Are Capital Gains Added To Your Total Income And Put You In A Higher Tax Bracket?

Yes, capital gains are added to your total income. Whether or not it puts you into a higher tax bracket depends on the type and amount of capital gains and whether you have any capital losses to offset some or all of the gains. Short term capital gains (< 1 year) are taxed at your ordinary income tax rate while long term capital gains are taxed at a reduced rate. It’s even possible to not change your tax bracket at all.

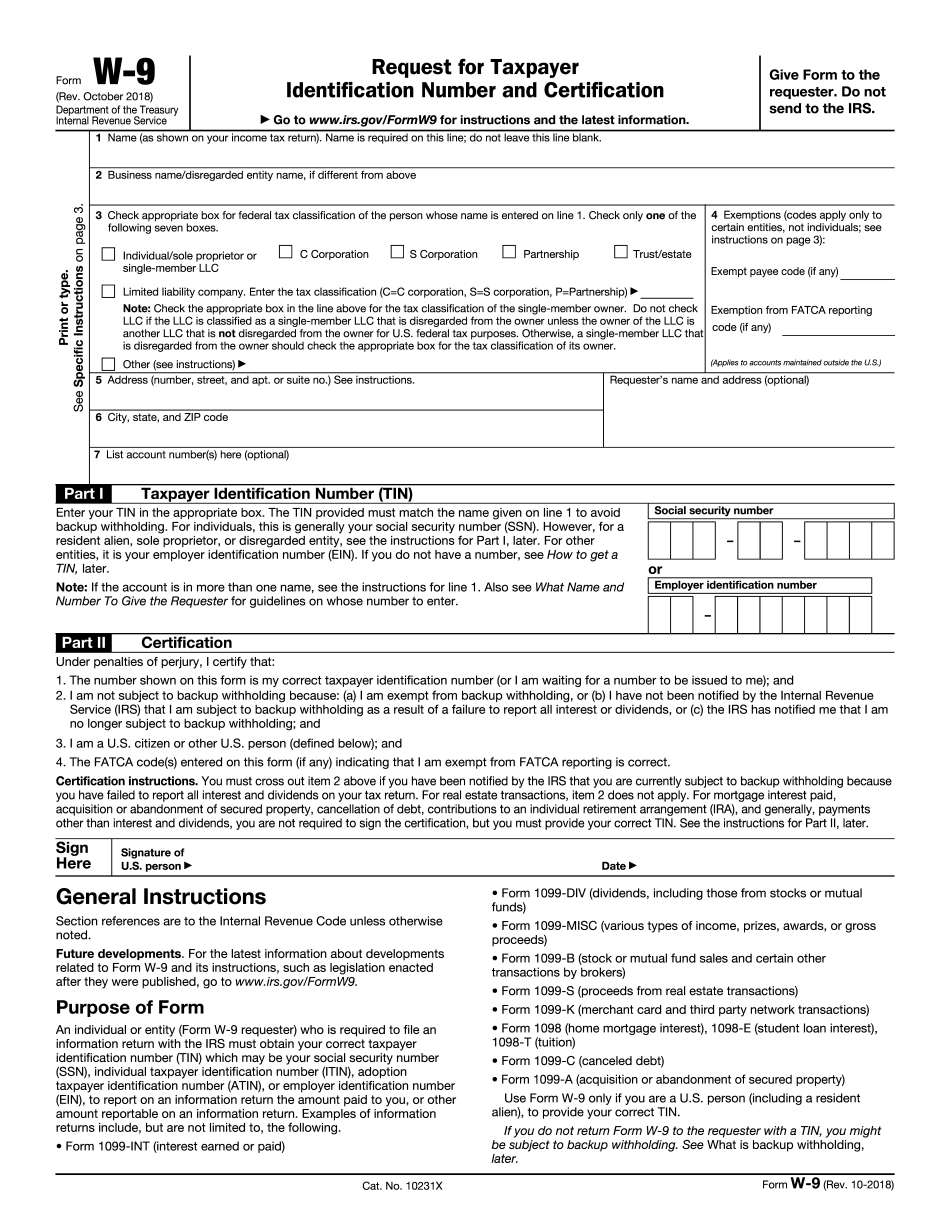

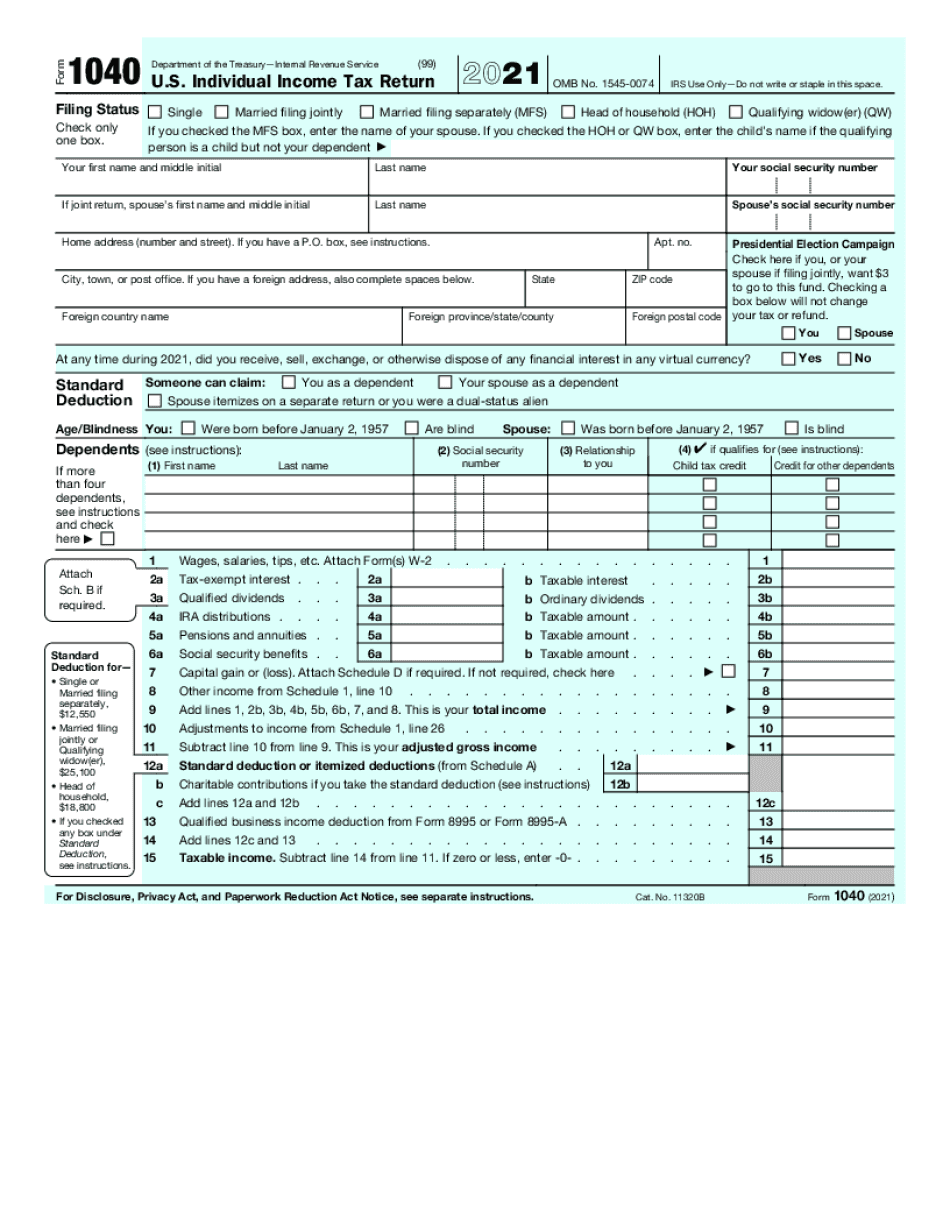

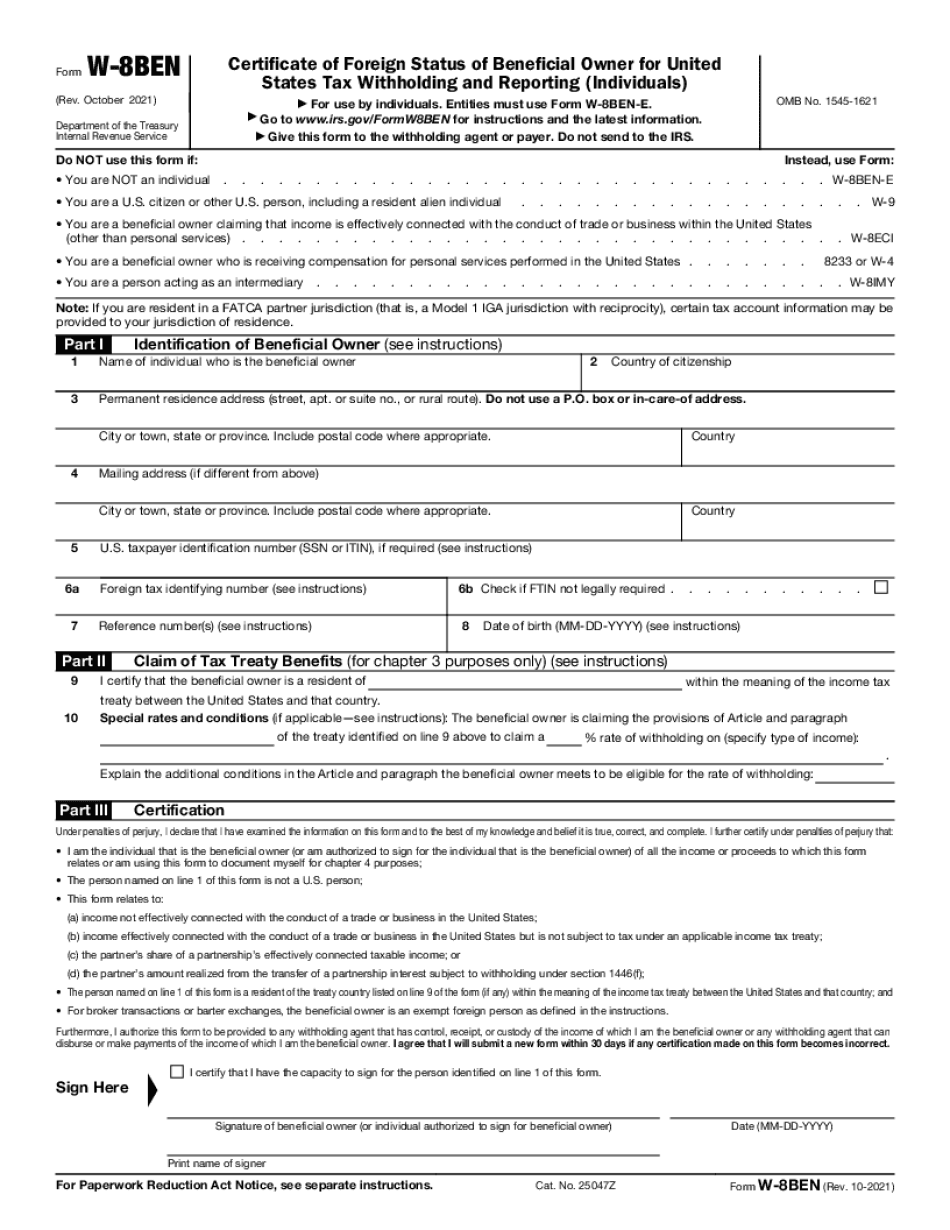

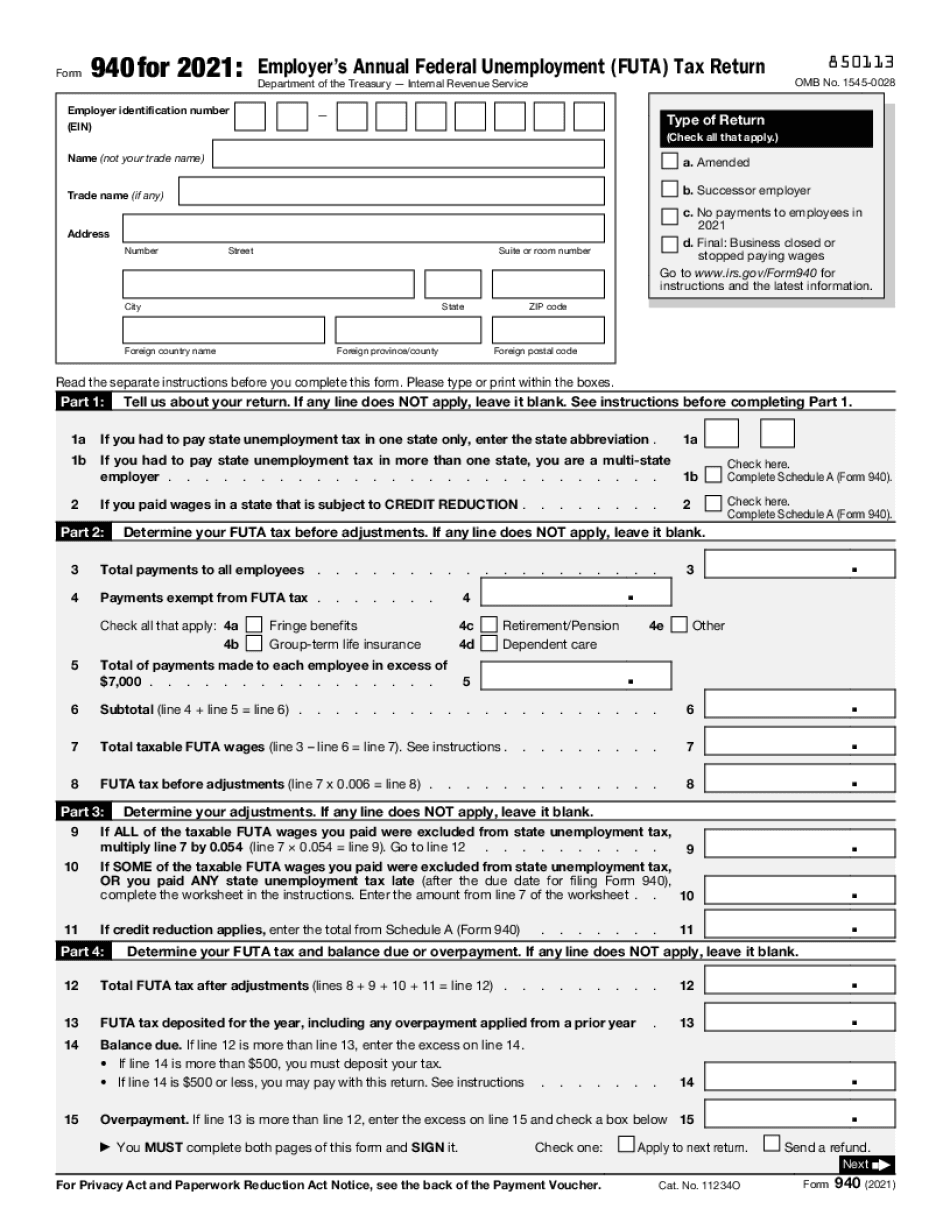

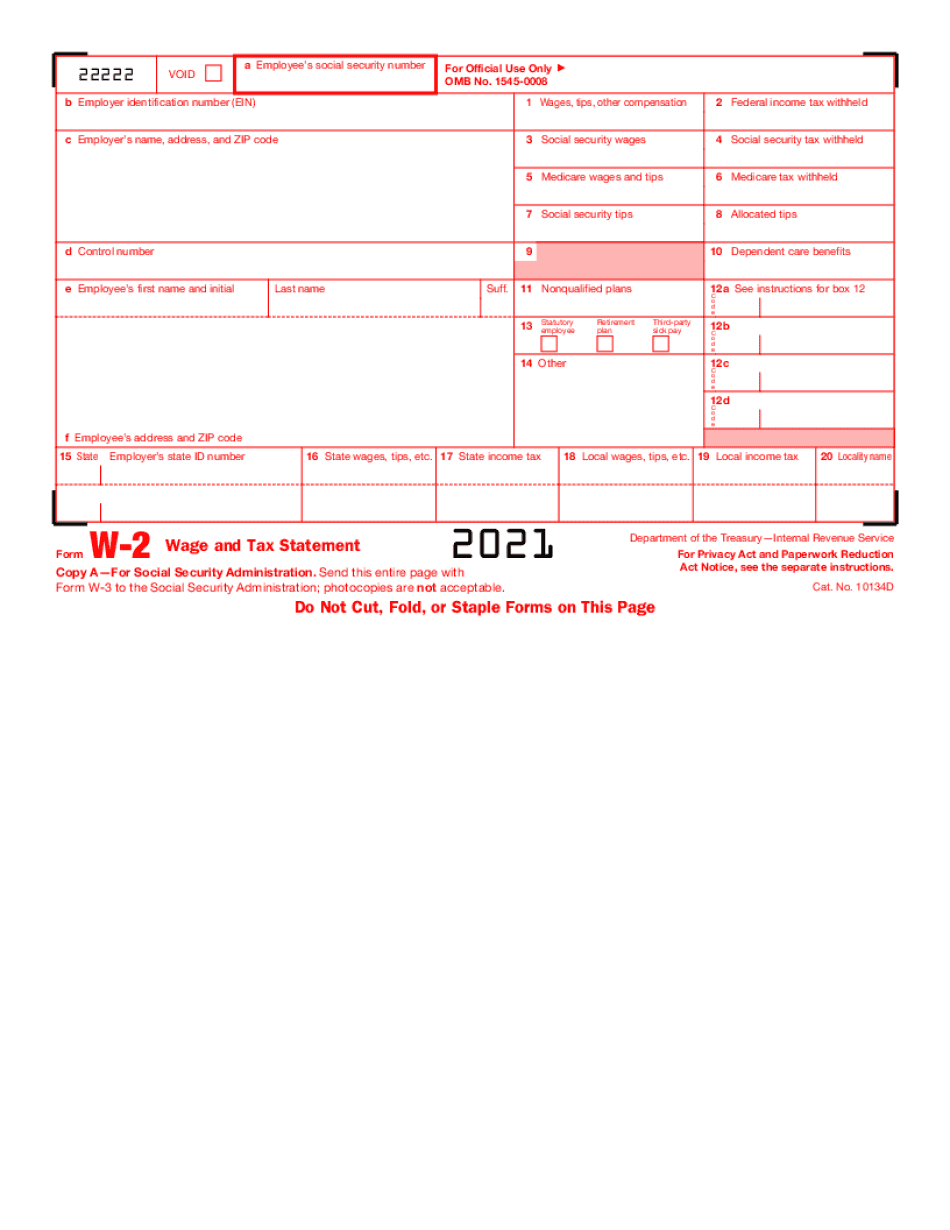

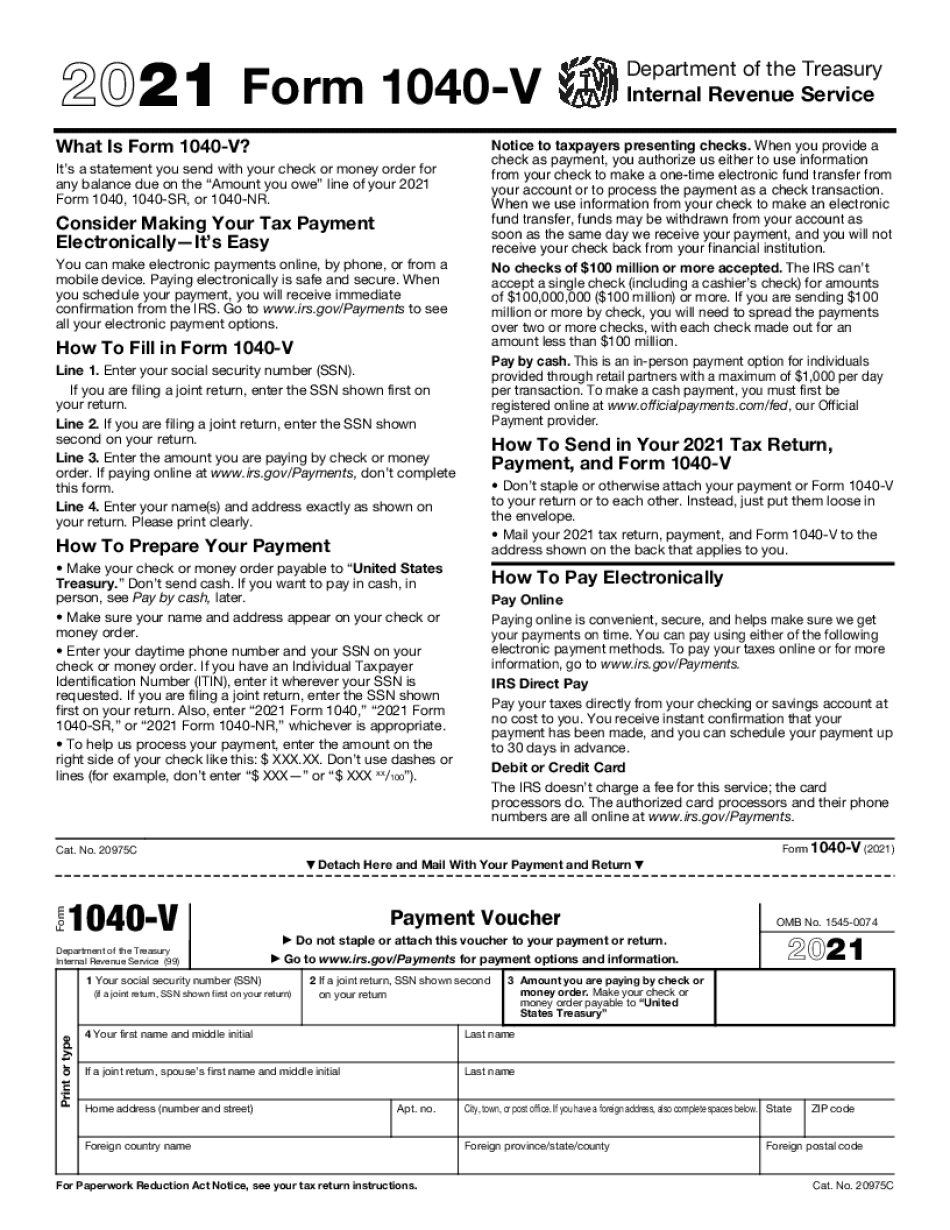

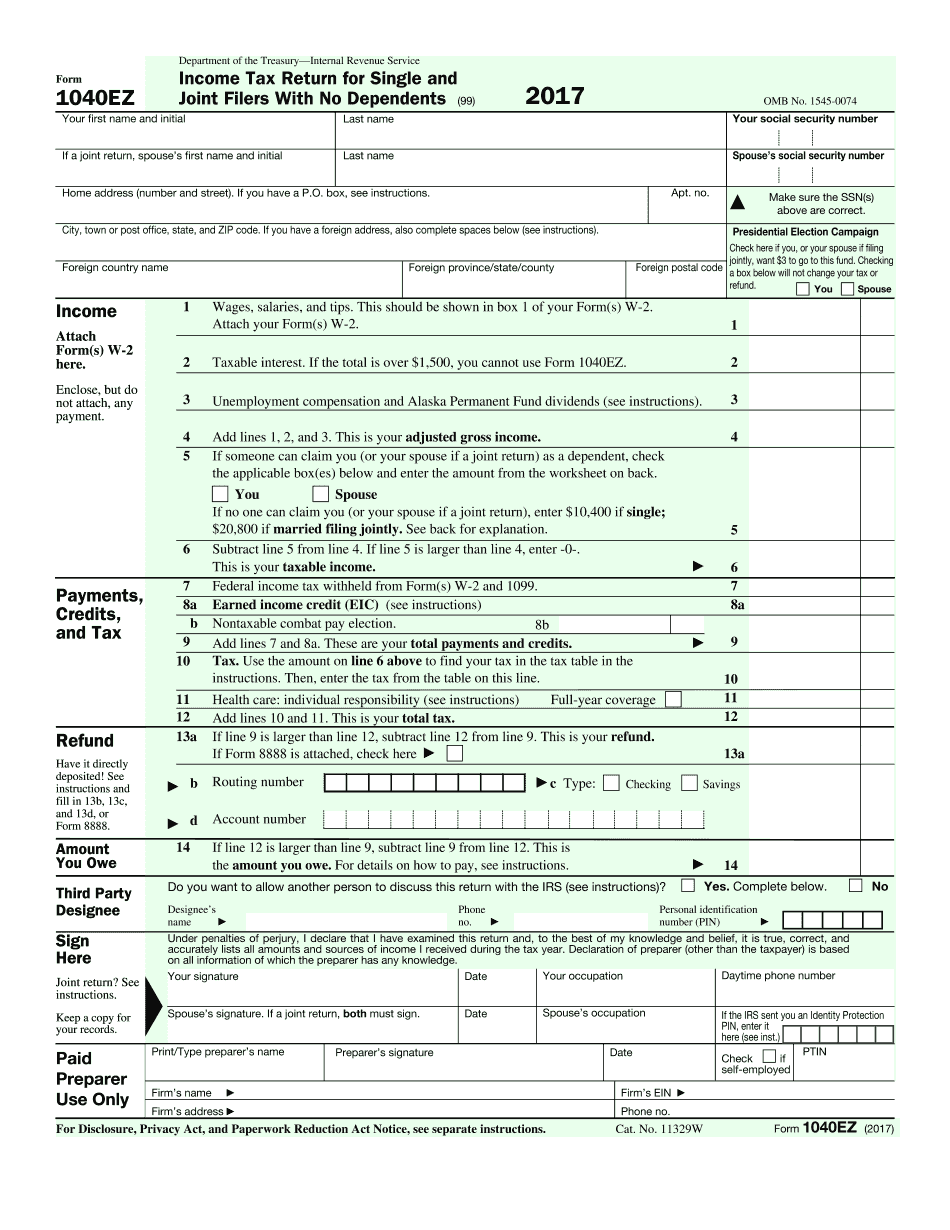

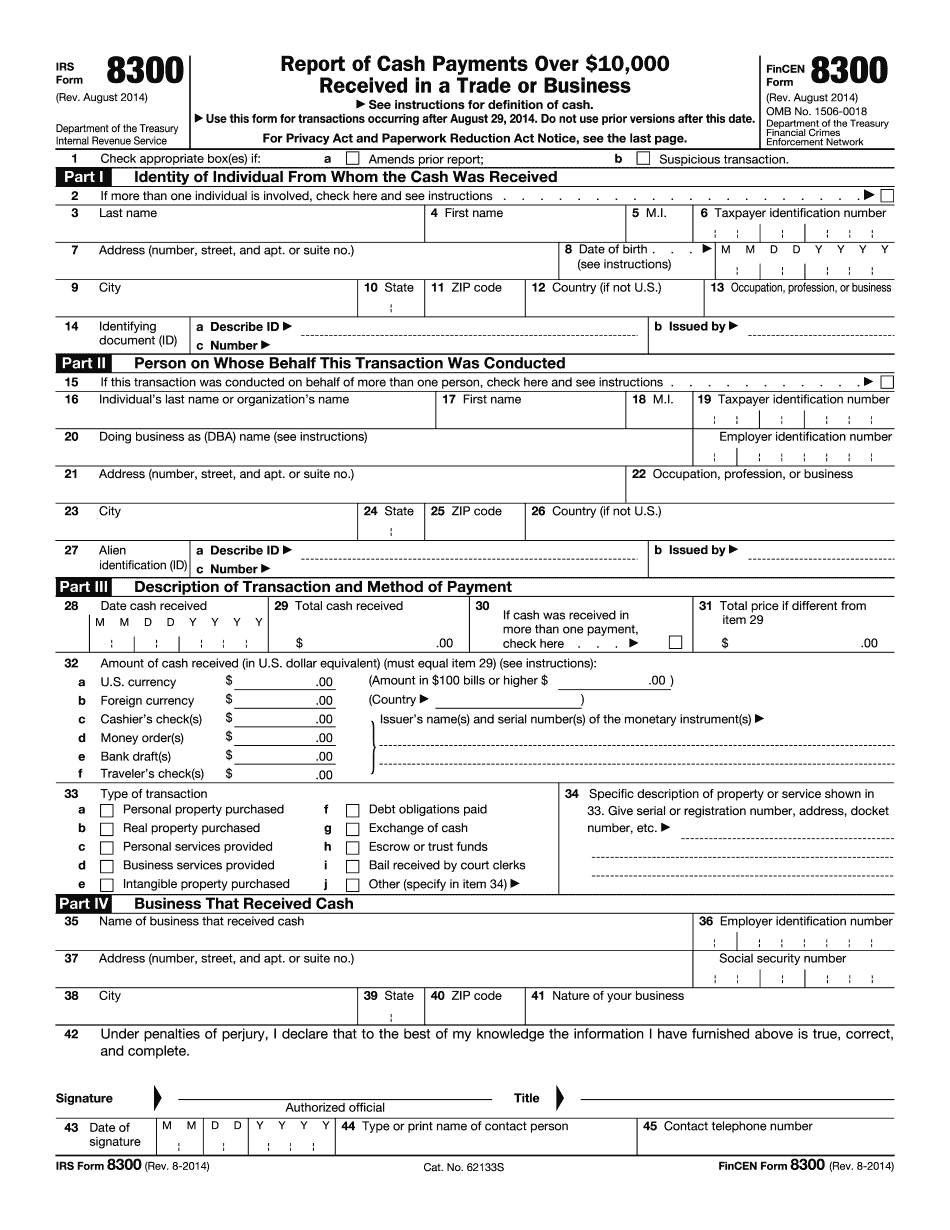

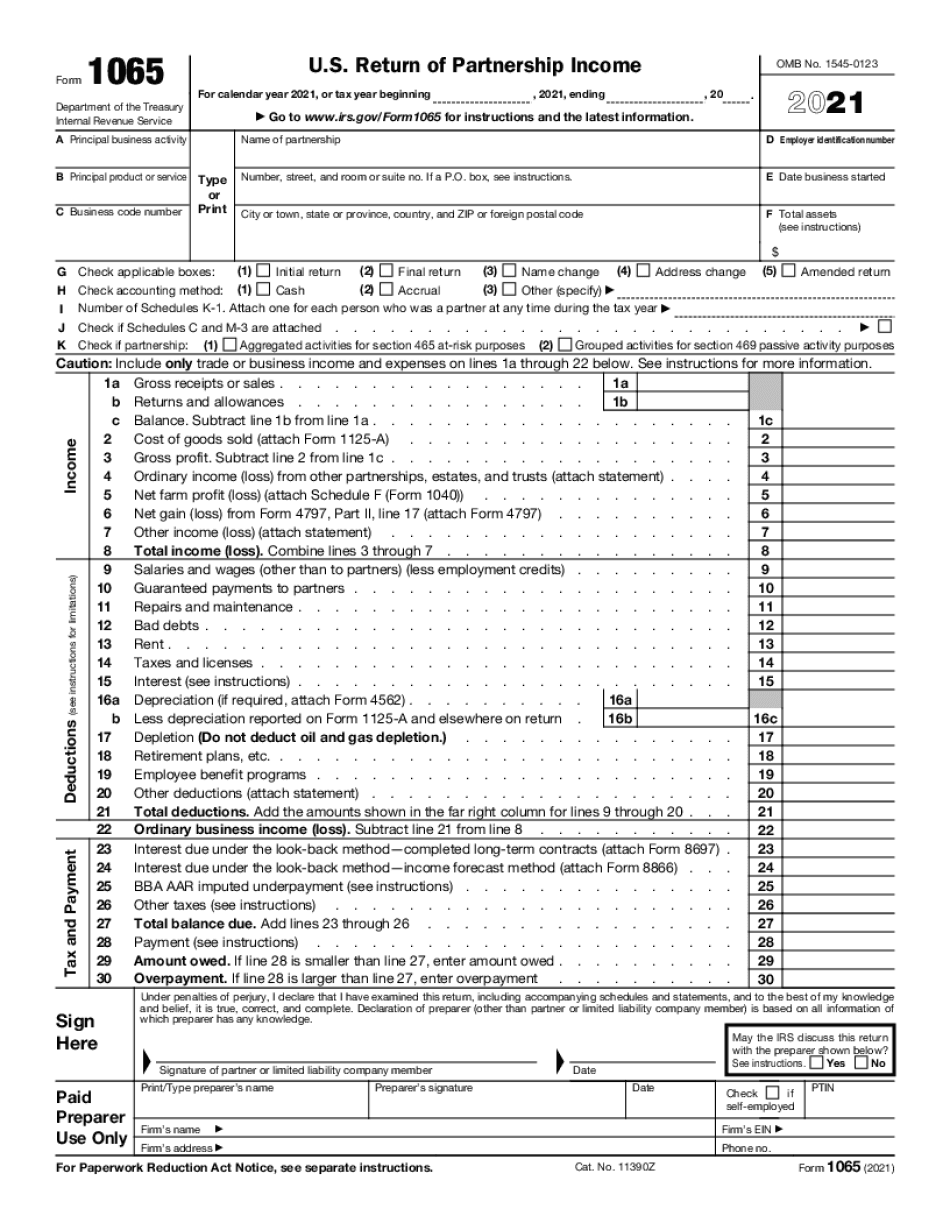

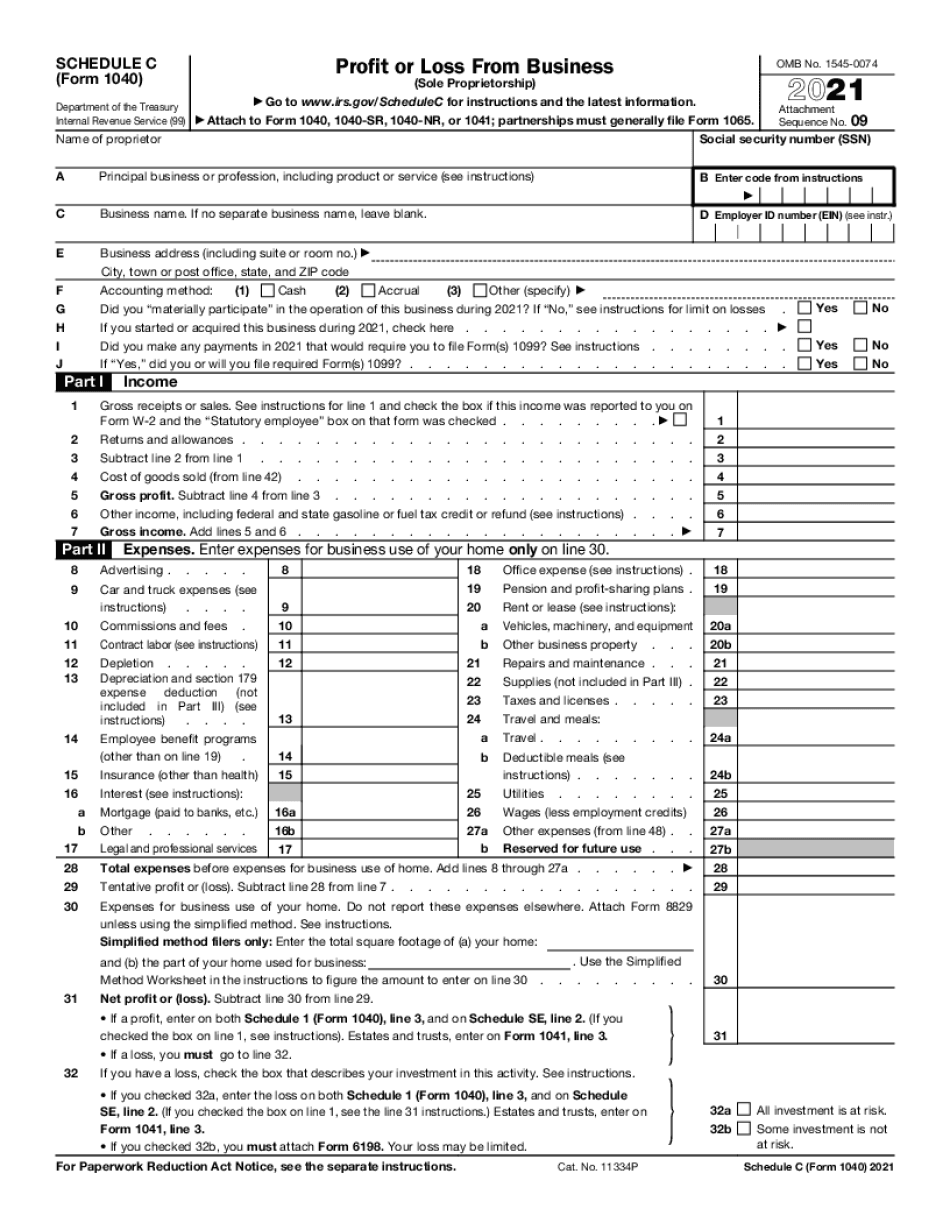

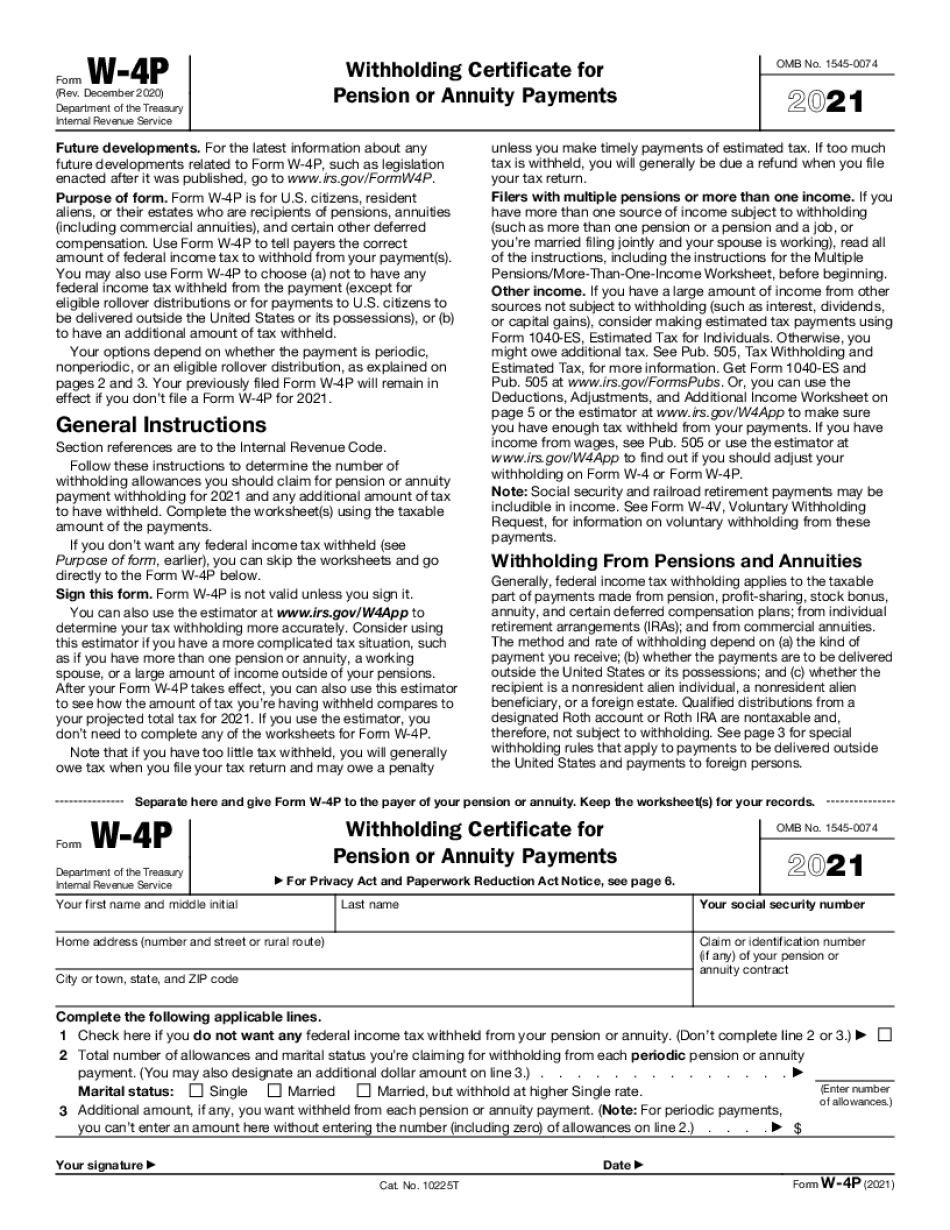

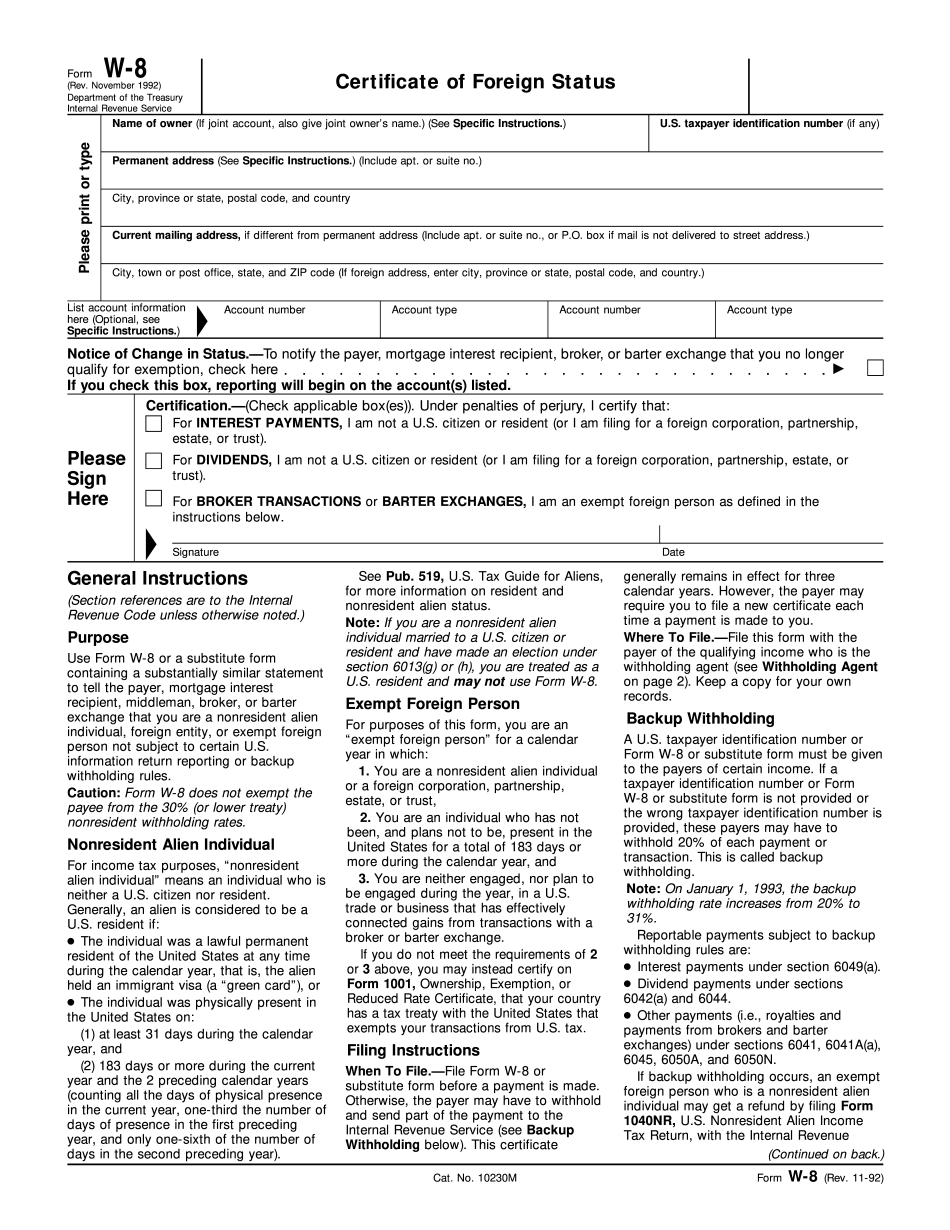

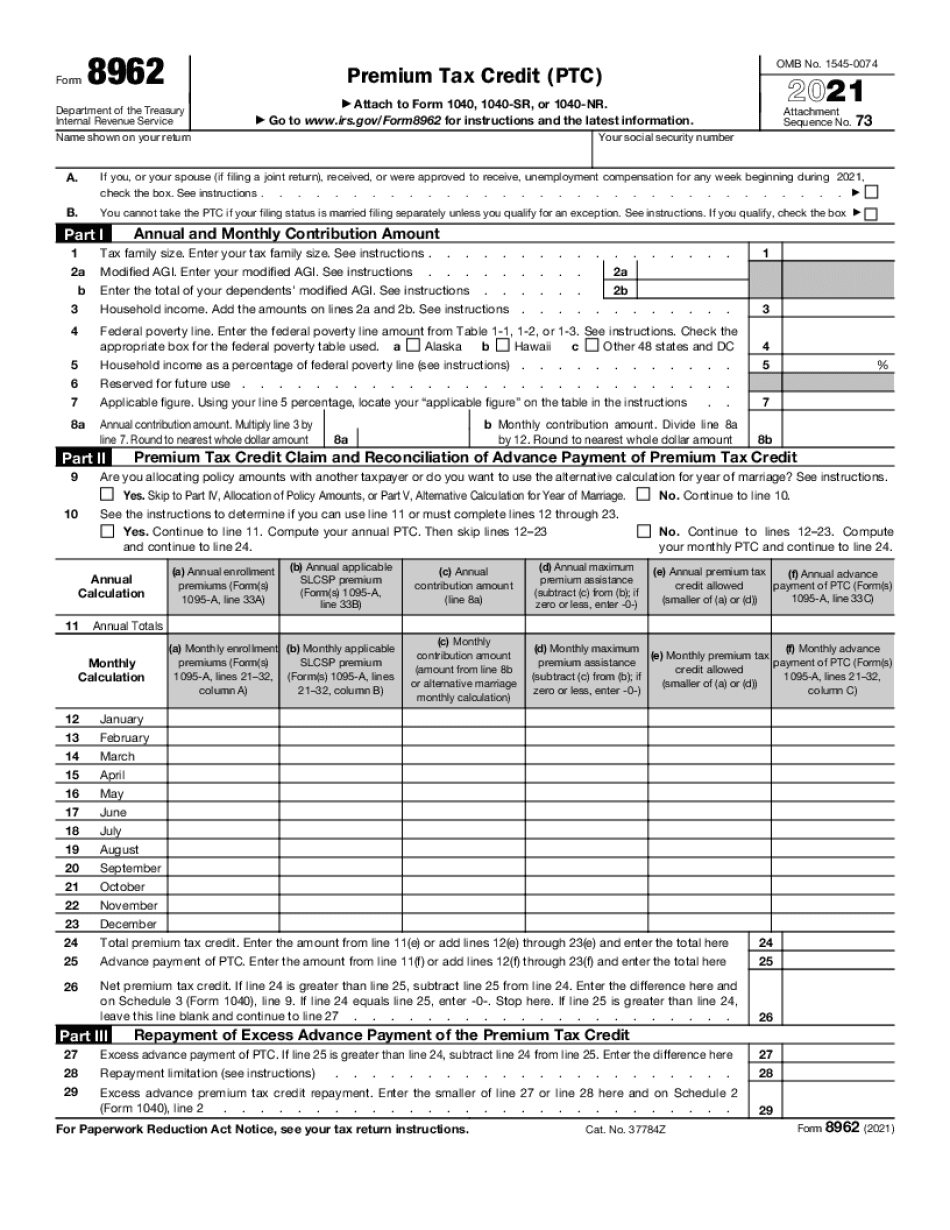

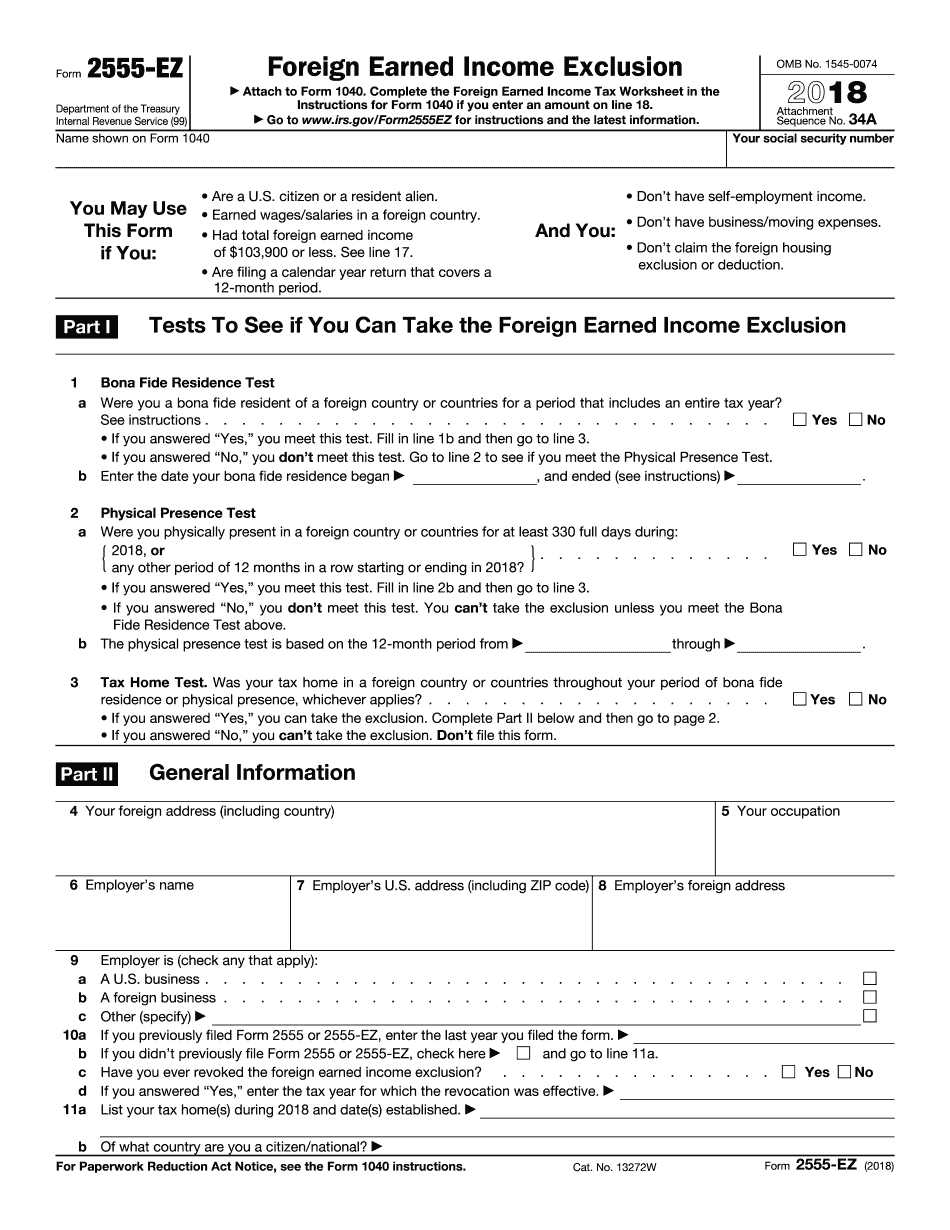

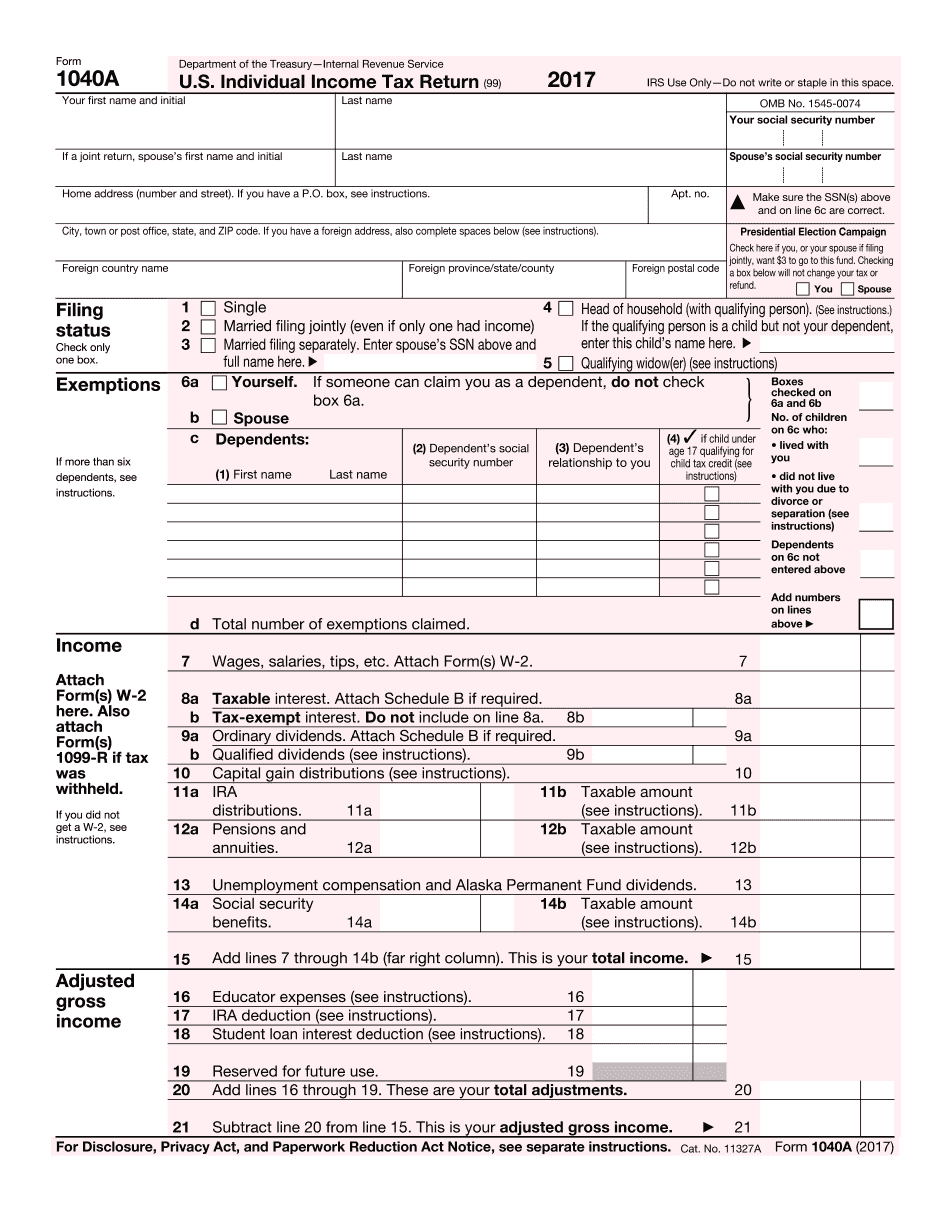

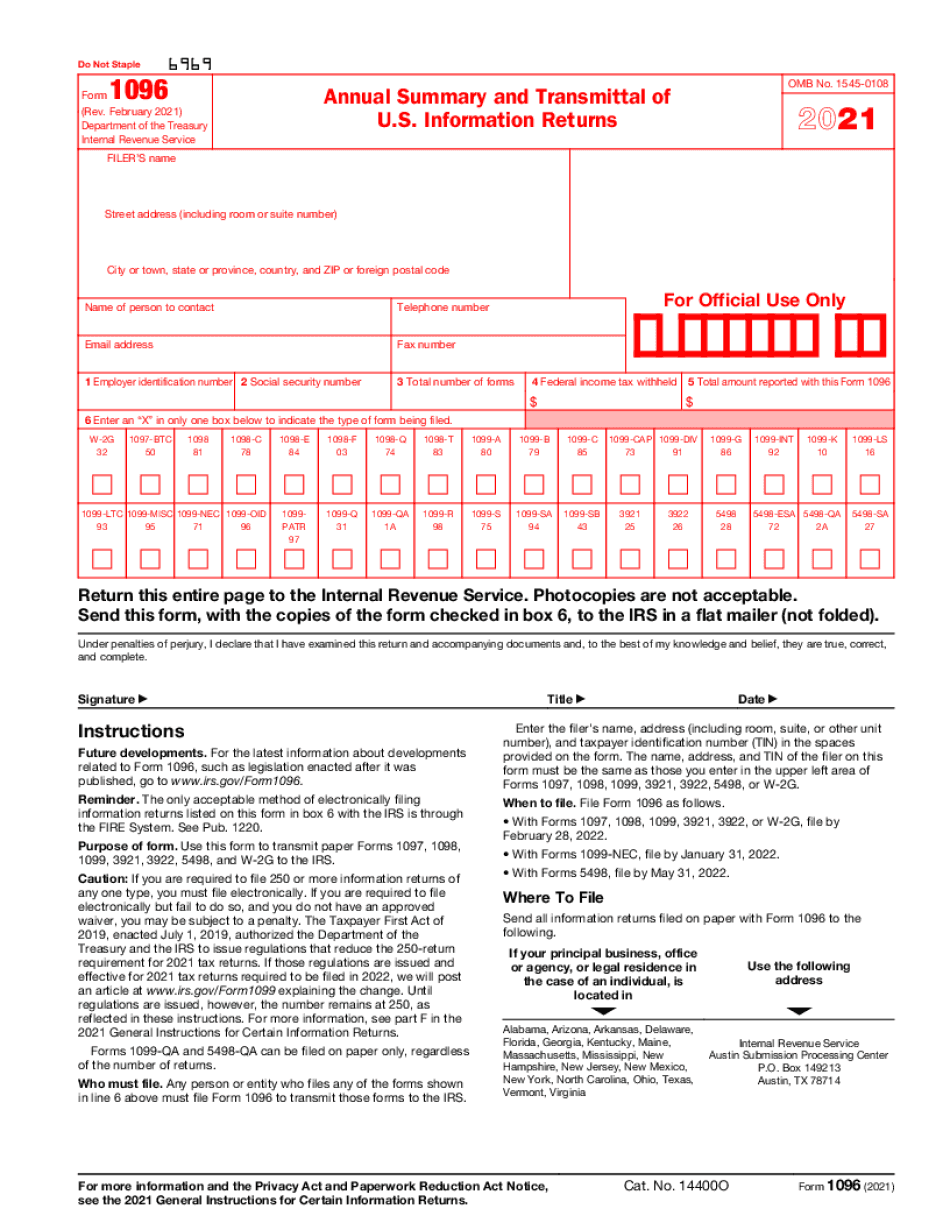

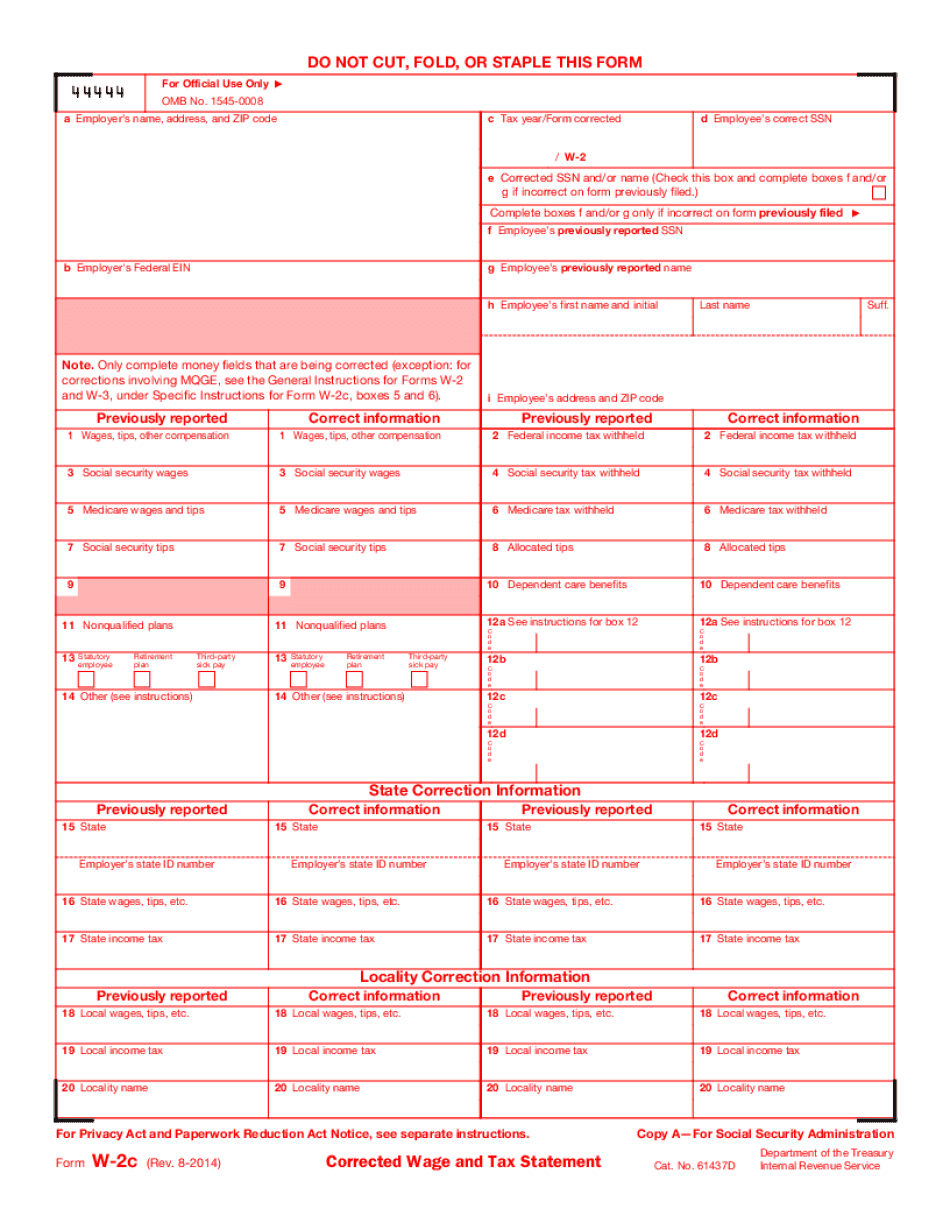

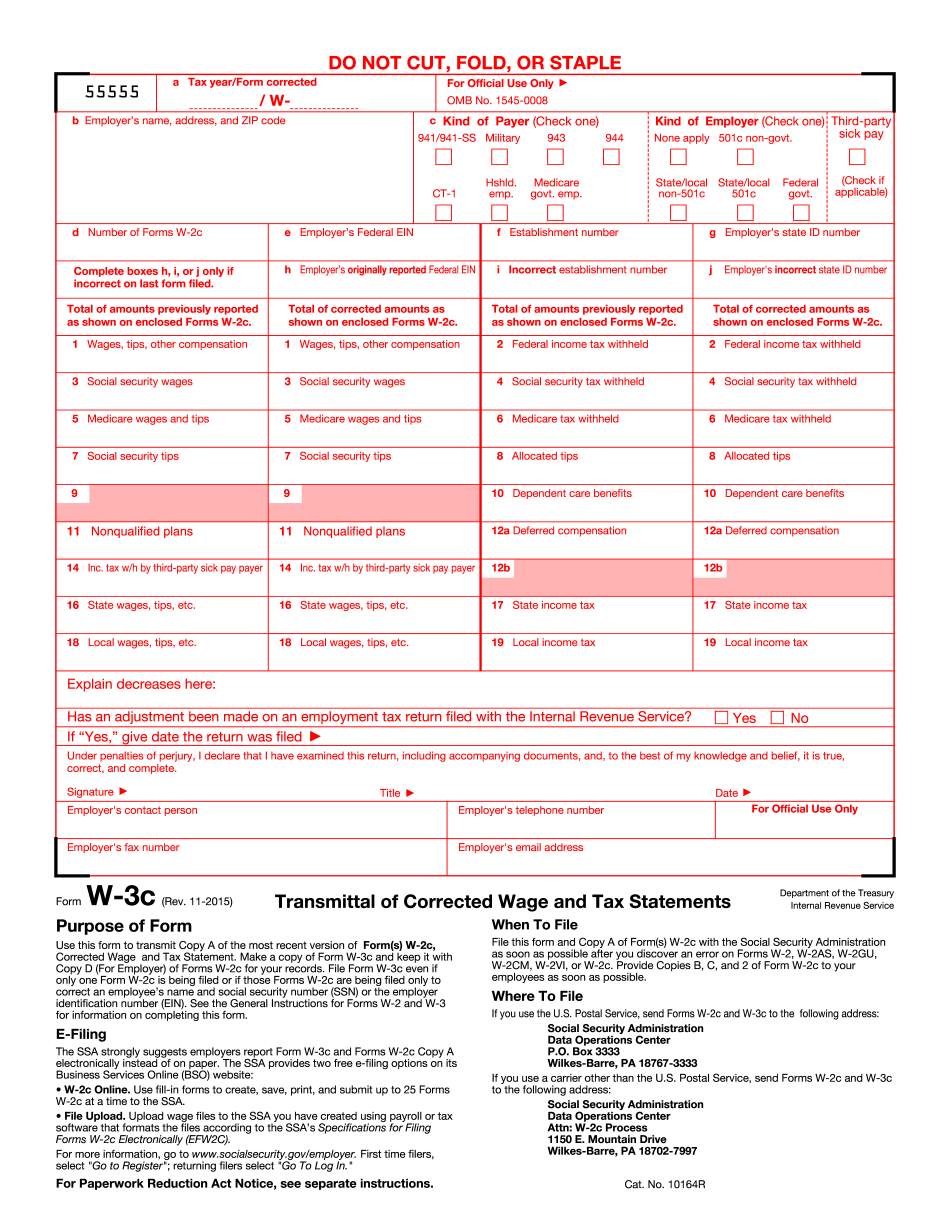

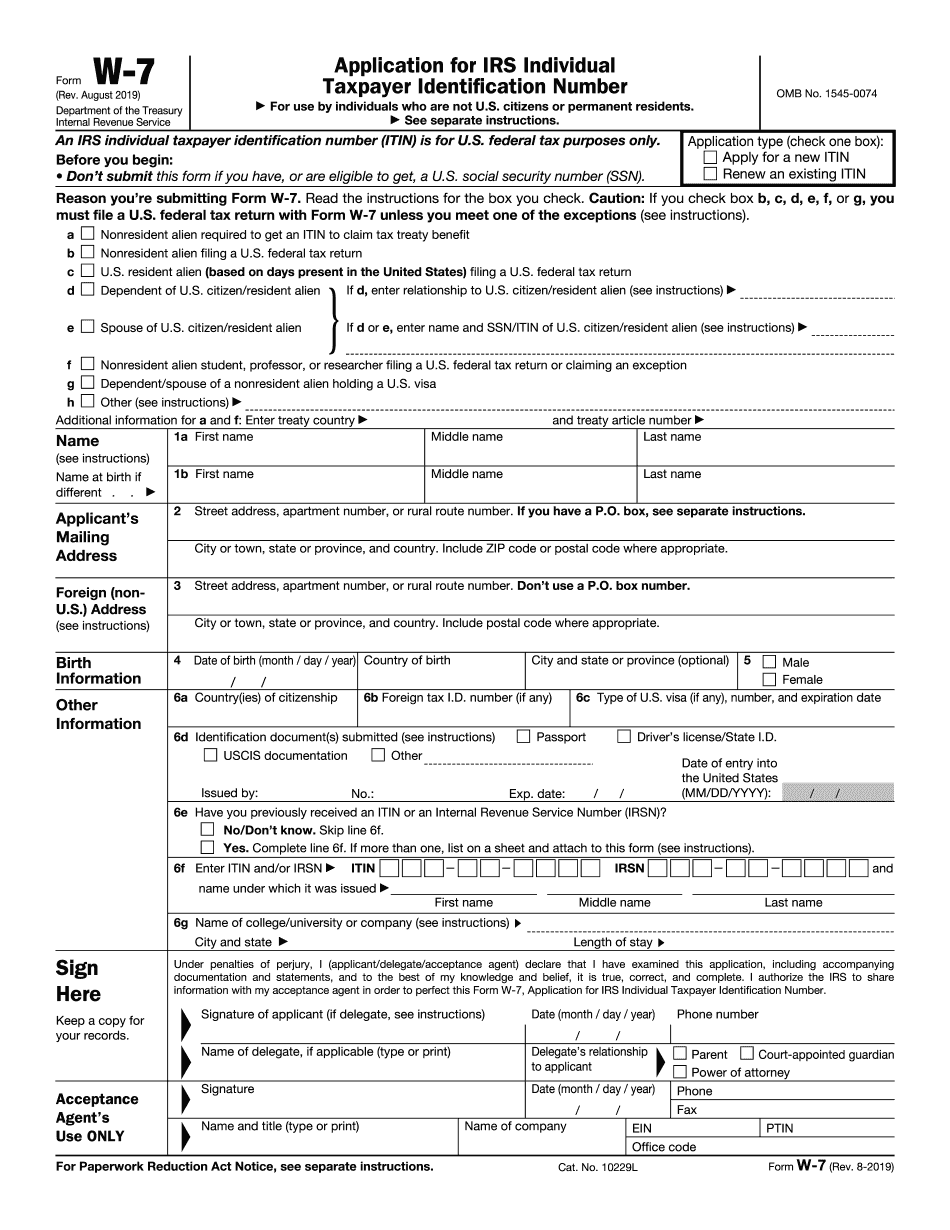

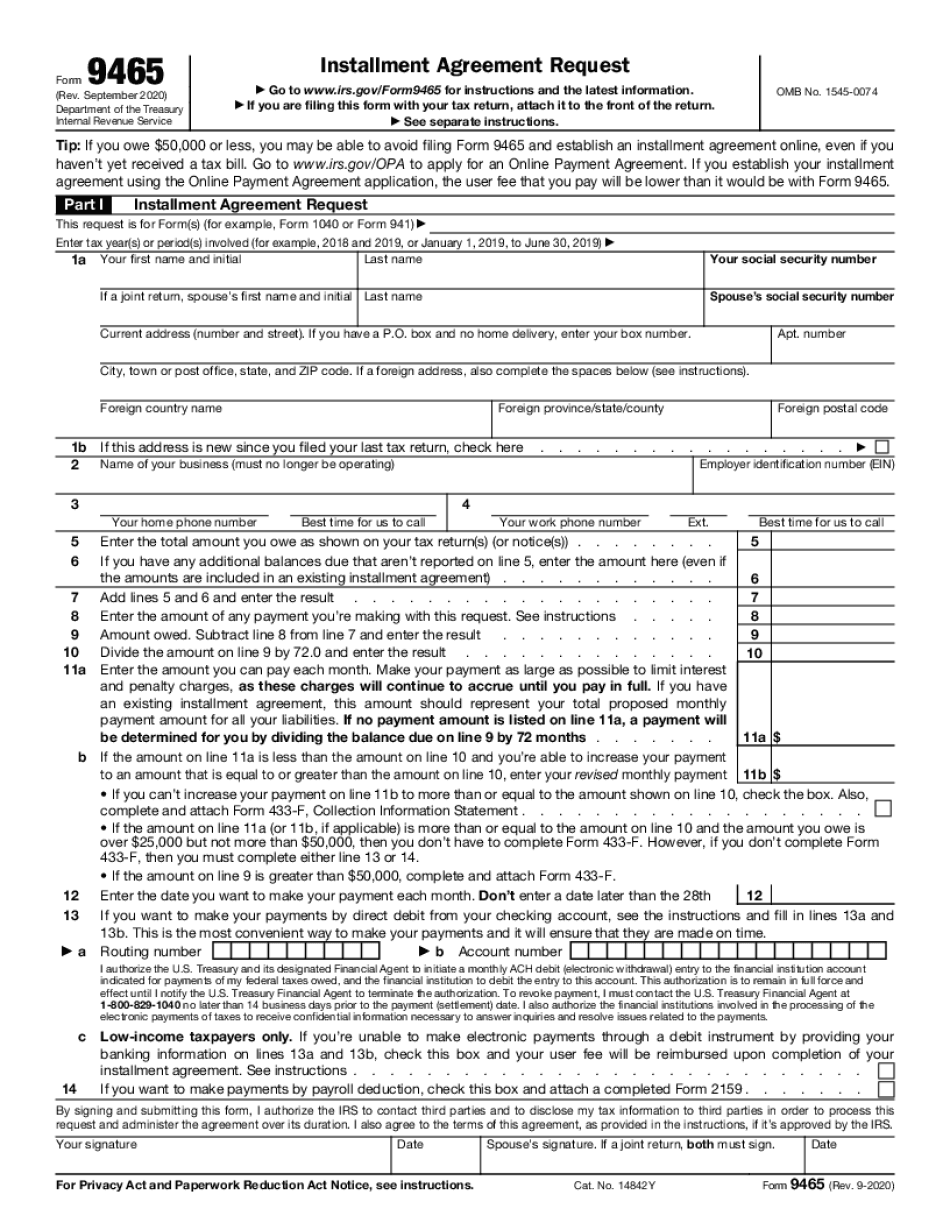

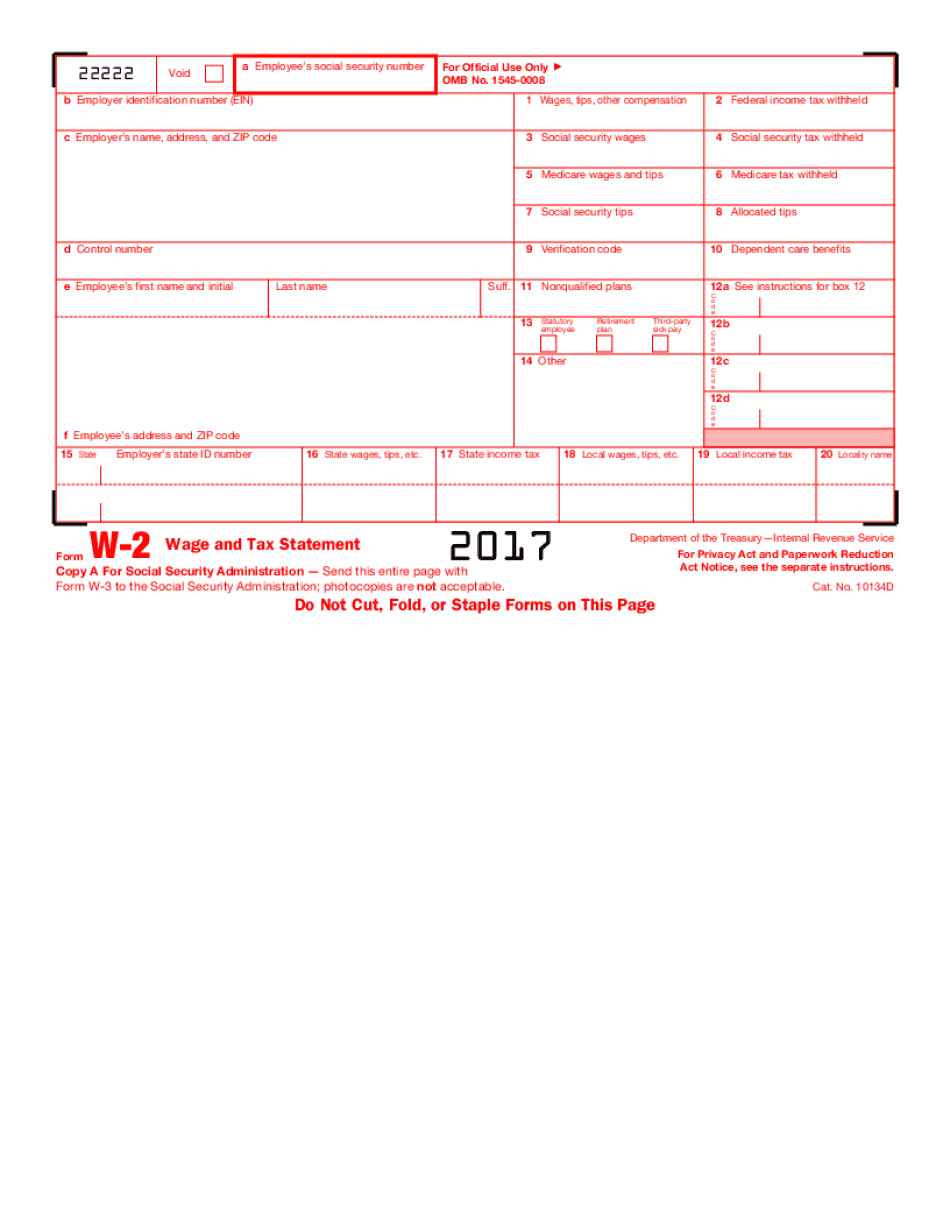

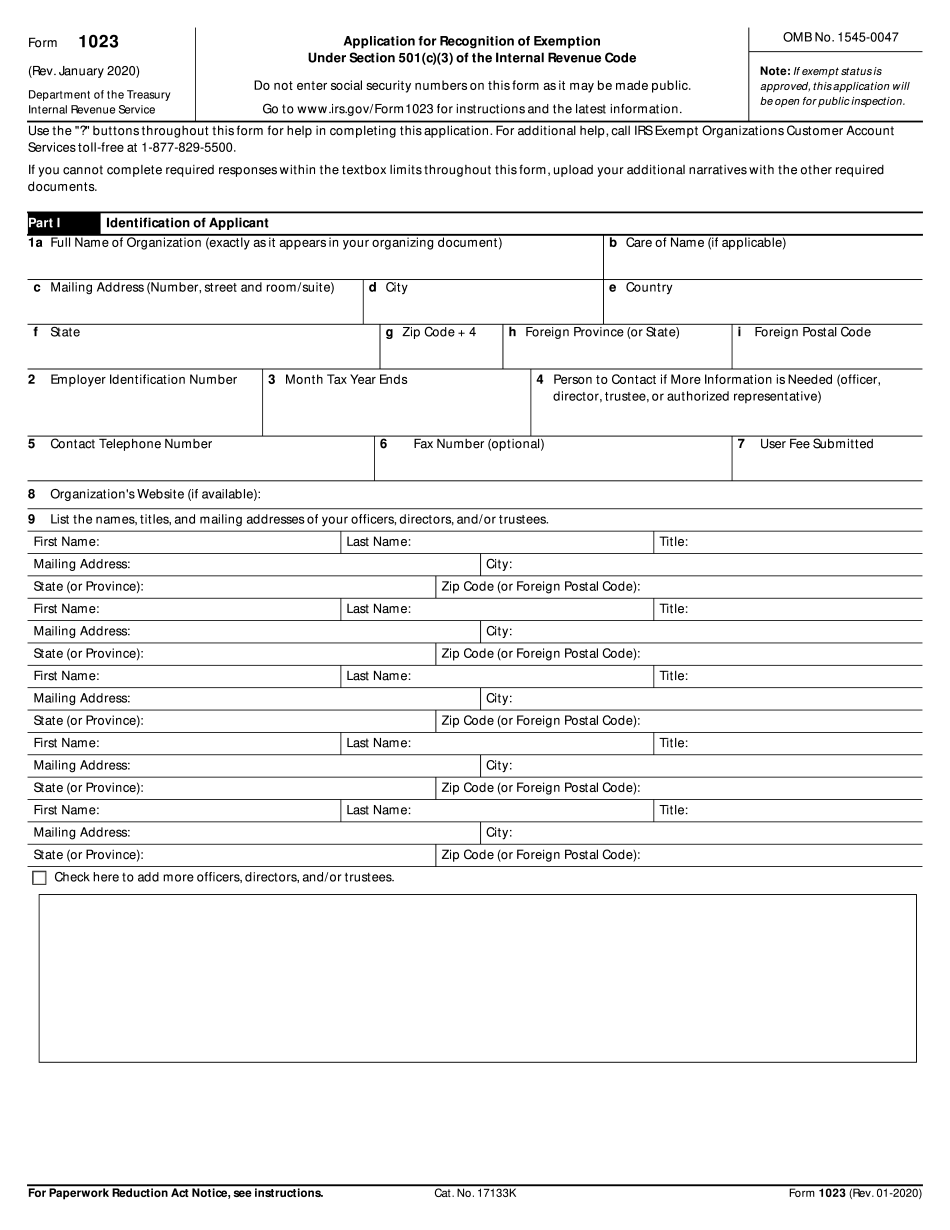

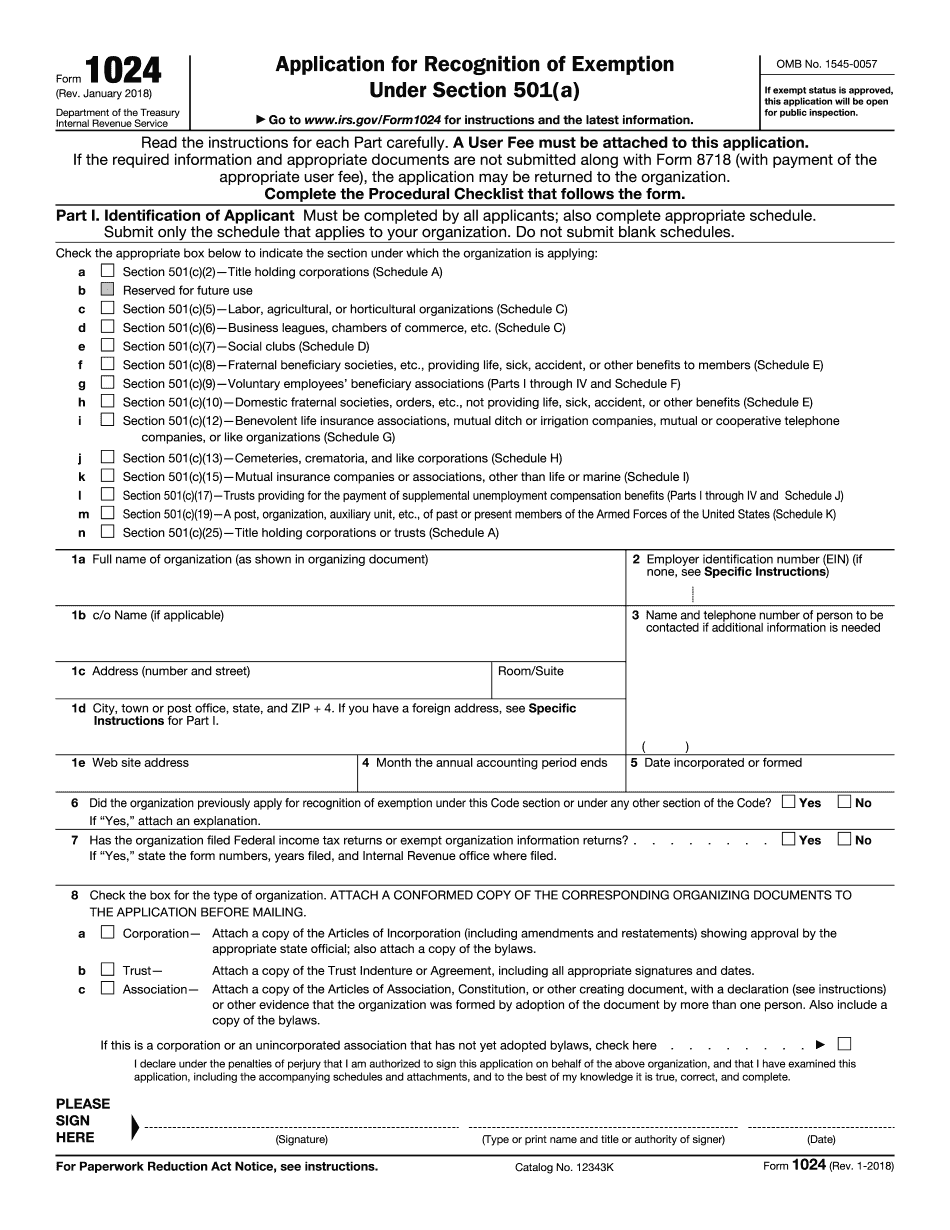

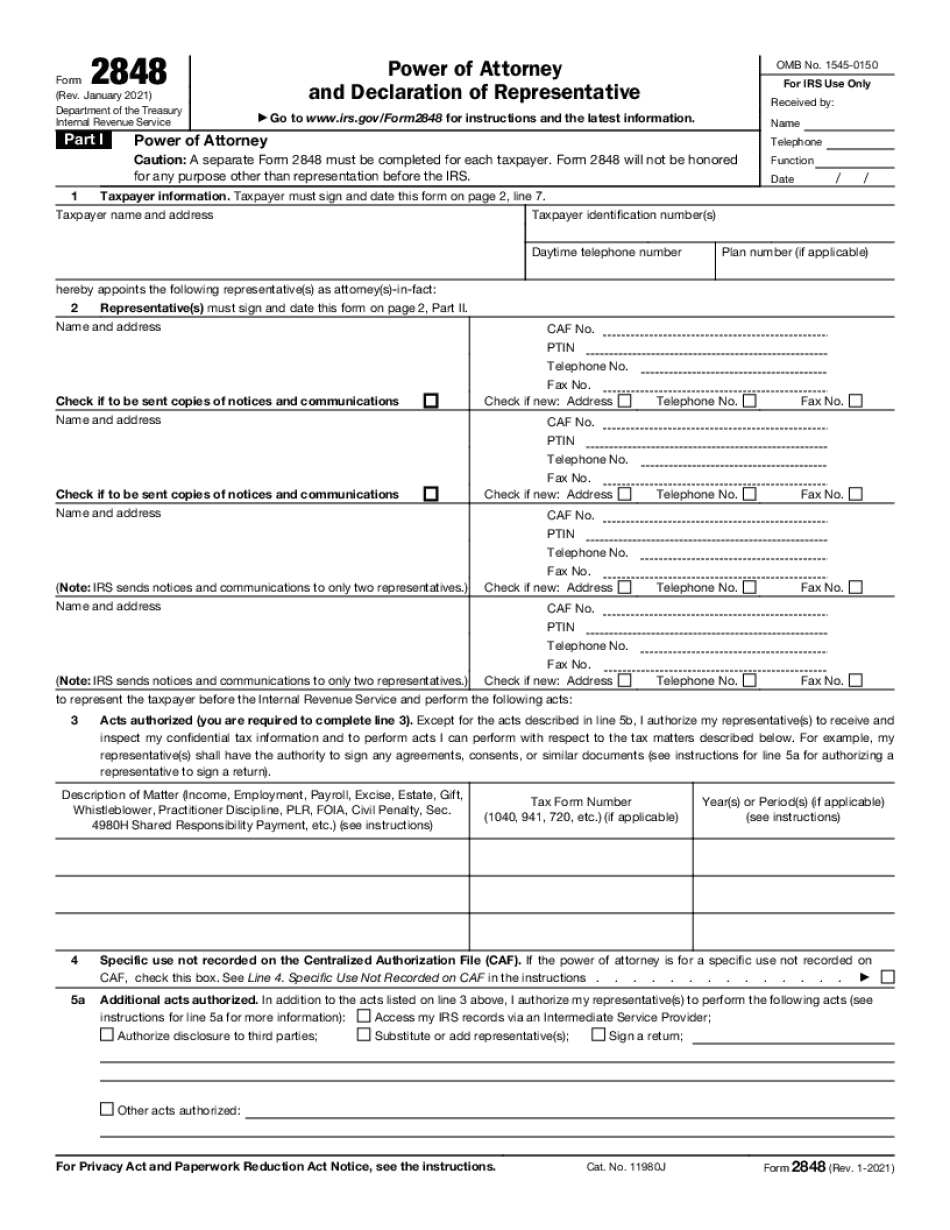

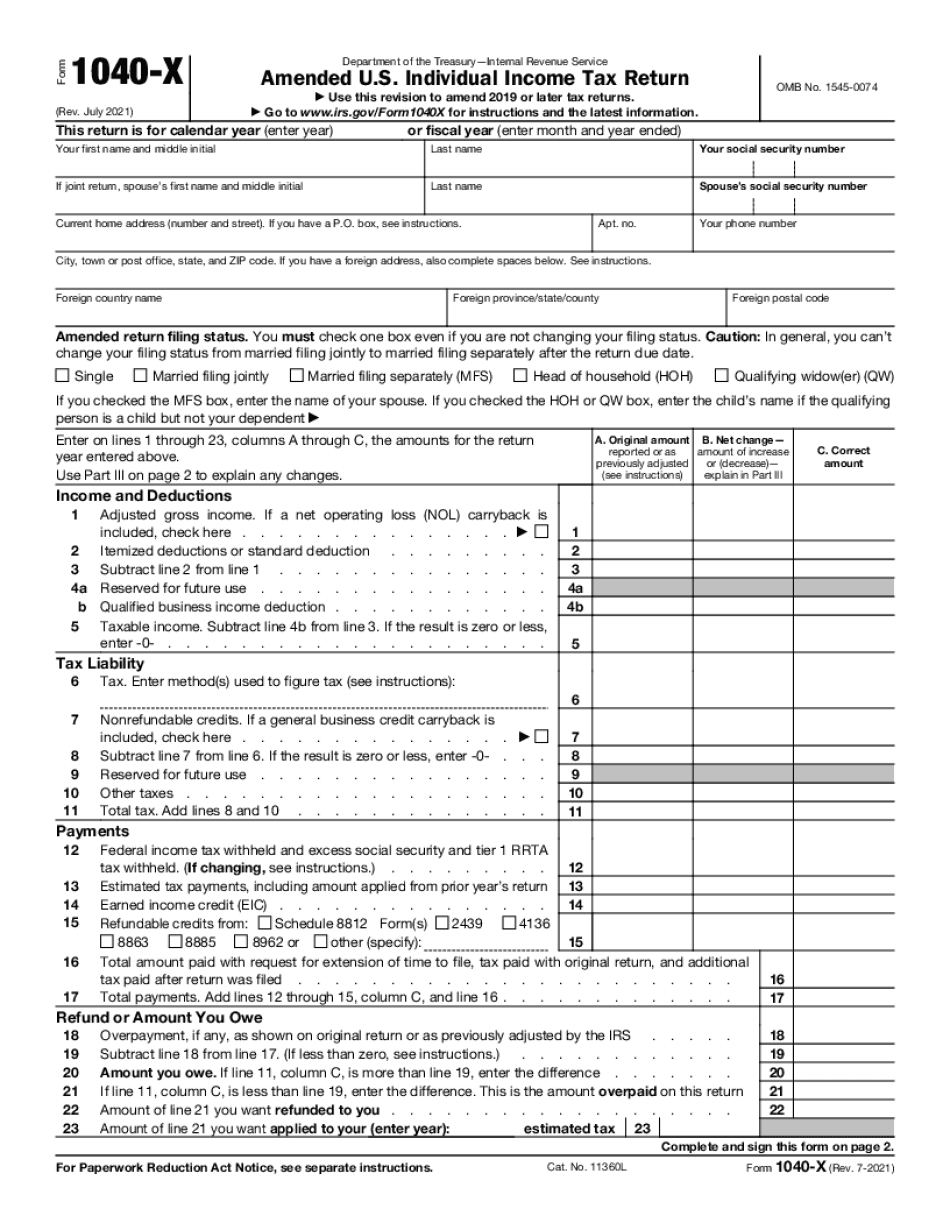

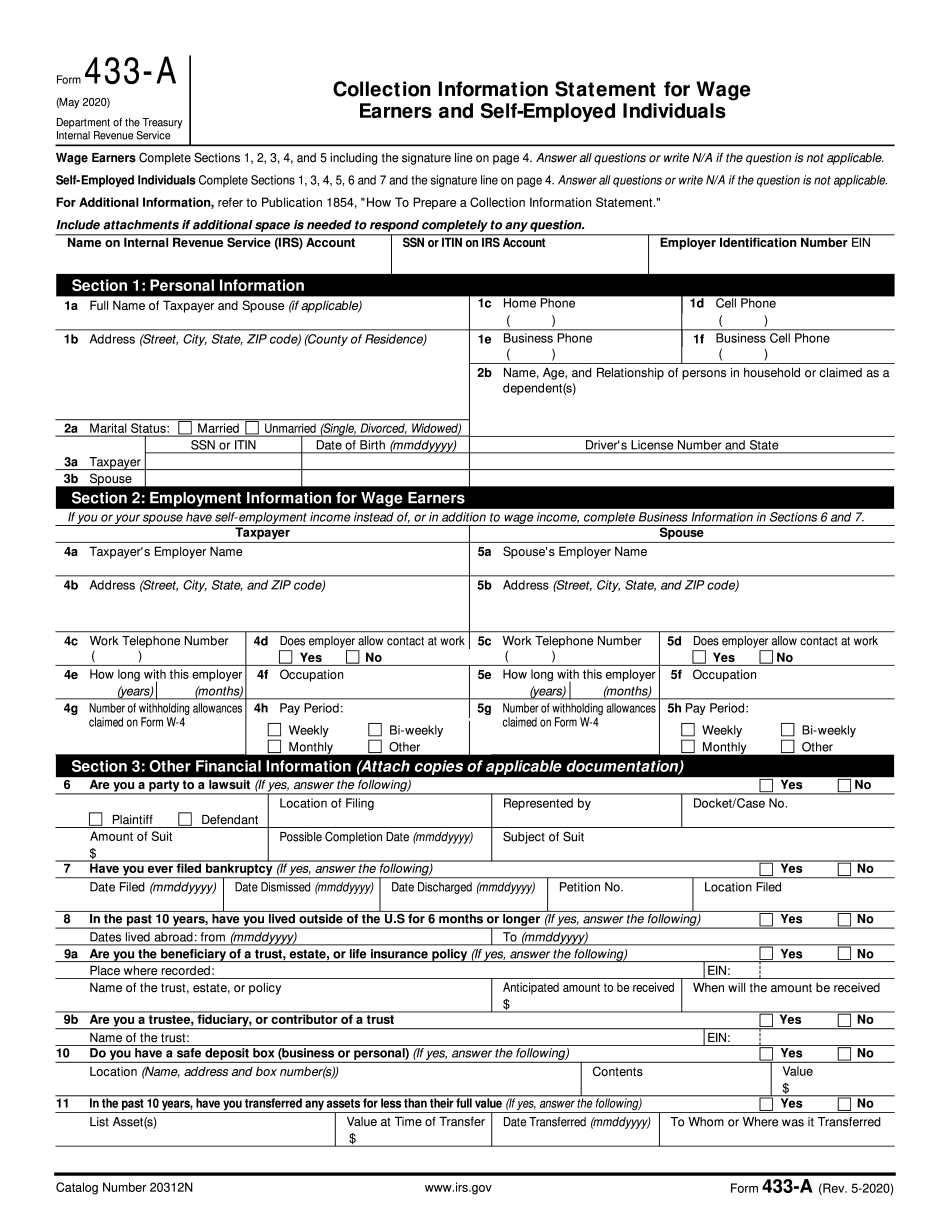

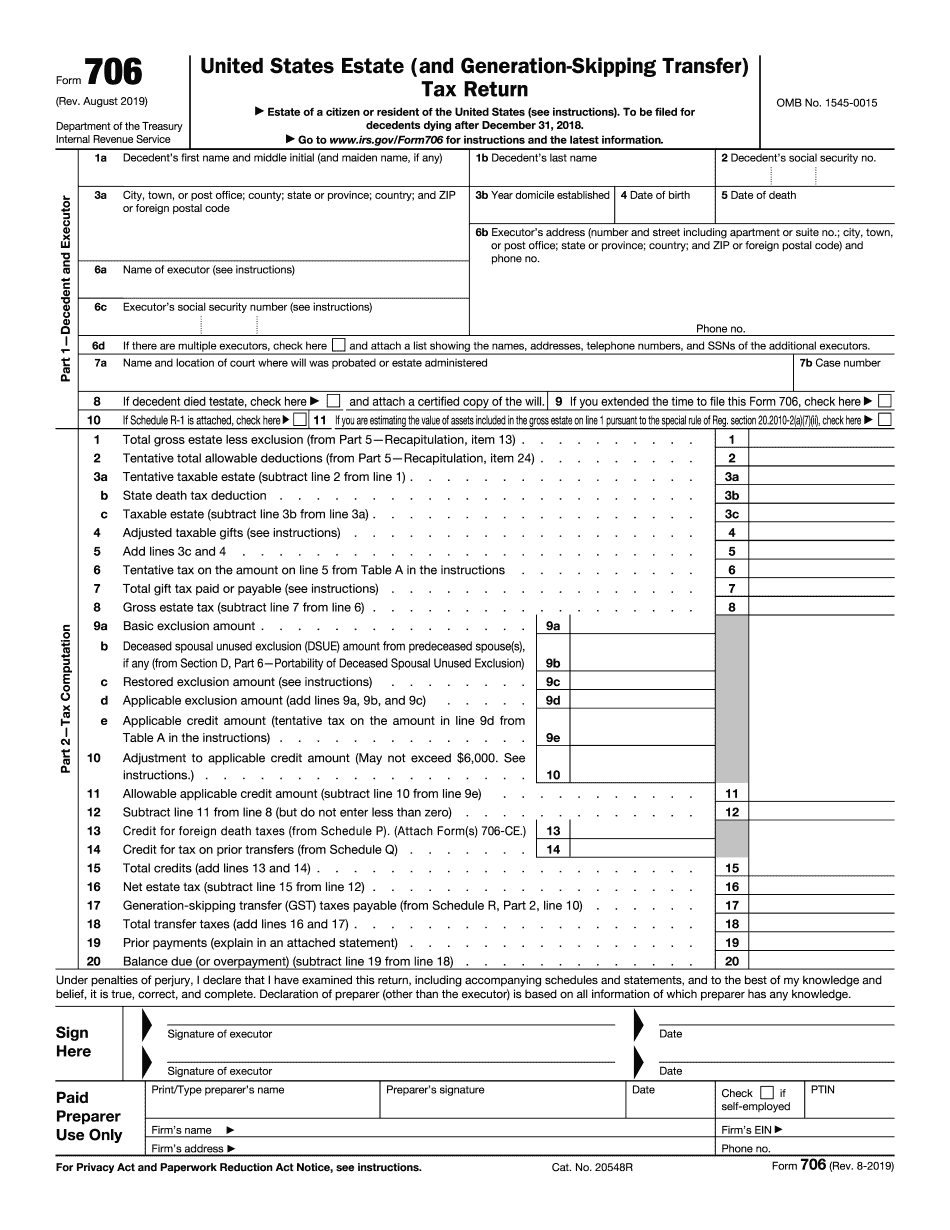

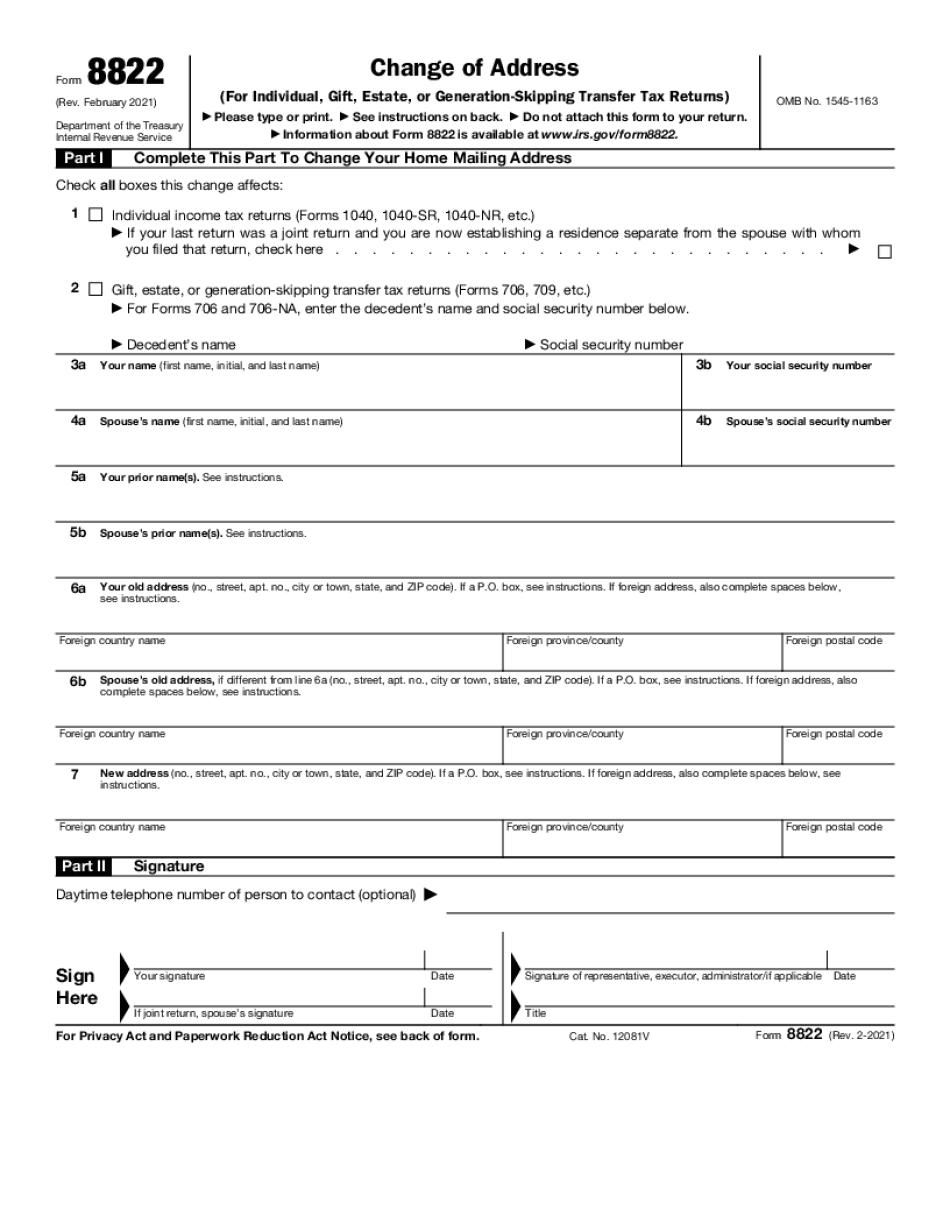

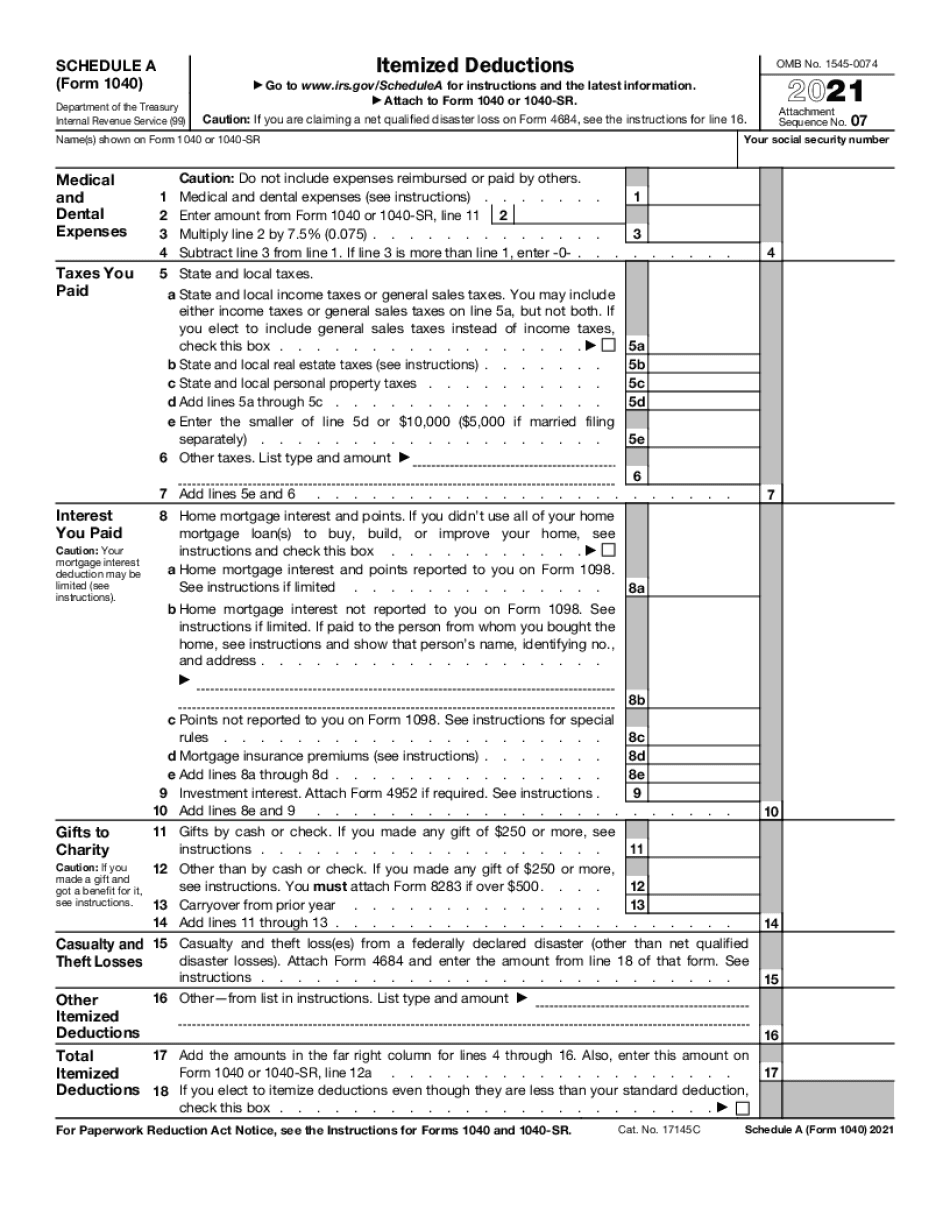

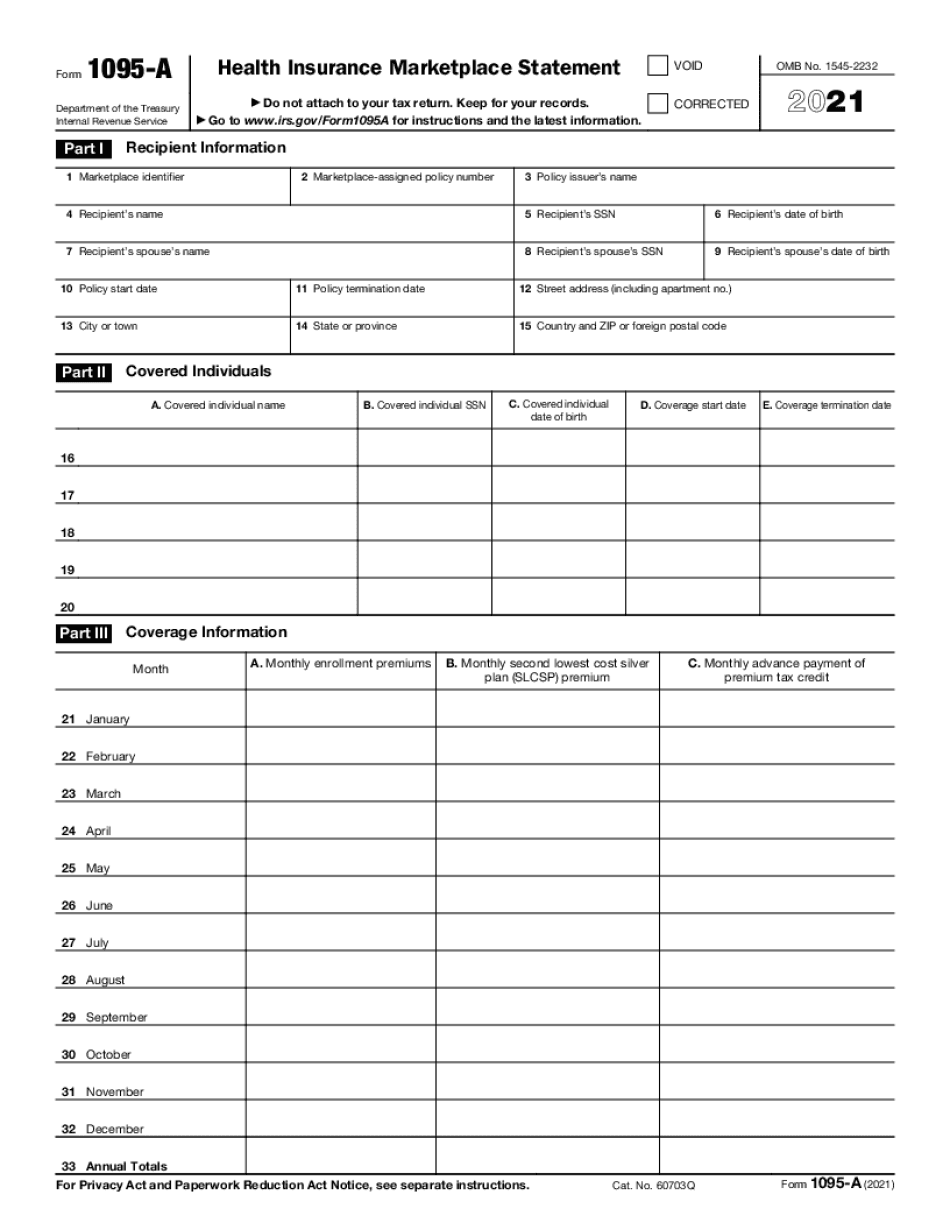

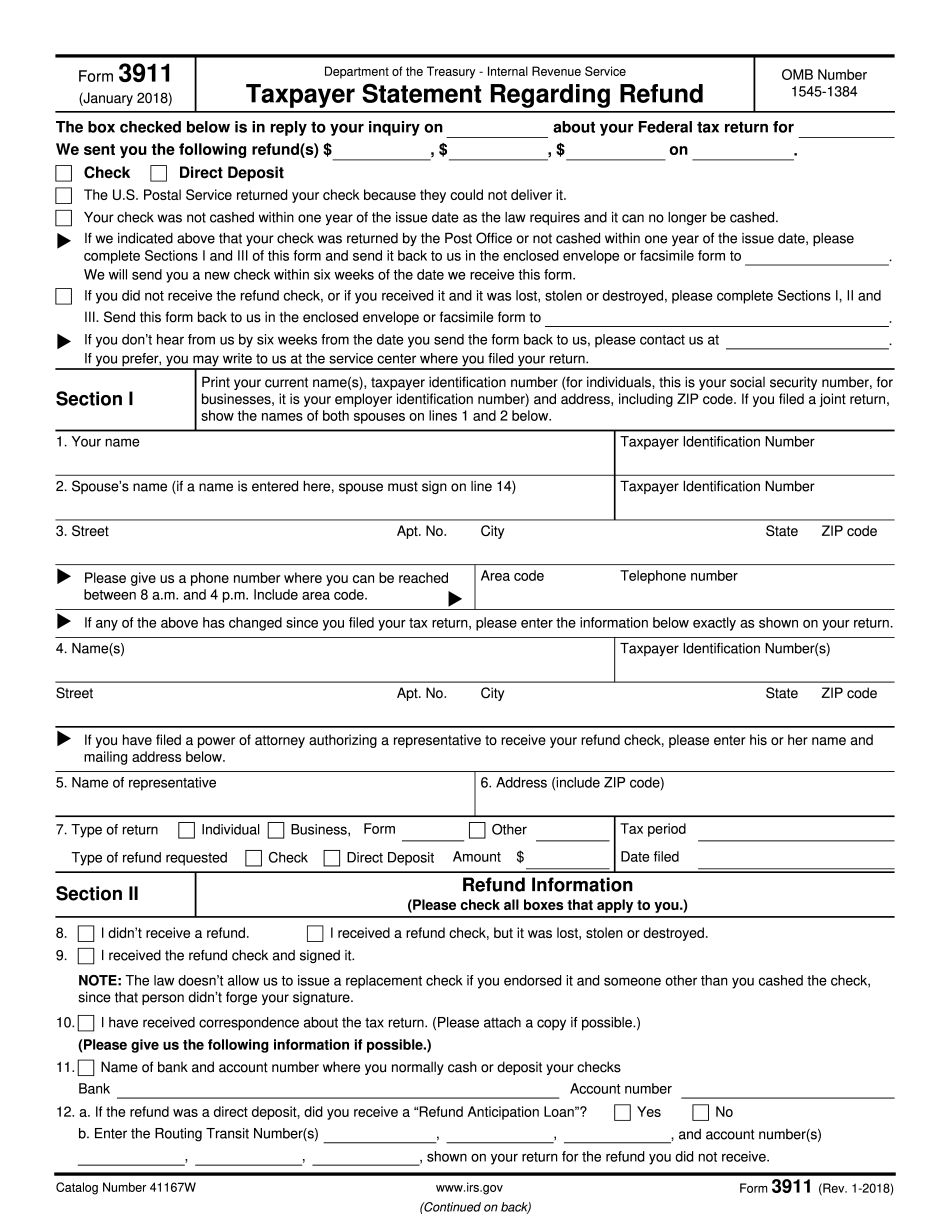

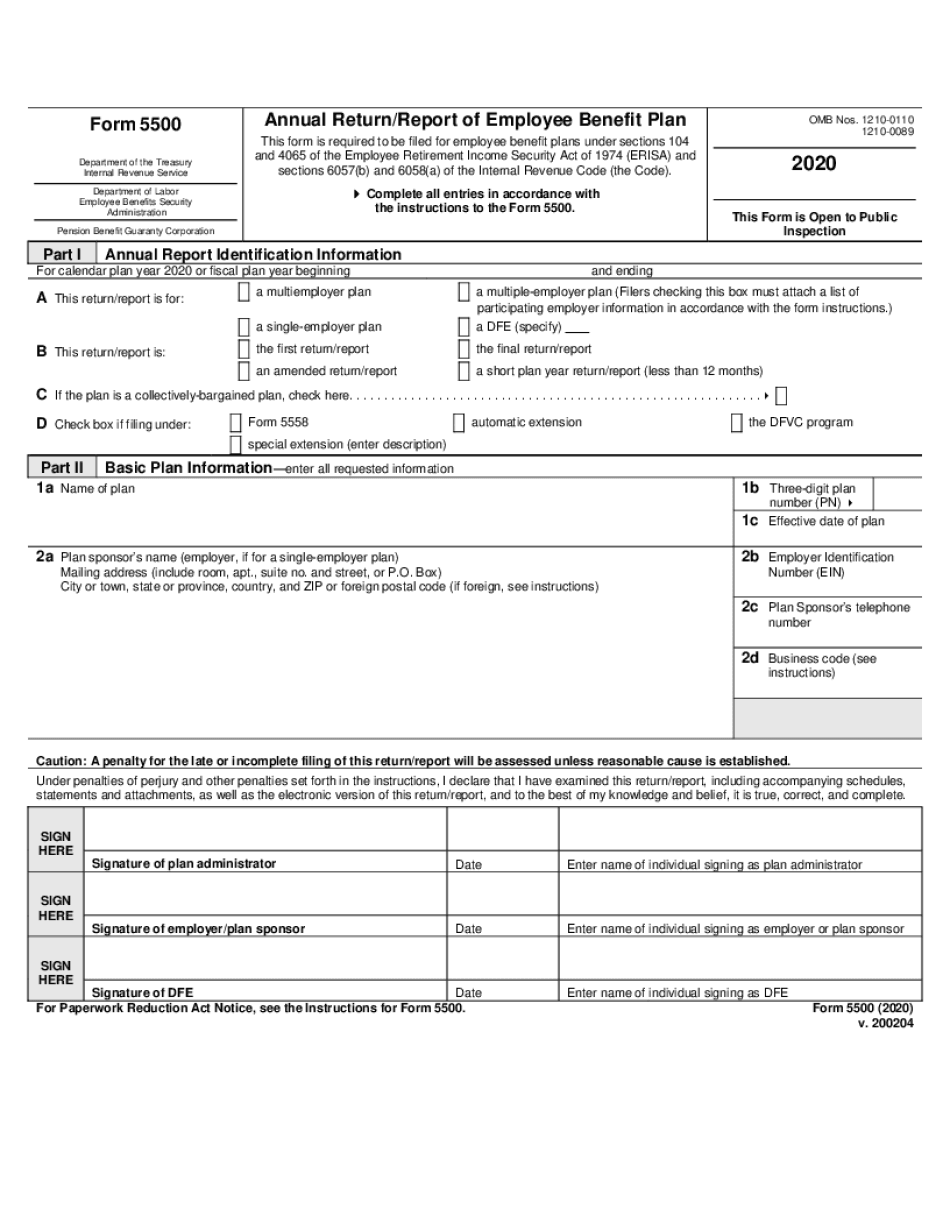

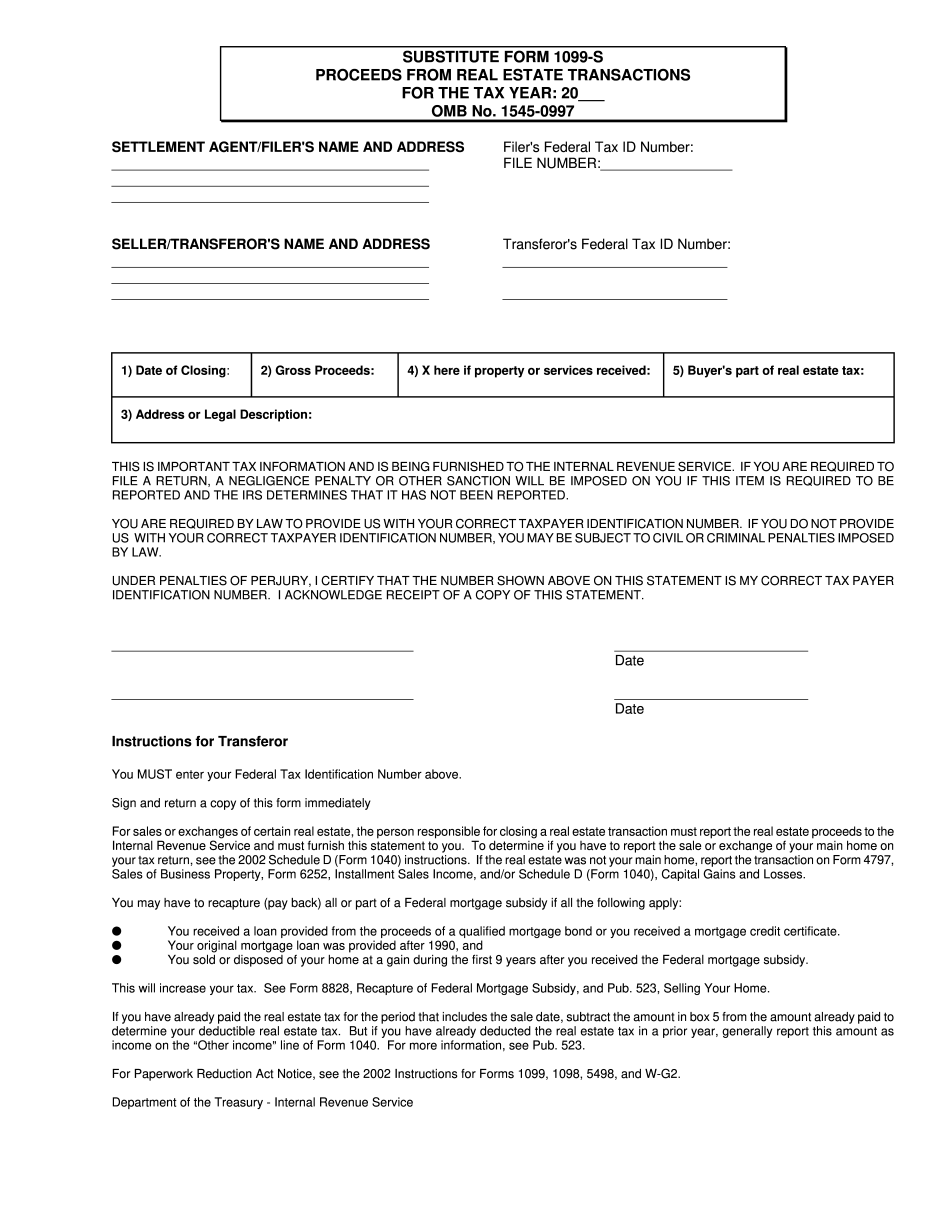

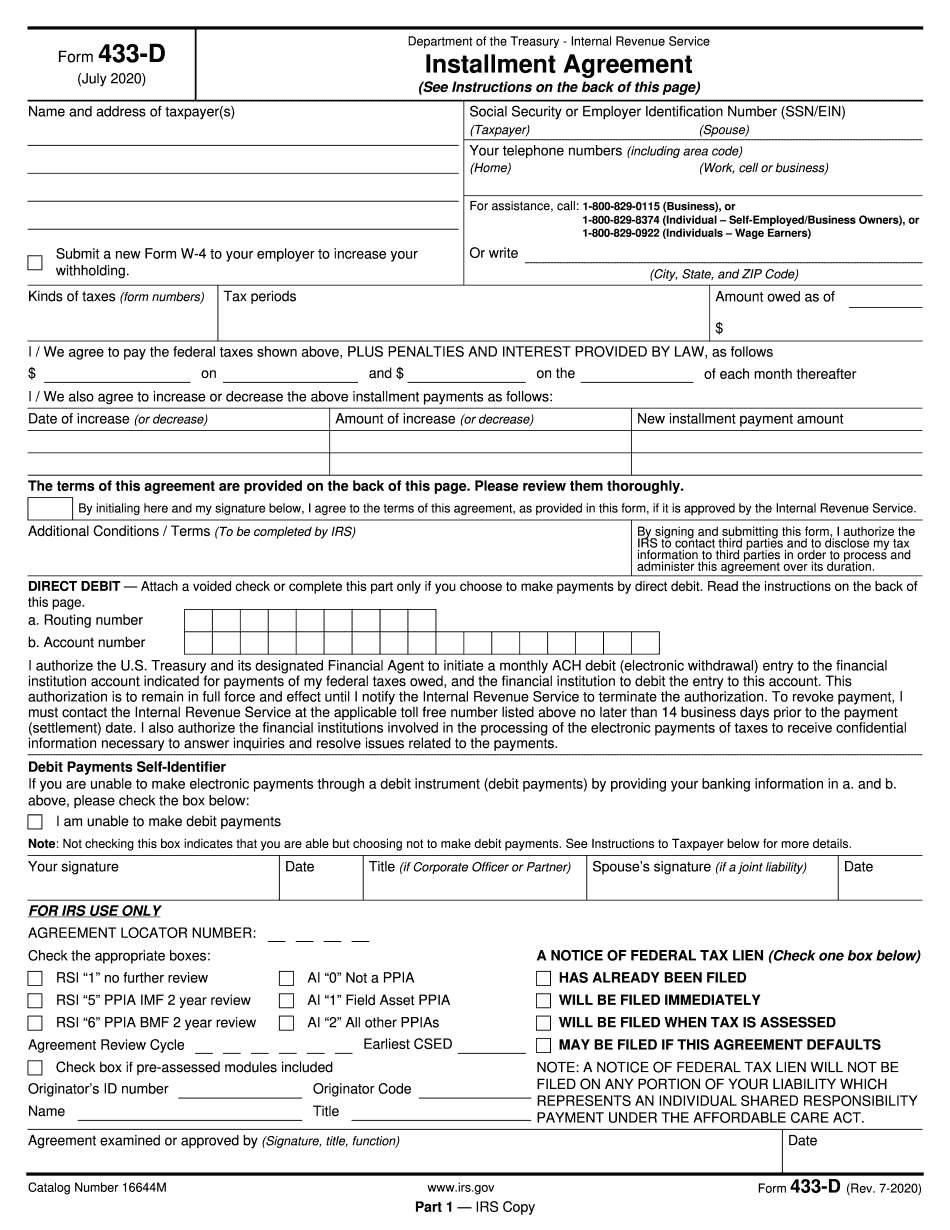

Most wanted tax and legal web forms

Choosen an appropriate tax year, your filing status, and annual taxable income to know your estimated tax rate and fill out the required form right now.

What are the us tax brackets?

Generally, paying income taxes isn't the most simple procedure. First, you should calculate the amount of your taxable revenue for the entire calendar year. Then, you'll be able to get the amount you are obligated to pay. When you try to look for rates, you get some divisions called US federal tax brackets. What are the us tax brackets?

At first, you indicate to which group you belong:

- single filer;

- married filing jointly (MFJ);

- married filing separately (MFS);

- Head of a household.

Every class has its own 7 tax rate divisions. For 2020, assessments start from 10% for the most affordable income and grow as income improve. You will find actual rates on the Internal Revenue Service site, but everything they have is info that doesn't make simpler the submitting procedure. Nonetheless, you have an alternative - our valuable platform in which it's impossible to get puzzled.

How are tax brackets applied

Allow us to jointly discover ways to make simpler the submitting procedure. Adhere to the recommendations listed below:

- Gather required details. Make certain you have your taxable incomes (like salaries, dividends and commissions and many others.) summed.

- Open our internet site inside your preferred internet browser.

- Choose your status (one among 4 types mentioned above). By default, it shows numbers for single filers.

- Click the 2nd dropdown menu to find out relevant brackets. Separate your annual income into part based on the shown list.

- Determine the due sum for every single part.

- Sum the resulting amounts.

- Double-check estimations and place them right into a necessary template.

In order to save more time, go paperless and make forms on the web - you may use necessary fillable templates below the calculator.