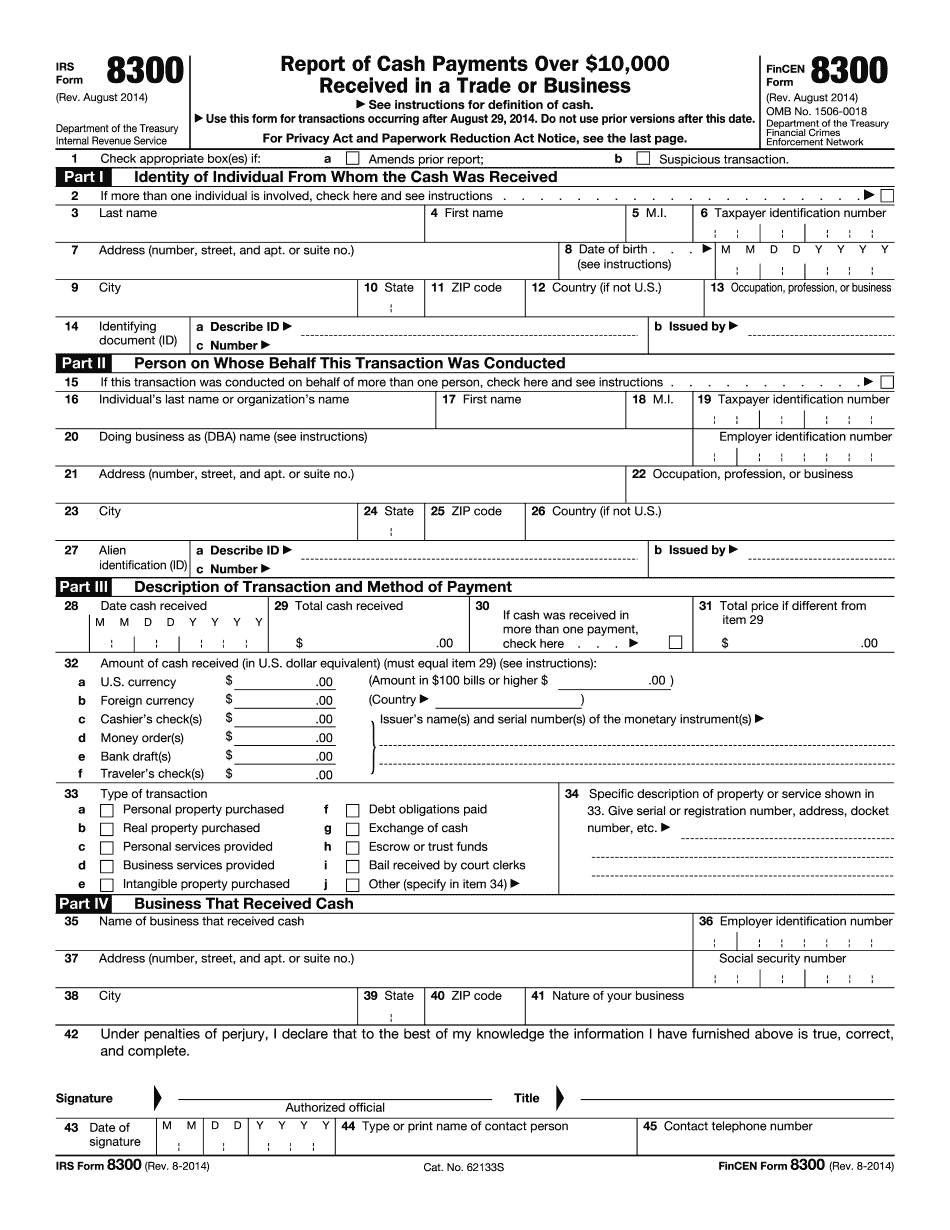

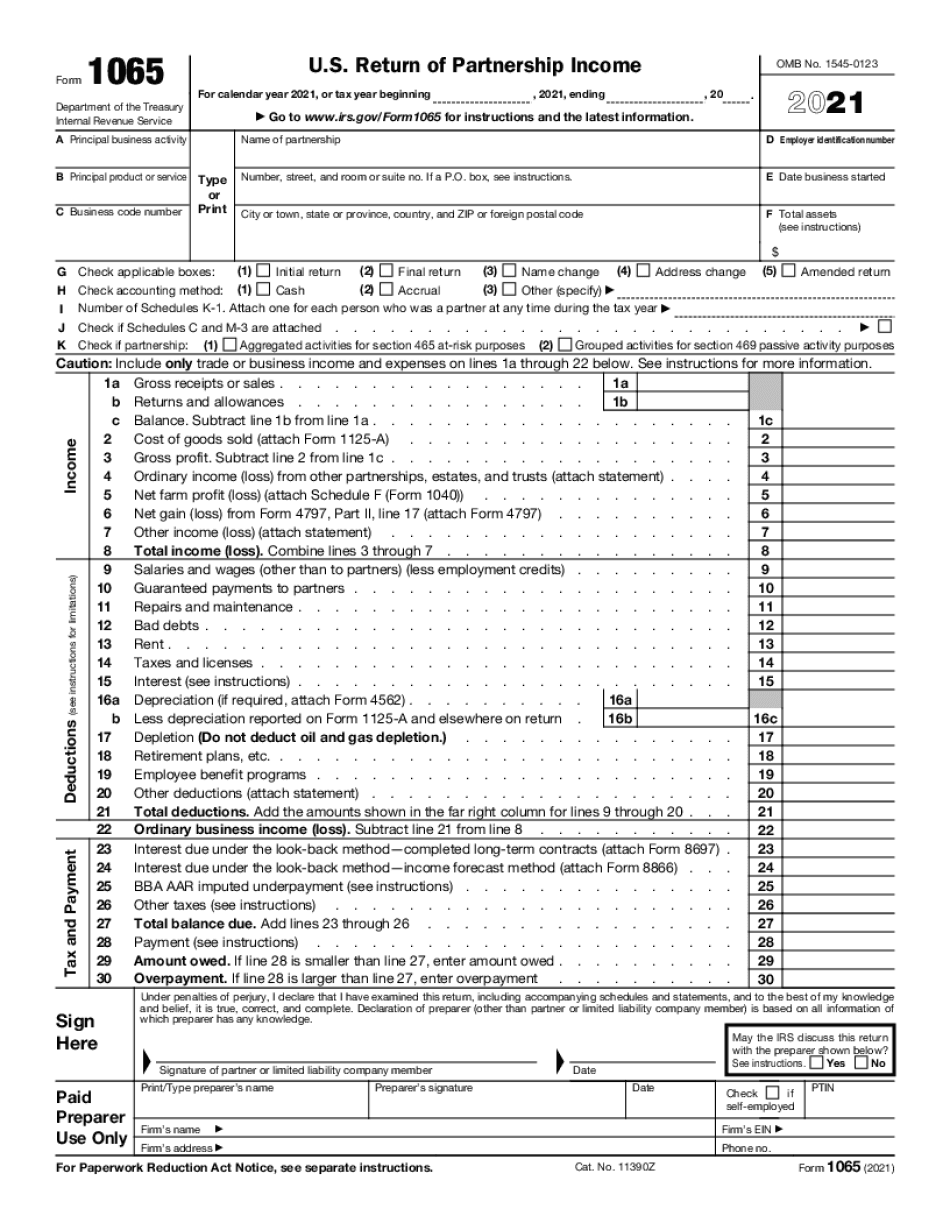

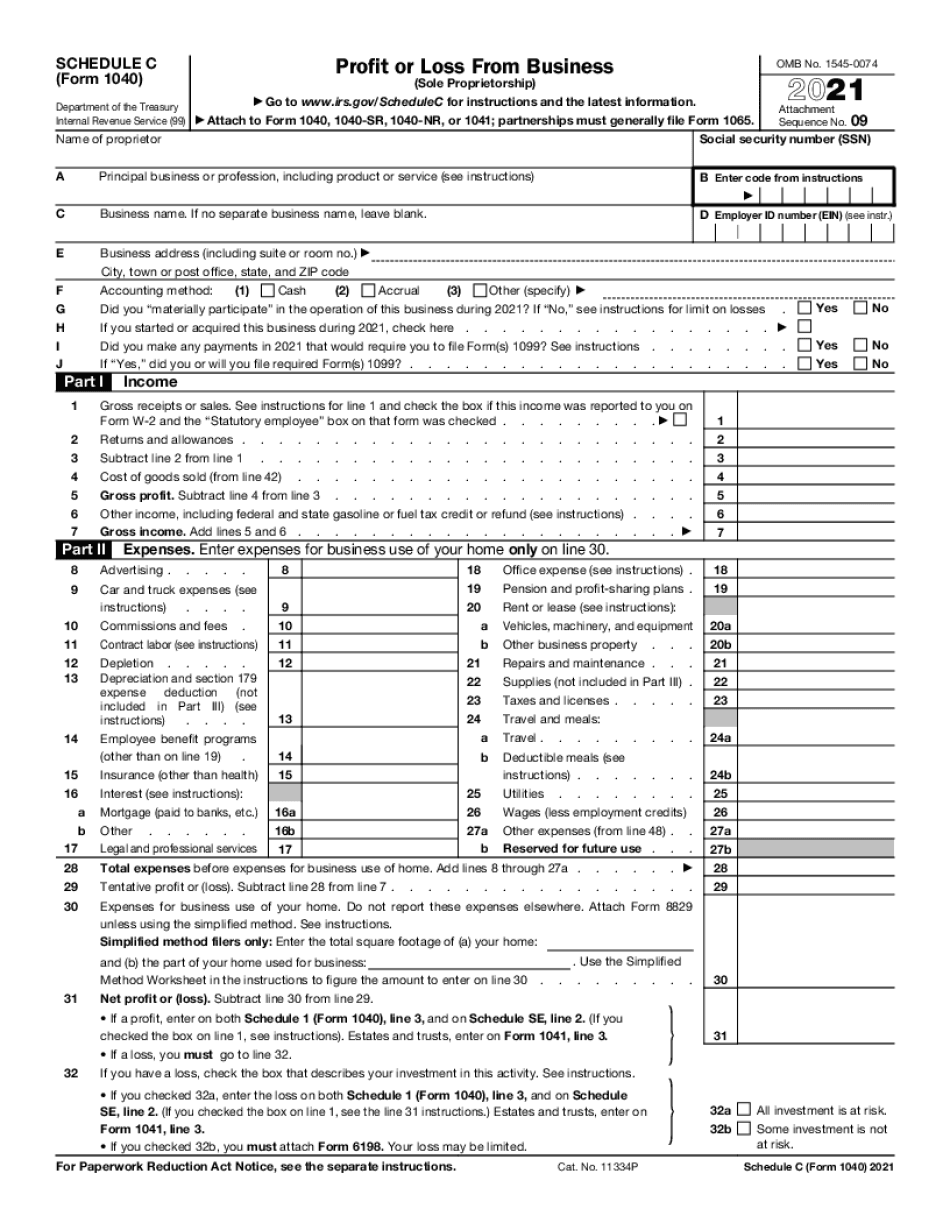

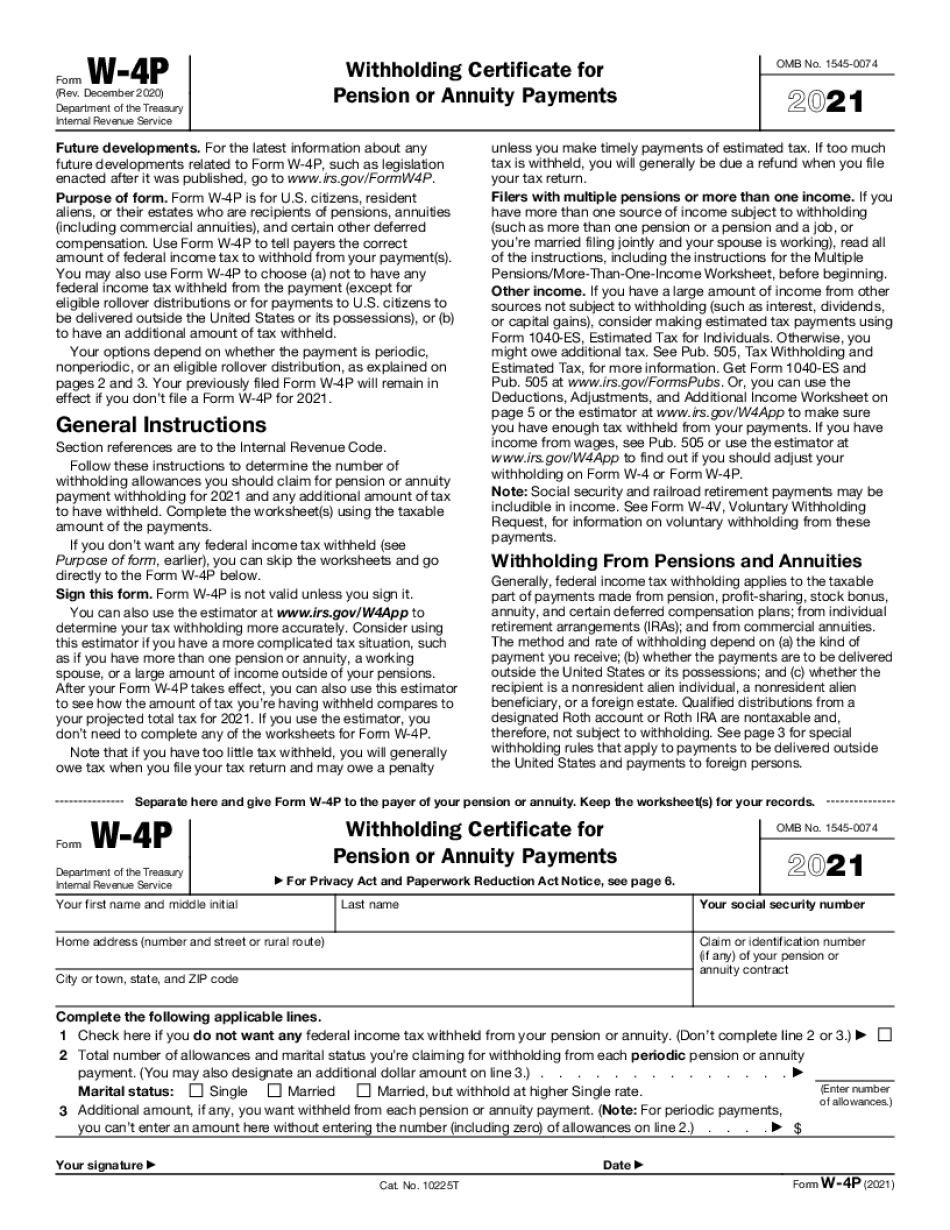

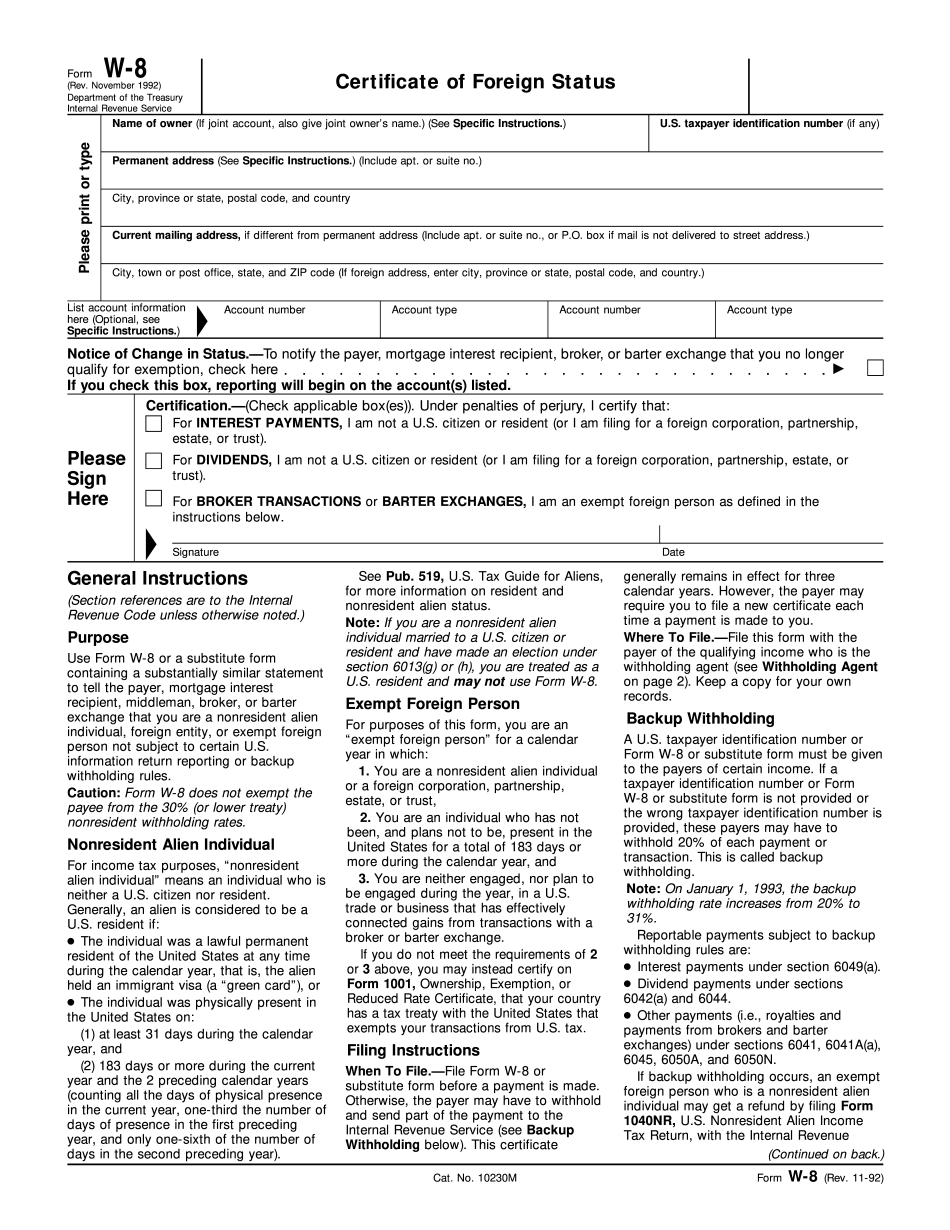

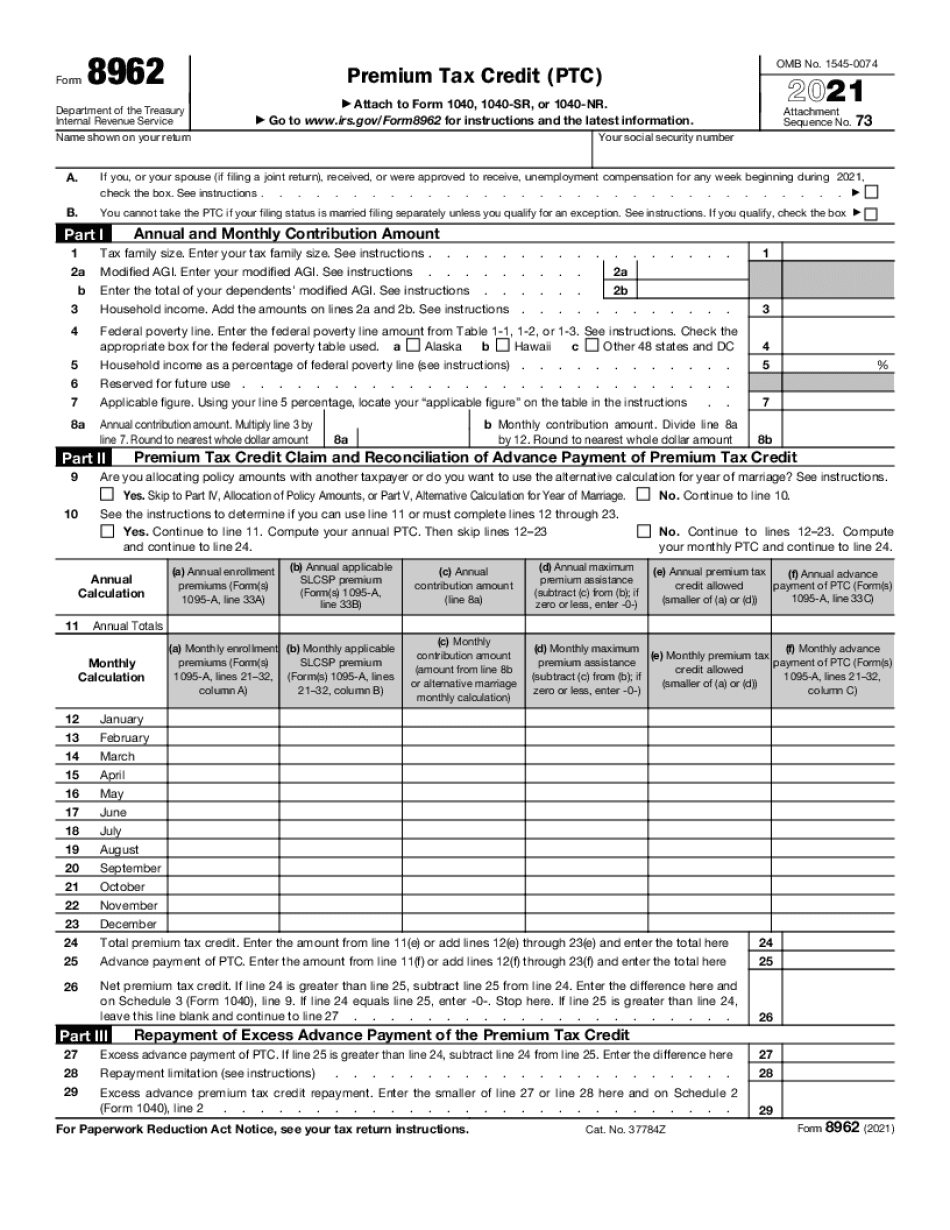

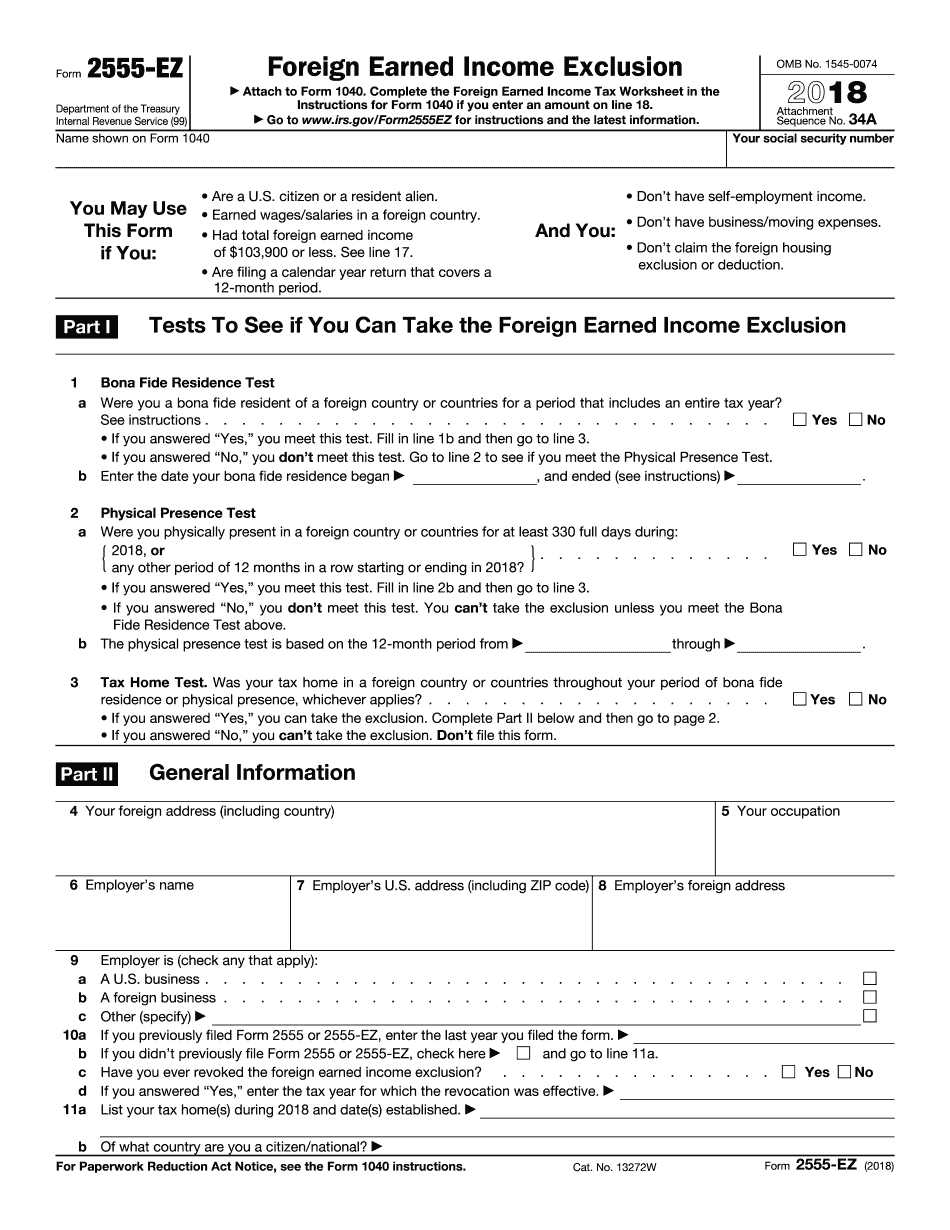

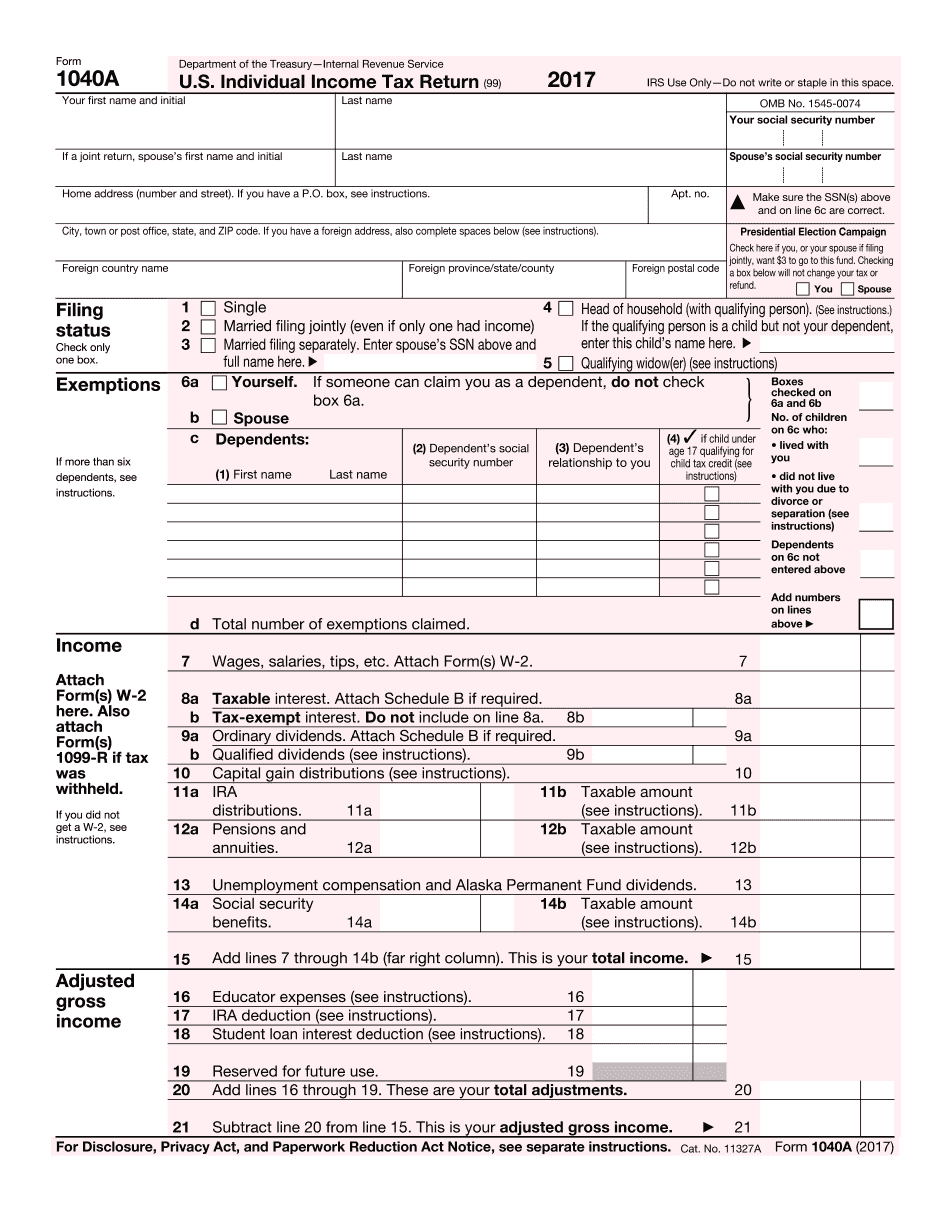

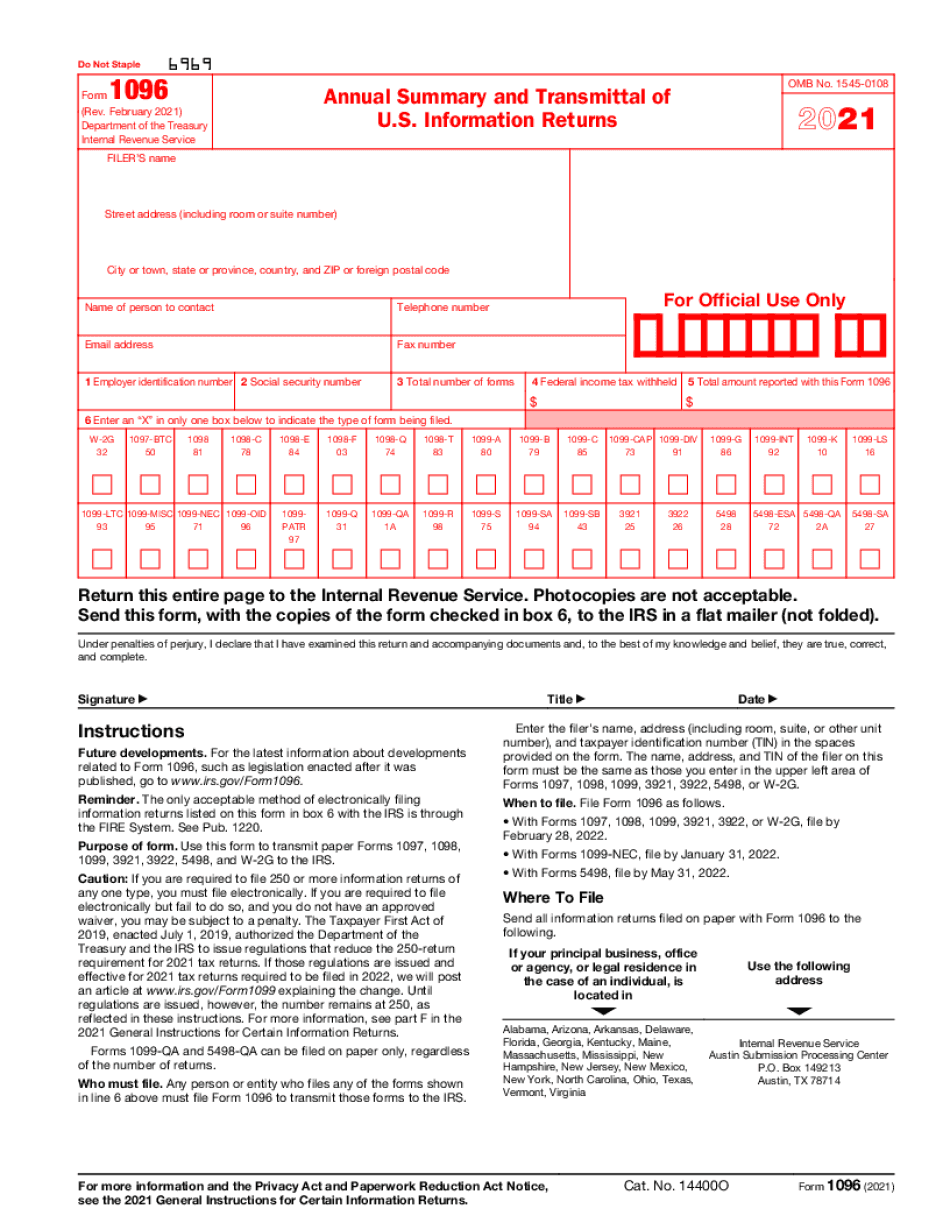

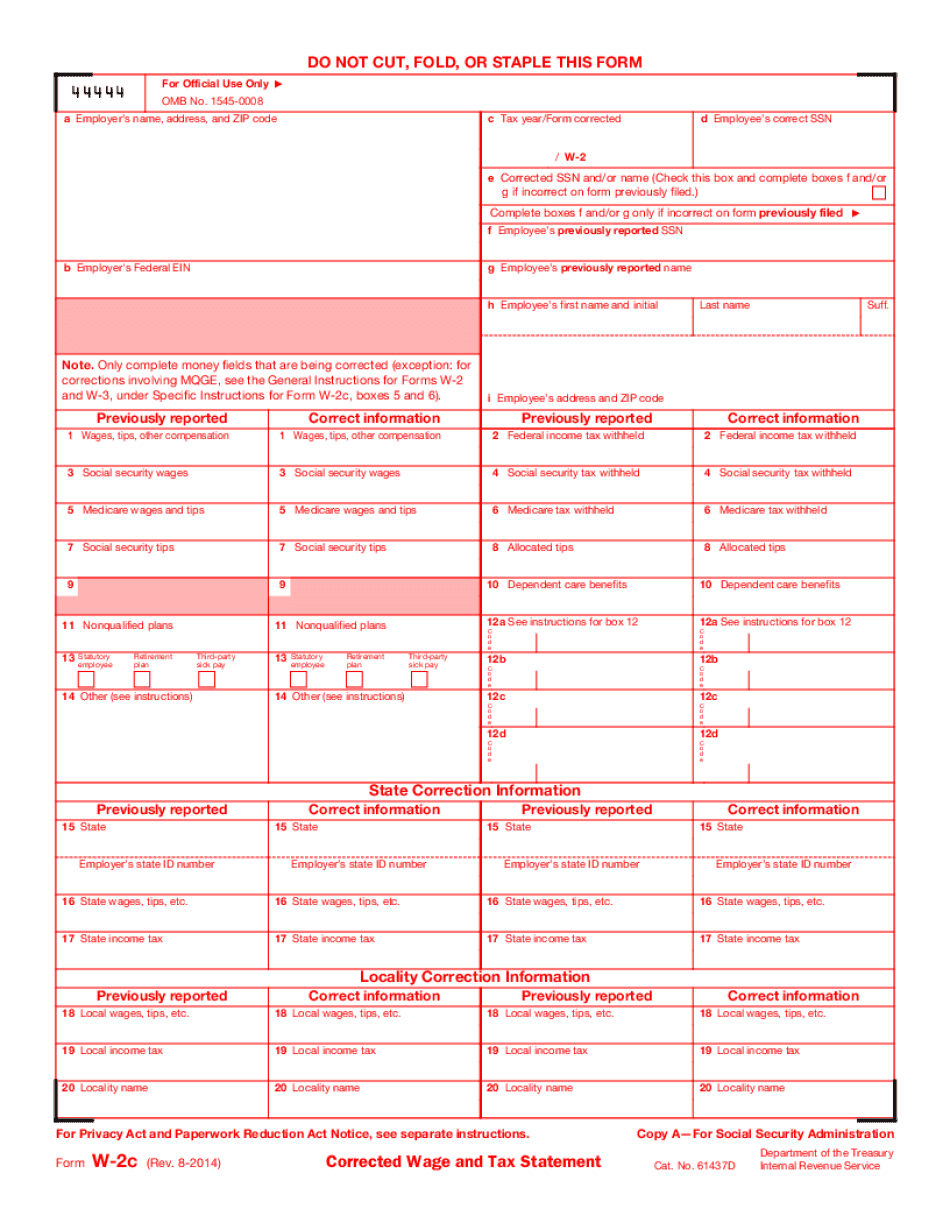

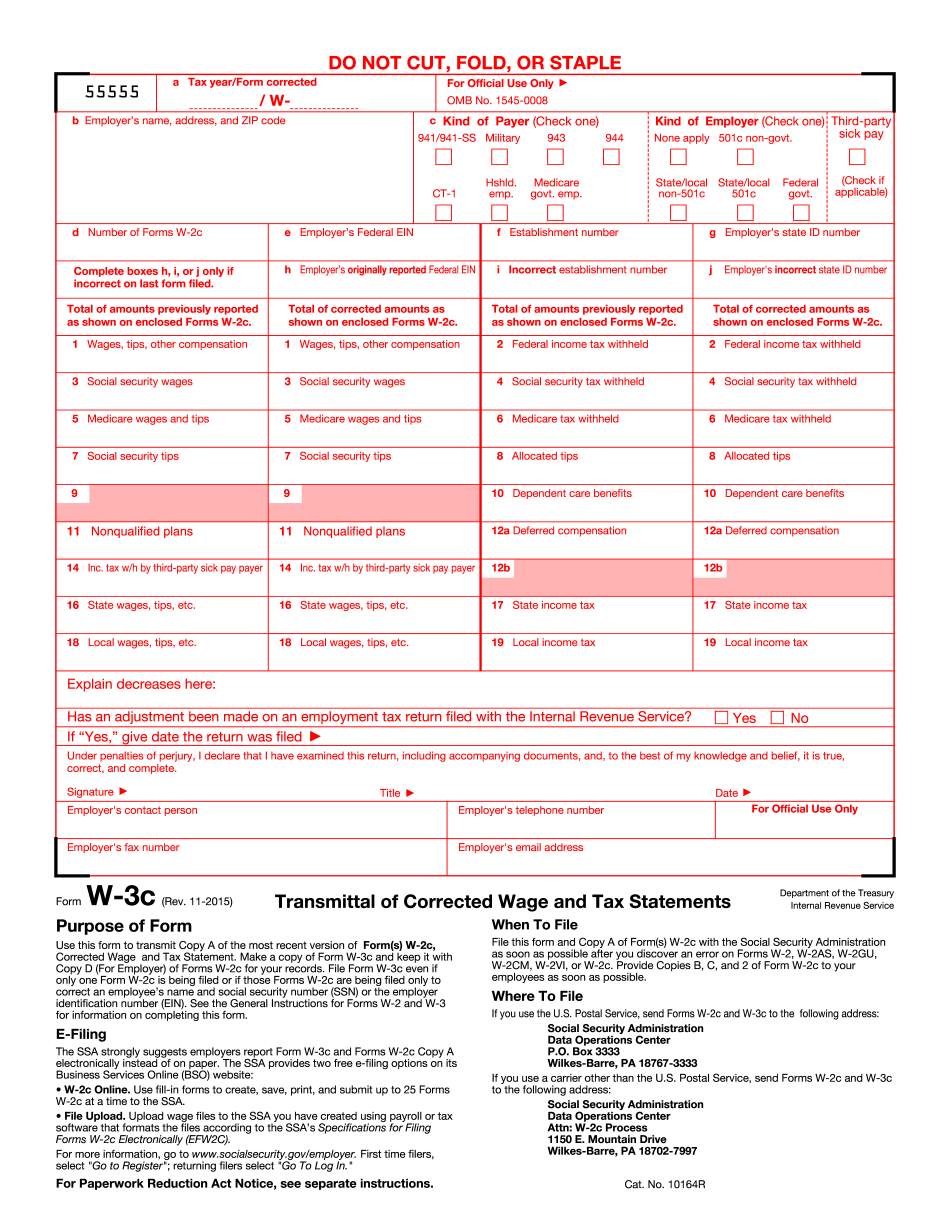

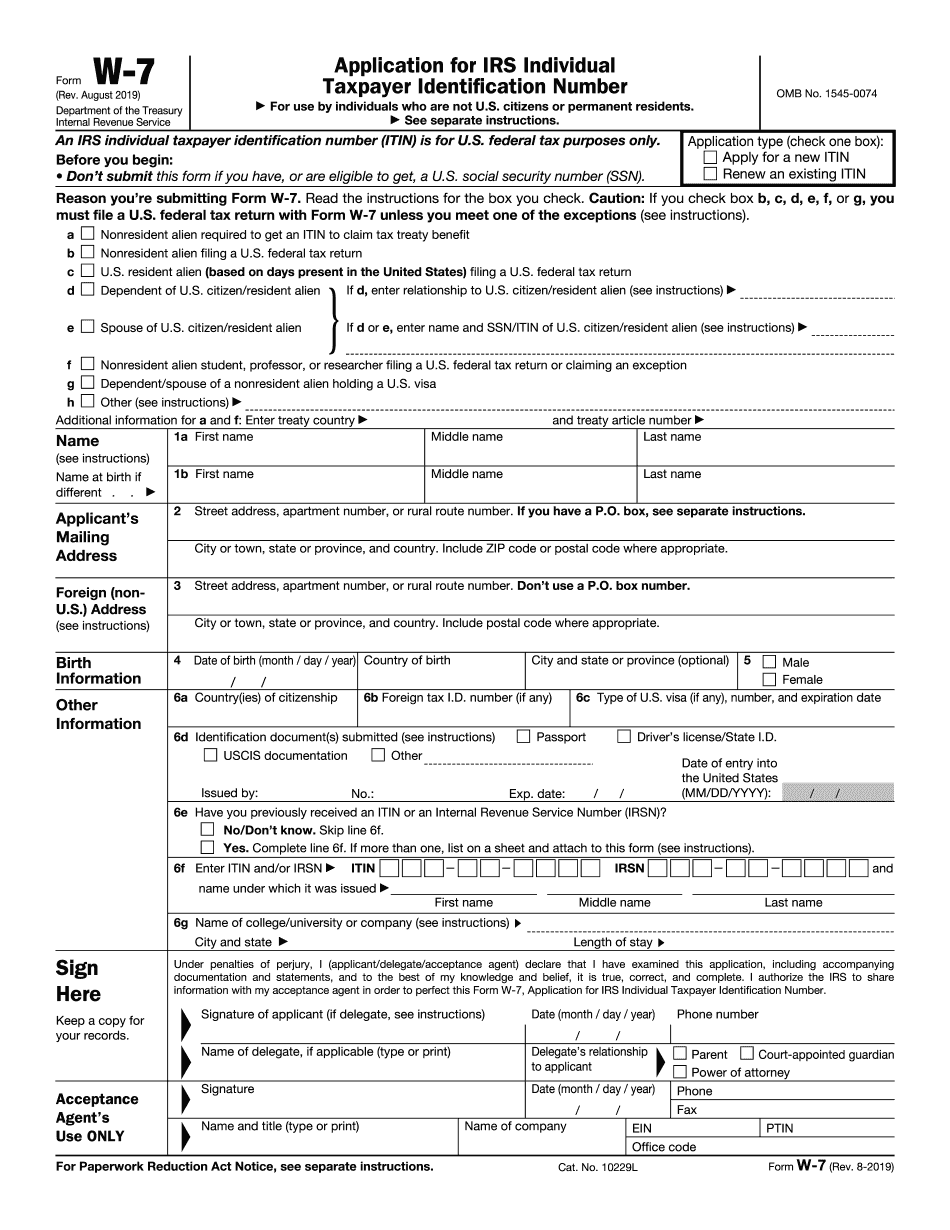

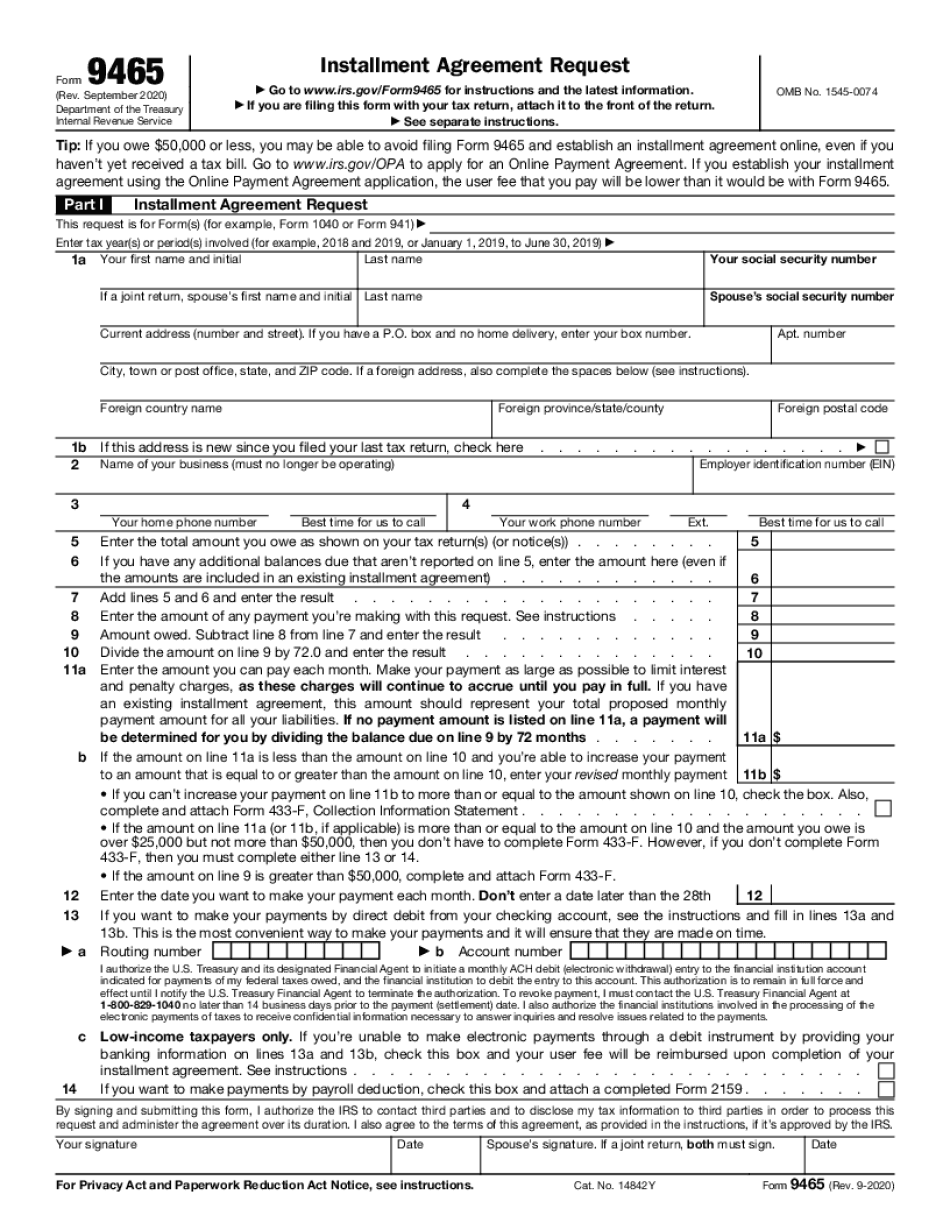

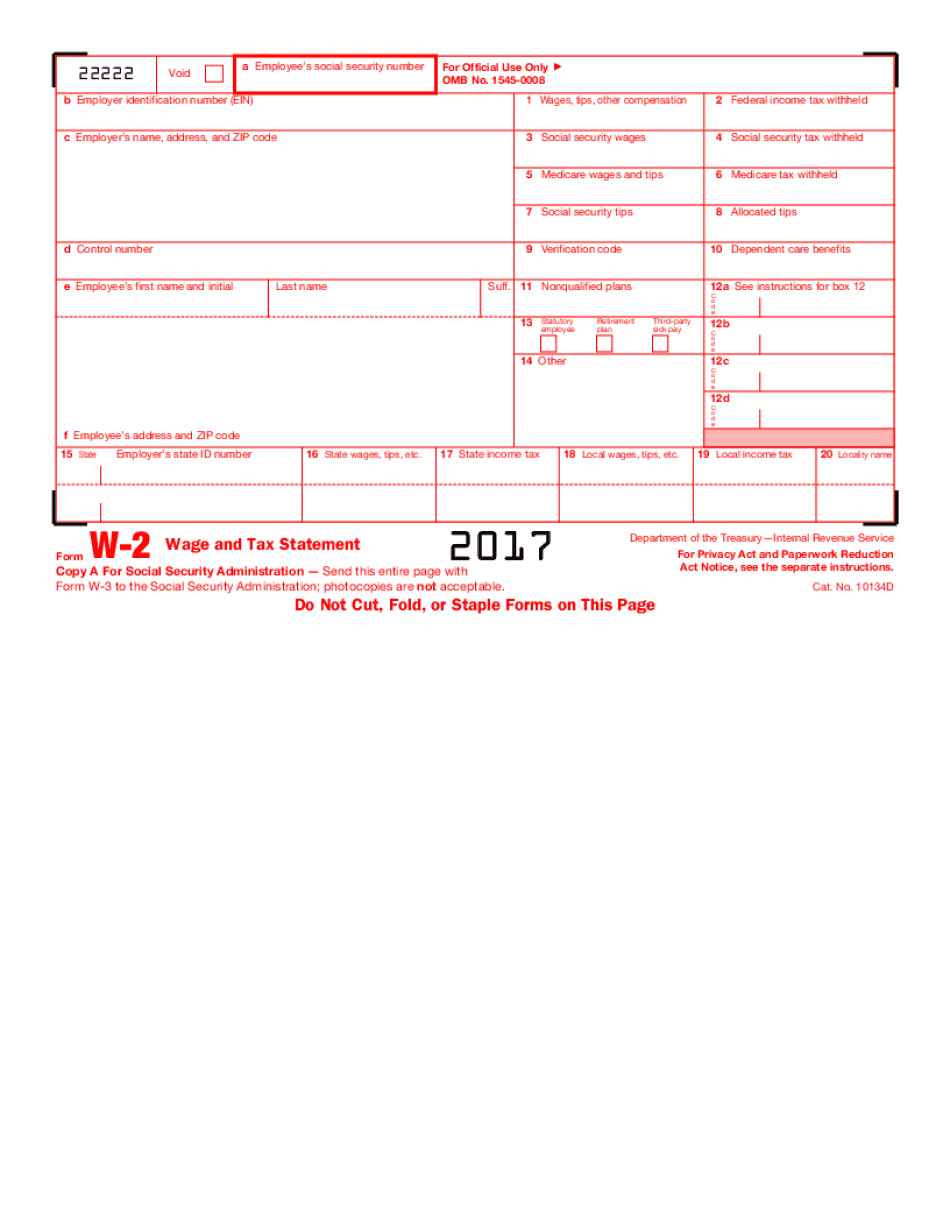

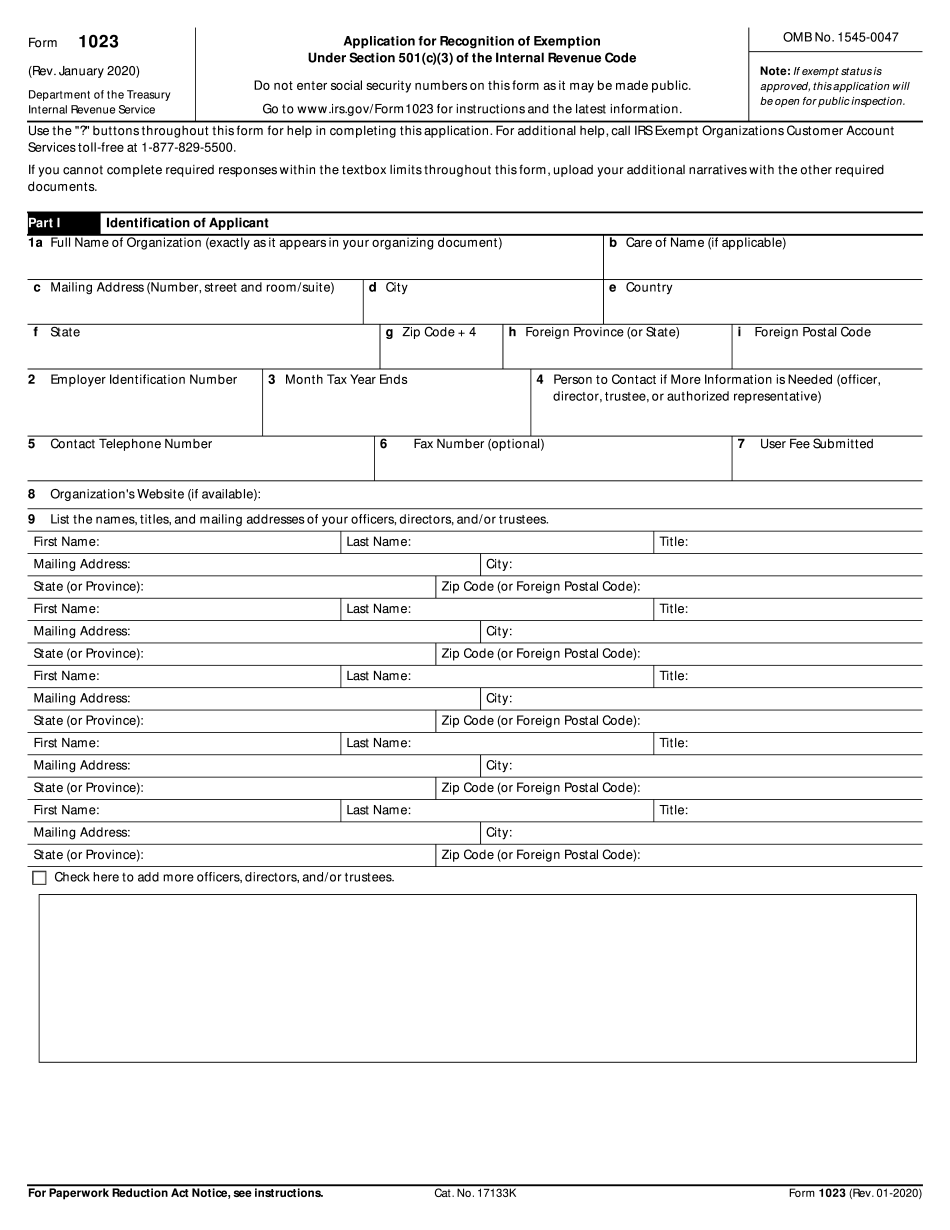

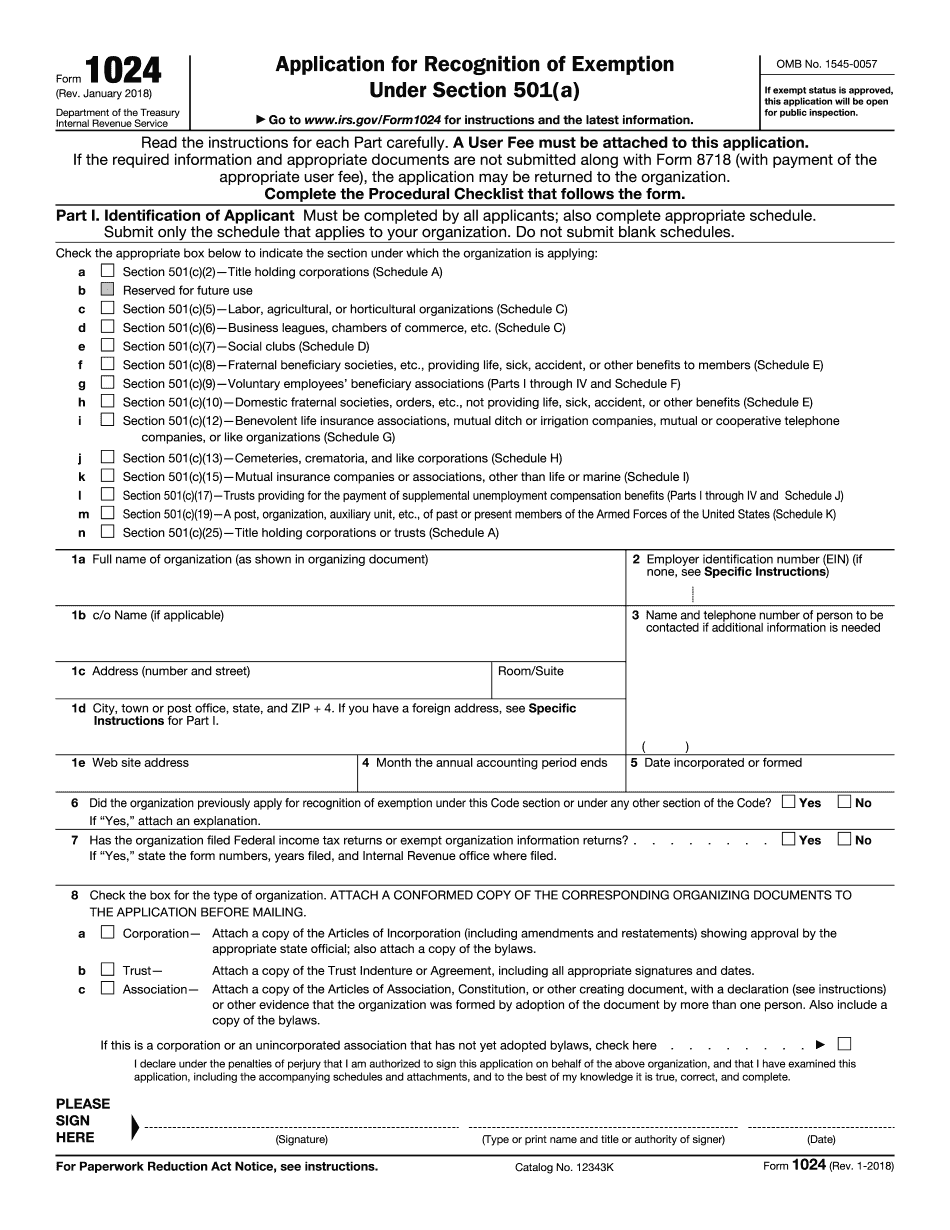

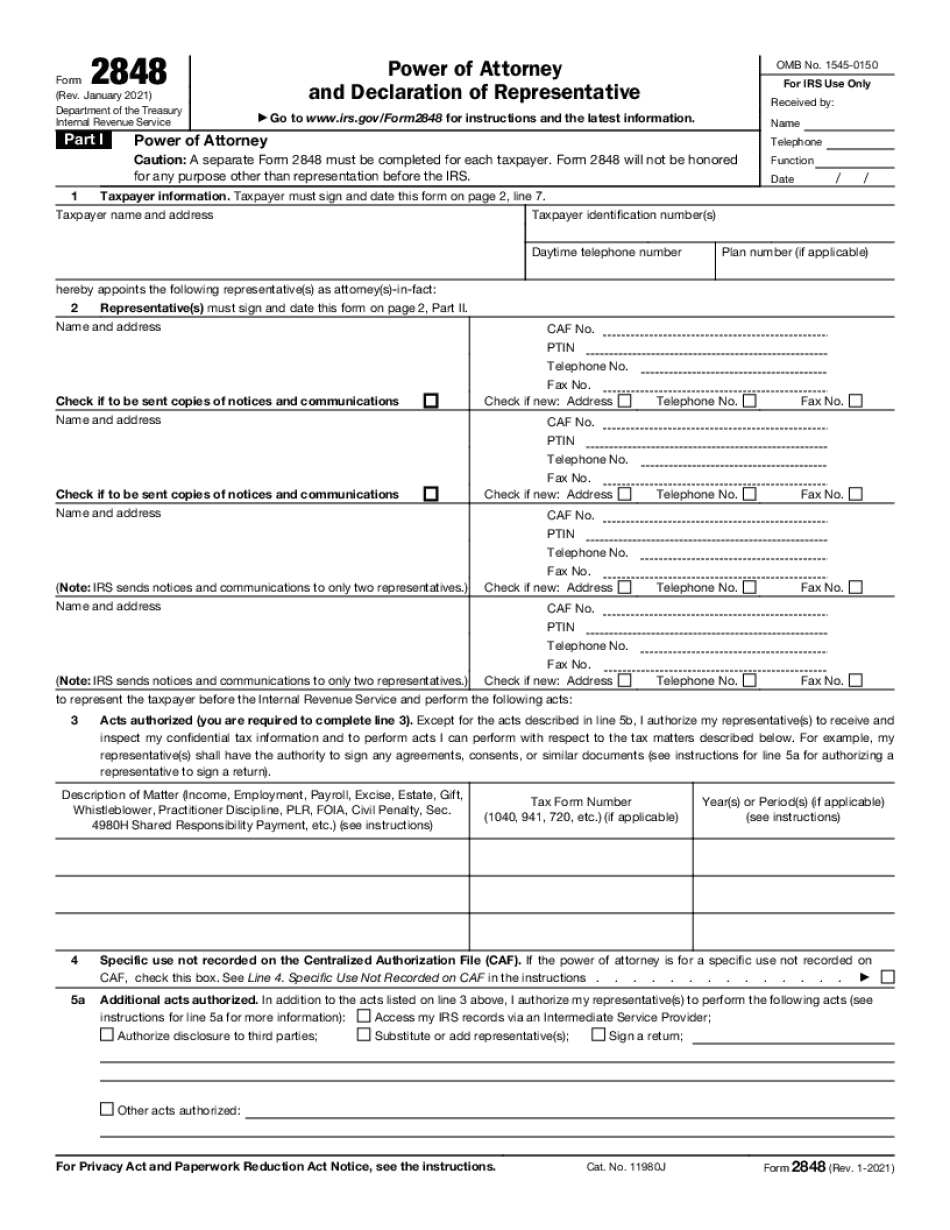

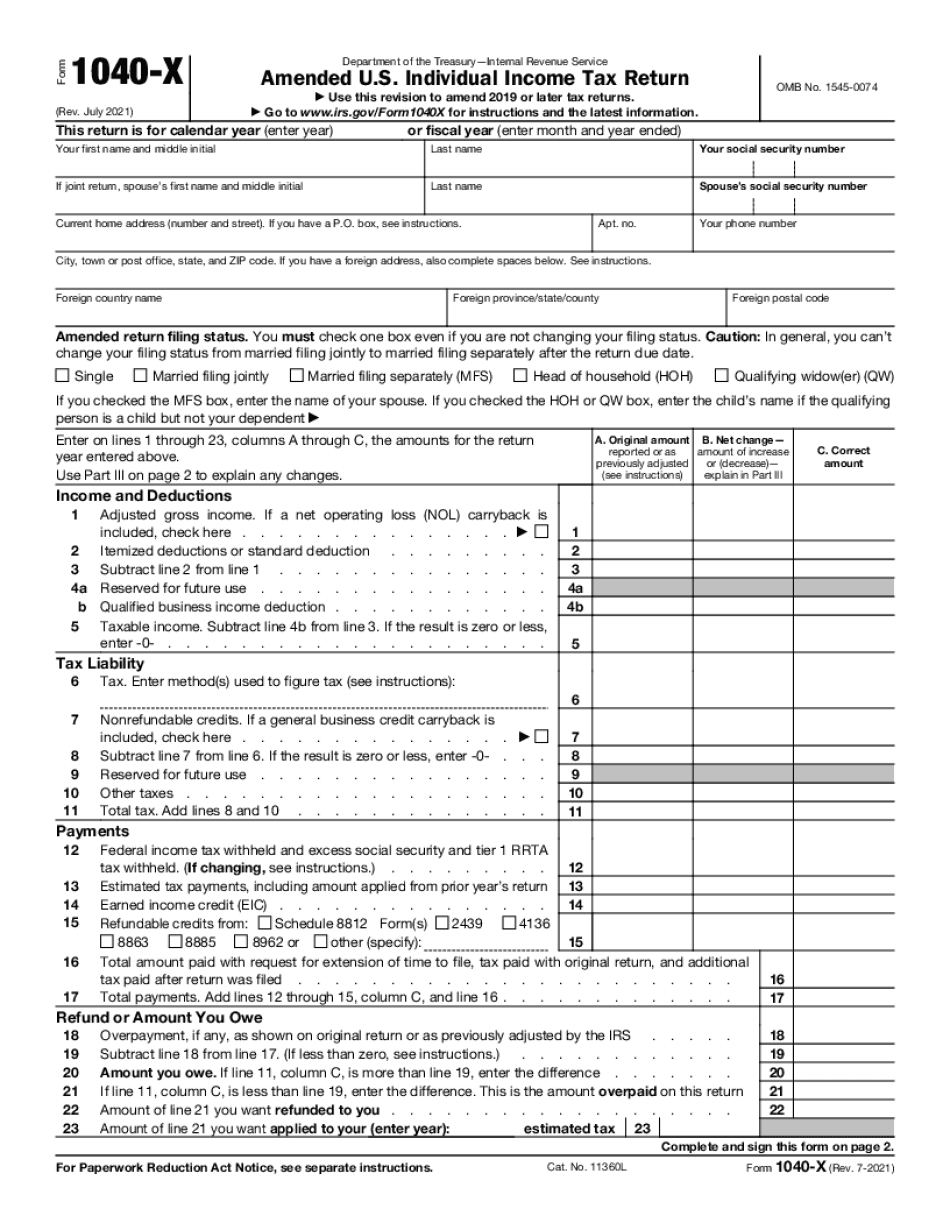

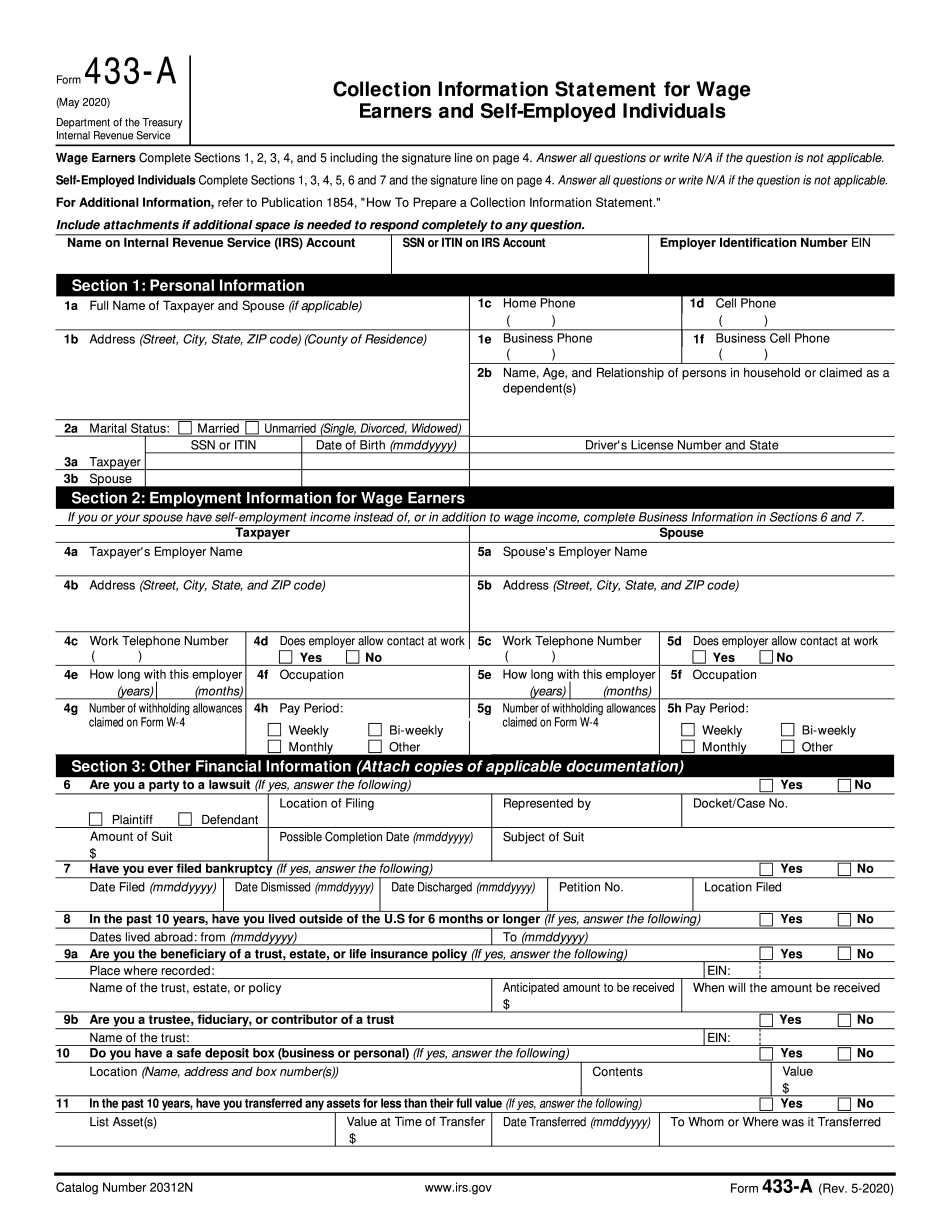

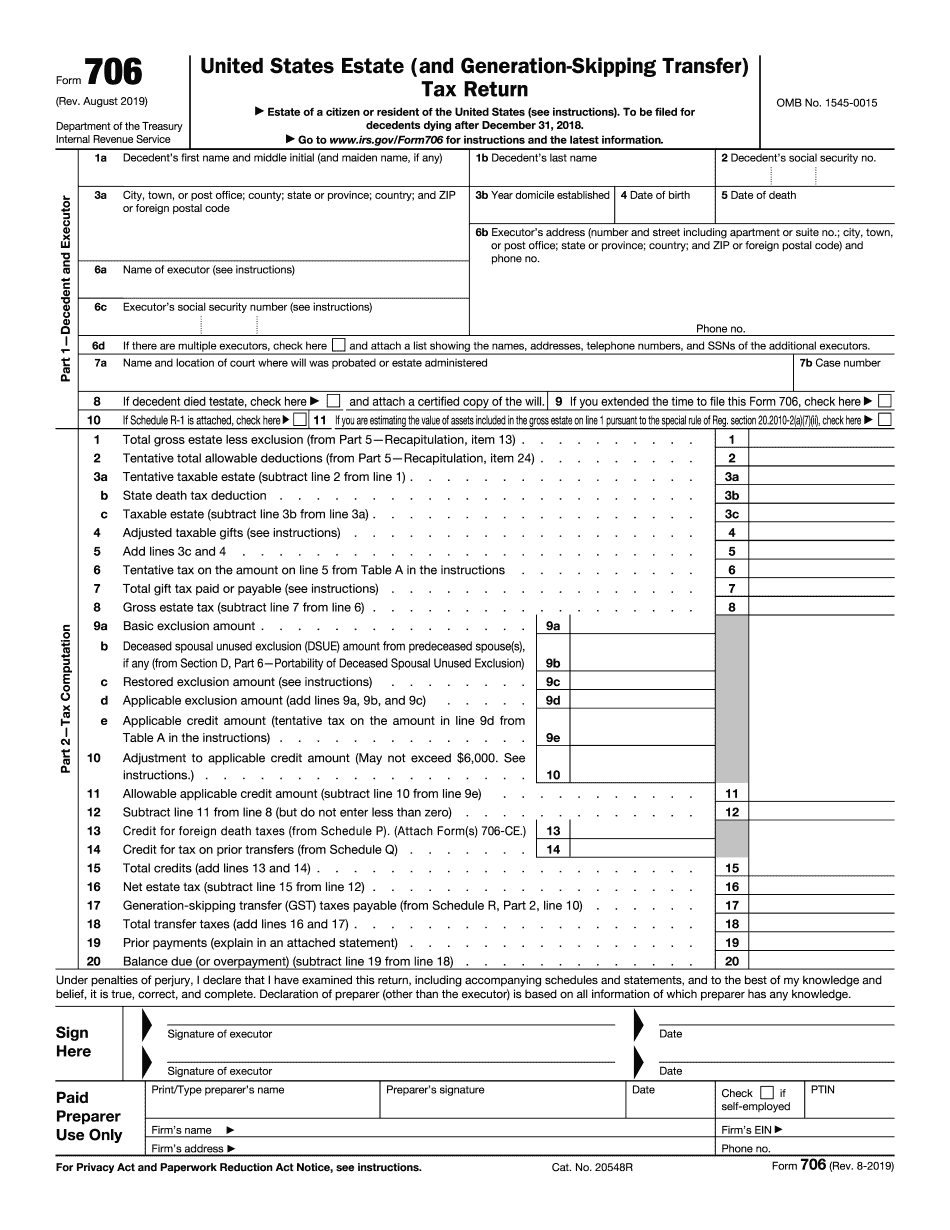

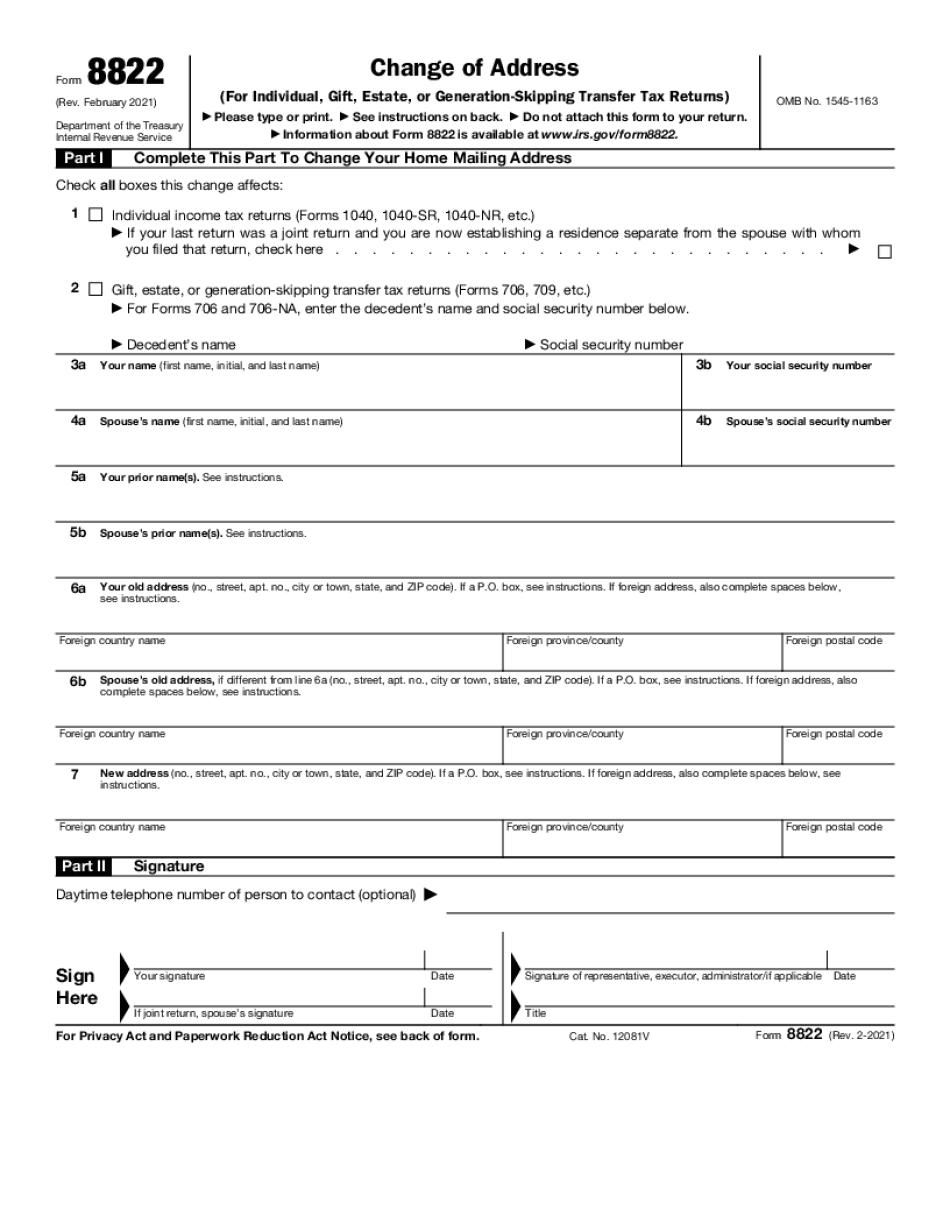

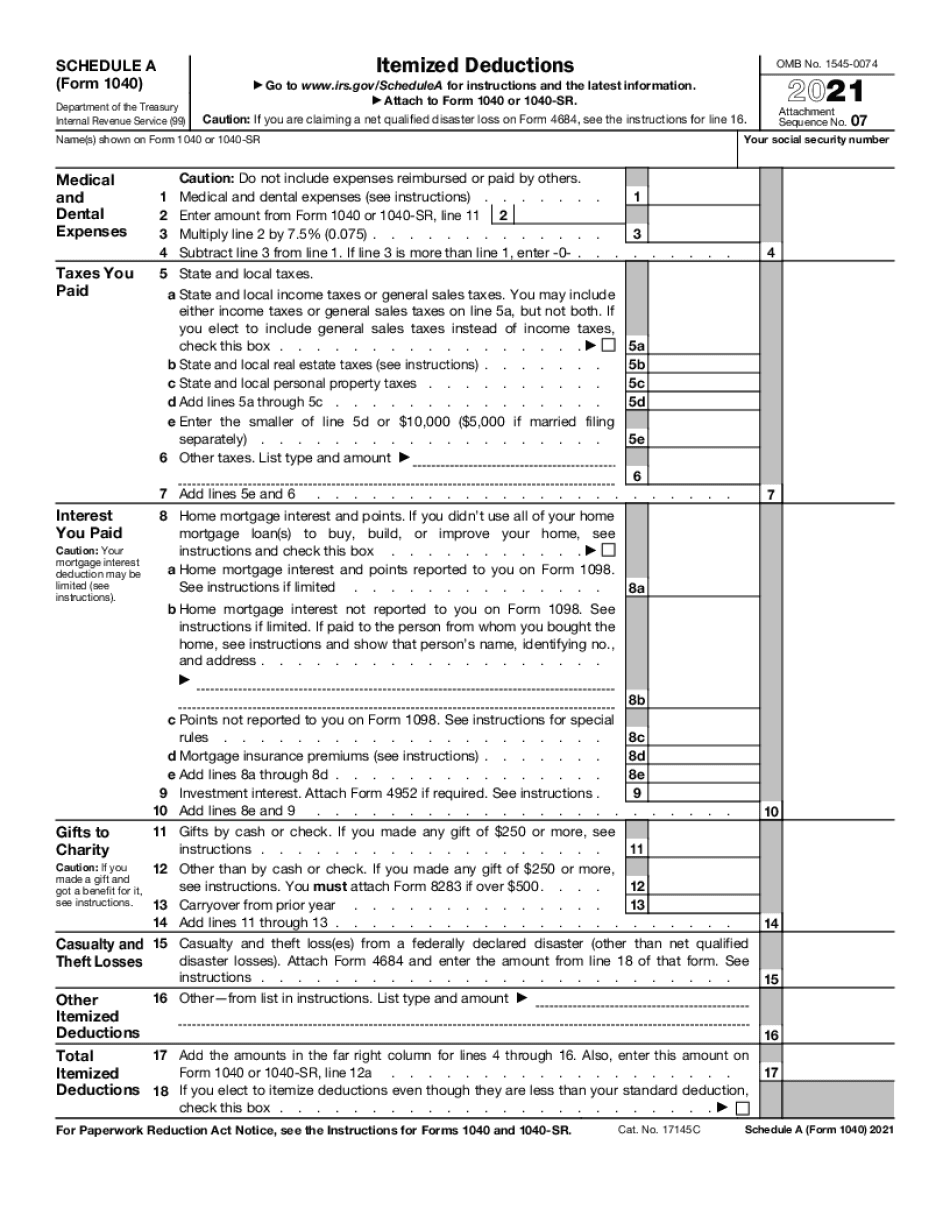

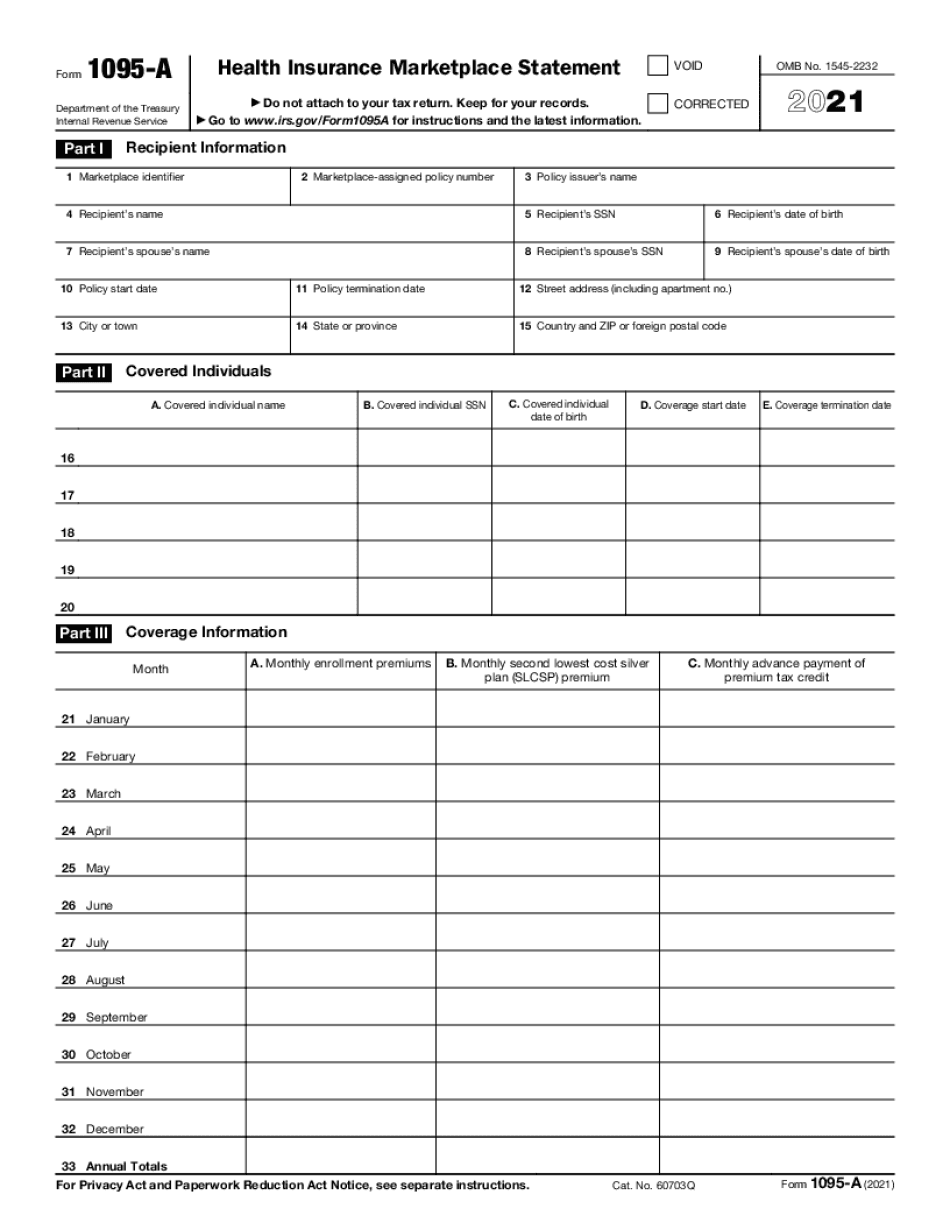

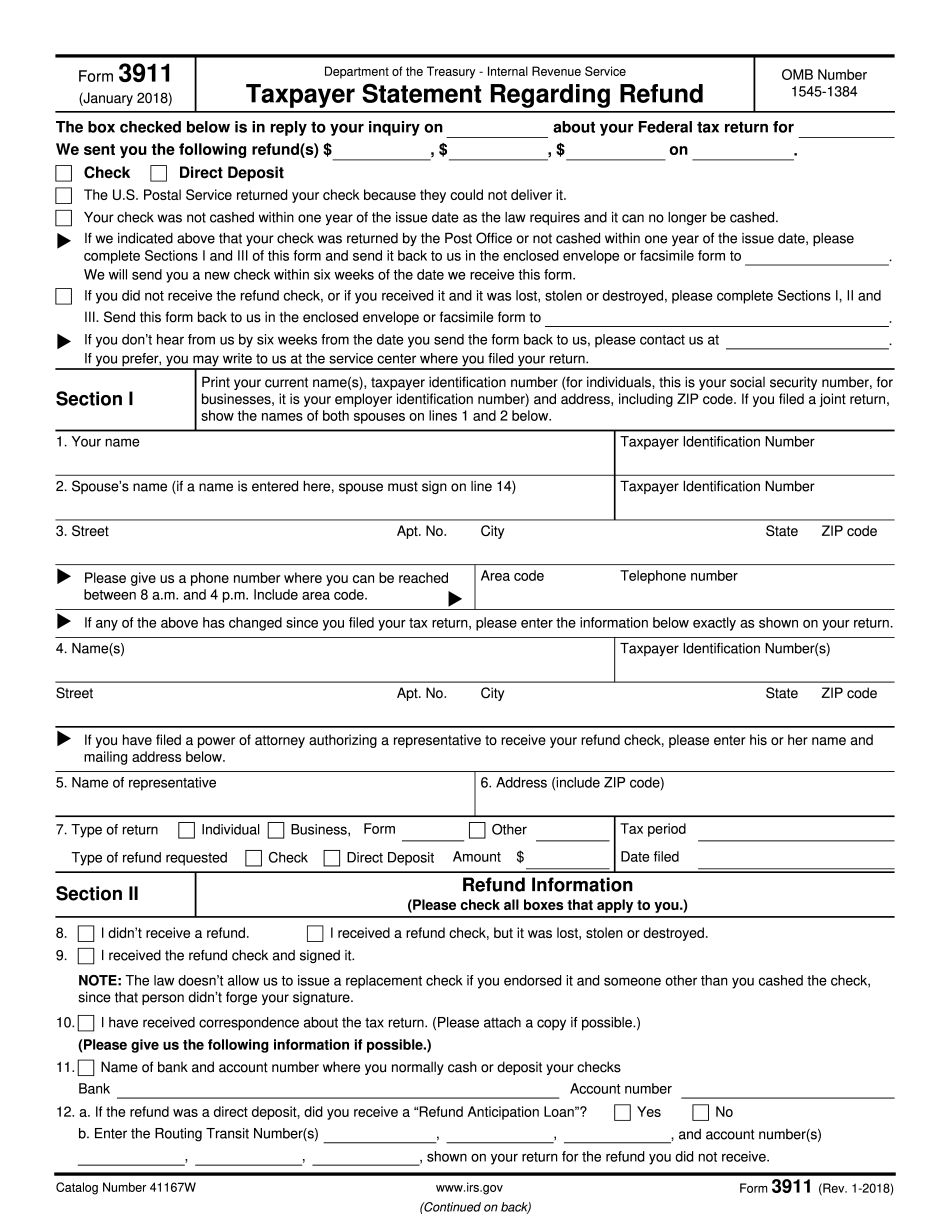

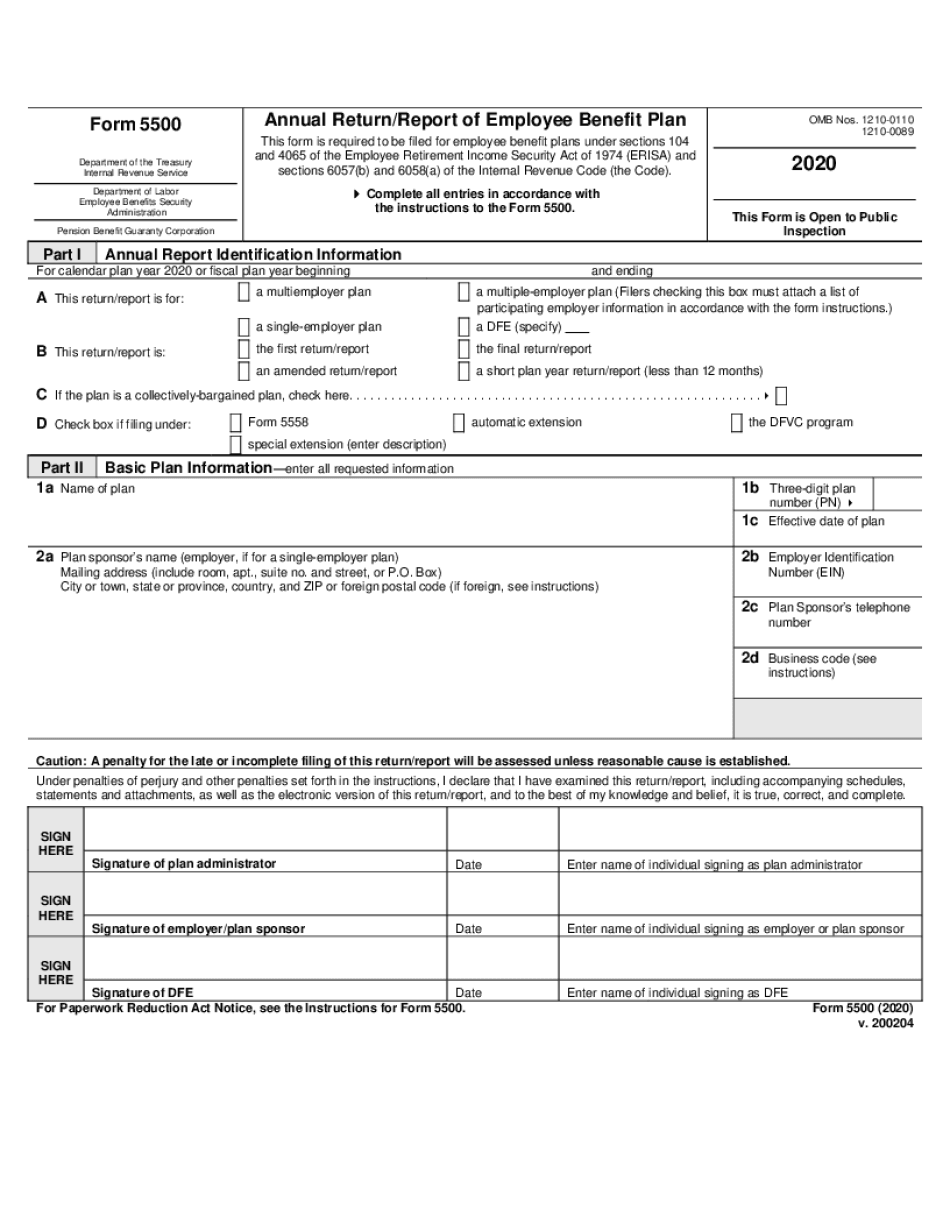

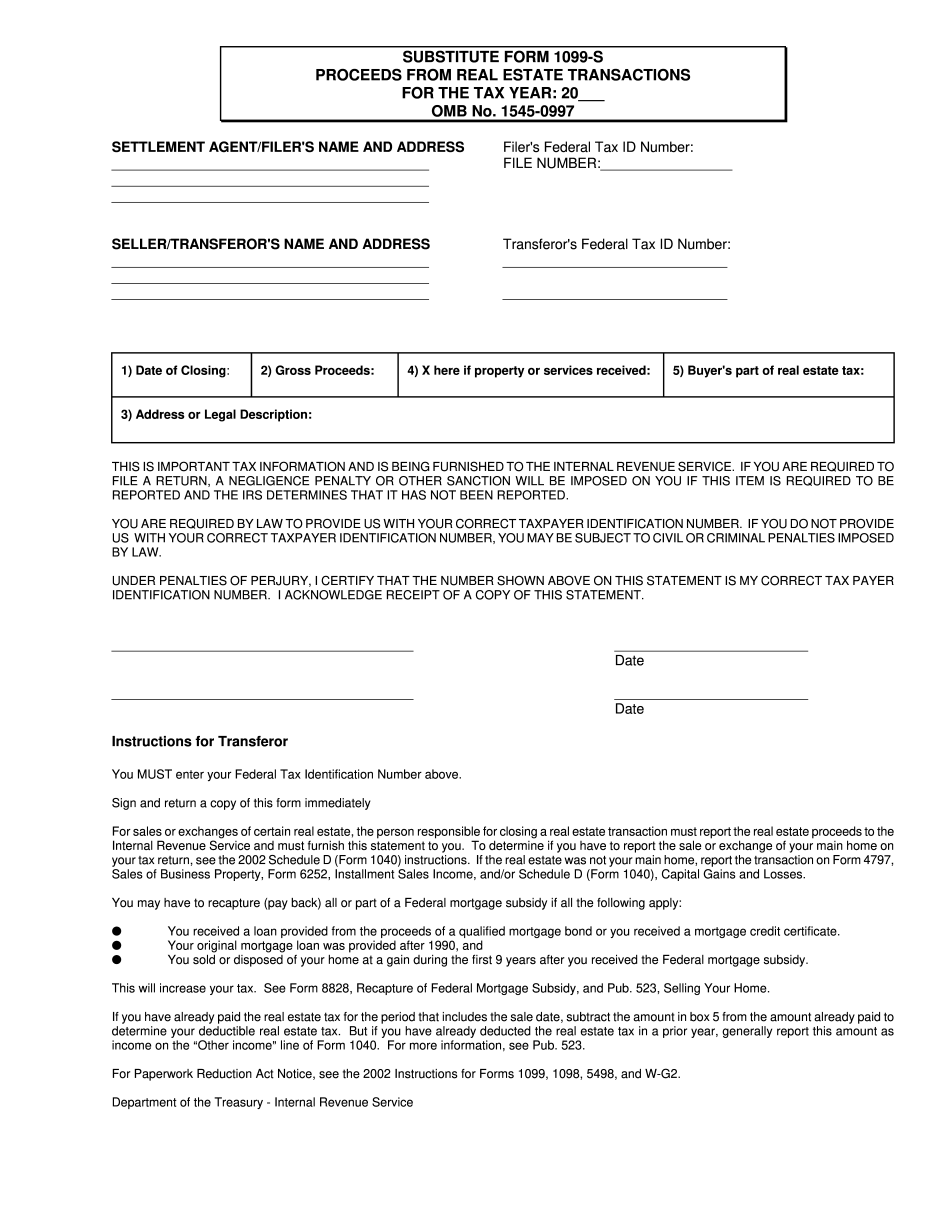

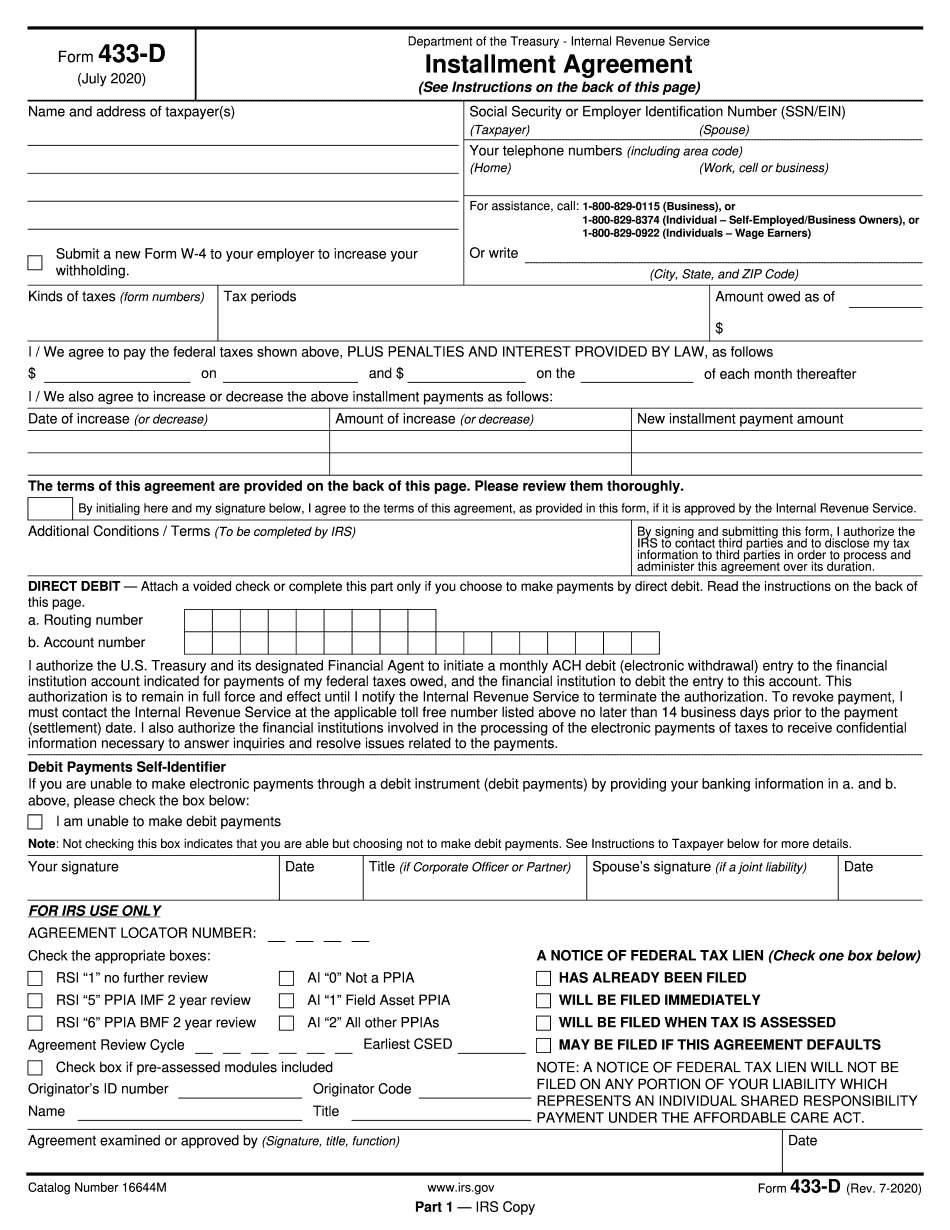

Most wanted tax and legal web forms

Choosen an appropriate tax year, your filing status, and annual taxable income to know your estimated tax rate and fill out the required form right now.

What are the new tax brackets?

Filing income taxes each year is definitely a tough problem for many individuals as a consequence of US taxation. How could I calculate the amount I I am obligated to pay? What are the new tax brackets? Nevertheless, these queries aren't that difficult. Let's handle them together!

The US tax technique is modern: it improves as individual's revenues expand. Therefore, people who have a lesser revenue level spend much less - only ten percent for income under $9,875 (2020). Still, income taxes can reach 37Per cent for individuals as their income are beyond $518,401. All possible earnings are split into seven specific divisions known as income tax brackets that outline taxes rates for different quantities of taxable income (dividends, capital gains, and so on.).

How tax brackets work

When you are aware much more about calculating fees, you can start planning forms for submitting. You can sit, research, and complete them manually or you can follow the step-by-step guideline below to file earnings reports less difficult:

- Compute your taxable revenue.

- Open the home page of Taxbracketscalculator.

- Pick your Filing Status inside the box at the top of the screen.

- Get true costs for each element of your profits.

- Compute the sum you need to pay.

- Put this info right into a necessary template.

- Send it to the Internal Revenue Service.

Don't waste your time on routine paperwork. Check our service out now!